While the world is gripped with the daily headlines concerning the Israel-Hamas war, the European Union has made a landmark move that brings the implementation of an all-in-one digital identity very close to launch.

Yesterday, November 8th, the EU Parliament formally reached an agreement on implementing new framework for a European digital identity (eID).

As stated by the EU in a press release, besides the digital IDs digitizing physical documents and records, it will also link things such as user’s bank accounts, education accolades, and more.

The revised regulation constitutes a clear paradigm shift for digital identity in Europe aiming to ensure universal access for people and businesses to secure and trustworthy electronic identification and authentication.

Under the new law, member states will offer citizens and businesses digital wallets that will be able to link their national digital identities with proof of other personal attributes (e.g., driving licence, diplomas, bank account). Citizens will be able to prove their identity and share electronic documents from their digital wallets with a click of a button on their mobile phone.

The new European digital identity wallets will enable all Europeans to access online services with their national digital identification, which will be recognised throughout Europe, without having to use private identification methods or unnecessarily sharing personal data. User control ensures that only information that needs to be shared will be shared.

The EU wrote (emphasis theirs)

The EU had voted to adopt the framework the eID in February.

Earlier this year EU members and other companies participated in piloting their new digital ID for multiple instances, such as “healthcare, financial services, education and transport.”

More specifically, the new digital ID would cover “Verification of a user’s identity when opening an online bank account, eliminating the need for the user to repeatedly provide their personal information;” or “Providing details of prescription to pharmacies and initiating the dispensation of medical products;” and “Verification of a user’s identity when initiating a payment online;” and even things like “securely access a user’s social security information and benefits, such as retirement or disability benefits. It can also be used to facilitate freedom of movement by storing documents such as the European Health Insurance Card.”

The EU provided more specific examples as to how some of these functions would play out in real life:

Initiating Payments: Danika, for business purposes, holds banking accounts at financial institutions in several Member States. Previously, to authorise transactions when banking electronically, she had to use different means (e.g. a fingerprint, a one-time passcode, or affirmation to transaction approval queries send to her personal device). Now all banks use her EU Digital Identity Wallet for this purpose.

Jeroen’s has been employed in another Member State. Jeroen uses the EU Digital Identity Wallet to access to his social security information and benefits, such as retirement and disability benefits. When is current employer posts him again across border Jeroen uses the wallet to store documents such as the European Health Insurance Card.

Moreover, in September The WinePress reported that EU President Ursula von der Leyen said adopting a digital ID would help to verify real people against artificial intelligence, and that the ID should be akin to the vaccine passports introduced these past couple of years.

Additionally, the EU explains in their recent press release, that ‘the revised law clarifies the scope of the qualified web authentication certificates (QWACs), which ensures that users can verify who is behind a website, while preserving the current well-established industry security rules and standards.’

Nadia Calviño, acting Spanish first vice-president and minister for economy and digitalisation, said in a statement:

With the approval of the European digital identity regulation, we are taking a fundamental step so that citizens can have a unique and secure European digital identity. This is a key advance for the European Union to be a global reference in the digital field, protecting our democratic rights and values.

The timing of this framework also comes just after a few weeks after the European Central Bank (ECB) had revealed their creation of a central bank digital currency (CBDC) had entered its latest phase of development. President Christine Lagarde stated in a video “the digital euro is on the move.” She added,

We need to prepare our currency for the future. We envisage a digital euro as a digital form of cash that can be used for all digital payments, free of charge, and that meets the highest privacy standards. It would coexist alongside physical cash, which will always be available, leaving no one behind.

And, interestingly enough, on November 7th, one day prior to the EU’s announcement for their eID, the bloc also revealed that they had voted to adopt the “agreement on the instant payments proposal, which will improve the availability of instant payment options in euro to consumers and businesses in the EU and in EEA countries.”

Instant payments allow people to transfer money within ten seconds at any time of the day, including outside business hours, not only within the same country but also to another EU member state. The provisional agreement takes into consideration particularities of non-euro area entities.

