The Federal Open Market Committee (FOMC) said in a prepared statement:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

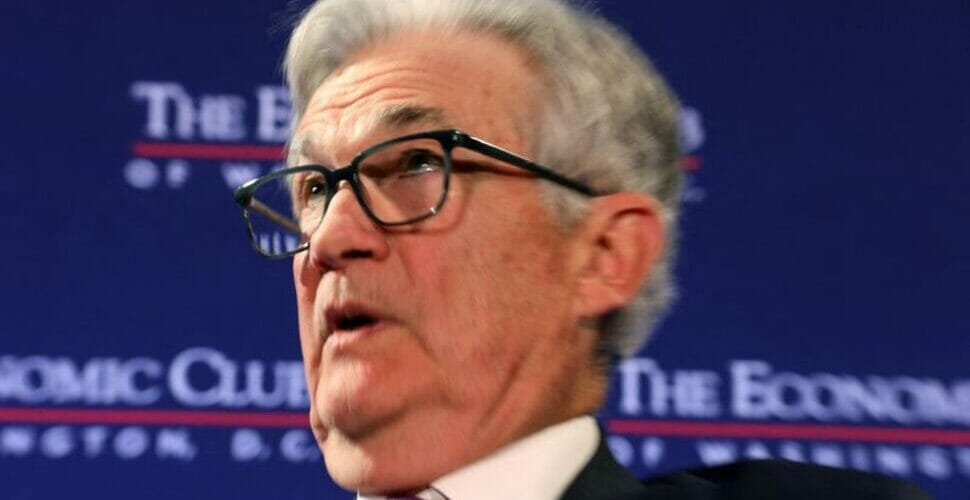

During his press conference, Fed Chair Jerome Powell said that although monetary policy is “still meaningfully restrictive,” he said it’s now “appropriate to move more cautiously.” “We really want to see progress on inflation […] as we think about further cuts…”

Brian Kim, ClearValue Tax, provides more details behind this move:

AUTHOR COMMENTARY

Kim’s assessment is simple and direct: they are a bunch of liars, and the Fed’s narrative is lies and does not hold up. But this isn’t close to being a hot take: Powell and the Feds are always lying, we know this.

The stock market today took a hefty correction today on this news because Wall Street traders traitors were banking on continuously lower rates in 2025. But the markets always get spooked at the slightest news. I have no doubt the markets will rebound fairly quickly, though that has no bearing on you or me.

But don’t be surprised if we still continue to get more rate cuts in 2025. The goal is to hyperinflate and devalue the currency so we can be forced into a new tokenized and CBDC system. There are going to be all sorts of shocks and chaos next year, which I believe will provide the perfect alibi to justify even heftier cuts, and more excuses to print money.

SEE: Tokenization: The New World Order Monetary System To Digitize All Assets And Nature, Including You

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.