It may not get an ounce of mainstream or even alternative media coverage, but right now, world central banks, financial juggernauts and fintech groups are rapidly developing a system by which literally everything will be converted into a unique digital record stored on a blockchain. This process is known as tokenization, where all things will be converted into a token, a piece of digital representation that is then bought, sold, and traded as a commodity. This system is needed to truly enable proper effectiveness for central bank digital currencies (CBDC). Such a system would fully allow central banks and asset managers to know precisely what people possess at all times, as all transactions and purchases would be completely tracked and mitigated in real-time, and would thus fulfill the ominous statement by the World Economic Forum: “You’ll own nothing and be happy.”

In December 2023, Trends Journal contributor Gregory Mannarino warned that this is the new world order monetary system. He wrote (emphasis his):

Envision for a moment a mechanism where every single conceivable asset, including life itself, or life expectancy, which is also an asset, is reduced into a token. Well, I am here to reveal to you that this is exactly what IS going to happen.

The new tokenized system is going to REPRESENT, (pay attention to the word represent), not just currency and other financial assets such as real estate, but ALL assets- including you, your past, what you have done, and even speculation on what you may do-including things like life expectancy, what you earn, what you potentially will earn in the future, what you buy, what you may buy, past illness, potential future illness, family history, what medications you take, what medications that you will potentially “need” in the future, your VAXX record, DNA, etc. Which means that this new token-based system, IN ITS ENTIRETY, will reduce/REPRESENT everything to a digital TRADABLE asset. Human life is going to become a tradable/cross-border convertible asset along with every manner of its associated derivatives.

Tokenization is simple, and incredibly cost effective. Tokenization eliminates the need for ANY asset to “be converted” into something else for transactions to take place anywhere in the world, (trans-world). This IS The Universal New World/One World System.

What Is A Token?

Before getting into the ramifications of tokenization and its current rollout, it needs to be explained what a token is.

According to the Bank of International Settlements (BIS), a relatively unknown entity referred to as ‘the central bank of central banks;’ whose mission is “to support central banks’ pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks,” the BIS defines tokenization as “the process of representing claims digitally on a programmable platform,” adding that a token “can be seen as the next logical step in digital recordkeeping and asset transfer.”

Citing the BIS, Lena Petrova with World Affairs in Context summarizes what a token is:

A token is a digital asset that can be manipulated by a financial institution: a tokenized customer’s deposit is subject to the rules defined by its issuer. For example, a token may be spent or exchanged only within the scope of a pre-defined set of rules. An asset (for example, a customer’s bank deposit) may have rules that allow the money to be spent only on certain services or products.

Further, a token stores all information about the underlying asset: previous owners, dates of purchase/ sale, transaction dates, etc. This data is stored on a blockchain that is managed by a financial institution.

Think of a token as a dollar bill or a promissory note. The note contains information that defines what it is worth and is owned by the issuing bank. Tokenization is comparable to digitizing that physical note in its most simplistic form.

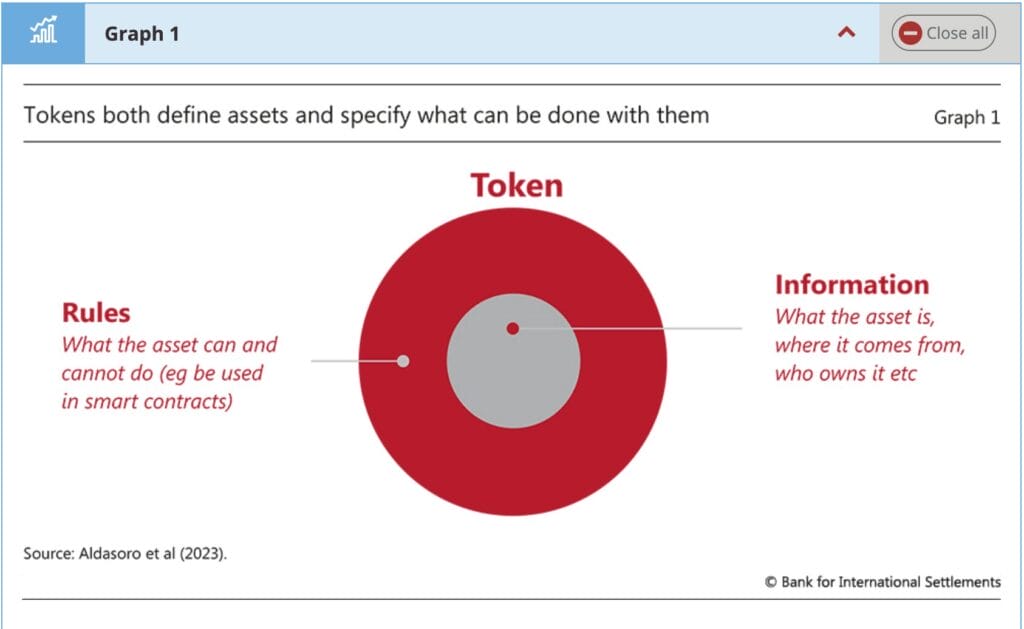

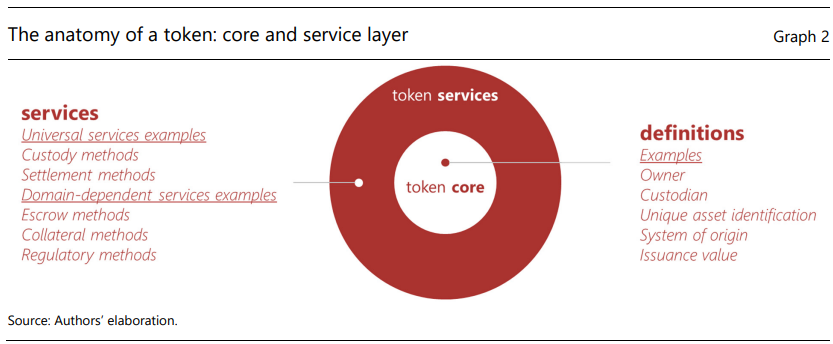

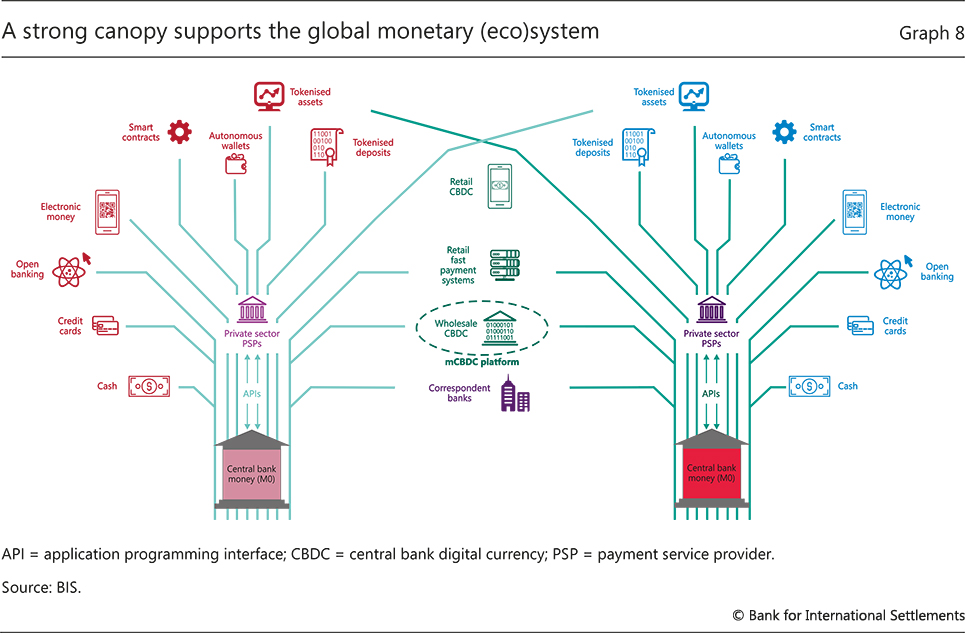

The BIS provides some basic charts that explain how a token works:

Tokenization introduces a new concept that the BIS refers to as “conditional performance of actions,” which it defines as:

[Tokenization] enables the contingent performance of actions through smart contracts, ie logical statements such as “if, then, or else”. By combining composability and contingency, tokenization makes the conditional performance of actions more readily attainable, even quite complex ones.”

This conditional performance of actions would probably be utilized when establishing the so-called “rules” of what an asset can and cannot do. These rules are likely to have the possibility to restrain the users’ ability to utilize their funds or a wide array of assets across all sectors.

