AUTHOR’S NOTE: See commentary at the end.

In mid-September The WinePress was one of the first to report that the United States Treasury drafted a proposal that would allow the Internal Revenue Service (IRS) to pry into every American’s bank accounts with $600 or more in it.

This proposal would create a comprehensive financial account information reporting regime. Financial institutions would report data on financial accounts in an information return. The annual return will report gross inflows and outflows with a breakdown for physical cash, transactions with a foreign account, and transfers to and from another account with the same owner.

This requirement would apply to all business and personal accounts from financial institutions, including bank, loan, and investment accounts, with the exception of accounts below a low de minimis gross flow threshold of $600 or fair market value of $600.

The Treasury’s memorandum said

These proposals were not headline news, as most Americans were unaware that these proposals were even on the table, though word began to quietly spread on the internet and social media. But then a plethora of banks all across the nation began to send letters and invoices to their customers, alerting them to this potential legislature. These local banks and chains were not happy, as they indicated that this would destroy the banks and the consumer in the process.

For example, 1st Source Bank – a local bank chain primarily servicing Hoosiers in the northern regions of Indiana, and Michiganders in the south of the state – wrote a letter (not long after The WP reported on this move) to customers stating,

Lawmakers say the intention of the law is to improve tax compliance for the very wealthy, but it requires collecting information from essentially every deposit account in the United States.

This proposed legislation will be very expensive for banks, but it will cost all of us, increasing tax preparation fees for individuals and small businesses. It also raises concerns about your right to privacy regarding your banking transactions.

We encourage you to evaluate this legislation and we urge you to contact your members of Congress if you have concerns. The American Bankers Association (ABA) has established a website called Secure American Opportunity that has additional information about this proposal and a simple customizable letter that you can use to send to your representatives in Congress.

Andrea Short, President of 1st Source Bank

After weeks of many Americans and banks voicing their concerns amongst themselves, and some reaching out to their congressmen and women, the proposal was then altered and the amount was greatly increased.

Real Clear Markets reported that this bank-snooping legislature was then upped to $10,000.

In other words, if a given taxpayer received $20,000 in payroll deposits, they would only exceed the threshold were other deposits and spending, taken together, to exceed $30,000.

That sounds at first glance like a big difference, but unfortunately it would still affect millions of Americans of modest means. After all, $10,000 a year comes out to just over $830 a month in spending. And while payroll deposits would be exempted, many Americans don’t make their income through traditional biweekly payroll deposits.

Andrew Wilford for Real Clear Markets explained

But then a day later, the entire act of prying into bank accounts – for any amount – was thrown out all together.

ZeroHedge, and other outlets, attribute Senator Joe Manchin of West Virginia for dealing the final blow to be rid of this piece of legislature, apart of the spending bill that has gone through multiple haircuts since the $3.5 trillion proposals back in mid-September.

I said, ‘Mr. President, I don’t know what happened. This cannot happen. This is screwed up.’

I said, ‘do you understand how messed up that is, to think that Uncle Sam is going to be watching… and what it does for bankers and this and that?’

So, I think that one is going to be gone.

So it currently stands, this proposal to look into American’s bank accounts are reportedly off the table.

But is it truly gone?

Now the Biden Administration – as part of the now currently $1.75 trillion “Build Back Better” package – is proposing to raise roughly $2 trillion in revenue across the next 10 years via 8 different policies that are designed to increase taxes and ending loopholes for the wealthiest Americans and large corporations.

According to Fortune, the Administration is currently considering dumping $80 billion in new funding for the IRS into this new venture.

‘But throwing money at the already overburdened IRS might not be enough to offset a significant lack of auditors and resources that has led to an agency unable to collect 15% of taxes owed, with falling audit rates across the board,’ Fortune writes.

Regular workers pay the taxes they owe on their wages and salaries—with a 99% compliance rate—while too many wealthy taxpayers hide their income from the IRS so they don’t have to pay. Yet the IRS does not have the resources it needs to pursue wealthy tax cheats.

The White House said in a fact sheet

But Fortune reports that this will nowhere be near enough to fix the many issues among the IRS they point out in their report, such as the massive backlog and shortage of workers they have.

[The IRS needs to be able to access] information that financial institutions already possess—without imposing any burden on taxpayers whatsoever—so the IRS can deploy these additional resources to audit more sophisticated tax evaders. These changes to the third-party information reports are estimated to generate $460 billion over a decade.Natasha Sarin, deputy assistant secretary for economic policy at the Treasury

AUTHOR COMMENTARY

The media is attributing this “final blow” to the tyrannical proposal to some Democratic senator, but that is NOT the reason why:

For the transgression of a land many are the princes thereof: but by a man of understanding and knowledge the state thereof shall be prolonged.

Proverbs 28:2

That proposal is being redrafted because the people stood up and said something about it. Phoning in letters to our so-called “representatives” would not have fixed anything – as I documented many other times we have no representation in this country. The masses and the banks spoke up and shared their displeasure about this. The pushback grew quickly. You don’t need to call up useless politicians to stop this: just stand up for truth and justice and that’ll get the job done.

