The International Monetary Fund (IMF) has disclosed in a new report discussing the safety risks surrounding central bank digital currencies (CBDCs) and fears people have about them. In it’s report, the IMF concedes that a central bank could collect a plethora of private data and could even overturn this information to authorities, acknowledging some of the animosity those critical of CBDCs have had about them.

Published on August 30th, the IMF’s paper – “Central Bank Digital Currency Data Use and Privacy Protection” – “offers a framework to help countries navigate, as well as tools to help them manage, the trade-offs between CBDC data use and privacy protection,” the IMF says.

The IMF begins its report immediately explaining how retail CBDCs contain all sorts of information when a transaction occurs, and therefore can be leveraged by central banks and other entities for themselves, and could be overturned to government authorities and police for potential crimes depending on national policies. The IMF wrote:

Central bank digital currency (CBDC), as a digital form of central bank money, may allow for a “digital trail”—data—to be collected and stored. In contrast to cash, CBDC could be designed to potentially include a wealth of personal data, encapsulating transaction histories, user demographics, and behavioral patterns. Personal data could establish a link between counterparty identities and transactions.

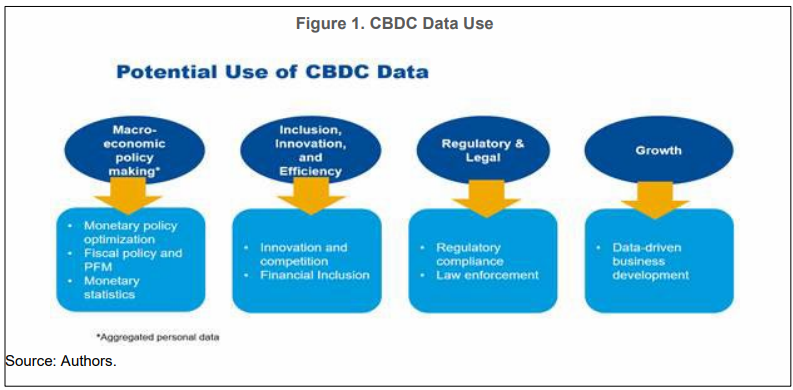

Like other payments data, CBDC data may have economic value. Data are non-rival. Data are infrastructural resources that can be used by an unlimited number of users and for an unlimited number of purposes as an input to produce goods and services. CBDC data could potentially be harvested by financial institutions that, in turn, could help develop data-driven businesses.

The authors later defined exactly what data collected is. This includes the payer’s/payee’s identity, payer’s/payee’s pseudonymous identifiers (account number or token address that belongs to, or is controlled by, a counterparty), transaction data, and other and payer and payee transaction metadata (merchant’s name, purchase location, and spending category).

The authors go on to write:

Furthermore, CBDC data use could help central banks achieve policy objectives. It could help reduce information asymmetries, potentially assist in supporting financial inclusion, facilitate payment system interoperability, and promote innovation and market contestability. It could provide more timely information about the state of the world and help improve macroeconomic policymaking and regulatory compliance.

Data use by central banks differ from that of law enforcement and national security authorities, which may be vested with powers under national legal frameworks to lawfully access personal data. If permitted by the relevant laws, CBDC data use could allow for increased traceability for such authorities to track or prevent illicit and fraudulent activities.

These worries persist despite the private sector often having extensive access to data, which is generally widely accepted and uncontested in comparison to concerns raised about official sector data gathering and usage. It can be a particular concern in countries with severe governance and corruption vulnerabilities. However, public attitudes toward state surveillance versus commercial surveillance also differ across countries.