In September, Christopher Desch, an engineer and product architect at the New York Innovation Center at the New York Fed, and Henry Holden, an adviser at the BIS and who is on secondment with the New York Innovation Center, wrote in a piece explaining what tokenization is and its potential in various forms of the economy. They wrote:

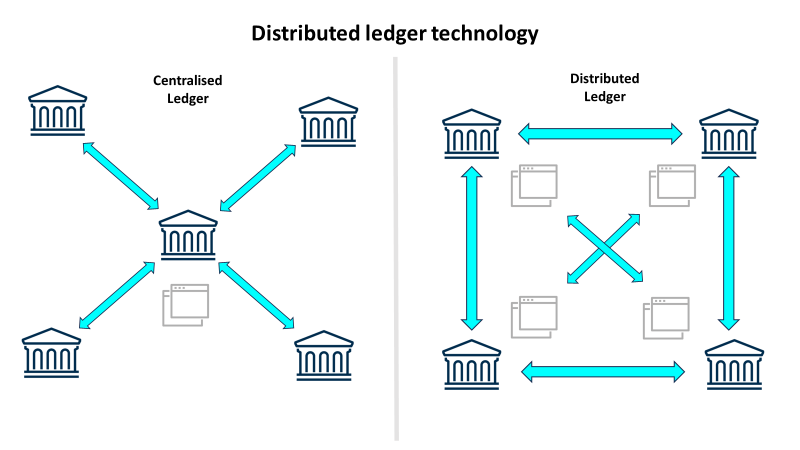

“With tokenization, assets can be dematerialized without being immobilized. In other words, electronic assets can move around like pieces of paper, and would not need to be held in a single, centralized ledger like they are today. This flexibility would be augmented by another aspect of [distributed ledger technology] (DLT): “smart contracts,” or programmable rules that can automate processes. For securities, tokenization could be used to automate asset servicing, custody, and trustee tasks currently performed by intermediaries.”

The BIS envisions and is working to help create a unified ledger, where all assets of all kinds would be tokenized and where all users’ personal income and assets would be stored. The BIS wrote in its Annual Report for 2023:

A new type of financial market infrastructure – a unified ledger – could capture the full benefits of tokenization by combining central bank money, tokenized deposits and tokenized assets on a programmable platform.

Moreover, by having “everything in one place”, a unified ledger provides a setting in which a broader array of contingent actions can be automatically executed to overcome information and incentive problems.

Then, in order to utilize these tokens and CBDCs, a digital ID wallet would be required to store all this information when transacting. Petrova points out: “A digital identity “wallet” is the infrastructure needed to create a unified global ledger; a database we have not seen or heard of before. Once assets are digitized by a financial institution, the original owners, by default, relinquish control over their property and become fully dependent on the availability, functionalities and rules of the digital system,” she explained.

Last November, the EU Parliament formally reached an agreement on implementing a new framework for a European digital identity (eID). The EU said at the time: “Under the new law, member states will offer citizens and businesses digital wallets that will be able to link their national digital identities with proof of other personal attributes (e.g., driving licence, diplomas, bank account). Citizens will be able to prove their identity and share electronic documents from their digital wallets with a click of a button on their mobile phone.”

Additionally, “Now that we have a Digital Identity Wallet, we have to put something in it,” EU Commissioner Thiery Breton said. He presumably was referring to a digital euro.

The WinePress has numerously reported on the advancement and procurement of digital IDs around the world. Of those many examples, in March, World Bank Group President, Ajay Banga, and Hans Vestberg, Chairman and CEO of Verizon, were guest panelists at the Global Digital Summit in Washington D.C., and advocated for the necessity of digital IDs and how governments should be the handlers of these IDs and wallets. Banga described the IDs as “the social contract of a citizen with their country to have an identity, a currency and safety.” Banga added: “I think providing infrastructure is a core element. But on top of that, creating a digital identity platform for citizenry is kind of foundational. I believe your government should be the owner of your digital ID.” Vestberg agreed: “Absolutely, 100%,” he remarked. Banga even admitted that a string crises would create the necessary justification to implement such IDs.

A sense of crisis is your best friend. Never let a crisis go to waste. A sense of crisis is your best friend in getting people to agree to tackle this triangle, along with the enabling tool of technology and the biggest headroom is geopolitics and fractionizing of the global order. That’s why I believe in digital for us.

Banga explained

In short, BNY Mellon, the 11th largest bank in the U.S. by assets, succinctly explains what tokenization is and broadly all things that can be tokenized:

Tokenization of assets involves the process of digitally representing real, physical assets on distributed ledgers, or issuing traditional asset classes in tokenized form. Within the context of blockchain technology, tokenization is the process of converting something of value into a digital token that’s usable on a blockchain application and a token represents a share of ownership in the underlying asset.

This process can work for tangible assets like gold, real estate, debt, bonds, and art, or certain forms of intangible assets such as ownership rights or content licensing. What is even more exciting is that tokenization allows for transforming ownerships such that traditionally indivisible assets can be fractionalized into token forms.

The Necessity For Tokenization

Banga and Vestberg’s claims are not in the least bit exaggerated. The implementation of digital IDs, which opens the door for CBDCs and tokenized assets, would grant central banks complete control over people’s money and by extension will then be able to have great influence on how that digital money is spent.

On October 19th, 2020, BIS General Manager Agustin Carstens openly admitted that CBDCs would grant central banks total control over the populace, acknowledging that central banks would know precisely how much money people have in their accounts at any given moment.

We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.

Carstens said

Carstens’ shocking admission was a departure from what he originally had articulated concerning CBDCs, when in March 2019 he downplayed the need for them, but then made a 180 degree shift roughly four months later saying that CBDCs are needed. As explained earlier, in order for CBDCs to be fully operational for public use, money, assets and commodities must be tokenized.

The Bank for International Settlements, autonomously existing in Basel, Switzerland, still remains largely unknown to the common masses. Though it is located in Switzerland, the bank technically has its own land reservations and is not subordinate to the Swiss government, similar to how the United Nations, headquartered in New York, is shared amongst member countries and exists in an autonomous zone.

Dr. Pascal Lottaz of Neutrality Studies discussed in an interview with World Affairs in Context earlier this year the shady history of the BIS, and how it was originally created in 1930 to facilitate payments and reparations after the first World War, and quietly funded the Nazi party during World War II.

The group is now aiding in the creation of CBDCs and tokenization of assets. BIS says its “mission is to support central banks’ pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks.” The BIS says on its website that it “is owned by 63 central banks, representing countries from around the world that together account for about 95% of world GDP.”

While the BIS does not directly mandate policy, its influence and the role it plays with member central banks is not to be underscored considering the sheer amount of money at play and the direct influence central banks have on their economies and global markets.

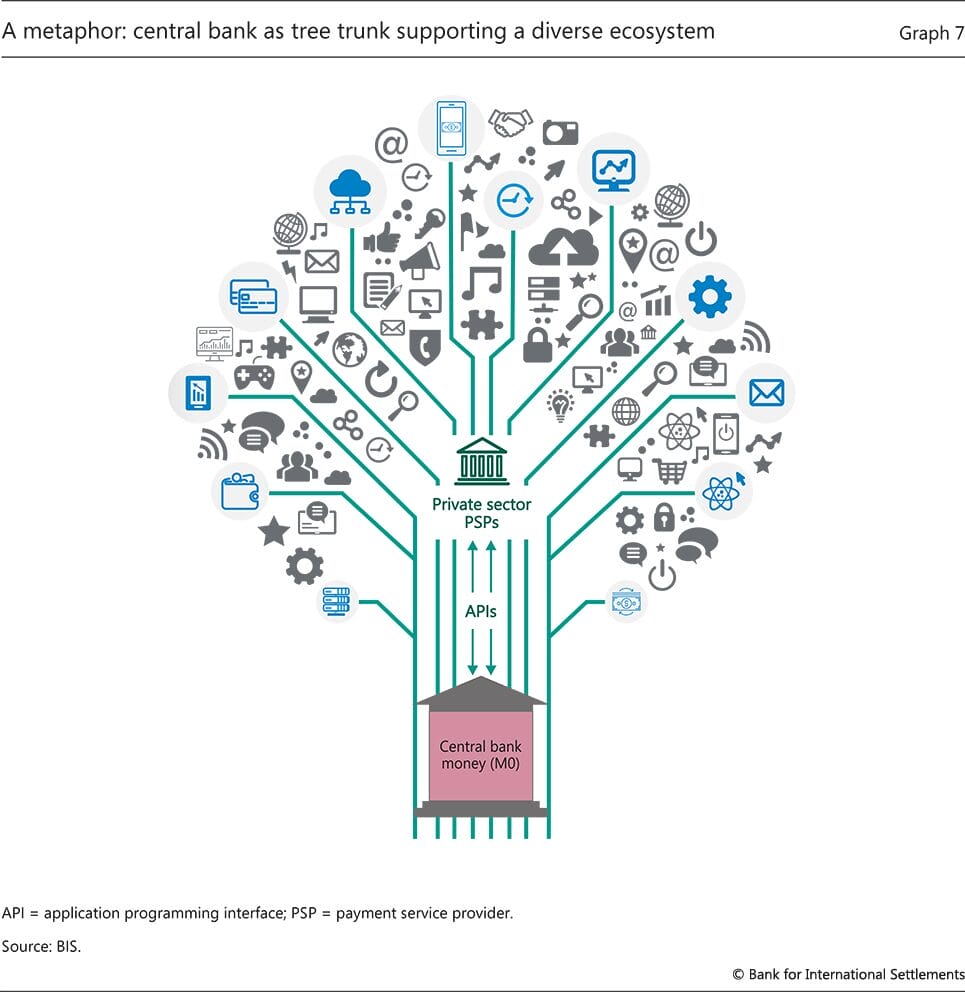

In 2022, Hyun Song Shin, Economic Adviser and Head of Research at the BIS, detailed the BIS’s vision for this during their 92nd Annual General Meeting in a segment called “The Future Monetary System.”

