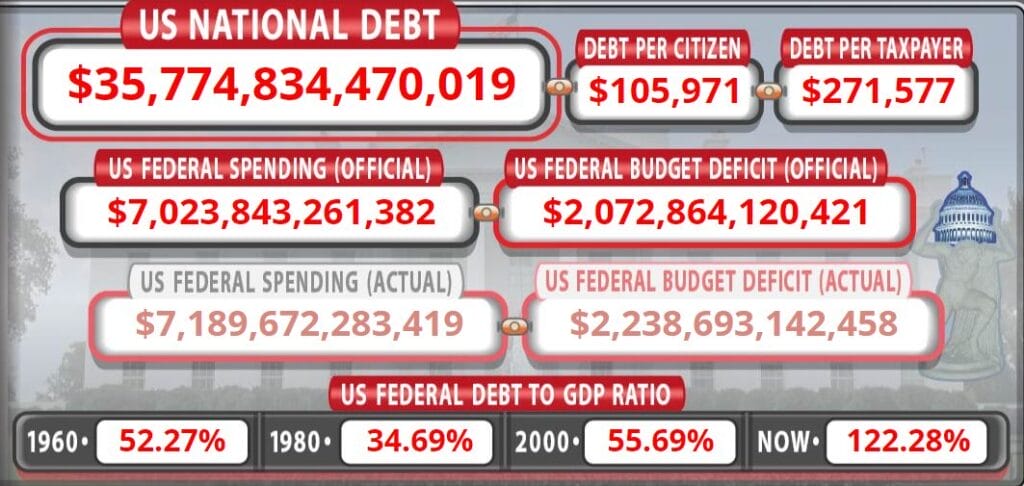

Shares of this national debt can be broken down into around $105,000 for each citizen, and a little over $257,000 for each American taxpayer.

