Australia, like the rest of the world, is racing to implement a central bank digital currency (CBDC), and in their case they have contracted a number fintech and financial services to help bring this to fruition, among them being Mastercard.

In March of this year the Reserve Bank of Australia (RBA) issued a press release claiming they are trialing a CBDC.

The central bank wrote in a statement,

“The project involves selected industry participants demonstrating potential use cases for a CBDC using a limited-scale pilot CBDC that is a real digital claim on the Reserve Bank. The project received a large number of use case submissions from a range of industry participants. A range of criteria were considered in selecting the use cases to participate in the pilot, including the potential to provide insights into the possible benefits of a CBDC.

“Today we are announcing the use case proposals, along with their providers, which have been invited to participate in the live pilot, which will take place over the coming months.”

Brad Jones, Assistant Governor (Financial System) at the RBA, said in a statement:

We are delighted with the enthusiastic engagement by industry in this important research project. It has also been encouraging that the use case providers that have been invited to participate in the pilot span a wide range of entities in the Australian financial system, from smaller fintechs to large financial institutions.

The pilot and broader research study that will be conducted in parallel will serve two ends – it will contribute to hands-on learning by industry, and it will add to policy makers’ understanding of how a CBDC could potentially benefit the Australian financial system and economy.

Dilip Rao, Program Director – CBDC with the Digital Finance Cooperative Research Centre (DFCRC), also said in a statement:

The variety of use cases proposed covers a range of problems that could potentially be addressed by CBDC, including some that involve the use of CBDC for atomic settlement of transactions in tokenised assets.

The process of validating use cases with industry participants and regulators will inform further research into design considerations for a CBDC that could potentially play a role in a tokenised economy.

The RBA listed the different financial institutions and companies that aided the central bank in developing this pilot program, including the likes of Mastercard:

| No. | Use Case Description | Use Case Lead / Consortium Partners |

|---|---|---|

| 1. | Offline Payments | ANZ |

| 2. | Nature-based Asset Trading | ANZ / Commonwealth Bank |

| 3. | SuperStream Payments | ANZ / Oban |

| 4. | Corporate Bond Settlement | Australian Bond Exchange |

| 5. | Tokenised FX Settlement | Canvas Digital |

| 6. | GST Automation | Commonwealth Bank / Intuit |

| 7. | CBDC Custodial Models | digi.cash |

| 8. | Livestock Auction | Fame Capital |

| 9. | High Quality Liquid Assets Securities Trading | Imperium Markets |

| 10. | Interoperable CBDC for trusted Web3 commerce | Mastercard / Cuscal |

| 11. | Funds Custody | Monoova |

| 12. | Construction Payments | NotCentralised |

| 13. | Tokenised Bills | Unizon |

| 14. | CBDC Distribution | ANZ |

Others on this list include some of the largest banks in Australia. These banks are currently operating in lockstep to reduce and phase-out the withdrawals of physical tender across the nation, including closing down a number of their branches. SEE: Australia Going Completely Cashless: Banks Are Now Beginning To Ban And Limit Cash Withdrawals While Continuingly Increasing Digital ID Issuance

Since then on August 23rd, the RBA issued a follow-up report that details their findings.

Brad Jones said in a statement:

The project yielded valuable insights into how a CBDC, alongside other innovations in digital money, could potentially unlock benefits for the Australian financial system and the wider economy. It also highlighted the benefits of close engagement between industry and policymakers in exploring the opportunities and challenges associated with innovations in digital money.

The key findings from the project will help to shape the next phase of the RBA’s research program into the future of money in Australia. Alongside our ongoing work on cross border payments, this will include deepening our understanding of the role that tokenised asset markets and programmable payments could have in the Australian economy.

Dr Andreas Furche, CEO of the DFCRC, added:

The report underscores that innovation in finance is a continuous journey. The strong industry engagement in this project speaks to the importance of collaboration between central banks as ultimate issuers of national currency, and industry experts driving its potential use cases.

As we move forward, our research on CBDC could look to target use cases where CBDC has the best potential to provide an infrastructure layer for further innovation in financial products and services.