Shin noted the volatility and fragility of decentralized cryptocurrencies and stablecoins, and instead argued that CBDCs and instant transfer rails are far more reliable and secure. In addition, Shin said, “These innovative payment rails are fully compatible with programmability, composability and tokenisation to support faster, safer and cheaper payments and settlement, both within and across borders.” He added: “In this way, the future monetary system will be adaptable, allowing private sector innovation to flourish while avoiding the drawbacks of crypto. Such initiatives could open up a new chapter in the global monetary system.”

As described by Shin, tokenization is a major feature of this future monetary system and the role tokens would play in tandem with CBDCs, anchored by central banks. Shin explained:

Within the new functions unlocked by wholesale CBDCs, one set of applications deserves special mention – namely, those stemming from the tokenisation of deposits (M1), and other forms of money that are represented on permissioned [Digital Ledger Technology] DLT networks. The role of intermediaries in settling transactions was one of the major advances in the history of money, tracing back to the role of public deposit banks in Europe in the early history of central banking. Bank deposits serve as the payment medium, as the intermediary debits the account of the payer and credits the account of the receiver.

The tokenisation of deposits takes this principle and translates the operation to DLT by creating a digital representation of deposits on the DLT platform, and settling them in a decentralised manner. This could facilitate new forms of exchange, including fractional ownership of securities and real assets, allowing for innovative financial services that extend well beyond payments.

As issuers of the settlement currency, central banks can support the tokenisation of regulated financial instruments such as retail deposits. Tokenised deposits are a digital representation of commercial bank deposits on a DLT platform. They would represent a claim on the depositor’s commercial bank, just as a regular deposit does, and be convertible into central bank money (either cash or retail CBDC) at par value. Depositors would be able to convert their deposits into and out of tokens, and to exchange them for goods, services or other assets.

Tokenised deposits would also be protected by deposit insurance but, unlike traditional deposits, they would also be programmable and “always on” (24/7), thus lending themselves to broader uses in retail payments – e.g. in autonomous ecosystems. This way, they could facilitate tokenisation of other financial assets, such as stocks or bonds. This functionality could allow for fractional ownership of assets and for the ability to exchange these on a 24/7 basis. Crucially, this could be done in a regulated system, with settlements in wholesale CBDC.

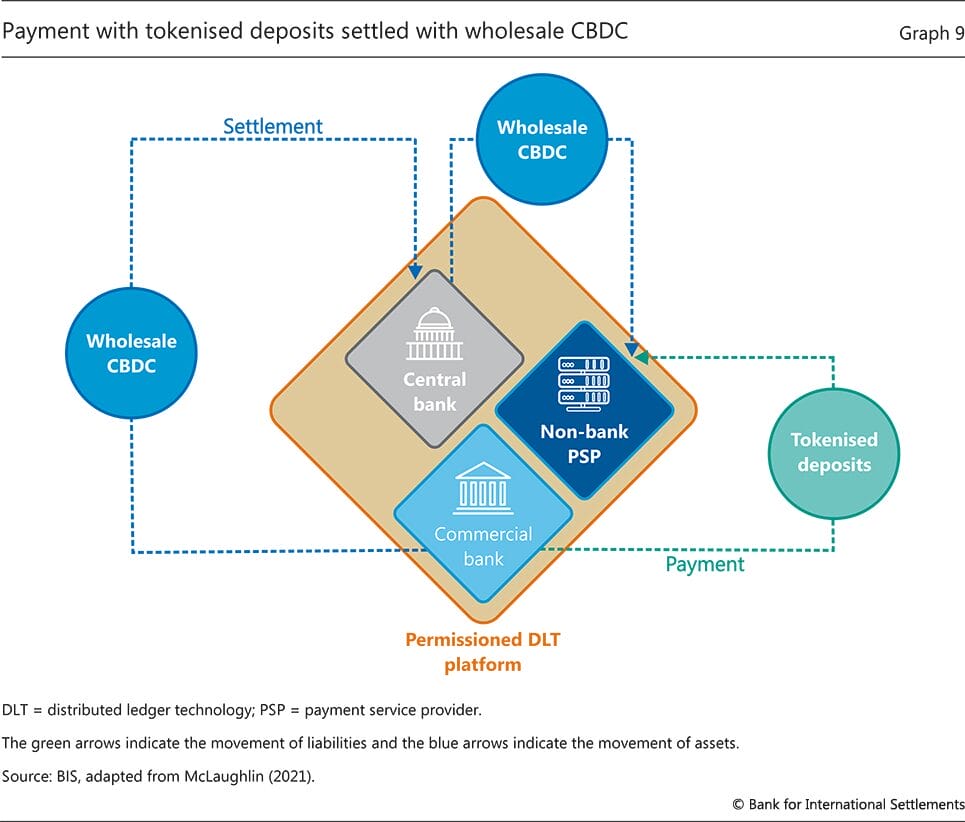

One possible system with tokenised deposits could feature a permissioned DLT platform.

This platform records all transactions in tokens issued by the participating institutions, eg commercial banks (representing deposits), non-bank PSPs (representing e-money) and the central bank (representing central bank money). Retail investors (depositors) would hold tokens in digital wallets and make payments by transferring tokens across wallets.

The settlement of transactions between financial institutions on the DLT platform would rely on the use of wholesale CBDCs as settlement currency. To get a sense of how this would work, consider a depositor who holds a bank’s tokens and wishes to make a payment to the holder of non-bank PSP tokens, representing e-money, for instance to pay for a house. Both parties may agree that the payment (green arrow) should occur at the same time the deed to the house is transferred. In the background, to settle the transaction, the bank would transfer wholesale CBDC on the DLT platform to the non-bank PSP (blue arrows). The non-bank PSP would transfer a corresponding amount of new tokens to its customer’s wallet. All of these steps could occur simultaneously, as part of a single atomic transaction, executed through smart contracts.

In this system, wholesale CBDCs help to settle transactions and to guarantee the convertibility and uniformity of the various representations of money. The same system could also allow for digital representations of stocks and bonds. This would enable end users to easily access (fractions of) these assets in small denominations, 24/7, from regulated providers – and to settle the transactions instantaneously.

The BIS has since reiterated the importance of tokenization in a number of other meetings and reports. Christopher J. Waller, Member of the Board of Governors of the Federal Reserve, also explained how tokenization will play a key role in the new economy during the “Cryptocurrency and the Future of Global Finance” conference in Sarasota, Florida, April 2023.

Waller explained that assets must be tokenized before they can be traded on a blockchain, and the advantages of tokenizing are that it allows for instant transferability and they are “programmable” and have “smart contract” capabilities. Waller stated:

Before a blockchain can be used to facilitate transactions in traditional assets, the assets must first be “tokenized”–that is, represented on the blockchain such that the blockchain becomes the ledger of record for the asset. At that point, parties can engage in transactions with the tokenized asset by updating records on the blockchain.

First, blockchain can offer fast or even near-real time transfers on a 24/7/365 basis, which, among other things, allows parties precise control over settlement times and in some cases, can enhance efficiencies and reduce liquidity risks. I will note, of course, that these benefits are not unique to blockchains. The Federal Reserve’s FedNow service, which is set to begin operations in July, does not rely on blockchain; and it will provide safe and efficient instant payment services in real time, around the clock, every day of the year. SEE: In Response To Criticism, Federal Reserve Asserts That Instant Payment System “FedNow” Will Not Facilitate A CBDC, But The Biden Admin. Says Otherwise

Another potential advantage of tokenized assets is that they are “programmable” and have “smart contract” functionality. A smart contract is a computer program stored on a blockchain, which can be programmed to execute predefined actions once certain conditions are met. When assets are tokenized, smart contracts can be used to construct and execute transactions involving the asset. When the smart contract is activated, the transaction proceeds automatically as long as the specified conditions are met. This is the sense in which smart contracts are smart: they do not depend on the parties to the transaction to implement them; instead, they implement themselves, based on the terms specified by the parties.

Smart contracts may allow for what is called “atomic settlement.” Rather than relying on each party to separately carry out its leg of the transaction, smart contracts can effectively combine the two, or more, legs of the transaction into a single unified “atomic” act that is executed by the smart contract. This may be an additional robust way to achieve delivery-versus-payment (“DVP”) and payment-versus-payment (“PVP”) functionality, such that one leg of a transaction settles if and only if the other leg settles as well. Atomic settlement is useful because it can mitigate settlement and counterparty credit risks: it ensures that the buyer will not pay if the seller does not deliver; and conversely, that the seller will not deliver if the buyer does not pay.

More recently, on October 18th, 2024, Waller gave a speech at the Vienna Macroeconomics Workshop, Institute of Advanced Studies in Vienna, Austria, where he emphasized the need for tokenizing assets.

“Distributed ledger technology, or DLT, may be an efficient and faster way to do recordkeeping in a 24/7 trading world,” he said. “We already see several financial institutions experimenting with DLT for traditional repo trading that occurs 24/7.

“But before these ledgers can be used to facilitate transactions in traditional assets—like debt, equity, and real estate—these assets must be tokenized. Undertaking the process to tokenize assets and use distributed ledgers like blockchain can speed up transfers of assets and take advantage of another innovation: smart contracts.