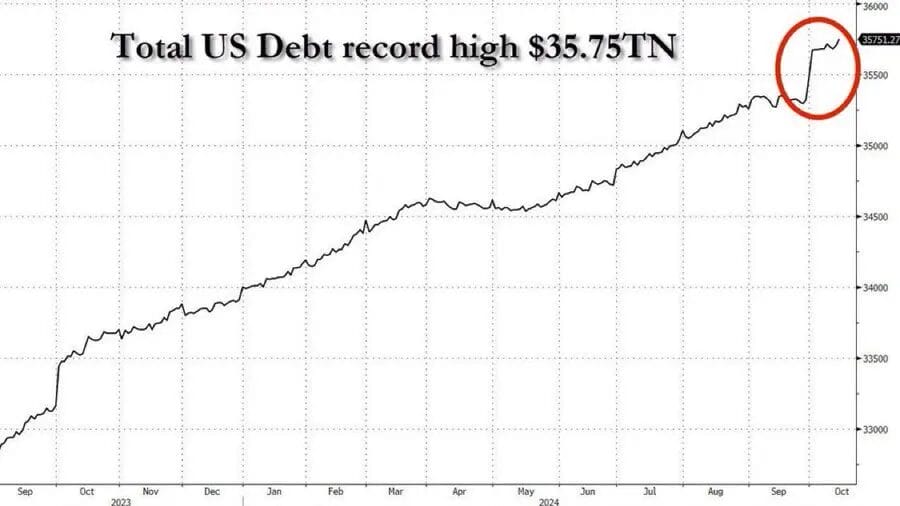

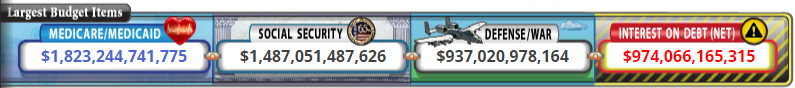

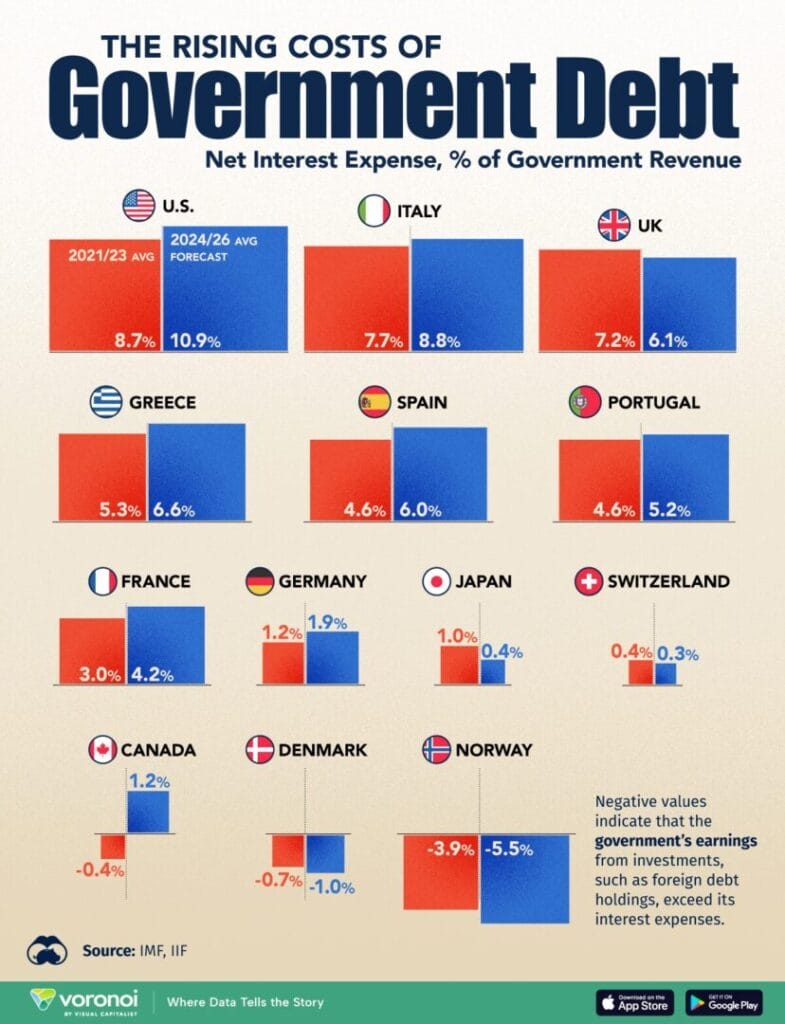

U.S. national debt reached $35 trillion in July. Interest payments due to service the debt are nearing $1 trillion roughly every 100 days, surpassing even America’s massive military and defense spending:

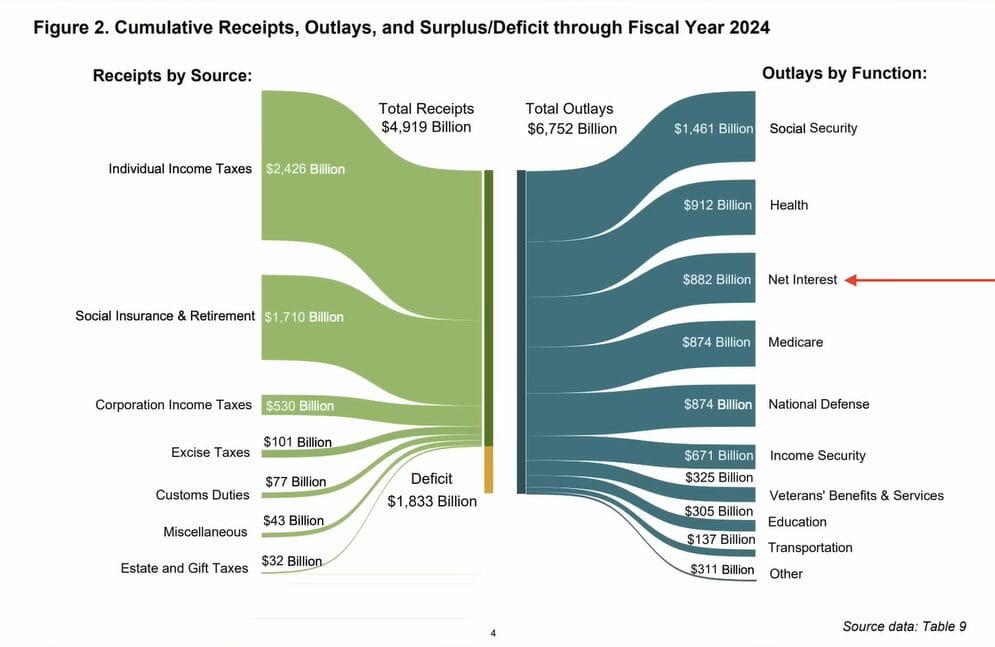

The U.S. Treasury Department has reported, according to their own numbers, $882 billion in interest payments through the fiscal year through the end of September.

World Affairs in Context provides more insight on this ballooning debt that Americans will have to pay for one way or another.

AUTHOR COMMENTARY

Lena Petrova, CPA, host of World Affairs in Context, asks, “You have to question why this is happening. Why? We are being distracted by a variety of other issues, but the most important ones are brushed aside.”

Well, to answer this question, Blackrock tells us why:

In 2019, just a few months before the Covid War was kicked into high gear beginning in 2020, Blackrock published a document that explicitly spells out that rapid inflation wrought by vast money printing and the creation of helicopter money would be the springboard into CBDCs and tokenization.