According to the RBA they performed their trials on an Ethereum-based blockchain (Quorum).

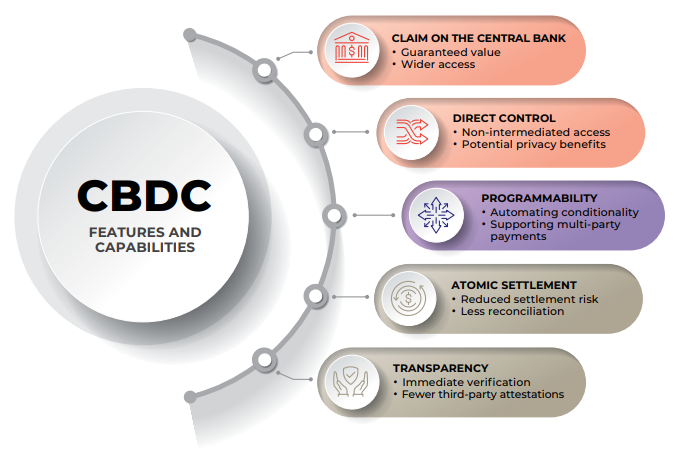

Digging deeper into the actual document the central bank provided, four key tenets emerged in their trials (emphasis mine):

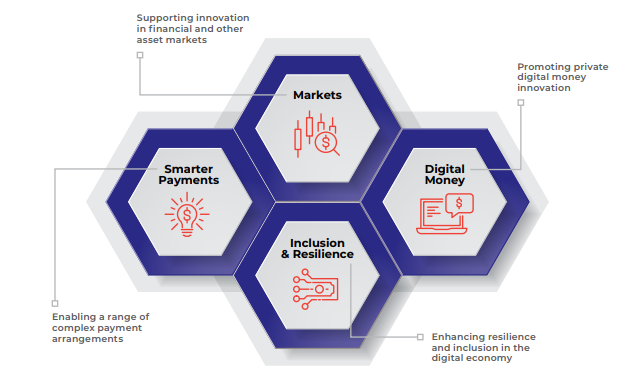

Enabling ‘smarter’ payments. Many submissions highlighted the ability to directly control and program a tokenised CBDC as enabling a range of complex payment arrangements that are not effectively supported by existing payment systems. Submissions highlighted how it was possible to write code, such as smart contracts, that automatically initiate payments using a tokenised CBDC when predefined conditions are met. This can allow complex transactions, such as multi-party or multi-stage payments, to execute automatically and simultaneously, reducing the need for costly reconciliation processes and the risk of failed transactions.

Supporting innovation in financial and other asset markets. There was significant interest from industry participants in exploring the tokenisation of financial and other (real) assets on distributed ledger technology (DLT) platforms, with CBDC being used in the ‘atomic’ settlement of transactions. This included traditional debt securities markets, where settlement times are typically measured in days. Several different types of less liquid assets were also tokenised in the transactional pilot, including Australian carbon credit units, NSW biodiversity credits, and supplier invoices, with atomic settlement effected in pilot CBDC. Participants noted that the tokenisation of assets on DLT platforms had the potential to deliver a number of benefits including improving the efficiency, transparency, liquidity, and accessibility of asset markets.

Promoting private digital money innovation. Submissions highlighted the role that a CBDC could potentially play in promoting interoperability and uniformity of new forms of private digital money, such as tokenised bank deposits and stablecoins backed by highquality assets. In this role, CBDC could serve a similar function to settlement balances held at the central bank for settling payments made using commercial bank money. A number of submissions also highlighted the potential for privately issued stablecoins that were fully backed by CBDC to more readily compete with digital forms of money issued by regulated financial institutions.

Enhancing resilience and inclusion in the digital economy. Some submissions explored the possibility that CBDC could improve the resilience of the payments system by providing households and businesses with an alternative way to make payments in certain scenarios. This included the ability to make offline electronic payments in scenarios where electricity and/or telecommunication services were not available, for instance following natural disasters. Others suggested that access to a digital form of money that does not rely on having a commercial bank account could offer social benefits to certain groups in the community who may encounter difficulties using conventional banking services, such as travellers, foreign students, and victims of domestic violence.