“The bottom line is that things like DLT, tokenization, and smart contracts are just technologies for trading that can be used in defi or also to improve efficiency in centralized finance,” Waller added.

Moreover, Cecilia Skingsley, Head of the BIS Innovation Hub, spoke at the Eighth Annual Fintech Conference of the Federal Reserve Bank of Philadelphia on October 23rd, and argued that the private sector must embrace change when it comes to accepting tokenization as the future of finance. During a speech at the annual meeting co-hosted by the Institute of International Finance (IIF), she argued that “the financial infrastructures of today, they are not going to be fit for tomorrow.” Skingsley said digital IDs and regulation are two key components needed for tokenization to work properly on an international scale, Ledger Insights reported.

In Desch’s and Holden’s aforementioned report from earlier, the two also noted that change is coming but will still take time. “Change takes time, and there may be a period of years where tokenized money would need to interact with traditional securities, or vice versa,” they wrote. “It is also not clear whether money or securities might be tokenized first. While money is simpler and easier to tokenize than complex, data-heavy securities, some researchers argue that managing complexity is where tokenization’s greatest potential benefits are to be found.”

Furthermore, Andrew Bailey, Governor of the Bank of England, said in an October speech at the Group of Thirty’s 39th Annual International Banking Seminar in Washington DC, discussed “The future of money and payments.” He said “we must continue to prepare for retail CBDC,” and argued that since there is a lack of “innovation” in commercial bank money, “central banks may be left as the only game in town insofar as retail payments innovation is concerned” and thus result in a CBDC, though he claims “that is not [his] preferred outcome.”

In his speech, he briefly mentioned the role of tokenization and referenced a paper published in July called “The Bank of England’s approach to innovation in money and payments,” which dives into much greater detail about the benefits of tokenizing assets. The Bank noted that “the potential benefits of DLT can only be realised if market participants issue tokenized financial assets, i.e. assets which could be represented in digital form on programmable platforms.” The central bank argues that “these new forms of making payments could support households and businesses by being faster, cheaper and more functional. They could be used in both wholesale and retail contexts.” The BoE further explains that a tokenized deposit would be treated similarly to a “traditional” deposit.

The Bank has a low financial stability risk appetite for this outcome. Central bank money must therefore keep pace with technological advances in financial markets such as tokenization. Accordingly, the Bank is considering innovations in wholesale central bank money to ensure it continues to play its critical role as an anchor for confidence in the financial system.

One approach would be for the Bank to develop its wholesale central bank money infrastructure. This could support singleness by enabling settlement in central bank money to be compatible with bilateral exchanges across stablecoins and tokenised deposits.

The BoE wrote in its report

BlackRock’s Bid To Tokenize The World

But the BIS and central banks are not the only major players chomping at the bit to institute tokenization on a global scale. In comes BlackRock, one of the world’s largest global asset management firms and a multinational investor based in New York that has a heavy hand in influencing environmental, social, and governmental (ESG) policies. BlackRock’s portfolio has the largest concentration of assets under management in the world, and has garnered the reputation of “owning the world” as well as the title of the world’s leading asset management company.

BlackRock, and its current chairman and CEO Larry Fink, have substantial influence and monetary resources to draw from, giving them the power to sway the direction of governments and corporations seeing as the company owns the majority stakes in many megacorporations and other big business sectors

At the beginning of this year, Fink began to reveal more publicly BlackRock’s intrigue and push for tokenization. In January, after the United States Securities and Exchange Commission (SEC) officially approved the listing of the first-ever spot Bitcoin Exchange-Traded Funds (ETFs), Fink then turned to the media to declare that the Bitcoin ETF marked the necessary stepping stone to implement a fractionalized, tokenized world. At the time he explained that the new asset class is “no different than what gold represented over thousands of years. It is an asset class that protects you,” he said. “Unlike gold where we manufacture new gold, we’re almost at the ceiling of the amount of Bitcoin that can be created. What we’re trying to do is offer an instrument that can store wealth.”

He went on to say that this is a big step towards the tokenization of assets, the future of commerce and transactions.

“Let me be clear: ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset. To me, this is where we believe it’s going. […] These are technological changes that can allow us to move forward.[…] As I said, these are just stepping stones towards tokenization. And I really do believe that this is where we’re going to be going. We have the technology to tokenize today.”

He continued: “Think about this: if you had a tokenized security, and you have a tokenized identity, you Andrew [Ross Sorkin], the moment you buy or sell an instrument on a general ledger that is all created together – you want to talk about issues about money laundering and all that; this eliminates all corruption by having a tokenized system.”

Fink’s grand ambitions and interesting connections were thoroughly detailed in a piece titled “Tokenized, Inc: BlackRock’s Plan To Own The Fractionalized World,” written by Mark Goodwin and Whitney Webb. The long article is definitely worth the read, but Coin Bureau highlighted some of the salient parts of the report in a video briefing. However, we will examine some of the details printed in Goodwin’s and Webb’s exposé.

On January 12th, Fink reiterated to Bloomberg Television:

We believe we’re just halfway there in the ETF revolution…Everything is going to be ETF’d…We believe this is just the beginning. ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset.

Less than a week later, Jeremy Allaire, CEO of the USDC stablecoin issuer and BlackRock affiliate Circle, referred to Fink’s comments during a panel discussion in Davos, Switzerland, at the World Economic Forum (WEF). He said: “It suggests confidence that tokenization is going to be coming on in a significant way. That we’re going to see some of the very biggest asset issuers in the world issuing tokenized versions of those assets this year. That’s significant.” SEE: CEO Who Manages Stablecoin USDC Says Global Economy Will ‘Become Instant, Global, Frictionless And Free’ In Less Than A Decade

More recently, Fink provided some new statements on “digitizing the dollar” and further investment into cryptocurrencies such as Bitcoin and Ethereum. “We believe bitcoin is [an] asset class in itself, it is an alternative to other commodities like gold,” Fink said during BlackRock’s third quarter earnings call, predicting these cryptocurrencies will “overlay” with artificial intelligence. “I truly believe we will see a broadening of the market of these digital assets. And then we’ll see how does each and every country looks at their own digital currency. That’s a very different asset than a bitcoin in itself. But I do believe what we’re going to witness as we build out better analytics.”

Fink also noted attempts in India and Brazil to digitize their currencies as a “big success.” “How do we see in [the U.S.] the role of digitizing the dollar? And what role does that play,” Fink asked. “That’s a very different question related to, let’s say, bitcoin and other items like that. But all of that is going to be under discussion.”

As explained in Goodwin’s and Webb’s report, BlackRock is adamant about tokenizing literally everything. Though Fink and crew do not use the term as often these days due to some scrutiny, their tough ESG policies (which are directly in line with the United Nations’ 17 Sustainable Development Goals (SDGs)) are still being implemented and enforced with companies they work with and/or invest in. Fink is heavily invested in what he refers to as “infrastructure,” which includes things in nature, land and natural resources such as food and water, and anything that can be measured (actually or arbitrarily) in carbon – more on that later.

The day after Bitcoin ETFs were approved, BlackRock acquired one of the largest infrastructure fund managers in the world, Global Infrastructure Partners (GIP). Fink shared in a statement how this acquisition allows for the merging of tokenization of the infrastructure sector, stating:

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy. We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and on-shoring or near-shoring of critical sectors. Policymakers are only just beginning to implement once-in-a- generation financial incentives for new infrastructure technologies and projects.”

Moreover, Fink, in an interview with CNBC, went on to articulate his reasoning for the GIP merger by explaining the future of infrastructure merging with the private market:

“I have been long advocating that deficits matter. The future of governments funding their deficits on their own balance sheets is going to become more and more difficult. We’re in a conversation with many governments of doing more public-private transactions. We are seeing more and more corporations, instead of selling divisions, they are selling blocks of assets. Sometimes 100% and sometimes 50% and going into partnership and building the infrastructure.

“We all know the need of re-calibrating our power grid as we digitize everything. We all know that more and more countries are focusing on energy independence and some of them are focused on decarbonization. All across these investments, we are talking trillions of dollars. We believe the big macro trend in the future is going to be much heavier reliance on private capital – retirement assets –– to co-invest with companies and governments with infrastructure,” Fink stated.

Fink has made it very clear in no uncertain terms that tokenization will ultimate into a centralized, universal ledger where all tokenized assets will be tracked and stored, and ever single person will be given their own unique digital identification number. Quoting Fink, the head of BlackRock boldly stated:

We believe the next step going forward will be the tokenization of all assets and that means every stock and every bond will have its own, basically, CUSIP [i.e. the system used to identify most financial products in North America]. It will be on one general ledger. Every investor, you and I, will have our own number, our own identification. We can rid ourselves of all issues around illicit activities around bonds and stocks and digital by having tokenization…. We would have instantaneous settlement. Think of all the costs of settling bonds and stocks, but if you had a tokenization, everything would be immediate because it is just a line item. We believe this is a technology transformation for financial assets.

