I’ve mentioned before in other posts that ever since 2020 there has been this ecstatic push by a number of YouTube and Reddit economists, and some C and B-list financial celebrities, many of whom cherry-pick very specific datapoints, post over-dramatic thumbnails and clickbait titles, to seduce the audience that a housing crash is coming.

And these people who have continued to perpetuate this imminent housing collapse since 2020 have proven to be dead wrong each and every time.

But wanting something to be is not the same thing as reality. And the truth is, whether you like it or not, a housing crash in the conventional sense is not going to occur anytime soon, relatively speaking at the very most.

I’m not going to try and get very technical in this report, so if you are looking for very lengthy, hyper-detailed analytics, this is not the article for you, but rather for the hopeful but innocent ‘novice’ just trying to maneuver this minefield and world of lies.

We are experiencing the worst home affordability crisis in a long time. A MarketWatch headline in September of last year said, “Housing affordability is now at its worst level since 1984, Black Knight says.”

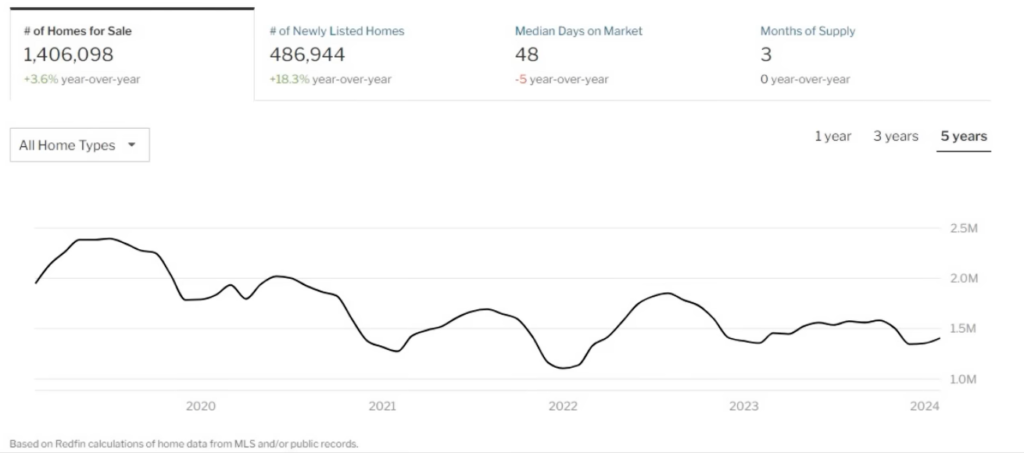

To keep things short and sweet, it comes down to the basics: supply and demand. Right now we have have volcano hot demand, and supply that simply cannot keep up for a number of reasons; due to unattainable prices and mortgage rates, institutional buying for pennies on the dollar, or even things such as older generations less willing to downsize their homes and close on a deal for a price less than the estimated values.

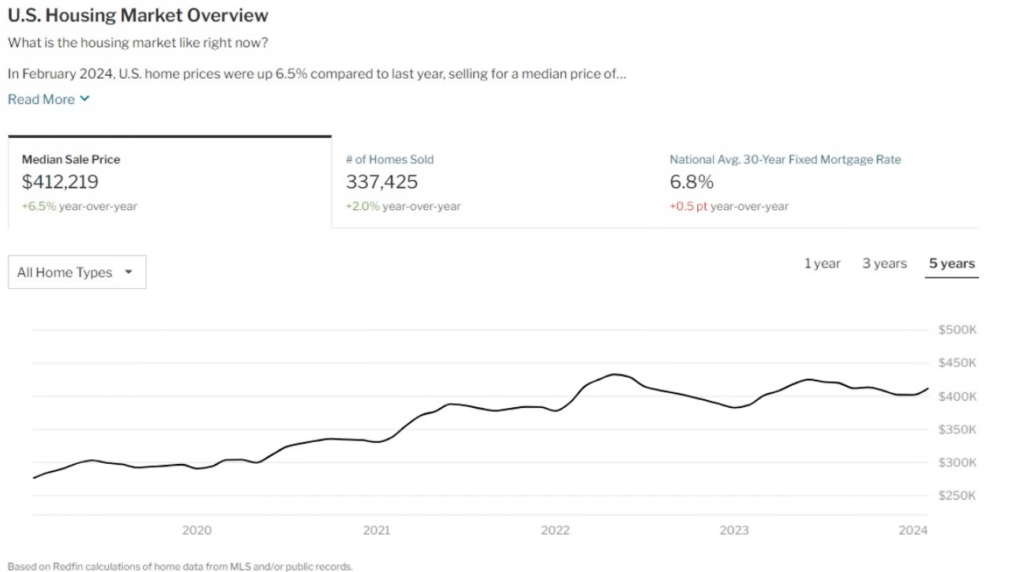

When looking at the actual data, according to Redfin, the median home price in February in the U.S. was $412,219, a 6.5% increase from just 12 months ago.

