The following report is by CNBC:

When Adam Moelis co-founded a fintech startup named Yotta in 2019, he wanted to give Americans a new way to save money to help them cushion the ups and downs of life.

Instead, his company has inadvertently been a source of deep pain for thousands of customers who relied on Yotta accounts to receive paychecks, pay bills and save for emergencies.

The crisis began May 11, when a dispute between two of Yotta’s banking partners — fintech middleman Synapse and Tennessee-based Evolve Bank & Trust — led to the lockup of accounts at Yotta and at least two dozen other startups. Synapse declared bankruptcy earlier this year after several key clients abandoned the firm amid disagreements over the tracking of customer funds.

For the past three weeks, 85,000 Yotta customers with a combined $112 million in savings have been locked out of their accounts, Moelis told CNBC. The disruption had upended lives, forced users to borrow money for food and thrown upcoming events like surgeries or weddings into doubt, he said.

The stories are heartbreaking. We never imagined something like this could happen. We worked with banks that are members of the FDIC. We never imagined a scenario like this could play out and that no regulator would step in and help.

Moelis said.

Boom & Bust

The ongoing mess has exposed the risks in a corner of fintech that grew in prominence during a boom in venture investment — and it will likely reverberate for years as regulators increase scrutiny of the space.

The so-called “banking as a service” model allowed consumer fintech companies to quickly launch savings accounts and debit services, with firms like Synapse acting as a bridge between the startups and FDIC-backed banks that ultimately held deposits.

The heart of the dispute between Synapse and Evolve Bank involves a foundational function of finance: keeping accurate ledgers of transactions and balances. Synapse and Evolve disagree on how much of Yotta’s funds are held at Evolve, and how much are held at other banks that Synapse worked with.

Synapse hasn’t responded to requests for comment, and Evolve has blamed Synapse for the breakdown.

The Synapse bankruptcy has mostly ensnared lesser-known consumer fintech firms, especially after larger fintech players including Mercury and Dave fled the Synapse platform in the past year.

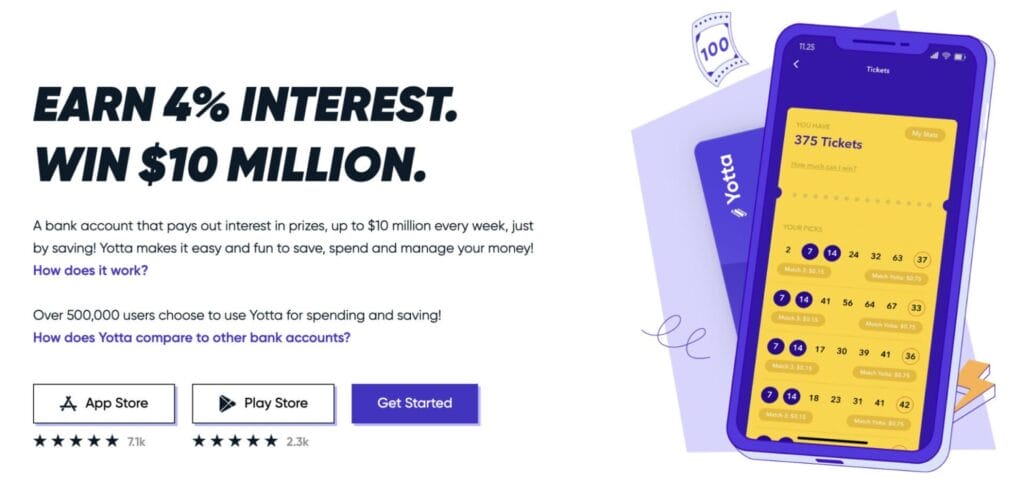

That has left Yotta, which encouraged users to save money with free weekly lottery-style sweepstakes, as one of the largest companies to be affected. Accounts at crypto firm Juno and at Copper, which offered savings accounts for families and teens, also have been frozen.

Non-Systemic Meltdown

Moelis, who has been in contact with other fintech principals impacted by the Synapse failure, estimates that at least 200,000 total customer accounts with balances are locked. While Synapse has said in court filings it has 10 million end users, it’s likely that active accounts are far smaller, Moelis said.

The fintech co-founder said he believes the relatively limited scope of the issue, and the fact that most of those affected aren’t wealthy, has given regulators clearance to let the situation play out. Last year, regulators swiftly intervened in the regional banking crisis that threatened uninsured deposits of startups and rich families, he noted.

“To me, if this was happening at a larger scale, I think regulators would have done something by now,” he said. “We’ve got real, everyday Americans that aren’t necessarily wealthy and don’t have the ability to lobby that are being impacted.”

The Federal Reserve and the Federal Deposit Insurance Corp. have declined to comment on the issue. Representatives of the agencies have pointed to efforts they’ve made to encourage banks to manage the risks of using fintech partners.

‘Money Doesn’t Just Disappear’

But developments in the California bankruptcy court overseeing the Synapse failure give Moelis hope that at least some relief — a partial release of funds, perhaps — may be coming.

Last week, former FDIC Chair Jelena McWilliams was named trustee over Synapse. Her job is to develop a plan to maintain Synapse systems and craft a solution “that allows funds to be returned to end users, to the rightful owners of those funds, as soon as humanly possible,” said Judge Martin Barash.

For his part, Moelis said he doesn’t side with either Evolve or Synapse in their dispute — he just wants the situation resolved.

I don’t know who’s right or who’s wrong. We know how much money came into the system, and we are certain that that’s the correct number. The money doesn’t just disappear; it has to be somewhere.

He said.

AUTHOR COMMENTARY

Earlier today investigative reporter Coffeezilla made a video about this mess, and lo and behold, a number of YouTube shills were out here promoting this without a second thought; and none more so than Graham Stephan, a little runt that is notorious for peddling scams (ie. FTX, BlockFi), selling garbage courses, click-bait, and just outright false and bad financial information. In his own words, Stephan claimed that he invested a percentage of his wealth into a “bank,” tricking so many people who saw his video into believing that Yotta was a legitimate bank when it’s technically not.

I also mentioned Stephan in a report I did in April – Sorry, There Will Be No Housing Crash. Stop Listening To The Liars And Sensationalists – for continuously hyping up an imminent housing crash for years that has not materialized, nor will it anytime soon; with ClearValue Tax exposing him for being a liar, calling him a “feminine little boy with a Napoleon complex.”

Be careful who you are listening to. These people are well-connected and will say and sell anything for a quick buck.

Psalm 15:5 He that putteth not out his money to usury, nor taketh reward against the innocent. He that doeth these things shall never be moved.

Once again, I must continue to emphasize that you hold onto your money privately. Keep your money under a mattress, piggy bank, safe or gun locker, somewhere – just don’t trust banks and apps like this to hold onto your money. It’s not a wise decision. Keep only limited amounts in institutions needed to pay bills, run a business, and maintain a balance.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

What’s shocking to me about this is how much people rely on other money services to do such basic things like pay bills, save, etc. It shows how financially illiterate many are, very sad. Money, budgeting, planning are so easy I literally teach anyone who asks me for free.