(Emphasis mine)

In their essay, Goodwin and Webb also note just how embedded and crucial tokenization is to fulfilling the goals of the UN and other globalist governing bodies, as it would allow these intuitions to exact more controlling power over populations. The authors wrote at length:

Fink’s statements are an apparent head-nod to the UN’s sustainable development goals (SDGs, sometimes referred to as Agenda 2030), which BlackRock has long supported, both in terms of public support and in terms of pressuring companies it influences to implement SDG policy goals and tracking their progress towards their implementation. SDG 16, in particular, contains provisions for biometric and interoperable Digital IDs to be developed by the private sector that all meet the technical standards laid out by the UN-backed ID2020 (now part of the Digital Impact Alliance). This is being done to provide the illusion of decentralization, when – in reality – these different ID systems will all be required to export data harvested from the Digital ID system to a global, interoperable database. That database is likely to be the World Bank’s ID4D.

UN documentation on the SDGs directly links Digital ID to the implementation of what it refers to as “financial inclusion.” Elsewhere, UN officials have described increasing financial inclusion as “imperative” to delivering the SDGs. As Unlimited Hangout previously reported:

The UN Task Force for the digital financing of SDGs explored how to “catalyse and recommend ways to harness digital financing to accelerate the financing of the Sustainable Development Goals.” It published a “call to action” with the objective of exploiting “digitalization in creating a citizen-centric financial system aligned to the SDGs.” The UN Task Force’s “action agenda” recommended “a new generation of global digital financing platforms with significant cross-border, spillover impacts.” According to the regime, this would, of course, require the strengthening of “inclusive international governance. Cross-border spillovers, or “externalities,” are the actions and events occurring in one country that have intended or unintended consequences in others. […] It is claimed that cross-border spillover could be managed by including “digital ID and data markets” in a system of “SDG-aligned digital financing.”

Another, related UN document, entitled “Peoples’ Money – Harnessing Digitilisation to Finance A Sustainable Future,” the UN describes how long-term financing for the SDGs and related infrastructure should come directly from the “peoples’ money,” i.e. regular people’s bank accounts, upon the implementation of “citizen-centric, SDG-aligned digital finance.” Essential pre-requisites for this system, the document states, “includes the core digital connectivity and payments infrastructure, Digital IDs, and data markets that enable financial innovation and low-cost service delivery. [. . .] Universally-available, reliable, secure, private, unique Digital IDs are critical to enabling people to access digital finance.” Other documents related to SDG implementation and “SDG-aligned digital finance” from entities like the Bank of International Settlements call for every business entity, from the largest to the smallest, to have “decentralized identifiers,” i.e. DIDs. In other documentation, the BIS, as well as the UN, have treated CBDCs and Digital IDs, including DIDs, as synonymous and essential to achieving the so-called “financial inclusion” agenda. Transactions of different yet interoperable CBDCs, and their private sector equivalents, are poised to be tracked on a single, global ledger, not unlike Digital ID. In fact, it appears it is all meant to be stored on the same ledger.

As stated in 2018 by Peggy Johnson, then a top executive at Microsoft, a ID2020 co-founder:

As discussions begin this week at the World Economic Forum, creating universal access to identity is an issue at the top of Microsoft’s agenda. [. . .] Last summer that Microsoft took a first step, collaborating [. . .] on a blockchain-based identity prototype [. . .] we pursued this work in support of the ID2020 Alliance — a global public-private partnership[.] [. . .] Microsoft, our partners in the ID2020 Alliance, and developers around the globe will collaborate on an open source, self-sovereign, blockchain-based identity system that allows people, products, apps and services to interoperate across blockchains, cloud providers and organizations. [. . .] We will also help establish standards that ensure this work is impactful and scalable. Our shared ambition with ID2020 is to start piloting this solution in the coming year to bring it to those who need it most, beginning with refugee populations.

These programs, from ID2020 and also from the UN’s World Food Programme, tie a person’s iris biometrics to a Digital ID that links directly to that person’s digital wallet, where aid money is disbursed, meaning that – if a refugee wants to eat – they must participate in a cashless, biometric-based financial system where financial transactions and key aspects of identity, including education credentials and health records, are stored. With the World Bank poised to serve as the database for much of this infrastructure once developed at scale via its ID4D initiative, it seems likely that the coming “SDG-aligned digital finance” and Digital ID system will also incorporate the World Bank’s aforementioned “climate wallet” functionality as developed through their D4C initiative. As noted earlier, this would enable large-scale engagement with tokenized carbon markets. One of Larry Fink’s reasons in calling for the “reimagining” of the World Bank was specifically to help “fund the [energy] transition in emerging markets,” which presumably involves facilitating carbon markets.

In previous years, Larry Fink was very vocal about ESG and pressuring the myriad of companies in which BlackRock is a significant shareholder to develop decarbonization policies. However, upon pushback – namely from the political “populist” right, Fink abandoned his faux-collectivist talking points to justify these policies and has since even dropped using the term ESG altogether. When this transition began, Fink argued that his push for ESG had been motivated by “the pursuit of long-term returns,” not by politics or ideology. He further described BlackRock’s approach to sustainability as being rooted in “stakeholder capitalism,” the economic system championed by the WEF’s Klaus Schwab and built on an interlocking, global network of public-private partnerships. In that same document, Fink called decarbonization, which includes voluntary carbon markets, “the greatest investment opportunity of our lifetime.” Fink has since altered his rhetoric around these agendas, moving from claims that they are necessary to avoid planetary doom, to claims that they are the key to unlocking next generational wealth.

The Transition To Tokenization, Multipolarity, The IMF, And A New World Order

While it is evident that central banks and key private interests and stakeholders have high and lofty ambitions for tokenization and the digitization of all assets and money, getting the public to accept it, voluntarily or involuntarily, (by hook or by crook), is another thing.

And yet, BlackRock, among others, have already spelled out one of the main ways they will get the world to adopt CBDCs and tokenization: hyperinflation of conventional currencies.

In August 2019, just months before the world was thrust into disarray and shutdowns of its economies, foreign and domestic trade, BlackRock published a paper called “Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination.” This report was presented during the big international bankers’ meeting in Jackson Hole, Wyoming, that year; and in that report, BlackRock unambiguously says that mass-inflation and “helicopter money” should be printed as a mechanism to drive the need for digital currencies. The authors wrote (emphasis added):

Unprecedented policies will be needed to respond to the next economic downturn. Monetary policy is almost exhausted as global interest rates plunge towards zero or below. Fiscal policy on its own will struggle to provide major stimulus in a timely fashion given high debt levels and the typical lags with implementation.

Without a clear framework in place, policymakers will inevitably find themselves blurring the boundaries between fiscal and monetary policies. This threatens the hard-won credibility of policy institutions and could open the door to uncontrolled fiscal spending.

This paper outlines the contours of a framework to mitigate this risk so as to enable an unprecedented coordination through a monetary-financed fiscal facility. Activated, funded and closed by the central bank to achieve an explicit inflation objective, the facility would be deployed by the fiscal authority

An extreme form of “going direct” would be an explicit and permanent monetary financing of a fiscal expansion, or so-called helicopter money. Explicit monetary financing in sufficient size will push up inflation. Without explicit boundaries, however, it would undermine institutional credibility and could lead to uncontrolled fiscal spending.

For example, policy innovations in the next downturn will likely need to take inequality more directly into account to be politically palatable. Not all asset purchase programmes are born equal when it comes to their impact on inequality. Policy responses that put money more directly in the hands of citizens might be more attractive. The rise of central bank-issued electronic money (not cryptocurrencies) might achieve these objectives in ways that were not previously possible.

You can download/read the whole document below:

BlackRock’s prescription was soon implemented around the world as central banks implemented radical and unprecedented “quantitative easing,” mass money printing and currency devaluation, and lowering interest rates at near or at 0%, and some even in the negative. For reference, Investopedia says that ‘Some could argue that the Fed’s stimulus measures in response to the COVID-19 pandemic and the resulting recession could be considered helicopter drop money. In response to the economic hardship facing the United States, the Fed took unprecedented steps to stabilize the financial markets and the banking system as well as provide direct support to small businesses. The result was an injection of trillions of dollars into the U.S. economy.’

In the United States, for example, BlackRock was called upon by the Federal Reserve in March 2020, to handle three debt-buying programs, along with the Bank of Canada contracting Fink’s firm to advise commercial paper purchases, and was hired by the European Union banking system to aid in sustainability. During his signing of the historic $6.2 trillion CARES Act, President Trump acknowledged BlackRock’s financial aid, saying, “People like Larry Fink we’re talking to, that’s BlackRock – we have the smartest people, and they all want to do it.”

Goodwin and Webb note Fink’s previous affiliation with Trump before the pandemonium of 2020. The authors wrote: “Before entering the White House, Fink had helped manage Trump’s finances, and after a 2017 meeting with his administration, made note of his previous relationship by stating “In every meeting we had, he talked about doing more…I didn’t think ‘doing more’ meant [being] the president.” It was no surprise then that just three years later, Trump would be employing Fink once again to manage the stimulus distribution programs alongside former majority BlackRock shareholder, Bank of America. “I do believe it’s going to continue to bring opportunities for us,” Fink stated during a 2020 earnings call, referring to government assignments. As if predicting the coming profiteering off the unprecedented government lockdowns, in a 2011 interview with Bloomberg, Fink went so far as to say “Markets don’t like uncertainty. Markets like, actually, totalitarian governments… Democracies are very messy.””

Larry did a great job for me. He managed a lot of my money. I have to tell you, he got me great returns.

Trump said during the 2017 meeting.

