Cleveland Federal Reserve President Loretta Mester provided some additional insights to the Fed’s new instant transfer payment called FedNow, which is set to launch later this month.

Two weeks ago the Federal Reserve published a list of banks and creditors that have partnered with them to trial and provide FedNow later this month, with many more expected to sign-up in short order.

The Federal Reserve succinctly describes what their new platform is and it’s purpose:

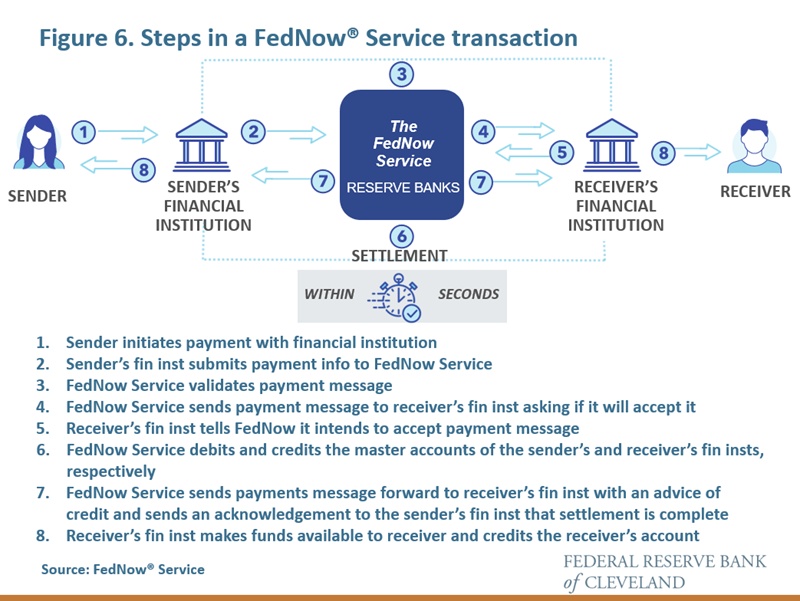

The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the U.S. to provide safe and efficient instant payment services.

Through financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real time, around the clock, every day of the year. Financial institutions and their service providers can use the service to provide innovative instant payment services to customers, and recipients will have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.

Other countries such as India and Brazil, two founding BRICS bloc members, also have their own instant payment transfer systems in place.

Even though the Feds have changed their tune as of late, FedNow is designed to lay down the groundwork to eventually facilitate a central bank digital currency (CBDC), per their previous statements and that of the White House:

SEE: Red Alert: Federal Reserve Set To Launch “FedNow” Digital Payment System To Usher In CBDC

Last week Cleveland President Loretta Mester provided some new details on this FedNow system in Cambridge, Massachusetts, for the Summer Institute 2023, National Bureau of Economic Research.

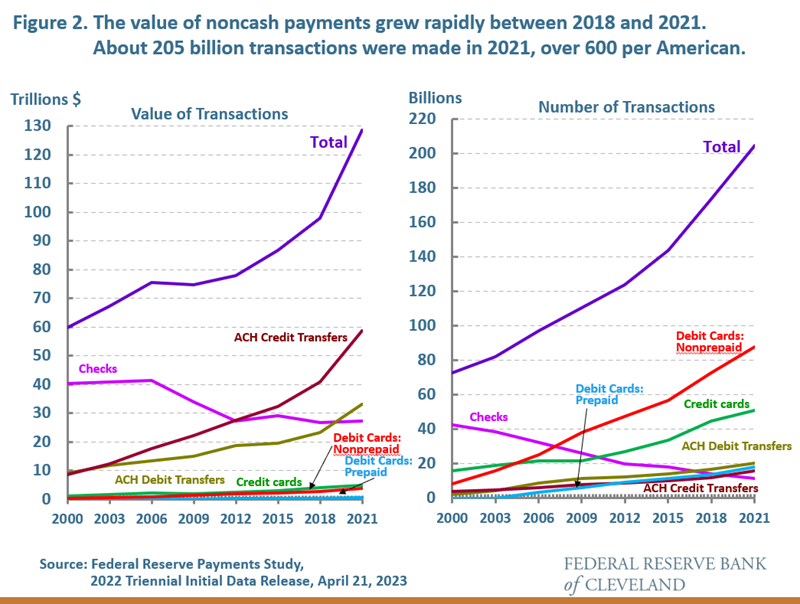

Mester said in her presentation that “more people are seeking new ways to execute transactions and they want to execute them much faster,” which FedNow will seek to alleviate, as more non-cash transactions continue to grow.

Mester revealed that, for now, FedNow will allow transactions of $100,000 per each customer credit action initially, but will eventually allow banks more flexibility in how much they can transfer per a single transaction, up to a max of $500,000. “Participants will be able to decide whether they want to both receive and send payments or whether they want to only receive payments. And they will be able to specify a list of suspicious accounts to and from which they neither want to send or receive payments,” Mester said.

