Another set of nations are primed and ready to dump the U.S. dollar as the world reserve currency, and to exclusively trade with their localized currencies and payment systems.

While the BRICS nations and alliance has been getting the most attention as of recent for wanting to dump the dollar (after years and years of this quietly happening underneath the noses of the Western populations), another financial alliance group is looking to do the same.

SEE: BRICS Nations Discussing Working On A ‘Fundamentally New Currency’ According To Russian Official

The Association of Southeast Asian Nations (ASEAN) made their intentions clear last week that they intend on doing trade with more localized currencies, and even going as far as to exclude payment giants Mastercard and VISA from the equation.

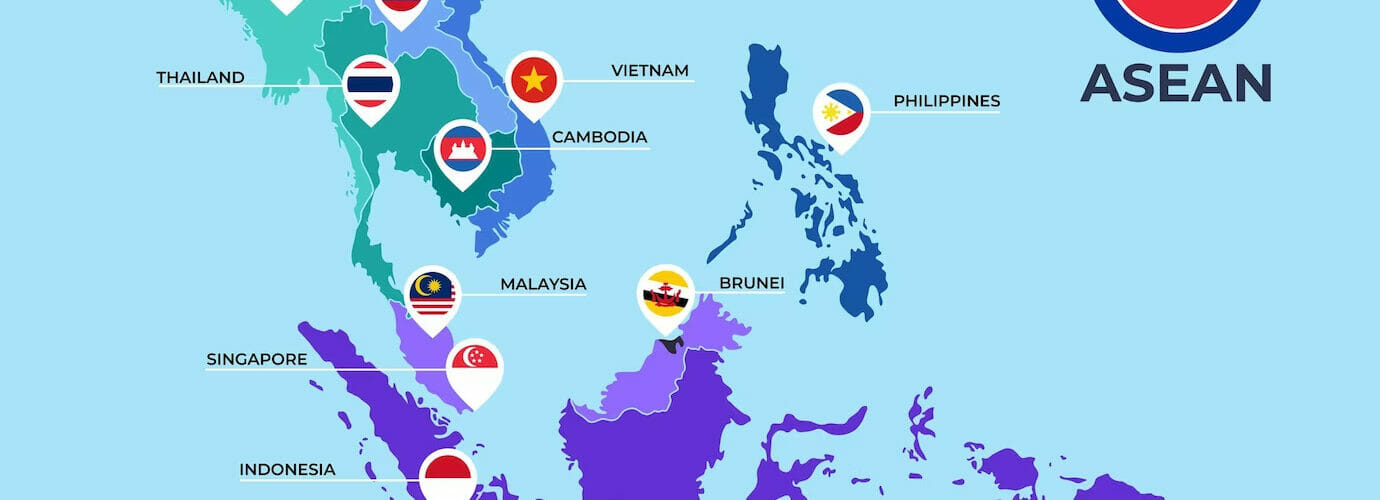

ASEAN comprises 10 different Asian nations, which include: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam; with Australia and New Zealand also working closely with this association via new a free trade agreement pact established in November, 2022. Subtract Australia and New Zealand, and ASEAN affects over 600 million people and is one of the world’s largest economies.

On March 28th finance ministers and the nation’s respective heads of central banks convened in Indonesia to discuss moving away from the U.S. dollar, the euro, and the Japanese yen; but instead trade with their currencies, via their Local Currency Transaction Plan and its digital payment system.

ASEAN wrote in a press release the following day:

An official meeting of all ASEAN Finance Ministers and Central Bank Governors kicked off on Tuesday (March 28) in Indonesia. Top of the agenda are discussions to reduce dependence on the US Dollar, Euro, Yen, and British Pound from financial transactions and move to settlements in local currencies.

The meeting discussed efforts to reduce dependence on major currencies through the Local Currency Transaction (LCT) scheme. This is an extension of the previous Local Currency Settlement (LCS) scheme that has already begun to be implemented between ASEAN members.

This means that an ASEAN cross-border digital payment system would be expanded further and allow ASEAN states to use local currencies for trade. An agreement on such cooperation was reached between Indonesia, Malaysia, Singapore, the Philippines, and Thailand in November 2022. This follows from Indonesia’s banking regulator, stating on March 27 that the Bank of Indonesia is preparing to introduce its own domestic payment system.

Indonesian President Joko Widodo has urged regional administrations to start using credit cards issued by local banks and gradually stop using foreign payment systems. He argued that Indonesia needed to shield itself from geopolitical disruptions, citing the sanctions targeting Russia’s financial sector from the US, EU, and their allies over the conflict in Ukraine.