More recently, Trump has apparently embraced a new love for cryptocurrencies and tokenization, and has made a number of promises to become the so-called “Bitcoin President,” and has floated the idea of establishing a “Bitcoin dollar” and making the U.S. the leading hub for Bitcoin mining. Trump said in July he would “create a framework to enable the safe, responsible expansion of stablecoins […] allowing us to extend the dominance of the U.S. dollar to new frontiers all around the world.” He then claimed that his administration’s work in cementing dollar stablecoins, “America will be richer, the world will be better, and there will be billions and billions of people brought into the crypto economy and storing their savings in bitcoin.” He added, “America will become the world’s undisputed bitcoin mining powerhouse.” The United States government is among the largest holders of bitcoin,” he also promised.

But not to be outdone, Vice-President Kamala Harris has embraced a crypto platform as well, though hers has not gotten as much attention. Cryptoslate reported in August: “Democrats launch ‘Crypto for Harris’ campaign to challenge Trump’s growing support.” Jonathan Padilla, CEO of Web3 marketing firm Snickerdoodle and one of the organizers of Crypto for Harris, said in a statement: “The United States must continue to be a leader in blockchain and crypto. Groups like Crypto for Harris are working hard to ensure the right policies and conversations take place to ensure that outcome.” In response to Trump, ‘Harris has strengthened her campaign by adding former crypto advisers David Plouffe and Gene Sperling. The move signals a commitment to understanding and supporting the crypto industry through informed advisory,’ the outlet added.

And while Trump has not been abashed about talking about his cozy relationship with Fink and BlackRock, the Biden-Harris administration has been just as equally friendly in adding a handful of BlackRock officials and affiliates to their cabinet. SEE: Bought & Paid For: Joe Biden Is Bankrolled By BlackRock And Donald Trump Is Bankrolled By Blackstone

Though there has been some scrutiny from both camps, both the Republican and Democratic parties in the U.S. have embraced a future monetary system that is crypto-based, even if it is not directly tied to a CBDC – which is something Trump claimed he would not allow as President. Very recently, the U.S. Treasury’s Borrowing Advisory Committee explored the topic of tokenizing U.S. treasuries. In the Treasury’s presentation, they wrote: “In a similar manner to how privately-issued ‘wildcat’ currencies were replaced by government-backed central currencies in the late-1800s, Central Bank Digital Currencies (CBDC) will likely need to replace stablecoins as the primary form of digital currency underpinning tokenized transactions.”

Even Fink recently said that whoever is President will not have too much effect on the price action and adoption of Bitcoin. “I’m not sure if either President or other candidate would make a difference. I do believe the utilization of digital assets is going to become more and more of a reality worldwide,” Fink said during an earnings call for the third quarter of 2024.

But as Goodwin and Webb note in a separate piece detailing Trump’s new affinity for Bitcoin and other digital assets (which is too detailed to get into in this report), the firm embrace of a private sector stablecoin in effect still acts similarly to a CBDC and still aids in the transition to a tokenized society, as noted earlier – even though there are some at the BIS who do not exactly share that same vision. Be that as it may, the two authors wrote in their report:

Thus, any policy that unites bitcoin and the dollar – whether under Trump or another future president – would most likely be aimed at enabling the same monetary policy that currently threatens the dollar. – [referring to massive money printing like BlackRock suggested]. The most likely outcome under Trump, as outlets like CNBC have speculated, would be making bitcoin a reserve asset and, as a consequence, a sink for the inflation caused by the government’s perpetual expansion of the money supply. Ironically, bitcoin would then become the enabler of the very problem it had long been heralded as solving.

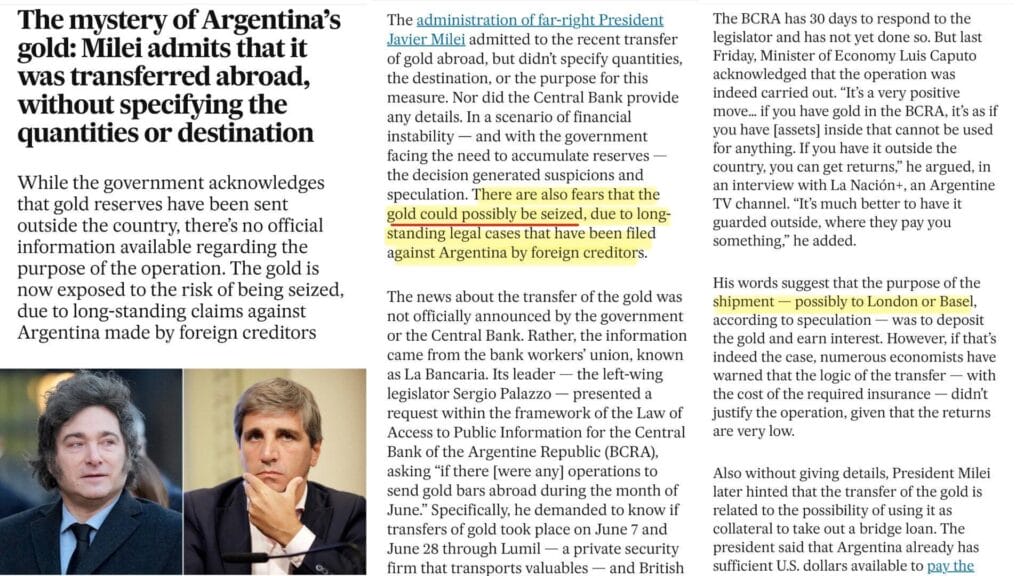

Not only that, but bitcoin would then become the anchor that would allow the U.S. government to weaponize the dollar against economies where local currencies fail to withstand the pressures of an increasingly unstable economy, effectively supplanting the local currency with digital dollars. This phenomenon, already under way in countries like Argentina, brings with it significant opportunities for the U.S. government to financially surveil the “billions and billions of people” to be brought onto dollar stablecoin platforms, some of which have already onboarded the FBI and Secret Service and frozen wallets at their request.

Considering that “private” stablecoin platforms are already so intertwined with a government known to warrantlessly surveil civilians both domestically and abroad, the surveillance concerns are analogous to the surveillance concerns around central bank digital currencies (CBDCs). In addition, with stablecoins being just as programmable as CBDCs, the differences between stablecoins and a CBDC would revolve largely around whether the private or public sector is issuing them, as both would retain the same functionality in terms of surveillance and programmability that have led many to view such currencies as threats to freedom and privacy. Thus, Trump’s rejection of CBDCs but embrace of dollar stablecoins on Saturday shows a rejection of direct digital currency issuance by the Federal Reserve, not a rejection of surveillable, programmable money.

So the question remains, why wouldn’t the U.S. government just make a retail-facing CBDC? For starters, there are likely more limitations for a public sector entity on who and what they can restrict on their platforms. However, the main reason is mostly an economic one: they need to sell their debt to someone else to perpetuate the U.S. Treasury system.

SEE: Wyoming Plans To Release Stablecoin By 2025 In Precursor To CBDC

On top of the massive currency devaluation and embracing stablecoins, another underlying key component driving tokenization is the push for the world to become multipolar. For many years the United States has had the luxury of the dollar being the world’s reserve currency, with the world having used and stockpiled dollar reserves. But having the world’s reserve currency allows the U.S. military industrial complex to export its debt and inflation onto the rest of the world, which of course then makes everything more expensive for everyone else; and grants the U.S. government the power to habitually sanction nations that are ‘disobedient’ and do not fall in line with America’s wishes. The Federal Reserve has admitted this in a report published earlier this year, which conceded that if the country were to hypothetically return to a gold standard then it would make the money supply “inelastic” and reduce inflation, and would limit the government’s ability to levy sanctions.

It should be carefully noted that while tokenization is not tethered to multilateralism and multipolarity in of itself, it cannot go unnoticed that the same power establishments and actors implementing tokenization are also calling for a multipolar and fractionalized world, one that is supposed to bring more peace and freer trade – one that allows nations to focus on their own currencies and economies will still being connected in real-time with the use of blockchain DLTs, digital IDs, CBDCs and tokenized assets.

To keep it brief, the existing world order structure is collapsing and the United States’ economic and military hegemony is coming to an end, and the world is now becoming more fractionalized and independent from one another. This is the underlying thesis behind the World Economic Forum’s calls for what they dub the “Great Reset,” and adopting a philosophy they refer to as “stakeholder capitalism,” where companies and the powerful elite class not only make profit but also invest in the ‘greater good’ for us all, they espouse. The WEF wrote in a June briefing: “The old rules-based order that was established after the Second World War is succumbing to unprecedented pressure as we enter a new multipolar world that will require an updating of these rules rather than their complete abandonment.”

Talks of multipolarity have gone on well before 2020 but have greatly exacerbated since that year, and especially in 2022 with the Russia-Ukraine war as a focal point. In 2017, for example, Klaus Schwab, founder of the WEF, wrote a piece titled “We need a new narrative for globalization.” He stated that “globalization has lifted over a billion people out of poverty. But in its present form it is no longer fit for purpose.” Schwab highlighted the “transition from a unipolar to a multipolar world, and consequently, to a world with competing societal concepts which challenge “Western” thinking.” Another article written by the WEF in 2019 explained how “today’s multipolar world mirrors the vast development of emerging markets, fueled by supportive demographics and the benefits that economic globalization brings. At the same time, it also reflects the relative decline of the middle class in developed markets.” In July, Schwab introduced the WEF’s 15th Annual Meeting of the New Champions in China, where he said in order “to drive future economic growth, we must embrace innovation and force collaboration across sectors, regions, nations and cultures to create a more peaceful, inclusive, sustainable and resilient future.:

At the WEF summit meetings in Davos earlier this year, United Nations Secretary-General Antonio Guterres said he wants to see a “new, multipolar global order” that can re-establish structure in the world and prevent growing crises. In 2021, he said, “We need multilateralism with teeth.”

