New Jersey Senator Cory Booker (D) and Massachusetts Congresswoman Ayanna Pressley, have co-sponsored a bill that would be provide a form of “baby bonds” by paying the youngest in society to deal with inflationary rises.

The bill has since received other backers, such as notable figures like Congresswoman Alexandria Ocasio Cortez from New York.

The bill is called The American Opportunity Accounts Act, which basically proposes that the federal government will provide a $1,000 check in the form of a bond in the newborn’s name, adding $2,000 to each child’s name annually until they are 18, with 3% interest earned each year as well.

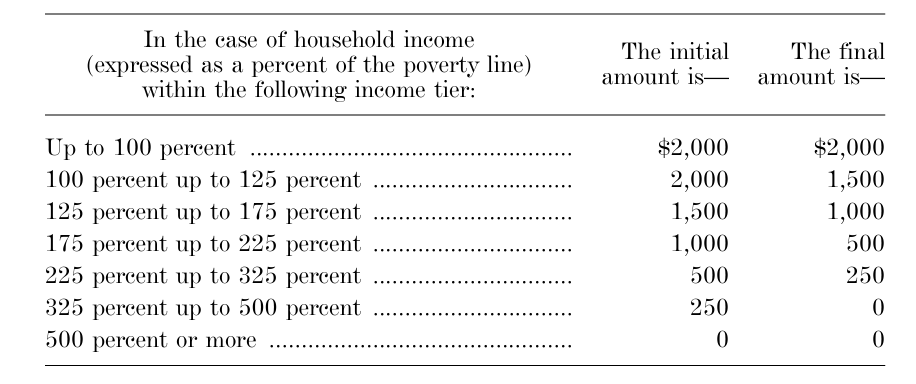

However the lowest income earning families would receive $2,000 for each child and the denomination will increase all the way down to zero if a family begins to earn more or too much.

The annual contribution amount shall be the amount such that the annual contribution amount for any taxpayer whose household income is within an income tier specified in the following table shall decrease, on a sliding scale in a linear manner, from the initial amount to the final amount specified in such table for such income tier:

The bill reads

‘At age 18, account holders could access the funds in the account for allowable uses like buying a home or paying for educational expenses. The legislation is fully paid for by making common sense reforms to federal estate and inheritance taxes, including restoring the estate tax to 2009 levels,’ as explained on Pressley’s website.

When it’s all said and done a child who received the full amount will have accumulated a little over $46,000 that can be redeemed, which the reps and senators backing this believe will help children from low-income families get a jumpstart into adulthood, and get their foot in the door for low-cost housing and education.

| Income | Income for family of 4 | Supplemental payment amount | Est. account balance for 18-year old ($2019) |

| <100% of FPL | <$25,100 | $2,000 | $46,215 |

| 125% of FPL | $31,375 | $1,500 | $35,081 |

| 175% of FPL | $43,925 | $1,000 | $23,948 |

| 225% of FPL | $56,475 | $500 | $12,815 |

| 325% of FPL | $81,575 | $250 | $7,248 |

| 500% of FPL | $125,751 | $0 | $1,681 |

The racial wealth gap in America is the result of generations of precise and intentional policy violence, so we must be as intentional and as precise about advancing policies that address it head on.

Baby Bonds are one of the most effective tools we have for closing the racial wealth gap and breaking the cycles of poverty and trauma that have prevented Black and brown folks from thriving in this country, so it is no surprise that this idea has gained traction in states across the country. Black lives and Black wealth matter, which is why Congress must pass our bill without delay.

Representative Pressley said in a statement

Americans today are having a harder time accessing homeownership, higher education, and a secure retirement than their parents did just a generation before them.

This is due in part to our upside-down tax code, which is great at preserving and building wealth for corporations and wealthy families, but fails Americans who are barely getting by and are unable to afford long-term investments to get ahead. ‘Baby Bonds’ would fix our broken tax code by providing every American child with startup capital for their life, and helping to drive down the wealth inequality that holds American families back from their full potential. With more cities and states across the country establishing their own ‘Baby Bonds’ programs, I’m excited for the potential of American Opportunity Accounts to build a foundation for economic opportunity for all Americans, while breaking the generational cycles of poverty for underserved communities in the process.

