According to an official statement from the Fed’s Federal Open Market Committee (FOMC):

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Fed Chair Jerome Powell once again reiterated the Fed’s mission to reach their inflation of 2%.

He noted that an “unexpected weakening” in the labor market may push the FOMC to “respond” earlier, but told the press that is “not what we’re seeing” or expecting.

So far this year, the data have not given us that greater confidence. The most recent inflation readings have been more favorable than earlier in the year however and there has been modest further progress toward our inflation objective. We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.

We’re looking for something that gives us confidence that inflation is moving sustainably down to 2% and readings like today’s, that’s a step in the right direction, but, you know, one reading isn’t — it’s just only one reading. You don’t want to be too motivated by any single data point.

I would say that today’s inflation report is encouraging, but it comes after several reports that were not so encouraging.

It’s a consequential decision for the economy, (and) you know, you want to get it right, and fortunately we have a strong economy, we have the ability to approach this question carefully and we will approach it carefully, while we’re very much keeping an eye on, you know, downside comes risks should they emerge.

Powell explained.

AUTHOR COMMENTARY

“We have a strong economy.” -LOL!! Seriously, who actually believes this nonsense?

Faithful readers know that all this stuff is just smoke and mirrors; none of the numbers and fair speeches are truthfully accurate. The Federal Reserve is just playing a very strategic game for maximum control. Nothing they ever say or do is honest. Theirs and the government’s data points are literally just lies, especially metrics such as inflation, job creation, unemployment, etc.

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

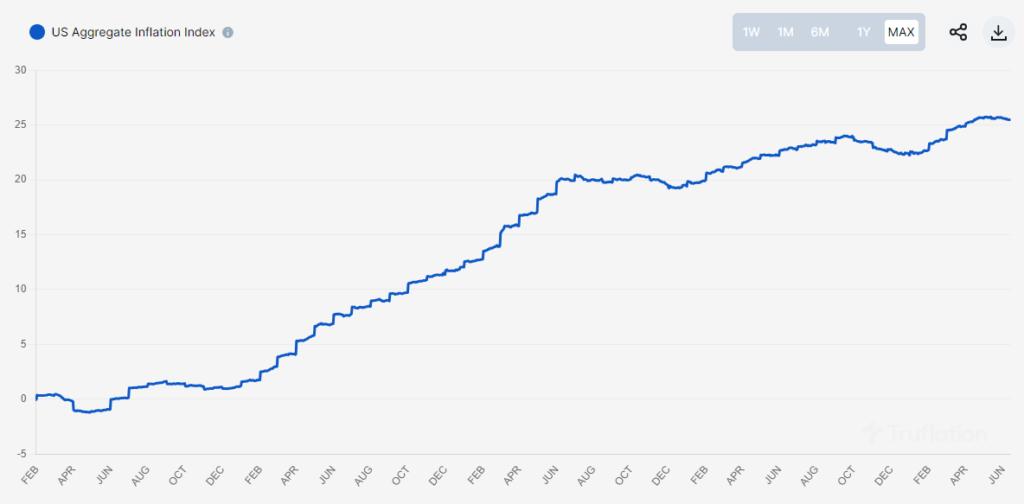

Truflation has real U.S. aggregated inflation at 25.5%.

The next likely cut could be in September, as July as it stands is most likely off the table, and they are on vacation in August, and then back for September. They could cut in November but that is during the elections so that might not happen unless they want to create chaos on purpose.

However, I still leave room for the fact that if some of these banks start to collapse and default later this year that could trigger an emergency meeting and rate cut. Time will tell.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.