I am confident we can build a new, multipolar global order with new opportunities for leadership, and with balance and justice in international relations.[…] The only way to manage this complexity and avoid a slide into chaos is through a reformed, inclusive, networked multilateralism. Now this requires strong multilateral institutions and frameworks, and effective mechanisms of global governance.[…] So let’s be clear: Rebuilding Trust is not a slogan or a PR campaign. It requires deep reforms to global governance to manage geopolitical tensions during a new era of multipolarity.

Guterres said. “Rebuilding Trust” was the slogan for this year’s WEF summit

BlackRock and their allies also want to further establish a multipolar world. Fink is a principal of the Global Financial Alliance for Net Zero (GFANZ), which seeks to re-create the “global financial governance system.” The co-chair of GFANZ, and current UN envoy for climate action and former Governor of the Bank of England Mark Carney, has stated the need to redesign the international financial structure several years before he quarterbacked GFANZ’s creation under the aegis of the UN. Speaking at Jackson Hole in 2019, Carney called for a brand new monetary system structured around “multipolarity” and “inclusivity.” He ended his speech by stating: “Let’s end the malign neglect of the IMFS [international monetary financial system] and build a system worthy of the diverse, multipolar global economy that is emerging.” Carney has gone on to say that this new IMFS should include new “multipolar” currencies, including CBDCs, and global carbon markets.

Goodwin and Webb noted in their report: ‘GFANZ, which comprises some of the most powerful private banks and financial institutions in the world, has been very open about their ambitions. Their goals include merging the powerful private banks and institutions that compose GFANZ with multi-lateral development banks (MDBs) in order to capitalize on “a vast commercial opportunity” – i.e. using the existing model of MDBs to trigger market deregulation through debt slavery to facilitate the “green” investments of GFANZ members, all under the guise of furthering “sustainable development,” “multipolarity” and “inclusion.” GFANZ’s ambitions also include the creation of global carbon markets as part of its broader push to recreate “global financial governance” by “seizing the New Bretton Woods moment.”’

In comes BRICS, an emerging economic bloc that has now surpassed G7’s gross-domestic product (GDP) output and controls roughly a little over 40% of the world’s oil supply. BRICS officially consists of Brazil, Russia, India, China, South Africa, Ethiopia, Iran, Saudi Arabia, Egypt and the United Arab of Emirates, along with 13 recently added strategic partners (not official members, yet), including a much broader waiting list of around 60 nations applying for membership, with a broader emphasis on trade with their own local currencies. The WinePress has covered a number of reports on BRICS’ explicit urgency to advance multipolarity and de-dollarize their economies, especially in part due to the fact that the States’ currency is eroding and because of the nation’s hypocritical exceptionalism and protectionism, using its reserve currency status to levy sanctions, among other things (though this is a very rough oversimplification of the issues at hand).

This year’s BRICS summit was held in Kazan, Russia, (October 22nd-24th) where this year’s main agenda was to strengthen and establish its digital currency blockchain platform and alternatives to Western payment systems, building the BRICS bank and increasing its infrastructure, among other items on this year’s itinerary. On the final day of the summit, which was also “United Nations Day,” UN Chief Guterres spoke at the summit and said “I salute your valuable commitment and support for international problem-solving as clearly reflected in your theme this year.” He continued: “But no single group and no single country can act alone or in isolation. It takes a community of nations, working as one global family, to address global challenges.” The UN head highlighted four avenues of focus: finance, climate, technology and, peace. He concluded by praising the bloc’s leaders for working towards multipolarity and achieving the UN’s SDGs. “The Summit of the Future charted a course to strengthen multilateralism for global development and security. Now we must turn words into deeds and we believe BRICS can play a very important role in this direction.”

The messaging coming out of this year’s summit was clear: its leaders fully support multipolarity. Brazilian President Luiz Inacio Lula da Silva, though not in attendance this year, said, “It’s not about replacing our currencies, but we need to work so that the multipolar order we aim for is reflected in the international financial system. This discussion needs to be faced with seriousness, caution and technical soundness, but it cannot be postponed any longer.”

On the final day, Russian President Vladimir Putin announced that the Kazan Declaration was signed, which is a comprehensive treatise that reflects the collective vision and goals of BRICS members, and will be distributed to the United Nations as a key expression of global multipolarity, Info.BRICS reported. Point three of the document declares:

“We reaffirm our commitment to the BRICS spirit of mutual respect and understanding, sovereign equality, solidarity, democracy, openness, inclusiveness, collaboration and consensus. As we build upon 16 years of BRICS Summits, we further commit ourselves to strengthening cooperation in the expanded BRICS under the three pillars of political and security, economic and financial, cultural and people-to-people cooperation and to enhancing our strategic partnership for the benefit of our people through the promotion of peace, a more representative, fairer international order, a reinvigorated and reformed multilateral system, sustainable development and inclusive growth.”

Lucas Leiroz, member of the BRICS Journalists Association, researcher at the Center for Geostrategic Studies, geopolitical consultant, had an interesting takeaway from the summit’s proceedings:

In practice, it can be said that this Declaration was the most significant and, in a way, bold in the history of BRICS summits. The group expressed itself jointly as a united bloc with a common political agenda, which is the creation of a multipolar order. The main global issues, such as conflicts, monetary transition and geopolitical changes, were accordingly discussed in a joint and peaceful manner, respecting the individual interests of each member and overcoming any specific differences in favor of a common agenda.

It is not yet clear how the BRICS will act in this new multipolar order. Some authors believe that the organization will be a kind of global platform for emerging nations within the conventional structures of the UN. Other authors believe that, in a way, the BRICS will replace the UN itself, completely changing the global decision-making process. In any case, one assessment is clear and irrefutable: the BRICS are contributing significantly to expanding the participation of emerging countries in global issues.

However, it should be noted that in an earlier BRICS meeting in June the member states agreed that their New Development Bank should help to achieve “the [UN] SDGs and further improve efficiency and effectiveness to fulfil its mandate.” Of these goals, some of which implicate the need to eat less meat in exchange for bugs, for example, “Goal 16 – Peace, Justice and Strong Institutions” includes the curation of digital IDs and birth registration for everyone by 2030; thus implying the formation of digital currencies and tokenization.

Ahead of the Summit, the bloc reintroduced a more up-to-date and improved version of BRICS Pay, a blockchain-based payment system that is meant to act as an alternative to conventional Western payment methods; allowing businesses and individuals looking to engage in cross-border trade within the BRICS nations and use their currencies whilst reducing dependency on the dollar. For whatever reason, BRICS Pay removed from its website that this platform can support CBDCs and tokenization, but The WP documented this last year. It said: “BRICS PAY set benefits from a combination of traditional payment systems and new technologies such as central bank digital currencies (CBDC), decentralized finance, and tokenized assets (secured money). BRICS PAY is an expansion of payment options for companies and citizens of participating countries, as well as for the entire world and all existing or emerging payment solutions.”

On top of this, Dr. Yaroslav Lissovolik at BRICS+ Analytics, who formerly held positions at the International Monetary Fund (IMF) and Deutsche Bank, described the BRICS involvement with the BIS and central banks to create CBDCs, one of these projects being a DLT-based framework called “BRICS Bridge.” The BRICS analyst told World Affairs in Context in an interview BRICS Bridge “has been sponsored by the [BIS] and has been ongoing for several years now – [it] has progressed significantly and has shown that it is possible through the use of the CBDCs and making them interoperable and making them interconnected through a common platform.” He added, “You can speed up significantly the transactions across the economies that are involved, reduce the costs, increase the efficiency of these transactions.”

Lissovolik added: “It’s going to be an improvement on the system that is operational now, in many respects outdated, and is in many respects also overburdened by the excessive layers of banking sector intermediation. Essentially, that system of a platform of [CBDCs] deals away with a lot of the intermediary costs. The transactions are far more effective, cheaper and easier to track, so technologically it is a superior kind of platform, a superior means of making these transactions.

“The creation of this BRICS Bridge system is not just the creation of an alternative route for developing economies in terms of payment systems, it is potentially a contribution to the improvement of the global financial system. These efforts to create this alternative payment system are at the advanced edge of the technological development of payment systems, and this is precisely where the development of advanced payment systems is taking place with the participation of such important institutions as the [BIS] and some of the key and leading economies of the world,” the former IMF official explained.

Later in the interview, Lissovolik clarified his earlier remarks and said that central banks will “essentially [act as] the key operators of this system. Central banks will need to be far more active in advancing greater interoperability and the harmonization of standards that will speed up settlements and make these settlements more secure.”