Moving away from Western payment systems is necessary to protect transactions from “possible geopolitical repercussions,” Widodo said.

Of the ASEAN nations, just Singapore has enforced sanctions on Russia, while all other ASEAN nations continue to trade with the country. There has been alarm at being caught up in US-led secondary sanctions, as are short to impact Central and South Asia countries involved in cotton manufacturing, a major industry in the region employing millions of people.

Foreign investors in Asia may wish to consider the amount of US dollars, Euros and Yen held in their accounts in light of a pending ASEAN currency trade decision. Professional discussions should be taken regarding any movement of company funds to alternative currencies.

It should be noted that these nations still freely trade with Russia, save only Indonesia that has joined the West in sanctioning Russia – which, according to the Trends Journal report that these restrictions are harming ‘the region’s cotton manufacturing industry, which employs millions of workers among several ASEAN countries.’

The rise of ASEAN is being felt by Australia who are now loose trading partners with them. Professor Tony Milner, the director of Asialink at the University of Melbourne and a veteran observer of the region, told the Australian Broadcasting Corporation (ABC) last month that these nations can no longer be considered countries in their “backyard,” as Australian influence continues to decline.

I saw a phrase the other day in an article … still referring to South-East Asia as our ‘backyard’. That’s not a way of capturing the Australian public, [showing] the extraordinary range of countries around us now.

Our GDP was, not all that long ago, larger than the whole of the ASEAN GDP put together. And now, they’re more than double ours.

ASEAN is our second biggest trading partner, but we’re only their eighth or ninth biggest trading partner, with 2-3 percent of their trade.

We also have a lot more competition in the region. Korea meant nothing a couple of decades ago in terms of the economy of South-East Asia. Now they do well over twice as much trade there as we do.

We talk a lot about India, but … the ASEAN GDP is larger than the Indian one, and certainly bigger in trade terms in the world than India. So we’re missing something.

Here’s an area we’ve spent decades in … We’ve got a record of involvement. We’ve got officials. We used to have academics with strong knowledge of that region. [There’s the] business community with some involvement in a trading way.

But we’re not using those assets – and that is really worrying.

Milner told ABC

Additionally, ABC reported: ‘And there’s an array of religious beliefs – with the world’s most populous Muslim country (Indonesia), along with one of the most populous Catholic countries (the Philippines) and most populous Buddhist countries (Thailand).’

‘Together, South-East Asia has a GDP of around US$3.6 trillion ($5.4 trillion) – for comparison, Australia’s GDP is around US$1.7 trillion ($2.5 trillion) – and includes one of the world’s most important financial centers, Singapore,’ ABC added.

In November of last year the health minister of Indonesia called for the implementation of digital health passports for the “next pandemic” at the G20 summit meeting. He said, “So let’s have a digital health certificate, acknowledged by the [World Health Organization] WHO. If you have been vaccinated or tested properly, then you can move around.”

Other ASEAN nations like Thailand trialed their own retail CBDC at the end of last year. The country also requires vaccine passports for visitors, and issuing digital IDs to access public services and banking.

AUTHOR COMMENTARY

The U.S is getting sucker-punched from every angle in terms of dumping their currency as the world reserve currency. This plan to de-dollarize and end U.S hegemony has been transpiring for many years now, but now so much of it has been happening at once, as the United States sits back and watches the empire collapsing; convincing themselves that everything is peachy, still playing the music as the Titanic is clearly sinking rapidly.

Over a week ago I told readers that Donald Trump causing a ruckus that he might get arrested (which turned out to be a ruse), was being used as a distraction for all the banking problems and dirty dealings going on (and still are). Now, not only are the banks still in trouble and getting worse, as is the whole of the economy, now scores of nations are ganging up (more loudly than ever before) to trounce and dump the U.S dollar as the world reserve currency – at a time when the media is laser-focused on Trump’s indictment this week. AGAIN, it’s a big distraction, while more serious issues are happening in broad daylight; but Americans would rather tune into another bread & circuses event cycle.

It’s all coming back to bite the U.S. in the behind.

He that oppresseth the poor to increase his riches, and he that giveth to the rich, shall surely come to want.

Proverbs 22:16

You can read more about these moves to dethrone the dollar by these nations under the economics tab.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I bet they’re part of the kings of the east when Armageddon is being prepared. China, Japan, India, North and South Korea for sure will be involved.

Dear winepressnews.com webmaster, Your posts are always well written and informative.