Under the provisionally agreed rules, payment service providers such as banks, which provide standard credit transfers in euro, will also be required to offer the service of sending and receiving instant payments in euro. The charges that apply (if any) must not be higher than the charges that apply for standard credit transfers.

The EU explained in a press release

This is identical to the Federal Reserve’s instant transfer payment system FedNow which launched earlier this year. While the Feds claim their rail system does not facilitate a CBDC, prior quotations from the Federal Reserve and federal government documents claim the opposite.

Bearing all of this in mind, after the EU Council excitedly announced the acceptance of the framework, Rob Roos, MEP from The Netherlands, spoke of his disappointment and provided an intriguing quote, claiming Breton said: “Now that we have a Digital Identity Wallet, we have to put something in it…” – insinuating it will be interlinked with CBDCs. In a brief video message posted to social media Roos said:

I just left the room where we had negotiations about the digital identity – and I have bad news. The member states and the European Parliament came to an agreement. That means that probably not far from now, the digital identity will be [in] effect in the European Union.

Right after this agreement, Commissioner Breton said, “Now, we have the digital identity wallet; we have to put something in it.” And what he meant was the digital Euro, also known as a central bank digital currency.

And this is a very bad development. They always promise us not to make this connection. And even a lot of experts, privacy experts, and security experts, warned also last week [that] this is a very bad idea for our privacy and our freedom. And still, this digital identity is pushed through.

But it’s not too late because we still have to vote on this in the plenary (meeting). So what you can do: send your MEP from your member state an email and tell him or tell her that you are against this tool.

Eva Vlaardingerbroek, Dutch activist, and supporter of a coalition resistance group of farmers in The Netherlands that have fought against the country’s radical green policies to seize farmland and euthanize livestock, also warned about the eID and is urging her country folk to resist this. “And of course, it’s all “voluntary” for now. Until it’s not,” she wrote on X, adding, “Simply do not use it. Do not comply. Do not go along.”

These privacy concerns are legitimate and great issue that is apparently being paved over. Just in recent days India’s digital ID system the Aadhaar was hacked, leaking roughly 850 million digital IDs that contain very private and intrinsic biometric information at ransom; representing about 10% of the entire world population. Their digital ID is practically applied to most things in society just like the EU is accelerating.

According to a post on the ECB’s website, the central bank provided the basics as to how the digital euro would work, of which requires the immediate download of a digital wallet.

The first step would be to set up your digital euro wallet through your bank. But you could also go to a designated public authority, for example a post office, to do this.

Once your digital euro wallet is set up, you could put money into it via a linked bank account or by depositing cash. You could then start making payments using the digital euro in your wallet.

Whenever you receive money in digital euro, you would keep it in your digital euro wallet, up to a certain limit, or deposit it in your bank account. You could either do this manually or set it up automatically.

Digital euro payments would always be safe and instant – be they in physical stores, online shops or between people.

However, it would never become programmable money. Programmable money is digital money used for a restricted purpose or duration, like a voucher.

By contrast, a digital euro will be unrestricted and always maintain its value. We don’t want a digital euro to come with any constraints on where, when or with whom people and business could use it.

We would set a limit for the amount of digital euro that a person or company could hold in their digital euro wallet. This would help prevent excessive outflows of deposits from banks, preserving financial stability.

Building off of this, Lena Petrova, CPA, explains in a Substack post how the Bank for International Settlements (BIS) is seeking to become the facilitator of all these digital assets via tokenization. She writes (emphasis hers):

The infrastructure for the implementation of these new digital products has been put in place by the Bank for International Settlements (BIS), an entity that functions as a banks’ bank. It’s mission is “to support central banks’ pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks.” Effectively, the BIS is the international “central bank” – a cross-border, global structure, governed by appointed officials, that has managed to remain in the shadows since its establishment on January 20, 1930.

