The following report is by Bloomberg:

US credit-card delinquency rates were the highest on record in the fourth quarter, according to a Federal Reserve Bank of Philadelphia report.

Almost 3.5% of card balances were at least 30 days past due as of the end of December, the Philadelphia Fed said. That’s the highest figure in the data series going back to 2012, and up by about 30 basis points from the previous quarter. The share of debts that are 60 and 90 days late also climbed.

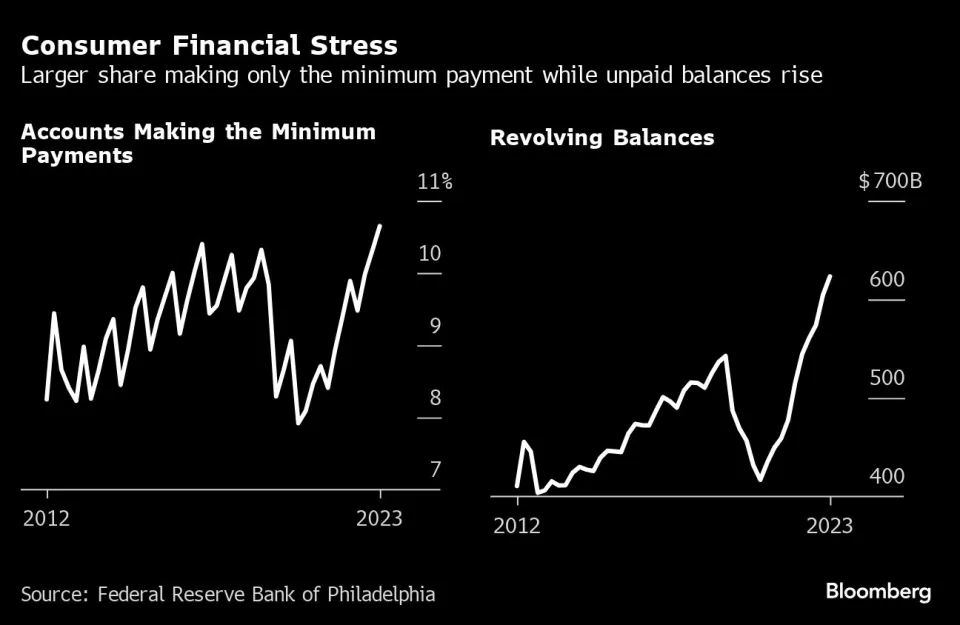

“Stress among cardholders was further underscored in payment behavior, as the share of accounts making minimum payments rose 34 basis points to a series high,” according to the report.

Nominal credit card balances set a new series high and card utilization also rose, as consumers stretched credit lines further. Inflation-adjusted credit card balances remained below fourth-quarter 2019 levels.

The numbers signal added pressure on US household finances amid higher costs of living. About 10% of credit-card borrowers now have an account balance that exceeds $5,200, according to the Philadelphia Fed. One-quarter of active accounts have a balance of over $2,000 for the first time.

But, underscoring the dichotomy among consumers, about one-third of card holders pay their balance in full every month.

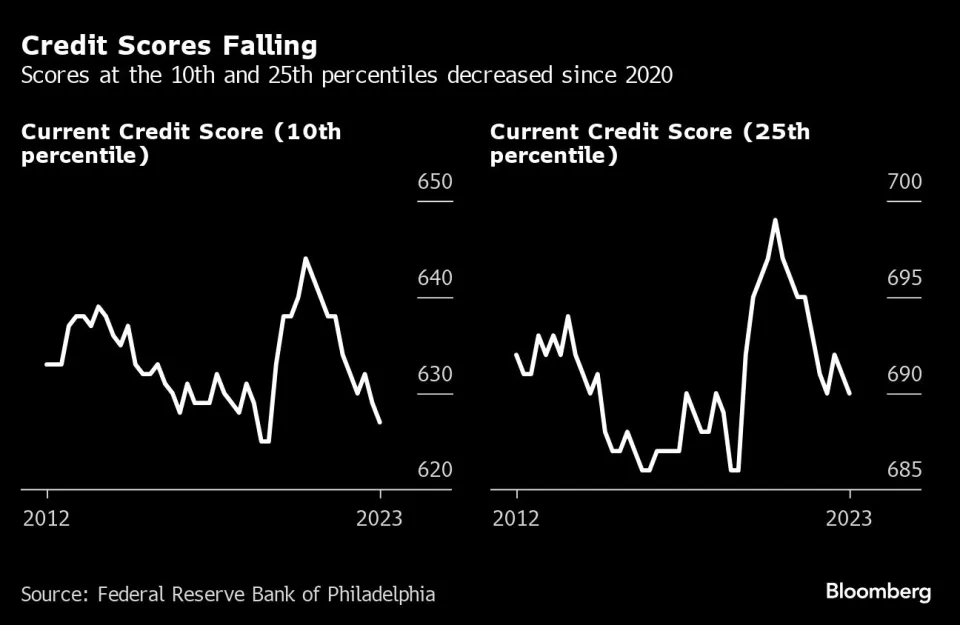

The Philadelphia Fed found that credit scores at the 10th and 25th percentiles of cardholders decreased to their lowest levels since the first quarter of 2020, indicating further performance deterioration could be on the horizon.

Issuers have responded by lowering the credit limit for new accounts. The median account opened with a $3,000 limit in the fourth quarter, down from the $3,368 high in the second quarter.

The data series, which started in the third quarter of 2012, covers loans by large lenders with at least $100 billion of assets, representing roughly four-fifths of total bank card balances.

AUTHOR COMMENTARY

Last year total American credit card debt surpassed $1 trillion for the first time ever, and now it is above $1.13 trillion in just roughly six months; and total household debt now sits above $17.5 trillion.

At the same time buy now, pay later apps have continued to explode in popularity, as I have covered before; and that is going to become a new issue that will explode eventually, as covered in a report by Credit News titled, “Next credit card epidemic? ‘Buy now, pay later’ becomes unregulated gateway drug into debt addiction.”

1 Timothy 6:6 But godliness with contentment is great gain. [7] For we brought nothing into this world, and it is certain we can carry nothing out. [8] And having food and raiment let us be therewith content. [9] But they that will be rich fall into temptation and a snare, and into many foolish and hurtful lusts, which drown men in destruction and perdition. [10] For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.

These debt problems come from years and years of people not being content with what they had. The got bit by the covetousness bug and now they can’t stop themselves, to the point where so many of these people realize they’re never going to recover with the current conditions, so they are throwing their last grenades and keep maxing out and opening new credit cards.

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Spoiled decadent Americans.

Never content with a nice small humble abode, a good working car, a sufficient job, food, clothes (raiment), good health, and perhaps a garden or trees with all kinds of fruits and vegetables, oh no can’t have that: they want the biggest house in the suburbs, the latest gadgets and doodads, the fanciest cars, and look like the rich and famous.

This covetous trend that came up called “Keeping Up With The Joneses,” what a bunch of nonsense and covetousness. I couldn’t care less about the Joneses and their escapades, I’m happy as it was before 1900, thank you very much!

You are a globalist because you are spouting the WEF mantra, own nothing and be happy. Trolls are everywhere. Nice try buddy.

Brother, would you happen to know where we can get reliable earthquake alerts ahead of time and internationally?