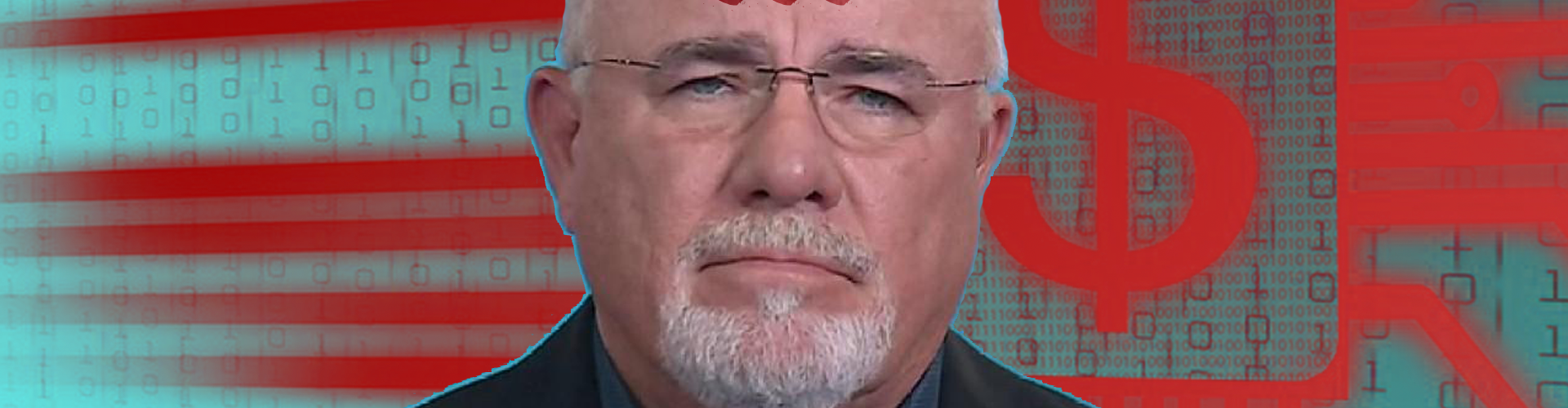

Dave Ramsey and his team have been in the news lately. A few weeks ago it was announced he was being sued by some former employees for being terminated unfairly. The terminated employees were fired for extramarital affairs or committing the sin of fornication. Ramsey’s strict work policy prohibits this, and if discovered, Ramsey is not afraid to let that person go.

In the wake of this as well, one of Ramsey’s most trusted and right-hand men was Chris Hogan.

It has been a very drama-filled situation that really came to public light in March. Then the financial community picked up on it. Now mainstream media and other large Christian outlets are commenting on the drama.

You can read up on more of the drama in these two reports:

Lawsuit alleges Dave Ramsey’s company fired/disciplined employees for premarital sex

Evangelical CEO Dave Ramsey’s company fired employees who had premarital sex

Nothing To Worry About

But I am not reporting on Ramsey to talk about that drama, and yet another “Christian” group having all kinds of problems with sexual sins; I wish to report on something Dave said in a recent radio broadcast.

For those that do not know, Dave Ramsey has one of the largest radio shows in America. He is a very large company with many employees and financial coaches, best selling authors such as himself, and a financial education program for middle and high schoolers (which I took when I was in high school).

Allow me to preface that I think Ramsey has some good advice. He absolutely hates debt and will never ever recommend it, following the precepts of Proverbs 22:7, Romans 13:8, and others.

He as many good tips, but he has some really bad advice in my opinion.

Prior to the creation of The WinePress, I did a video on my personal YouTube channel showing that Dave Ramsey and Chris Hogan had very arrogantly said cash was never going away, scoffed at a coming cashless society, and basically mocked the concept of the mark of the beast clearly laid out in scripture.

Now, WinePress readers know of a surety that all roads are leading to a cashless society: we have repeatedly shown this across numerous reports. But you don’t need me to tell you that: just look out your window and take a trip out into town and observe the grocery stores, banks, stadiums, etc., and you will see that people predominantly use a credit card for even the smallest of transactions. Even many in the comments in the above video all point out the obvious fact that it is going cashless and crypto.

The REAL Reason Sweden Did Not Lockdown

The FED Warns Of More Inflation. Yellen Favors Digital Dollar Governed By The FED

JPMorgan Chase Working To Create A Digital Bank

Amazon One: The Contactless Payment Method Gaining Popularity

I have been watching Dave Ramsey’s videos for a while now, and more and more callers have noticed that the stock market is acting very peculiar. These people are not aware of the total rigging and artificial pumping of the markets, but even they, not knowing practically anything about the markets, can see something is amiss. If Wall Street is seeing record highs each week, then logic would dictate Main Street would reflect that: it is not, and more people are starting to realize that.