Could you imagine what would have happened if the masses had this same kind of response and then some to all this Covid shamdemic nonsense from day one?!

But as you can see by the government’s statements, they are now going to be attempting to track everyone’s taxes another way that is much more subtle and not in your face.

Moreover, I am not trying to be the pessimist here, but PAYPAL IS STILL CENSORING ME!

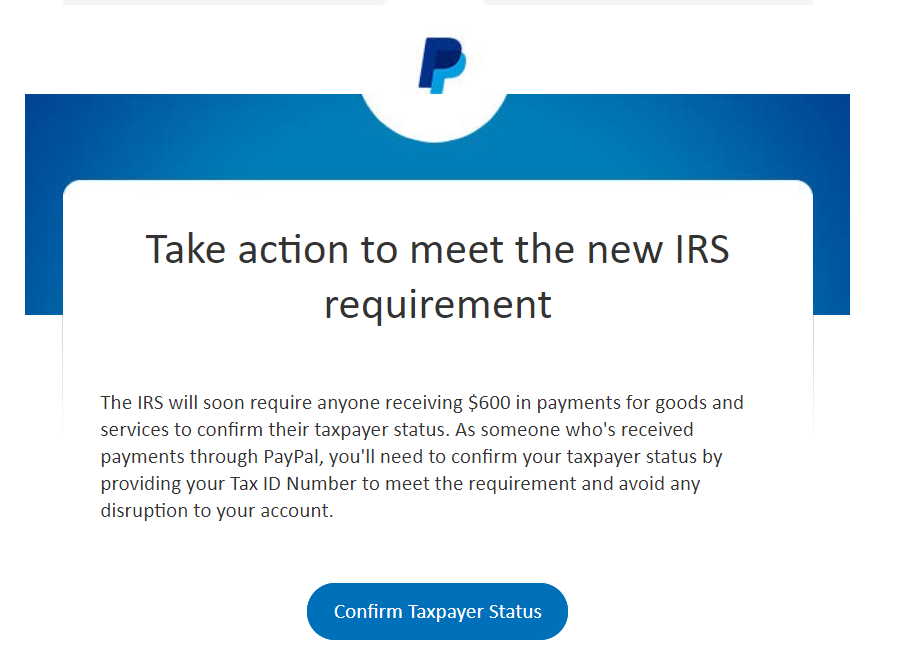

For those that are unaware (as I had several people contact me asking why they could not donate), I reported a week ago that PayPal cut off my account from being able to collect donations from my account for not giving them my tax data, to meet this $600 “proposal.” You can read more about it here:

But now that this “proposal” is supposedly gone now, PayPal stopped hassling me, apologized for jumping the gun, and reinstated my account, right? How about NO!

This is not “conspiracy.” Don’t believe me, here is a picture of an email that was sent to me this morning:

And I have been getting this same message, a couple of phone calls, and other few other similar ones, almost every. single. day.

So, this is the stuff right here that makes me a self-admitted pessimist. What does PayPal know that we do not? Or maybe PayPal is just screwing with me – after all, they did in fact announce that earlier this year they were going to clamp down on “extremists.” Maybe this is their way of doing it.

Either way, it is absurd, and the government will continue to monitor all of our transactions one way or another.

UPDATE: I am currently getting a new donation system set up: it has been quite stressful, as I have to jump through hoops for this as well. I have decided to get a small P.O.Box. It costs money, sadly, but I will get a cheap one so people can donate via the mail with cash or check. I will let everyone know when these things are ready.

Well, I hope with all of this money that CCP Boe Jiden is wanting to throw at the IRS , that they will be right on top of Joe and Jill Biden and collecting the $500,000.00 in back taxes, penalties and interest, compounded daily, like they charge every other tax evader or those who have not paid their taxes.

https://www.washingtontimes.com/news/2021/sep/24/joe-biden-may-owe-much-500000-back-taxes-report/

He’ll just get a slap on the wrist, as they all do.

If only there was enough sense in people’s minds that they would stand up against the COVID tyranny… People can see through the IRS thing, but they can’t see through the COVID scam??? With all the mistakes and contradictions these goons like Fauci have made during it all???

Strong delusion I guess.

That’s the only thing that explains why the masses can be so stupefied with this Covid nonsense. The Lord is just sending them into their deaths, because eve now more vaccinated goobers are waking up to the scammery, but it’s too late for most of them.

They have eased up on this newest banking tyranny, but in exchange they are pushing through more gun control. The “Federal Extreme Risk Protection Order Act,” allowing for gun seizures in all 50 states on scant due process grounds. Ultimately, they will take everything anyway, especially with an unarmed citizenry. One pastor is making gun ownership a requirement of his church membership, making it a First Amendment issue instead of a Second Amendment issue. That might be the way to go for a little while anyway. I wonder if this could work for an online ministry? If the powers that be make a fuss, we have Scripture to back us up……”sell your garments and buy a sword.”