The BIS has been working with BRICS-aligned central banks on a project called “mBridge,” which is separate from “BRICS Bridge.” BIS described it as, “After experimenting with different technology architectures in earlier phases of the project, the project team developed a new blockchain – the mBridge Ledger – custom-built by central banks for central banks to serve as a specialised and flexible platform for implementation of multi-currency cross-border payments in central bank digital currencies (CBDCs).” However, following this year’s BRICS Summit the BIS decided to hand over the project to the central banks of China, Hong Kong, Saudi Arabia, Thailand and the UAE, after the project was nearing completion. General Manager Agustín Carstens responded to the controversy that this had nothing to do with politics. He stated: “Whatever projects we put together should not be a conduit to violate sanctions. MBridge is not the BRICS Bridge and I have to say that categorically. MBridge was not created to cater (to) the needs of BRICS. It was put together to satisfy broad central bank necessities. I would say that the project has been so successful that we can declare that we’ve graduated out of that project. The BIS is leaving that project. Not because it was a failure and not because of political considerations, but mostly because we have been involved for four years and it is at a level where the partners can carry it on by themselves,” said Carstens.

Furthermore and on top of this, Lissovolik also noted in a blog post in his coverage of the BRICS Summit as it was happening that BRICS is still in support of the World Trade Organization (WTO) and the IMF. He wrote: “There is also a specific mention of the BRICS Informal Consultative Framework on WTO issues – a sign of further movement to coordinate BRICS trade policy agenda within the WTO. The BRICS also state their support for the International Monetary Fund (IMF) that is at the center of the Global Financial Safety Net of the world economy, with calls for expanding the share and the representation of the Global South in this international financial organization.”

The IMF of course has made no secret of its intentions to implement CBDCs and digital assets. During an open dialogue with Governor of Bank Al Maghrib Abdellatif Jouahri and others on a panel discussion in June 2023, IMF chief Kristalina Georgieva echoed Lissovolik’s sentiment and said the benefits of CBDCs include increased “inclusion” by broadening access to financial services at lower costs, along with establishing cross-border payments “and remittances [that are] cheaper and quicker,” she said.

These are important considerations for the IMF, as we have a mandate to help ensure that digital money, including CBDCs, fosters domestic and international economic and financial stability.

Georgieva said

Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department at the IMF, also weighed-in in a prepared speech at the forum, where he discussed the “opportunity for money to evolve.” He noted that besides the IMF, the World Bank, the BIS, and the Russian-controlled Federal Security Service (FSB) are “tightly collaborating” to advance this venture. Speaking on the CBDCs and this new cross-border system, Adrian stated:

“This will bring people together through faster and cheaper payments, and countries together through a more stable and cohesive international monetary system. It’s about technology, but it’s also about governance, which establishes the “rules of the game.” These are tricky to establish, but an organization such as the IMF with its wide membership, focus on macro-financial interactions, and well-oiled internal governance can help countries build consensus. To get global finance right, we must come together to get global payments right.”

He went on to describe “the vision” “for a trusted ledger,” that basically is “an electronic document representing property rights on which digital versions of central bank reserves in any currency can be traded among participants,” he said, and that it cannot “exist in a vacuum;” for which “only those who need it can see it.” Adrian provided more insight into how this system would operate:

“The platform would settle money denominated in many different currencies. […] To make these interchangeable, we propose creating unique and standardized digital representations of them on the platform. To make a payment, participating banks would deposit their domestic central bank reserves in an escrow account controlled by the platform operator, and in return obtain a digital version to trade on the platform.

“In the case of the Moroccan ceramics exporter, its bank would receive tokenized reserves from the Spanish customer’s bank. The exporter’s bank would credit the exporter’s account, but may not be terribly happy holding euro reserves. So it could sell them to another participant on the platform in exchange for domestic reserves. Settlement would be quick, final, and safe. The ledger would be controlled by the platform operator, and only this operator would settle transactions. The single ledger would ensure there is a unique description of who owns what, so no double spending can occur,” he explained. He later stated: “As money, CBDCs provide safety. As infrastructure, CBDCs bring interoperability and efficiency among private networks for digital money and assets.”

As previously reported be The WP, The IMF which has said it wants to link internet search history with social credit scores. They believe by using non-financial data, more specifically, “the history of online searches and purchases,” they can solve the problem of “certain kinds of people not having enough hard data (income, employment time, assets and debts) available.” Accompanying this, the IMF’s Georgieva has urged nations to implement a carbon-based tax to reduce emissions. The IMF also admitted in a paper this year that “CBDC data allows for commercial exploitation while also raising the possibility of state surveillance.”

All in all, while the world is clearly going multipolar, for better or for worse, it is crystal clear that the beating heart of it will place greater authority on world central banks whilst striving to meet globalist arbitrary goals; and the digitalization of all assets and money will be necessary to properly fulfill these overarching goals, regardless if you live in the West or in the East and Global South.

Everything Is Being Tokenized Very Rapidly

– And yet hardly anyone is even paying attention to the sheer speed things are being tokenized, quite literally everything; and these last two years have seen significant strides in this department. There are a myriad of examples that could be cited, far too many to list, but some of the more conspicuous and pertinent events will briefly be noted.

Similar to what the BRICS is currently working to create, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) – which is the largest international banking network that facilitates transactions and interbank lending between nations, and connects over 11,500 banks and institutions in more than 200 countries and manages trillions of dollars’ worth of transactions per day, and has sanctioned Russia and Iran from using the platform – announced in March that “we plan to extend our solution to support a wider range of emerging digital networks, in addition to CBDCs, such as platforms for tokenized deposits,” and this platform should be operational within 12 to 24 months (2025 or 2026) from the time they issued that statement.

In September, SWIFT announced the potential for supporting the settlement of digital asset transactions utilizing the Swift network, enabling tokenized asset settlement with the “cash leg” using fiat currencies. This solution might trek to CBDC or tokenized deposits as more of them come networked. In October, SWIFT announced it will support banks in conducting live pilots for digital assets and currencies from 2025, which will include payments, FX, securities and trade commerce across various DLTs. On October 4th, SWIFT revealed it had completed a successful tokenized asset pilot with several firms, linking tokenization systems between central securities depositories (CSDs) and global custodians. “Our vision for instant and frictionless transactions not only applies to traditional securities instruments but also to new asset classes as well,” said Vikesh Patel, SWIFT Head of Securities Strategy. “The insights from this exercise with leading capital markets participants will help us define and prioritize the concrete steps required to enable seamless processes for tokenized assets.” Moreover, days before the mBridge project was officially passed-off to participating central banks by the BIS, Mu Changchun, head of the Digital Currency Institute of the People’s Bank of China, indicated that mBridge could connect to traditional payment systems, along with faster and real-time gross settlement systems (RTGS). “We are looking forward to possible cooperation with Swift in the future,” he said.

The European Central Bank (ECB) has made it very clear that its members are closely eyeing the benefits of tokenization. ECB director Piero Cipollone proposed the creation of a European ledger to support tokenization in capital markets, their version of the Unified Ledger. “Imagine a future where money and securities no longer sit in electronic, book-entry accounts but “live” on distributed ledgers held across a network of traders, each with a synchronised copy,” Cipollone conveyed in a speech last month. “If we don’t act soon, it may be impossible to achieve a genuine digital capital markets union with efficient wholesale payment and settlement services using risk-free central bank money,” he added.

[… We should] move towards a European ledger, which would be a single-platform solution where assets and cash would coexist on one chain. […] A European ledger could bring together token versions of central bank money, commercial bank money and other digital assets on a shared, programmable platform. In essence, this would see T2S evolving into a DLT-based, single financial market infrastructure for Europe. While central banks would provide the platform, or the “rails” so to speak, market participants would supply the content, or the “trains”. […] Our primary objective in this evolving landscape is to ensure that central bank money – the safest and most liquid settlement asset – remains a cornerstone of stability, even in a capital market based on tokens and DLT. Cipollone argued. “T2S” refers to the EU high value payment system used for the settlement of securities transactions in central bank money.

On October 31st, the ECB announced it is reaching out to so-called “visionaries” across multiple sectors and academics to help them with the “possible issuance of a digital euro.” This work will begin in 2025, and is asking “interested stakeholders to propose innovative use cases and explore their possible impact on communities, societal challenges and technological opportunities such as tokenisation.”

Large commercial banks have also already begun tokenizing their deposits. Last year, Citi Bank announced the creation and piloting of Citi Token Services for cash management and trade finance. “Citi Token Services will integrate tokenized deposits and smart contracts into Citi’s global network, upgrading core cash management and trade finance capabilities,” the bank said at the time. This past month, that project has now officially gone public commercially and is live in New York and Singapore, with the MARS candy company as one of its first large clients. “The continued progress of Citi Token Services is a key component of Citi’s pursuit of real-time, always-on services for its institutional clients,” said Ryan Rugg, Head of Digital Assets, Treasury and Trade Solutions at Citi. Not long after Citi announced their tokenization platform last year, JP Morgan-Chase launched its own tokenized blockchain-based system called the Tokenized Collateral Network (TCN), with BlackRock being its finest client. “Money market funds play an important role in providing liquidity to investors in times of high market volatility. The tokenization of money market fund shares as collateral in clearing and margining transactions would dramatically reduce the operational friction in meeting margin calls when segments of the market face acute margin pressures,” Tom McGrath, deputy global chief operating officer of the cash management group at BlackRock said in a statement.