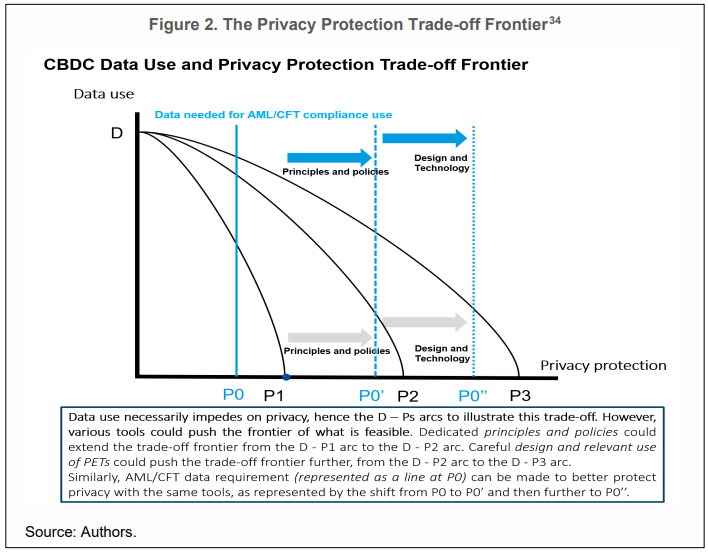

The rest of the paper mostly covers all the ways governments and central banks can mitigate these risks and distrust, either by being open or close-handed when it comes to allowing the public and third-party entities to see the data, its programmability that prevents the CBDCs from being hacked, to building trust and repour with the people into accepting them.

The authors list a handful of steps authorities can take to accomplish these things:

- Decide what data can be collected, stored, shared, and used; define the roles and responsibilities of all parties involved in the CBDC ecosystem regarding data access and usage; and take data protection measures, such as data security and encryption

- Decide who is responsible and held accountable for ensuring that the privacy principles are being followed. For instance, bank supervisors should make sure that the Board of Directors of the PSPs are held accountable for setting up processes and implementing policies of privacy protection

- Set up institutional mechanisms to ensure that established principles and policies for privacy protection are implemented, stakeholders are compliant, and violators are held accountable

- Use the traditional tools for privacy protection tools such as choice, consent, control, and transparency to provide adequate privacy protection

- Communicate with the public to provide information and transparency on the implications of different CBDC design choices for privacy

- Offer a rich menu of CBDC designs to cater to different users and different preferences for privacy: from mostly anonymous wallets for small value transactions to full identity wallets for larger value transactions. Central bank can offer from low data intensity (with high privacy protection requirements) to high data intensity designs (with less privacy protection requirements)

- Decide how to convince the public that the central bank will not have access to CBDC data, if that is the choice of the central bank, depending on its own legal and regulatory practices.

Read the IMF’s report for more specifics.

AUTHOR COMMENTARY

Having read through the paper, the IMF is doing a whole lot of gaslighting, pretending to lay out ‘all options’ or something, when in reality they are outright telling us that the implementation of CBDCs will be a total loss of freedom and liberty. We know the IMF is gaslighting just based on some of the other draconian statements it has made over the last several years:

IMF Chief Kristalina Georgieva Urges Governments To Implement Carbon Tax To Reduce Emissions

Singapore Unveils Standards For CBDCs In Collaboration With IMF And Amazon

IMF Advocates That Credit Scores Be Linked To Internet Search History

It’s real simple, and it does not matter if the metadata is shared in a public blockchain or not: if you don’t hold it, you don’t own it.

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 29:5 A man that flattereth his neighbour spreadeth a net for his feet.

In my viewpoint, the International Monetary Mafia Fund has essentially spelt out that the CBDCs will completely erode all remaining freedoms, as these programmable tokens will be leveraged against us on a whim. Everything will be tracked, so everything can be perfectly taxed and leveraged against the masses. The IMF even acknowledges that these systems have the potential to get hacked – which means they will eventually in the years to come.

We already knew this, but now the IMF is saying it wide out in the open…

SEE: SWIFT Banking System To Launch CBDC And Tokenized Platform, Expected To Be Released By 2025 Or 2026

World Bank Explores Wholesale And Retail CBDC Interoperability And Faster Payment Systems

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

There was a Yahoo news report sometime last year–maybe as long as 18 months ago, that referred to cbdcs in the title of the report as, Biden’s Money–in reference to the idea that we will not own our money–the state will. They went on to say in that report that the government, in time, would allow or not allow a person’s money to be spent they way they want to spend it based on data tracking and one’s social media scores, etc. A few weeks after reading that Yahoo news report, I went back to print a copy and it was no longer posted–but I vividly remembering reading it and the fact that the Yahoo reporter expressed caution and serious concern about cbdcs.

I’ll have to try and find that article. It’s probably archived somewhere.

CBDC’s are the foundation for the Social Credit Score, and Universal Basic Income.

Disagree with the thuggery, you get canceled.

Not to mention acceptance of the Adult Vaccination Schedule that will be required of all.

CBDC hell is coming

https://rumble.com/v5dhg9t-video-that-will-shock-theyre-telling-you-the-truth.html