On March 30th a video was uploaded to Ramsey’s highlight YouTube channel entitled “Are We In a Housing Bubble? (And Will It Burst?!)” The short answer is, no: Dave essentially says that these crazy prices we are seeing will become the new baseline and does not expect a correction within the next decade.

On March 14th we wrote a report titled “History Repeating Itself: The Masses Did Not Learn From The Great Recession” showing the undeniable proof that America is in the midst of a massive housing bubble (and that is just one bubble we are in). I encourage you to check that out if you have not read that. So for Ramsey to say we are not in a bubble is a major understatement.

I am reporting on this because Ramsey has a very large following, and so many people are being led to believe to keep buying and buying and to invest into a market that is totally propped up by the Federal Reserve that is continually ballooning.

To give even more validation that we are in a housing bubble, the following report is from Wolf Street released on March 22nd.

Everyone Knows the Housing Market Craziness Can’t Last, Then The First Dip Turns Into A Big Drop

Home prices skyrocketed by the double digits starting last summer, despite the loss of 10 million jobs still, and with 2.5 million mortgages still in forbearance, as mortgage rates dropped from historic low to historic low. People bought homes without putting their old and now vacant home on the market because it’s profitable to hold it, amid surging home prices and low interest rates and the possibility of yanking cash out of the old house via a refi. As homes got grabbed and sales surged, other homes weren’t put on the market, inventory for sale plunged, and prices surged. But now, sales have turned from a preliminary dip late last year to a big drop in February. And everyone is wondering why.

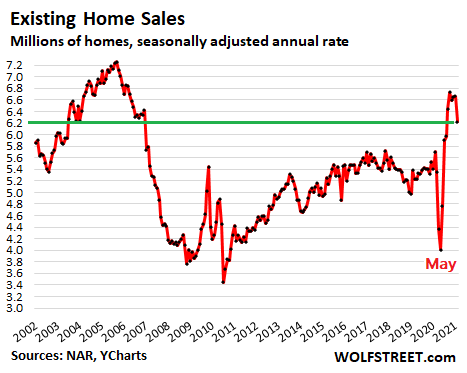

In February, sales of existing homes – single-family houses, condos, and co-ops – dropped by 6.6% from January to a seasonally adjusted annual rate of 6.22 million homes, the National Association of Realtors reported today. On a year-over-year basis, sales in September through January had been up in a range from 19% to 24.4%. In February, the year-over-year increase was down to 9.1% (data via YCharts):

Now everyone is wondering why sales dropped.

Rising mortgage rates and the affordability issues that come from the dual impact of surging home prices and rising mortgage rates are on top of the list. But note that many of the home sales that closed in February went into contract before February, and that in January, mortgage rates had just started to rise from record lows at the end of the year. And we haven’t even seen the impact in the data of the jump in mortgage rates in late February and so far in March.

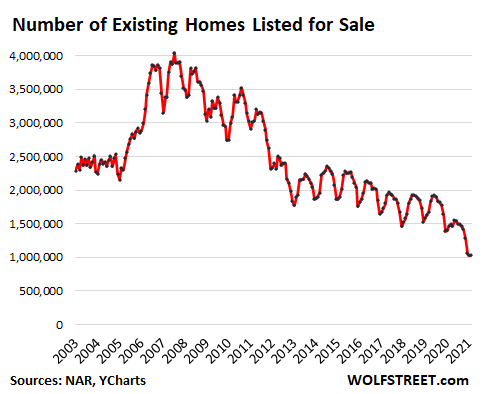

The inventory of homes for sale plunged to a record low in the data series in January of 1.03 million units, and stayed there in February, representing 2.0 months’ supply at the current rate of sales (up from 1.9 months in January).

Why the 12-year-long decline in inventory for sale? There has been a structural change: the business of selling homes has changed. It used to take months to sell a home, from the moment the home got listed in a paper publication to the day the sale closed, involving a lot of personal contact and paperwork. Now homes instantly appear in the listings and are marketed online; potential buyers can tour the home via video. Mortgage approvals are largely automated and lightning fast. So the period that homes sit on the market waiting for the processes to occur has shortened. This reduces the inventory for sale. During the Pandemic, technology has invaded home sales with a quantum leap and sped up the processes.

