The following report is by Gregory Mannarino from the Trends Journal:

Before I even begin this article, I want you to be crystal clear on this…

Ready?

EVERYTHING YOU ARE SEEING NOW WITH REGARD TO THE GLOBAL ECONOMY AND THE MARKETS IS DELIBERATE.

Public Enemy Number One—The Federal Reserve, has allowed inflation to surge WAY beyond their 2 percent target, and today the current rate of inflation—their numbers, sits at 6.8 percent. But now the Fed is saying that NOW they are ready to do something about surging inflation.

How about no, the Fed is lying.

Food and energy prices will continue to balloon with no sign of relief in sight, in fact, we can all expect inflation, or should I say the absolute strength of the dollar to crater FASTER.

Uncertainty is taking hold on the world equity markets and over the past week we have seen stock markets fall under pressure. Here in the US, the debt market is pricing in a Fed rate hike sometime soon—which in my opinion will happen.

The big secret that you are not supposed to know is this. Whatever the Fed does regarding hiking rates, expect it to be minimal to an extreme.

Understand, the Federal Reserve IS NOT DONE fulfilling its goal which is to become not just the lender and buyer of last resort, but to own it all. In order for the Fed to finish its end game, along with other world central banks, MUCH more debt will need to be issued, globally.

Speculation on what the Fed will actually do moving forward is causing world stock markets to fall under pressure, and as a ripple effect the crypto markets have also taken a hit.

I see no guesswork here. I fully expect that the Fed will continue to inflate.

There is also talk of a Fed balance sheet runoff, that is, the Fed will sell some of the debt it is currently holding, but let me ask this… there is NO WAY that is going to happen. Why? Who, or what entity would buy debt which the Fed is currently holding which is yielding LESS than the current rate! Can’t happen.

Looking over at the yield curve, there is some “normalization” as the market is pricing in a rate hike, and with that, risk in the market is climbing—(See the MMRI, Mannarino Market Risk Indicator, which can be found on my website TradersChoice.net).

The bottom line here is expect the unexpected, but also understand that price action distortion across the spectrum of asset classes will continue to get worse.

Expect EXTREME volatility in the crypto space, and to a lesser degree in the equity space as well.

The Fed will in fact keep rates suppressed for as far as the eye can see and beyond, therefore nothing really has changed. With that, global debt issuance by central banks will skyrocket with no end in sight which will drive global central bank issued currencies lower in terms of purchasing power. Debts, deficits, and inflation will continue to spiral out of control for the foreseeable future.

AUTHOR COMMENTARY

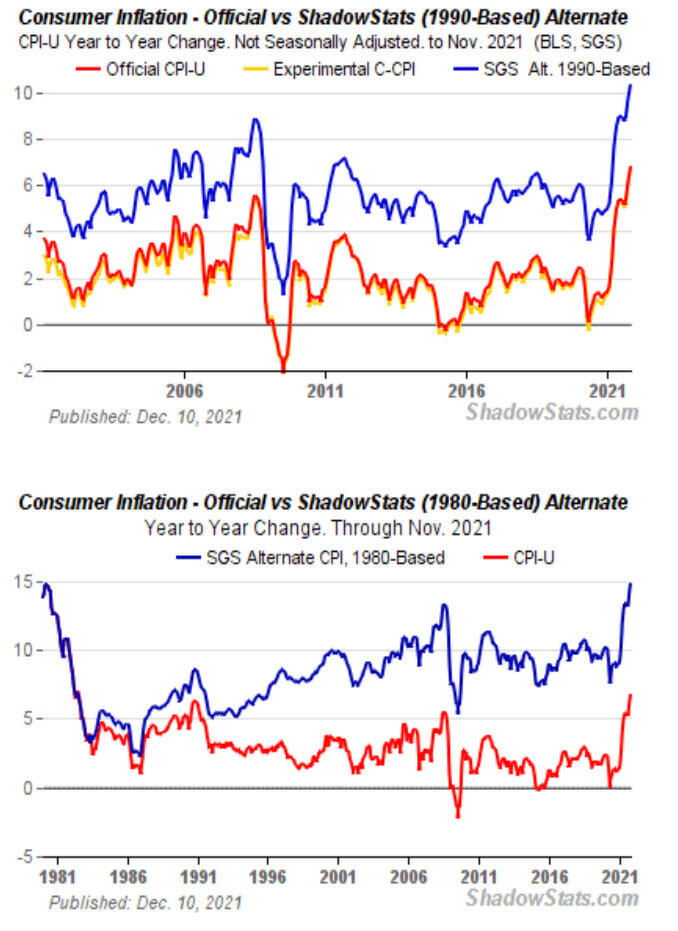

Bloomberg reported this morning that inflation has now hit 7%. But these are the falsified government numbers, that subtracts many other factors. According to ShadowStats, the number is MUCH higher:

But Bloomberg, among others, are stoking the move for rate hikes. But as Mannarino explains, these moves will be so infinitesimally small it will not matter. The markets know that if the FED’s do an actual hike on interest rates, the economy will blowup. This of course WILL eventually happen, but as it stands, I do firmly believe that one more year of this gravy train will commence, and then the plug will pulled. On top of that, with so much inflation, we have negative interest rates by default, as the interest rate is basically at zero.

The FED wants inflation to soar out of control, so it will lead to more artificial famine and government control. Remember one of the endgames: “You’ll Own Nothing And Be Happy.”

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.