Mester went on to explain that “also included at the rollout will be request-for-payment functionality that will support bill payment; the ability to include information about a payment along with the payment, e.g., invoice information; and certain fraud-mitigation tools.”

After explaining how a transaction through FedNow operates, Mester proceeded to detail some of the other important features of it. One of those is throttling and controlling the flow of payments. Mester addressed the risk of fraud attempts by trying to potentially accounts of large sums of money they are not there, so FedNow has built-in tools that participating institutions can utilize to limit payment flows, to also prevent against things such as bank runs.

The initial release of the FedNow Service will include features to help banks manage fraud risk and mitigate fraud losses.

It will include tools that allow participants to reject payments to and from accounts they have designated as suspicious and to put limits on the amount of the transaction.

In addition, there will be tools that help a financial institution investigate erroneous or suspected fraudulent transactions. Combating fraud is a dynamic endeavor, so the service will be offering more fraud-prevention tools over time.

For example, in the aftermath of the bank closures earlier this year, some have raised concerns that the ability to move money quickly at all times of the day and night might exacerbate a bank run.

It is true that FedNow and other payment services can be used to move money; however, banks have tools they could use to mitigate large outflows of deposits. For example, within FedNow they could lower their transaction limit, restrict access to the service to certain non-wholesale customers, or change to “receive payments only” status. They could also design their own controls to limit the total volume of transfers to manage their risks while serving their customers.

Future releases of the FedNow Service may allow configurable transaction limits by customer type, if such limits are deemed useful. In addition to a bank being able to borrow from the Fed during the hours the discount window is open, a bank could use liquidity management transfers to replenish its master account balance from private funding sources on the weekend when the discount window is not accessible, which would help to mitigate the effects of deposit outflows on the health of the bank.

Mester detailed

Moreover, Mester explained that there is a desire and plans in the works to connect FedNow with other instant transfer payment systems, allowing for cross-border transactions. The Federal Reserve is also looking into the possibility of allowing the use of emails and phone numbers as an alias to complete transactions.

Mester also provided an interesting forewarning and foreshadowing, and that is she indicated that current “payment rail” platforms – PayPal, Zelle, Venmo Cash App, Stripe, and many others – will have to eventually adapt to the FedNow system. In other wards, the Federal Reserve is looking to consolidate their platforms and effectively place them under their roof; and even truncate the number of them that are currently in existence, the Fed President revealed. Mester explained:

It seems likely that over time those payments that are time-sensitive will shift from the traditional payment rails of check, ACH, and wire to the instant payment rails of FedNow and RTP.

The timing and extent of such movements across payment rails are difficult to predict and will be affected by the pricing of payments services by market participants, as well as other factors.

In thinking about the evolution of the payment rails, it may seem more efficient to have fewer rails for smaller-transaction payments, but those efficiencies need to be balanced with ensuring that the payment system has sufficient redundancy to remain resilient.

She concluded her presentation by saying this:

A well-functioning and secure payment system is vital to our economy. As we modernize the payment system, it is important to remember that the foundation of a successful payment system is the public’s confidence in it.

The public needs to be confident that the system will be: available whenever the customer needs it; efficient at routing and settling payments; resilient against cyberattacks and fraudulent actors; and reliable without the public having to know the intricacies of the infrastructure behind it.

As the payment system evolves, the Fed, the industry, and end users will need to continue to collaborate to ensure that the modern payment system lives up to its promise of being efficient, safe, resilient, and available to all. That’s the best way to maintain the confidence of the public the Fed serves.

The Federal Reserve Will Now Have Direct Access To Our Financial Records

But what Mrs. Mester did not disclose is all the personal information these aligned banks will be covertly overturning to the Federal Reserve, without the public’s overt knowledge.

In 2021 the Federal Reserve published a short document their first “Operating Circular,” which covers “the terms for opening, maintaining, and terminating a master account with a Federal Reserve Bank, as well as general provisions regarding Reserve Bank services applicable to institutions whether or not they maintain a Reserve Bank account.”

Buried within the document, section 6.0 deals with the “Federal Reserve Bank Response Program For Unauthorized Access To Sensitive Consumer Information Obtained In The Course Of Providing Financial Services.”

Section 6.1 details “The Reserve Bank’s Possession And Use Of Consumer Information.” The Fed writes:

The Reserve Banks do not hold accounts for individuals and do not provide Reserve Bank services to individuals. In the course of providing Financial Services to Depository Institutions and other authorized users of Reserve Bank services, the Reserve Banks obtain, store, and transmit information that includes Sensitive Consumer Information.