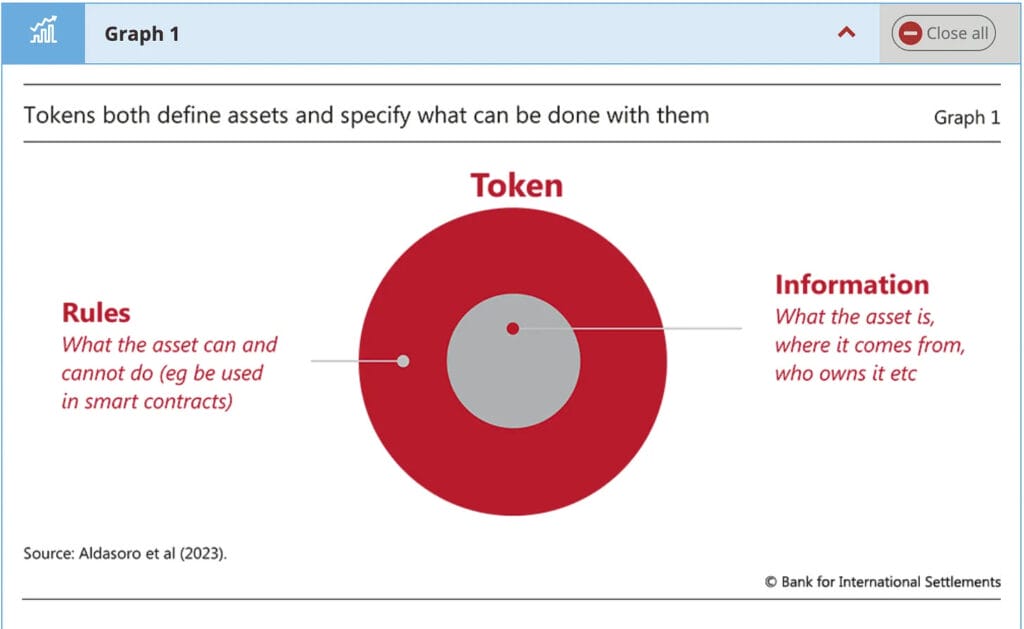

The launch of a Digital Identity Wallet is only the first step. According to the BIS, a central ledger will be created for the world’s central bank digital currencies. For the transition to be successful, financial assets would be tokenized. The Bank of International Settlements defines tokenization as “the process of representing claims digitally on a programmable platform.” Further, BIS makes an attempt to assure us that a token “… can be seen as the next logical step in digital recordkeeping and asset transfer.”

A token is a digital asset that can be manipulated by a financial institution: a tokenized customer’s deposit is subject to the rules defined by its issuer. For example, a token may be spend or exchanged only within the scope of a pre-defined set of rules. An asset (for example, a customer’s bank deposit) may have rules that allow the money to be spent only on certain services or products.

Further, a token stores all information about the underlying asset: previous owners, dates of purchase/ sale, transaction dates, etc. This data is stored on a blockchain that is managed by a financial institution.

The Bank of International Settlement explains the structure of a token in the following illustration:

Further, tokenization involves a new concept of a “conditional performance of actions”. Here is how the bank defines it:

“It [ i.e. tokenization] enables the contingent performance of actions through smart contracts, ie logical statements such as “if, then, or else”. By combining composability and contingency, tokenisation makes the conditional performance of actions more readily attainable, even quite complex ones.”

The so-called conditional performance of actions would likely be used when setting the “rules” of what an asset can and cannot do. These rules are likely to have the potential to limit users’ ability to use their funds or other types of assets (tokenized equities, real estate, precious metals, etc.)

According to the Bank of International Settlements, all assets would be tokenized when the central ledger is launched. Such assets would include deposits, real estate and even precious metals (gold, silver, etc.). Effectively, all items of value would undergo the process of tokenization:

A new type of financial market infrastructure – a unified ledger – could capture the full benefits of tokenisation by combining central bank money, tokenised deposits and tokenised assets on a programmable platform.