Moreover, the central bank says the CBDC could “provide additional functionality in various retail payment applications, such as automating the payment of utility bills and rental payments, micropayments, time-based streaming payments and even wage payments.”

The bank also tested the concept of them having full control to allow, pause, and completely pause payments, writing: “The pilot CBDC was made available as a digital token on the pilot CBDC platform that was able to be directly controlled using hold, release and transfer functions without the use of an intermediary.”

Furthermore, the bank concludes their simulations open the possibility for issuing “stablecoins that are fully backed by CBDC. In this sense, a CBDC could be viewed more as an enabling complement to, rather than substitute for, private sector innovation.”

However, the RBA claims that there is still much to be done with these CBDCs and their implementation of one, if decided upon, will still be some years yet, they claim.

[…] The experience highlighted potential challenges associated with the integration of use case applications with a CBDC platform. This included ensuring the efficiency and integrity of atomic settlements and programmability across networks. Further analysis would also be needed to validate the business and technical design features of a CBDC so it could deliver on the identified capabilities.Considering the broader context – where the Australian payments system is currently meeting most of the needs of end users and work on CBDC in advanced economies is generally still in an exploratory stage – it is likely that any serious policy consideration of issuing a CBDC in Australia is still some years away.

The RBA wrote in their report

AUTHOR COMMENTARY

The language being used by the RBA is the same rhetoric the Federal Reserve and other central banks have used, claiming that they are unsure if they are even going to implement a CBDC. This is just poppycock, and all this jibber jabber about ‘weighing their options’ is just a formality. Australia, like the all the rest, will come out with a CBDC, and much sooner than they are claiming.

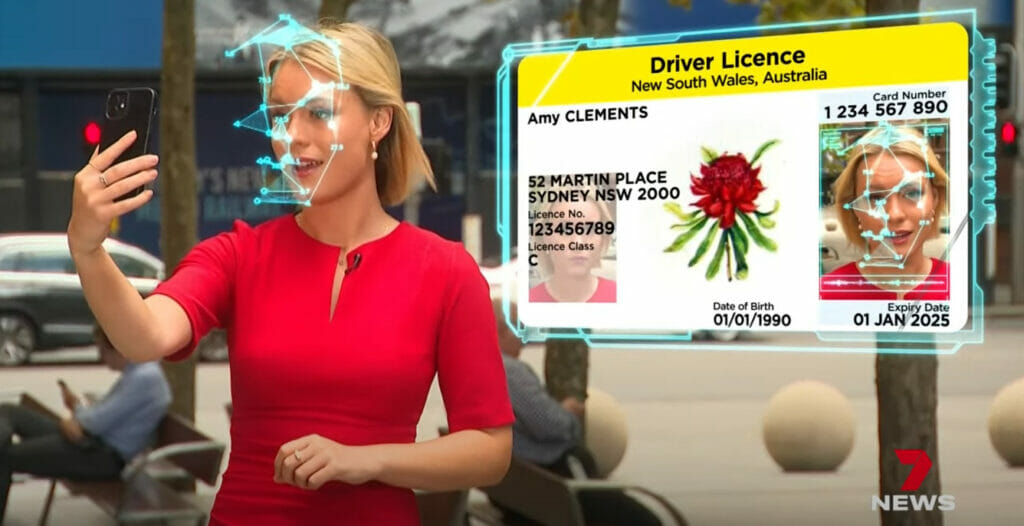

But before that can occur digital IDs need to be implemented, and is stands, Australia is leading the pack.

Again, CBDCs are a no-go. They are a total loss of freedom, as seen in their whitepaper and other statements made by the central banks around the world. Fight against it and warn others. SEE: Ways To Resist And Slowdown The Introduction Of Central Bank Digital Currencies

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Trust us, it’s for all of our benefits, safe and secure; right more like for the government’s control over all you buy; keep the masses in lock step.