In their report, “Dealing With the Next Downturn,” Blackrock wrote:

Unprecedented policies will be needed to respond to the next economic downturn. Monetary policy is almost exhausted as global interest rates plunge towards zero or below. Fiscal policy on its own will struggle to provide major stimulus in a timely fashion given high debt levels and the typical lags with implementation.

Without a clear framework in place, policymakers will inevitably find themselves blurring the boundaries between fiscal and monetary policies. This threatens the hard-won credibility of policy institutions and could open the door to uncontrolled fiscal spending.

This paper outlines the contours of a framework to mitigate this risk so as to enable an unprecedented coordination through a monetary-financed fiscal facility. Activated, funded and closed by the central bank to achieve an explicit inflation objective, the facility would be deployed by the fiscal authority

An extreme form of “going direct” would be an explicit and permanent monetary financing of a fiscal expansion, or so-called helicopter money. Explicit monetary financing in sufficient size will push up inflation. Without explicit boundaries, however, it would undermine institutional credibility and could lead to uncontrolled fiscal spending.

For example, policy innovations in the next downturn will likely need to take inequality more directly into account to be politically palatable. Not all asset purchase programmes are born equal when it comes to their impact on inequality. Policy responses that put money more directly in the hands of citizens might be more attractive. The rise of central bank-issued electronic money (not cryptocurrencies) might achieve these objectives in ways that were not previously possible.

So, there’s the answer to our question, straight from the horse’s mouth. And the puppets in charge laugh about it, whoever is in charge at the time.

Governments around the world, not just the U.S., are in a race to the bottom to erode what’s left of the purchasing power of its currencies, continue to borrow and create new money to pay existing debts, while exacting money from the masses through increased taxes on us and tax breaks and incentives that are clearly designed to only benefit the top earners.

This is known as the Cantillon Effect, which basically means those closest to the money printer reap the biggest reward, but it becomes worth less and less as it “trickles down” to the lowest common denominator.

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

Expect money printing and inflation creation to VASTLY accelerate even more in 2025, regardless of who is President…

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Realistically, One Trillion can never be paid back – it’s insurmountable. It’s absurd to think otherwise.

For a very long time now, denizens are playing real life Monopoly.

How can the church stop it or slow it down?

Read my study I just did on “time and chance”. There is no stopping it: it’s too late, and America needs to be severely judged and cut down to size.

HERE IS A FACT NOBODY EVER MENTIONS. THE GOVERNMENT TAKES IN NEARLY A TRILLION DOLLARS ANNUALLY AND NOT FROM ILLEGAL INCOME TAXES

FROM THIS LINK WHICH I SAVED SINCE IT WAS PUBLISHED: https://www.devvy.com/notax.html

What other revenues does the government collect? Corporate taxes, social security taxes, constitutional revenues such as excise taxes on cigarettes, alcohol, tobacco, firearms, tires, etc., tariffs on trade, military hardware sales, and some minor categories. Let’s say that those revenues will total $900 billion dollars. The politicians want $1.7 trillion to spend on their favorite welfare programs, wars and foreign welfare, but have a short fall of $800 billion dollars. This is called the deficit and the deficit, created by the spending of Congress, creates the “national debt.”

How? Because the politicians are $800 billion dollars short, they simply call up Al Greenspan and borrow your children’s and grand babies’ futures. The “Federal” Reserve Banks don’t loan anything of value to Congress. They aren’t banks; they’re really an overpaid, powerful, private accounting service. When that $800 billion dollars worth of ink is transferred to the Treasury, it gets piled on top of the existing “national debt.”

THE ARTICLE IN THE LINK GOES INTO MUCH MORE DETAIL, IT WAS POSTED BY DEVVY KIDD WHO IS A CONSERVATIVE WEBSITE PUBLISHER TNAT NOBODY EVER HEARD OF OR REMEMBERS BUT I DO., GO AHEAD AND CHECK THE LINK. I CANNOT GET ANYONE ELSE, ALEX JONES, TRUMP CAMPAIGN, ETC., ETC TO REVIEW THIS INFORMATION AND YOU HAVE TO WONDER WHY.

NOW TRUMPY WANTS TO PARDON HUNTER BIDEN JUST LIKE HE DECLINED TO PROSECUTE HITLERY AFTER THE 2016 ELECTION. HERE IS A LINK https://www.breitbart.com/2024-election/2024/10/24/donald-trump-says-open-pardoning-hunter-biden/ THIS IS A DISGUSTING EXAMPLE OF BETRAYAL. MAGA MY REAR END. PROTECTING HIS BUDDIES IS WHAT THIS IS ABOUT. MAKES ME SICK THAT I VOTED FOR THIS CREATURE BUT THE ALTERNATIVE WAS FAR, FAR WORSE

Heya i am for the first time here. I came across this board and I find It really useful & it helped me out much. I hope to give something back and aid others like you helped me.