(BIS Annual Report, June 23, 2023)

The ultimate goal of the digital system is to create a “unified ledger”, a new type of financial market infrastructure that would contain every bit of information about a person’s income, assets, holdings, etc. According to the BIS,

“Moreover, by having “everything in one place”, a unified ledger provides a setting in which a broader array of contingent actions can be automatically executed to overcome information and incentive problems.”

Lastly, the implementation of digital IDs are a very important tool central banks are working to bring to the forefront. In July Economics Professor Richard Werner, the man who introduced the economic philosophy of “Quantitative Easing” (QE1 and QE2), and was formally recognized by the World Economic Forum in 2003 for his accomplishments, revealed in an interview that before central banks can really enforce CBDCs, which be used to heavily mitigate behavior and spending habits, said that a digital ID must be in place for them to truly take effect.

There is an argument to be made, and that is the entire Covid scam may have been run in order just to prepare things for the CBDCs and the real goal, or the big prize to them, [are] the CBDCs.

There is one step before then: they need digital IDs.

Werner explained

AUTHOR COMMENTARY

While everyone is napping and distracted with bread and circuses, like always, a massive move to enslave the population is happening right underneath the people’s noses. The EU Parliament’s and ECB’s two-facedness is to be ignored: obviously this will be leveraged to control and mitigate everyone’s lives via social credit scores and internet behavioral points.

SEE: The DQ Institute: The Social Credit Score To Become A Global Citizen To Use The Internet

The EU is certainly not the first to come out with a digital ID, as I have been reporting on their intrusion around the world since the Covid nonsense was in full swing; which was the point of the lockdowns and vaccine passports, to lay the foundation for the digital IDs and CBDCs. It was social conditioning.

In order for the masses to more broadly accept these digital IDs “voluntarily,” they will need to launch a massive trigger event to get the public scared enough to accept them. Most people will, sadly, accept them; especially if cheap, easy money, food and water, and instant entertainment are attached to it. I personally believe a big way this will be achieved is through artificial famine and food shortages, coupled with an imploding and hyperinflating economy.

And Satan answered the LORD, and said, Skin for skin, yea, all that a man hath will he give for his life.

Job 2:4

The debacle in India, though is getting no press coverage, cannot be overshadowed. The digital IDs are flawed by design. It’s not meant to be perfect. Once more of the world gets on board it will be nothing short of a trainwreck, and the people will have to be propagandized into believing that carrying phones are too cumbersome and inconvenient, and subject to data loss and hacking. Therefore, at some point implantables will be pushed harder, leading to the eventual final solution:

[16] And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. Revelation 13:16-18

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

What is it, those famous 9 words: I’m from the government and I’m here to help…

don’t forget: trust us it’s 100% safe and secure

Isa 3:11 Woe unto the wicked! it shall be ill with him: for the reward of his hands shall be given him.

Whenever a government official or politician says “has the highest level of both security and privacy.” Always believe the exact opposite. Our faith will be tested brethren. DO NOT BEND THE KNEE!!! All Glory and Praise to the Lord Jesus Christ!

AMEN

Well, I guess one could see why a Tech guy like Bill Gates is so interested in vaccines. Early on I wondered why the government was so bent on everyone taking the COVID shot. I believe that marker for digital ID connecting a person with digital money will be the nanotechnology in the vaccine. The ultimate identity fail safe. Jesus said the life is in the blood, boy was he right. US patent W02020060606A1. Cryptocurrency system using body activity data.. Does anyone Know how they caught the people at the airport in Spain with the fake vaccine passports? It was in 2022, How did they determine the vaccine credentials were fake? I have a few ideas.

Along with almost everything that seems to be developing throughout this subject material, a significant percentage of points of view are fairly refreshing. Nonetheless, I appologize, but I do not give credence to your whole suggestion, all be it radical none the less. It appears to me that your opinions are generally not totally justified and in simple fact you are generally your self not really completely certain of your argument. In any event I did take pleasure in reading it.

I don’t even know the way I ended up here, however I assumed this post used to be good. I do not recognise who you might be but definitely you’re going to a famous blogger in case you are not already 😉 Cheers!