In an official statement, the Fed’s Federal Open Market Committee said in a release:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

All members voted unanimously to cut rates by half a point, save only one who voted to only cut interest rates by a quarter point.

While a rate cut today was guaranteed, remarks by Fed Chair Jerome Powell gave further insight into their expectations moving forward. The Fed is planning to end the year by making at least one or two more cuts down to 3.5%, and around 2.75% by the end of 2026.

Powell said during his press gaggle that the Fed “will not be in any rush,” but will set rates on a “meeting by meeting” basis in response to what economic data seems to say about “the outlook and the balance of risks.”

As the economy evolves, monetary policy will adjust in order to best promote our maximum employment and price stability goals. If the economy remains solid and inflation persists, we can dial back policy restraint more slowly. If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we are prepared to respond.

We’re going to go carefully meeting by meeting and make our decisions as we go.

We’re recalibrating policy over time to a more neutral level. We’re moving at a pace we think is appropriate given the base case for the economy.

Powell said

Moving forward, these rate cuts will further weaken the dollar’s strength and purchasing power. The Fed’s “deliberate” act, according to economist Lena Petrova, CPA, said in her analysis: “The Fed just effectively planted the seeds for a massive wave of inflation and the next crisis, [which] will be far more serious than any recession we’ve experienced before.”

Massive Currency Devaluation Begins

As previously noted, this move by the Federal Reserve officially marks the day when the U.S. dollar’s value will further erode much faster and the rate of inflation will tick back up much higher in 2025.

In anticipation of the Fed’s rate cut, stock market analyst and Trends Journal contributor Gregory Mannarino wrote in a piece explaining how the dollar will become massively devalued, and what that will do for the economy.

Mannarino had this to say in a Substack report on Saturday (emphasis his):

Here in the United States, mortgage rates have now dropped to a near two-year low.

But how is this even possible?

I mean, the Fed. has yet still not made their highly anticipated rate cut announcement?

NO ANNOUNCEMENT NECESSARY.

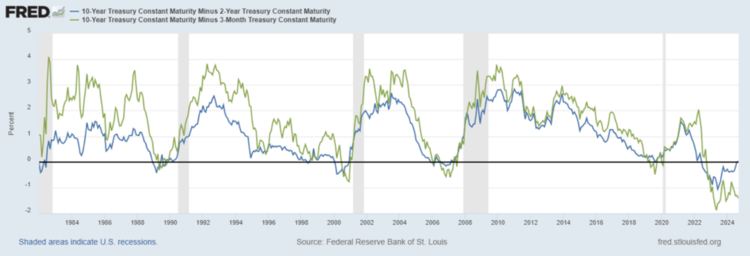

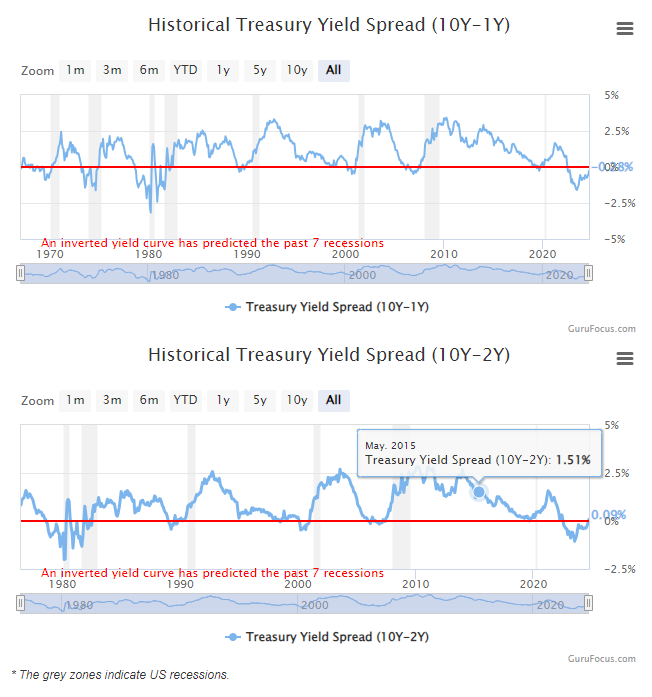

Unannounced, the Fed. back in June of this year started a NEW AND EXPANSIVE quantitative easing cycle which has not only caused the benchmark US 10-year yield to crater, but has also caused the ENTIRE YIELD CURVE TO UN-INVERT. (Unannounced YIELD CURVE CONTROL).

This unannounced QE cycle has also caused the US dollar to freefall. (A central bank cannot just “cut rates” without also causing the currency to lose purchasing power).

So, you were kept unaware that the Fed. had already begun a massive “easing” cycle back in June?

Well, how would you know? The mainstream media/not a single financial channel is talking about it. Not a whisper about it by Fox Business, CNBC, Reuters, Bloomberg, etc. However, the TRUTH is always hidden in plain sight despite the “look here do not look over there” propaganda and deception campaign against us.

Quantitative easing is THE NUMBER ONE TOOL which is used by a central bank to artificially suppress rates.

HERE’S HOW IT WORKS.

New “money” is first created right out of thin air, (obviously this new money creation is inflationary). Then, this new money/currency is then used to buy debt IN MASS. This mechanism, in effect since June, has caused bond yields to fall precipitously and rates have subsequently dropped.

