The following report is a press release by the Federal Reserve Bank of New York:

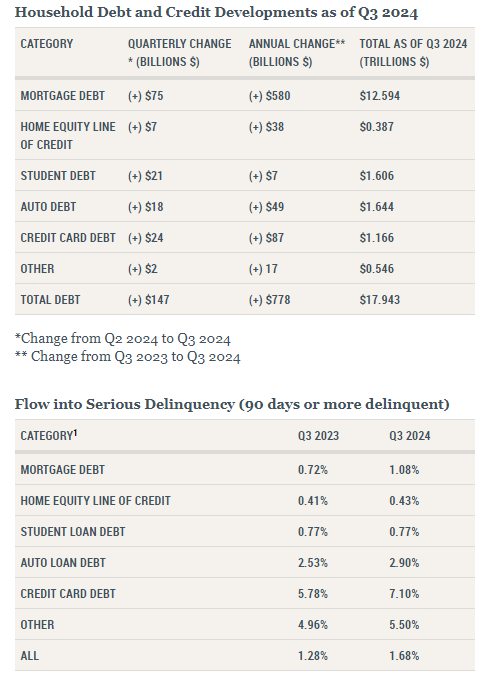

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $147 billion (0.8%) in Q3 2024, to $17.94 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel. It includes a one-page summary of key takeaways and their supporting data points.

The New York Fed also issued an accompanying Liberty Street Economics blog post examining the evolution in aggregate debt to income ratios and what that suggests about Americans’ ability to manage their debt obligations.

“Although household balances continue to rise in nominal terms, growth in income has outpaced debt,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “Still, elevated delinquency rates reveal stress for many households, even amid some moderation in delinquency trends this quarter.”

Mortgage balances increased by $75 billion from the previous quarter and reached $12.59 trillion at the end of September. HELOC balances increased by $7 billion, representing the tenth consecutive quarterly increase since Q1 2022, and stood at $387 billion. Credit card balances increased by $24 billion to $1.17 trillion. Auto loan balances saw a $18 billion increase and stood at $1.64 trillion. Other balances, which include retail cards and other consumer loans, were effectively flat, with a $2 billion increase. Student loan balances grew by $21 billion, and now stand at $1.61 trillion.

The pace of mortgage originations increased slightly from the pace observed in the previous four quarters, with $448 billion of newly originated mortgages in Q3. Aggregate limits on credit card accounts increased modestly by $63 billion, representing a 1.3% increase from the previous quarter. Limits on HELOC increased by $9 billion, the tenth consecutive quarterly increase.

Aggregate delinquency rates edged up from the previous quarter, with 3.5% of outstanding debt in some stage of delinquency. Delinquency transition rates were mixed. Credit card delinquency rates improved, with 8.8% of balances transitioning to delinquency compared to 9.1% in the previous quarter. Early delinquency transitions for auto loans and mortgages worsened slightly, rising by 0.2 and 0.3 percentage points respectively. About 126,000 consumers had a bankruptcy notation added to their credit reports this quarter, a small decline from the previous quarter.

AUTHOR COMMENTARY

Psalm 37:21 The wicked borroweth, and payeth not again: but the righteous sheweth mercy, and giveth.

America is a nation of thieves and debtor slaves. They cannot stop spending what they don’t have and expect someone else to pay for their mistakes and bad behavior. This ridiculous expansion of both personal consumer and federal debt is going to vastly increase in 2025…

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Not to mention the amount of money borrowed from the banks

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

Yay debt, debt and more debt who doesn’t love it?………….

…….Now that I’m thinking about it, becoming a feral person doesn’t look too bad now.

I really appreciate this post. I?¦ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

obviously like your web-site but you need to check the spelling on quite a few of your posts. Many of them are rife with spelling problems and I find it very bothersome to inform the truth however I will certainly come again again.

whoah this blog is wonderful i love reading your posts. Keep up the good work! You know, many people are searching around for this info, you could help them greatly.