Senator Corey Booker added

Dean Karayanis for the New York Sun explained why he thinks this bill is a flaw and is not addressing the current inflationary problems:

Why not confront the larger problem instead of making children wait 18 years for relief as inflation eats away at their bonds’ value? It’s because tax reform isn’t a sexy topic for politicians, but showing up with a check in the maternity ward makes them heroes.

Ms. Pressley’s statement cited the legislation’s “common sense reforms to federal estate and inheritance taxes, including restoring the estate tax to 2009 levels.” It’s clever political rhetoric, but if the bonds’ wisdom is self-evident, why must those with means be compelled to fund them?

From time immemorial, the common-sense thing has been that parents get to decide where they bequeath the fruits of a lifetime spent working to build something for the next generation. The government stepping in to seize a portion of their wealth isn’t “reform,” it’s robbery.

If the bill passes into law and a family farmer wishes to pass on the land to his children, the government will step in to ensure some of that nest egg is shunted off to the children of others. This will only incentivize them to safeguard their wealth, since human beings are dynamic.

When the wealthy don’t sit still and pay the higher tax rate, Ms. Pressley’s description of the Baby Bonds as “paid for” will ring hollow, leaving taxpayers — as with so many similar programs in the past — on the hook to make up the shortfall long after the signing ceremony at the White House ends with the dolling out of ceremonial pens.

Although reducing the wealth gap and expanding opportunity are worthy goals, choosing to offer relief to a select group two decades from now is more political stunt than panacea. If the tax code is the problem, Congress has the power to change it for everyone today, but unlike Baby Bonds, that wouldn’t make Big Government the hand that rocks the cradle.

SEE: Oregon Considers Bill To Pay Homeless $1,000 A Month With Zero Stipulations

AUTHOR COMMENTARY

In all labour there is profit: but the talk of the lips tendeth only to penury.

Proverbs 14:23

The stupidity of this needs no commentary but I shall anyways.

Just the like paradoxical “Inflation Reduction Act” did the exact opposite of reducing inflation, so too will this not fix anything but make it even worse. None of the press releases ever disclose the estimated grand total of this in perpetuity; and while I have not taken the time to crunch the numbers, the cost of this would easily be in the trillions upon trillions in no time.

You can NOT print your way out of inflation and economic downturn: it only makes inflation WORSE, and yet Democrats and RINOs don’t want you to figure that out, even though it’s Economics 101.

Also, addressing the elephant in the room: this in no way actually provides relief in the short term to address inflation. By the time these kids can claim their bonds (assuming they will to get the full amount) at the pace things are moving, $46K will probably be enough to afford groceries for that week!

[22] A good man leaveth an inheritance to his children’s children: and the wealth of the sinner is laid up for the just. [23] Much food is in the tillage of the poor: but there is that is destroyed for want of judgment. Proverbs 13:22-23

Forget working hard and actually earning a living, and God forbid if family worked hard enough to pass down something to their children and their children; now you can just live off of the state. This once again paves the way and opens the door for CBDCs and social credit scores.

As the economy totally implodes in the months to come and the tsunami wave to follow, expect this and more to get pushed, and I would not be surprised if lots of Republicans get on board with this as well.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

So who gets the money if the child is vaccinated and dies suddenly before he or she reaches the age of 18? Will this country even be around in 18 years? I’m not good at figuring out these elaborate money making schemes, but I am confident the money will be lining the pockets of these legislators and the ones who control them. No wonder nobody wants to work anymore and jobs go begging to be filled.

Google pays $300 on a regular basis. My latest salary check was $8600 for working 10 hours a week on the internet. My younger sibling has been averaging $19k for the last few months, and he constantly works approximately 24 hours. I’m not sure how simple it was once I checked it out. This is my main concern………………………….Www.Coins71.Com