Under the general supervision of the Board of Governors, the Reserve Banks have implemented information security measures designed to protect the security and confidentiality of nonpublic personal information obtained by them, to protect against any anticipated threats or hazards to the security or integrity of such information, and to protect against unauthorized access to or use or reuse of such information that could result in substantial harm or inconvenience to a Depository Institution’s customer.

In short, the Federal Reserve is saying they require your “sensitive” data to protect you from fraudulent behavior. Subsection 6.2 defines what this “sensitive information” is:

Sensitive Consumer Information means a consumer’s name, address or telephone number, in conjunction with the consumer’s social security number, driver’s license number, account number, credit or debit card number, or a personal identification number or password that would permit access to the consumer’s account, if the Reserve Bank or any other party that holds Sensitive Consumer Information as an agent of the Reserve Bank obtains such information in the course of providing Financial Services.

So, essentially, when a bank, institution, or platform aligns itself with FedNow, those banks and apps will now overturn their own customer’s data and personal information to the Federal Reserve – no doubt something that is or will be included in the fine print of the terms and conditions, that no one reads.

AUTHOR COMMENTARY

FedNow in a nutshell:

[22] Let their table become a snare before them: and that which should have been for their welfare, let it become a trap. [23] Let their eyes be darkened, that they see not; and make their loins continually to shake. Psalms 69:22-23 – which contextually is talking about something else, but for our purposes it fits

The Federal Reserve can try and save face all they want, but this is clearly and unmistakably laying the groundwork for a CBDC – no question.

Mester gave the slip, to those that are paying attention (which are not many, sadly), but is something WinePress readers already knew; is that the goal here is to consolidate the banking system, leaving only just a handful of the megabanks and the Federal Reserve. No more local and community banks. We covered this when Silicon Valley Bank collapsed, and the others that came after.

Treasurer and former Federal Reserve Chair “Granny” Janet Yellen openly admitted several months ago that the big banks will be bailed-out by the government (the tax cattle, she means), but your little community bank can go eat dirt and die; and they will, unfortunately, at some point. Get ready: we are in for the biggest banking collapse ever witnessed before in the history man, which is not too far off from now, for a plethora of reasons, but the reasons were simple in leading up to the impending doom: no deposits, no loans, no deals. Then, when the Federal Reserve started rapidly rising interests rates, all these banks big and small, who were on a buying spree, gobbling up bonds, treasuries, derivatives, and more for pennies – now that rates are really high, these banks are going to have to eventually sell at monumental losses just to cover their rear ends. And then you have to factor the housing market bubble letting out some air right now, the auto loan apocalypse, and the sleeping gran-daddy which is commercial real estate and office building busts.

The Federal Reserve has everything and everyone right where they want them: broke and blind; and when they finally allow this Ponzi to collapse and rug pull this fake economy – the fallout will be grand.

Therefore, when this happens and people frantically run around in hysteria, the Feds will hop in to save the day with this FedNow, and eventually their CBDC that is coming. Ignore their mixed messaging.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

One the 57 banks and institutions who are early-enrollees with FedNow, my bank, 1st Source, is one of them. Therefore I will most likely be looking to close out my account or switch to a new one soon that is not yoked up with FedNow, yet anyways.

Keep calm and be smart.

[34] Wait on the LORD, and keep his way, and he shall exalt thee to inherit the land: when the wicked are cut off, thou shalt see it. [35] I have seen the wicked in great power, and spreading himself like a green bay tree. [36] Yet he passed away, and, lo, he was not: yea, I sought him, but he could not be found. [37] Mark the perfect man, and behold the upright: for the end of that man is peace. [38] But the transgressors shall be destroyed together: the end of the wicked shall be cut off. [39] But the salvation of the righteous is of the LORD: he is their strength in the time of trouble. [40] And the LORD shall help them, and deliver them: he shall deliver them from the wicked, and save them, because they trust in him. Psalms 37:34-40

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Sorry for the off topic but this is a spiritually motivated comment based on the picture of Ms Loretta posted at the beginning of this article. It is most obviously a transgendered woman who is in need of a touch-up on its facial feminization surgeries. This people come from elite families where their religion is to be like their god, baphomet who is both genders. Most of them transgender their children very young and raise them as the opposite sex. Because Loretta still has her male parts down below, and still has testosterone, its bones still want to grow like a mans except for the overworked nose. He had a little too much taken off there. He is super creepy looking! Makes sense it would be put in charge of a bank. Who would want to ask that for anything?!

My first reaction was “that is one ugly woman”. I still have not trained my brain to consider I’m looking at a tranny.

Its been my research for about 14 months. Most of the time, their spouse is transgendered too.

Hi there, I found your site via Google while searching for a related topic, your website came up, it looks great. I have bookmarked it in my google bookmarks.

Some times its a pain in the ass to read what website owners wrote but this website is really user friendly! .