WHAT IS ABOUT TO HAPPEN.

This Wednesday the Federal Reserve will “officially announce” that it is cutting rates, doing so in concert with the European Central Bank, the Swiss National Bank, and the Bank of Canada.

In effect, the Fed. is “giving itself permission” to inflate on a vast scale.

Understand that the NUMBER ONE WAY in which a central bank makes itself stronger, and therefore makes us weaker, is via their ability to inflate/create/and issue debt. This mechanism not only creates nation slaves to its central bank, but also debt slaves on an individual/personal level. Henceforth not only why national debt is skyrocketing at a rate of ONE TRILLION DOLLARS on average every 3 months here in the US, but also why today individual citizens themselves are carrying their heaviest debt loads in history. This mechanism creates MORE DEPENDENCY ON THEIR SYSTEM. PAUSE: Why not a single question about this mechanism during the Presidential debate?

SEE: The US Has Accrued So Much Debt The Interest Payments Are Topping $1 Trillion Every 100 Days

Is there a solution?

ABSOLUTELY! Yes, there is a solution, but you WILL NOT HEAR ABOUT IT.

The solution is simple. And it’s the POLAR OPPOSITE of what we are being sold, AGAIN, by both prospective US Presidential selectees here in the US.

Both Trump and Kamala are PROMISING lower rates, which also means a weaker currency– this is EXACTLY what the Fed. wants so to strengthen their stranglehold on us.

The Lie: WE NEED LOWER RATES.

The Truth: WE DO NOT NEED LOWER RATES!

Lower rates empower central banks and help to fulfill the corporate agenda.

>>>> In Finance and Economics there are ONLY TWO fundamental truths. And these are:

IN ORDER TO HAVE A STRONG ECONOMY YOU NEED

1. A STRONG CURRENCY and

2. A CORRELATING INTEREST RATE HIGH ENOUGH TO MAKE MONEY HARDER TO GET. (Which is what gives the currency its purchasing power).

MORE EASY MONEY IS NOT A SOLUTION! Does that make sense to you?

A weak currency and low rates are ECONOMIC DESTROYERS.

Need proof?

Just look back to times when the currency was stronger, and rates were higher. Families were much better off, more prosperous. Small businesses were thriving, and only ONE income was needed to support a family nicely.

Need even more proof?

During the Trump/Kamala debate, did you hear EVEN ONE question about monetary policy? Why wasn’t there even ONE QUESTION as to why the both of them are promising LOWER RATES?

Instead, you heard a blame game regarding which one of them is responsible for inflation.

NEWSFLASH! Presidents DO NOT HAVE a currency printing press, OR the ability to devalue the currency. Inflation is a product of MONETARY POLICY which is run by the Fed.

NEWSFLASH! It’s the Fed, which is NOT ONLY responsible for monetary policy, but is also responsible for the economy, the financial markets, and THE ENTIRE FINANCIAL SYSTEM.

The Fed. has BUT TWO mandates. 1. To ensure maximum employment, and 2. To maintain price stability. If it’s NOT the Fed., and instead Presidents, who are responsible for these two mandates, THEN WHY ISN’T IT THE PRESIDENT who is responsible for implementing them?

No mention of the Fed. during the clown show debate because IT JUST MIGHT get people to think.

No mention of the Fed. because THE FED must be portrayed to a dumbed down public as being on the side of Angels.

WE ARE BEING DESTROYED, DECIEVED, AND LIED TO FROM WITHIN

AUTHOR COMMENTARY

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

Make no mistake about it: this action by the Fed officially marks the final years of U.S. economic hegemony. The American economy and empire is at an end, and this is a very deliberate and coordinated detonation; which will be used in part to justify a global shift into digital IDs, CBDCs and tokenization.

It takes time for rate cuts and easy money to make its way into the economy. This series of rate cuts and added helicopter money will not really be felt until the midway of 2025 and into Q3 – regardless of who is President or not.

We all feel it in the pits of stomachs – 2025 is going to be a disastrous year. These last two were the calm before the storm, but the F5 tornado will come barreling in next year and cause irreparable damage, as the powers at be throw the kitchen sink at us. It’s going to be a rough ride to say the least…

Psalm 32:10 Many sorrows shall be to the wicked: but he that trusteth in the LORD, mercy shall compass him about. [11] Be glad in the LORD, and rejoice, ye righteous: and shout for joy, all ye that are upright in heart.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

You will own nothing and be happy.

Creature of the Jekyll Island. The Fed and the International Bank of Settlement in Basel, Switzerland, the United Nation, the World Hell Organization( WHO) and other alphabet soup agencies are the enemy. Love one another. We only have each other. We can overcome difficult times ahead if we come together as one. Pray. Keep ourselves physically strong, mentally strong, emotionally strong and spiritually strong.

Great article, however the main problem is a dishonest currency that can be manipulated at will as is obviously occurring now. I watched this cycle here in the 1970’s and in Africa in the 1990’s. It never ends well for the currency. It seems we are well on track for $3000 Gold which is the barometer that tells us what a dollar is no longer worth. It is the thermometer that tells us the patient is deathly ill.

Thank you again brother. You presented this information very well. So, a person like me can understand it. A person that does not really know too much about economics and is not a fan of math.

You’re welcome!