World Economic Forum’s associate partner Blackstone has revealed they plan to vastly add to their ginormous asset list, by dumping another $50 billion to purchase entire neighborhoods, in preparation for the looming housing collapse.

The WinePress has warned this formality is rapidly approaching.

Mortgage Rates Continue To Climb. Housing Market On The Verge Of Collapse

When the markets pop and prices become dirt-cheap, groups like Blackstone will be there to gobble them up. An identical company, Blackrock, who also is heavily allied with the World Economic Forum, has been quietly doing this already:

Citing a Wall Street Journal article, ZeroHedge details Blackstone’s open intentions for all to see:

The past two months have seen a barrage of negative news coverage focusing on the US housing market…

- Is The Housing Crash Starting?

- Why The Housing Bubble Bust Is Baked-In

- The One Housing Chart That Shows A ‘Buyer’s Market’ Has Returned

- As Mortgage Rates Explode Price Cuts Soar And Buyer Demand Collapses

- Housing Market Peaks: Home Prices Finally Drop From All-Time Highs

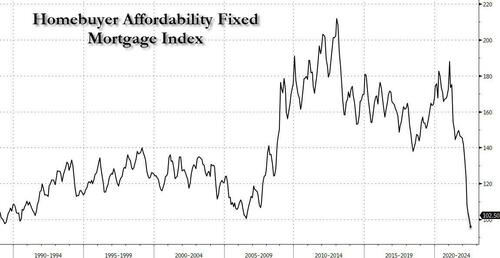

… which is predictable: after all, with mortgage rates soaring at the fastest pace on record to decade highs, and sending US housing affordability to the lowest in history…

… only a handful of the “1%” can afford the American Dream.

Alas, it also means that just like in 2007, a housing crash is now just a matter of time.

That much is known. What is also know, is that once housing craters, the largest US residential and commercial landlord – private equity giant Blackstone – is about to get even bigger. That’s when it will deploy some (or all) of the record $50 billion in dry powder it has raised to prepare for just the coming housing crash.

According to the WSJ, Blackstone is the final stages of raising a new real-estate fund that would set a record as the biggest vehicle of its kind, defying market volatility and a crowded landscape for fundraising.

The private-equity giant said in a regulatory filing Wednesday it has closed on commitments totaling $24.1 billion for Blackstone Real Estate Partners X, the latest iteration of its main real-estate fund.

According to the WSJ, Blackstone is committing about $300 million of its own capital and has allocated an additional $5.9 billion to investors, which will bring the fund to $30.3 billion when it is finalized. The firm raised the fund, expected to be the largest traditional private-equity vehicle in history, in just three month. It was also Blackstone that set the prior record, with the $26 billion buyout fund it raised in 2019. The new real-estate fund will be 50% larger than its predecessor, a $20.5 billion pool raised in 2019.

Together with funds dedicated to real estate in Asia and Europe, Blackstone will have a war chest of more than $50 billion to do so-called opportunistic investments, which tend to be higher-risk deals with the potential for higher returns.

That, according to the WSJ, “could allow the firm to take advantage of a downturn in the public markets.” Translation: at a time when Americans are liquidating their housing en masse to shore up liquidity when the bottom falls out from the economy, Blackstone will step in and buy all the distressed properties at pennies on the dollar, becoming an even bigger presence in US, and global, real estate.

Not surprisingly, many of Blackstone’s best-performing deals—like its 2014 purchase of the Cosmopolitan casino and hotel in Las Vegas and its 2016 deal for life-sciences buildings owner BioMed Realty Trust —were struck during periods of market turmoil.

It won’t be just Blackstone that goes bottom fishing in a few months: a slew of private-equity funds are in the market this year, with many trying to raise huge sums even after stocks fell and deal-making dried up. The surge in requests for new cash has overwhelmed investment teams at institutions such as pension funds and endowments and has meant many have delayed making commitments to all but the top managers.

The size of Blackstone’s new fund and the speed at which it was able to raise the money demonstrate that institutional investors are still eager to participate in vehicles being offered by established managers with good records. And while the ranks of $20 billion-plus buyout funds have been growing, there are still relatively few real-estate megafunds comparable with Blackstone’s.

As the WSJ adds, just like the firm as a whole, Blackstone’s $298 billion real-estate business has embraced a thematic investment strategy with the goal of targeting areas of the economy where growth is outpacing inflation. That has led it to focus on four key areas: warehouses used for e-commerce; life-sciences office buildings; rental housing; and hospitality tied to travel and leisure. It has also excelled in all four areas, long ago becoming the largest US residential landlord much to the chagrin of tens of millions of Americans who dutifully pay Steve Schwarzman for the privilege of having a roof over their head.

AUTHOR COMMENTARY

Agenda 2030: You’ll Own Nothing And Be Happy

[7] The rich ruleth over the poor, and the borrower is servant to the lender. [16] He that oppresseth the poor to increase his riches, and he that giveth to the rich, shall surely come to want. [26] Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee?Proverbs 22:7, 16, 26-27

When the WEF says “you’ll own nothing and be happy,” they are not playing around. It is not a “conspiracy theory:” they are announcing their plans in broad daylight for the world to see and know, and yet the masses would rather stupefied doing everything else under the sun, and hating the truth when there are pimp slapped with it on a routine basis. The masses will fall for this and be forced to comply with these buyouts, and will know no differently.

[1] Doth not wisdom cry? and understanding put forth her voice? [2] She standeth in the top of high places, by the way in the places of the paths. [3] She crieth at the gates, at the entry of the city, at the coming in at the doors. [4] Unto you, O men, I call; and my voice is to the sons of man. [5] O ye simple, understand wisdom: and, ye fools, be ye of an understanding heart.Proverbs 8:1-5

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

How far would their tentacles spread, would they reach true brethren in Christ who had already gotten out of the cities to live in fewly-populated, country-type and off-grid areas? Would they continue to buy out every single property or land out there: city, country and off-grid areas (though off-grid and isolated places won’t really yield them much profit in terms of populace patronage, compared to the money they are and will be getting from whatever type of services or businesses they already have set up and are planning to establish in densely populated areas like cities and other attractive areas that tend to draw people in)?

I am making $162/hour telecommuting. I never imagined that it was honest to goodness yet my closest companion is earning $21 thousand a month cdc11 by working on the web, that was truly shocking for me, she prescribed me to attempt it simply ,

COPY AND OPEN THIS SITE_________Www.SmartJob1.com

Hey, Work AT Home, I need a better answer to my questions than that.

America is finished.

Neighborhoods and suburbs will be a thing of the past. That’s part of God’s judgement too, these wicked Americans with their neighborhoods and their little communities, that’s all coming to a screeching halt.

I understand being friendly and kind I’m all for that; however, when complete strangers you haven’t met or spoken to once or visa versa, saying “welcome to the neighborhood,” and they bring you a baked good or something and invite you to what they call a “housewarming party,” I find that dangerous and I call that cult indoctrination – and that’s going to be disappearing very soon!

Plant based food = plant DNA mixed with HUMAN DNA:

https://www.trendhunter.com/trends/human-meat-burger

That’s scary!

Setting up the masses little by little to accept and commit cannibalism.

With the famine coming up, that’s just what’ll happen in the not-too-distant future.