The shadow inventory: Empowered by low mortgage rates and surging home prices, people who buy a home feel no urge to sell the old home. They can just hold the vacant home and profit from the current price increases that far outrun the carrying costs. In addition, they can refinance the mortgage and take cash out of the vacant home, while speculating on further price increases. I personally know several people who have done this as part of their financial calculus.

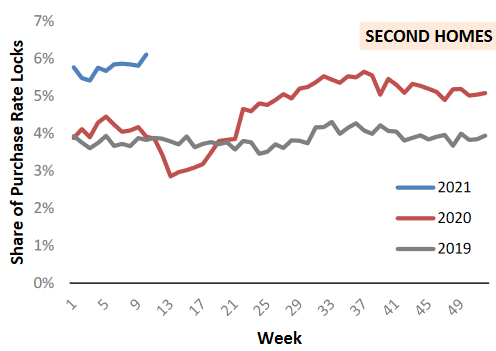

The share of second-home purchases as percent of total home purchases has soared to over 6%, a high in the data series by the AEI’s Housing Center, and far above the prior two years at this time. Some of these may be vacation homes, others may be part of the urban exit, with people simply not selling their old homes:

Mortgages in forbearance are still a big factor. According to the Mortgage Bankers’ Association, 2.5 million mortgages, or 5.1% of all mortgages, are still in forbearance, meaning that lenders have agreed not to execute their right to foreclose, thus allowing the borrower to skip mortgage payments. Many of these mortgages were already delinquent when they entered forbearance.

“Forbearance” doesn’t mean “forever,” though it may now appear that way, given the repeated extensions. The exit from forbearance can take various ways, including putting the home on the market and selling it to pay off the mortgage.

Prices upend historic seasonality.

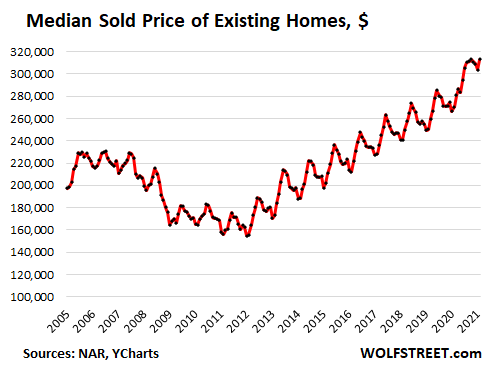

The median price for all existing homes jumped by 15.8% year-over-year to $313,000, according to the NAR’s report. This was up 46.5% from five years ago. By home type: for a single-family house, the median price jumped by 16.2% year-over-year to $317,100; and for condos, it jumped by 12.3% to $280,500 (data via YCharts):

As in so many other economic indicators, the well-established seasonality of the median home price has been nixed during the Pandemic. I[n] the past, it would peak in June or July (the high points in the chart above), and it did so even during the Housing Bust, and then it would drop and hit the seasonal low point in January or February. But in 2020, the median price hit a high in October, then dipped from November through January, and in February bounced back to the October level.

The Fed smiles upon rising long-term Treasury yields as sign of economic growth and rising inflation expectations. Read... First Signs that Surging Mortgage Rates Are Dialing Down the Heat under the Housing Market.

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

These evangelicals are as lukewarm as day old coffee and I can’t tolerate them for a second, and ultimately God is going to spew them out of His mouth. Dave Ramsey is just one of the bits of foreign matter that are yet to be spewed out.

I learned a long time ago without King James guidence that evangelicals are no good. It all started with that TV network PAX which flopped so badly, it was worth 40 cents on the stock market and finally in 2005 it got thrown off the air after 6 years. Lukewarm garbage that didn’t edify or witness, just lame pathetic “entertainment” and a bunch of semi-religious fluff. Paxson the now deseased founder, would give his money to political causes all in support for Bush and McCain (say no more) no wonder Obama became President. God gave America the President they deserved.

Oh yeah, I remember Pax. What a flop that was lol. And Ramsey is just a lover of money. Advice is fine, but he is just a greedy pig.

Agree with DR that this higher housing cost market is here to stay. First, the author’s analysis here doesn’t account for the tectonic shift of thousands of people from expensive/packed urban appts to cheaper suburban homes. This is made more urgent by COVID-driven improvements in telecommuting and companies eager to cut costs by moving their employees to cheaper cost of living areas. Second, in doing so, these movers are using high amounts of capital they accumulated in the cities (I-5 and I-95 corridors) and have cashed out to spend in these suburbs, significantly driving up prices while leaving prices in their old neighborhoods largely unchanged. Third, the author is not accounting for post-boomer generations demand for higher and more expensive standards of living. This is not a short-term bubble caused by monetary policy, but a long-term shift in prices driven by demographics. No correction is coming soon.