The “rub” comes when a lot of these clickbaiters and crash callers highlight how in certain areas and counties prices are dropping quickly. And while that maybe true for specific regions, and that’s great and all, the data plainly shows that prices continue to trend upward nationally, just as inflation continues to still tick up steadily and remain high (grossly higher than the government would ever care to admit).

Brian from ClearValue Tax did a very good video breaking down this data and why a conventional housing crash is not on the horizon. As he points out, “if home prices are down 26% in your area, that means that homes prices are up by 26% in a different area. If you don’t believe in math, then what I can say? I’m not going to argue with you.” He’s not wrong; and the same wisdom applies to something like the stock market: in order to earn money someone hast to lose money. This is a truism that is vaguely understood and seldomly explained.

Furthermore, as logic would dictate, and as Brian has pointed out, the Federal Reserve has made it clear that they will be lowering interests later this year, most likely by June/July. Doing so will cause a drop in the 10-year-yield, and mortgage rates will also slide, and therefore the price of homes will be poised to increase as lower rates and yields will create a new influx of prospecting buyers; which could effectively exacerbate the problem even deeper for longer.

As I said, it comes down to supply and demand. In order for there to be a crash there needs to be more sellers, and a lot of them all hitting the skids at once, but that’s not happening; and supply cannot keep up, whether it’s because of non-sellers, not enough new homes and apartments being constructed, too many immigrants and aliens that are also competing and being subsidized for property, etc.

As explained plainly by Bankrate last month: ‘No. There are still far more buyers than sellers, and that means a meaningful price decline can’t happen: “There’s just generally not enough supply,” says Mark Fleming, chief economist at title insurer First American Financial Corporation. “There are more people than housing inventory. It’s Econ 101.”’

Dave Liniger, the founder of real estate brokerage RE/MAX, said: “You’ve got an entire generation of pent-up demand. We’re in this fascinating position of tremendous demand and too little inventory. When interest rates do start to come down, it’ll be another boom-and-bust cycle.”

Prices will remain firm and will not decline on a national level.

Lawrence Yun, Chief Economist, National Association of Realtors

This is what The Trends Journal forecasted in December, 2023, writing:

When the U.S. Federal Reserve begins cutting interest rates in the first part of next year, more homes will come onto the market as homeowners now sitting on low-rate mortgages will find themselves able to afford mortgages on new digs. That will put more homes on the market but also boost the number of potential buyers for them.

Therefore, prices nationally will stay high and possibly keep rising. People with the most cash and best credit will secure funding and shut out people who, in a normal housing market, would be able to own a home of their own.

And even before that forecast, The TJ had been saying for a couple of years before this one that there would not be a crash, accurately saying “housing prices would fall but not crash. The shortage of homes for sale has kept buyers bidding against each other for the few available.” Of course now, before interest rates have even been cut, housing prices are still ticking upwards.

Lower interest rates will bring more of those frustrated would-be buyers into the market. However, home prices will remain elevated even then: demand will still outpace supply and many sellers will be unwilling to accept a price significantly lower than today’s boom time.

[…] Because home prices and mortgage interest rates are high, and will remain so at least through this year, first-time and modest-income buyers will continue to be denied their chance at the American Dream of home ownership and the opportunity to build wealth in the way that most Americans have in the past. The magazine added

Moreover, earlier this week Creditnews published a detailed report on housing affordability across the country, and while there are some ‘deals’ (in relative terms) to be had, they say “what we discovered reveals the story of two Americas: one where middle-class families can still qualify for an average home and one where they’ve been priced out entirely.”

There’s no two ways about it: Housing affordability has worsened significantly since Covid. In 2019, middle-class households could comfortably buy a typical home in 91 of the top 100 largest metros. By 2024, that figure had fallen to just 52. Families in the lower middle class can only afford to buy an average home in 7 of the top 100 metros.

Sam Bourgi, Senior Analyst at Creditnews

In short, as Bankrate points out, there are five main reasons why a housing crash will not occur:

- Inventories are still very low

- Builders didn’t build quickly enough to meet demand

- Demographic trends are creating new buyers

- Lending standards remain strict

- Foreclosure activity is muted

Definitely give ClearValue Tax’s video a watch:

More recently, earlier this week Brian went after some of these crash callers, blasting them and making fools of them. In particular, he went after Graham Stephan, a popular financial channel on YouTube, who has been repeatedly calling for an imminent housing crash that has never come to pass, even just recently saying there’d be one this year.

Stephan was the only one Brian namedropped, calling him a “feminine little boy with a Napoleon complex,” because apparently Stephan dogged on Brian a while ago.

But his main reason for doing this response is because of the people who come to Brian’s channel confused because they got misled by these clickbait videos pumping hopium and misinformation.

And I’ll add to this list of some of the people I’ve seen peddling the imminent crash calling:

In February I called out and exposed “The Economic Ninja” for this very thing, selling courses with grifter-like and fraudulent tactics, getting all emotional and using Bible verses to try to sound genuine and sincere.

Another one is Kevin Paffrath, better known as “Meet Kevin.”

Another one is “Reventure Consulting.”

There are many more but these are just a small sampling. And then on the flipside you’ve got “boomer meme” Dave Ramsey and crew, who keep telling people to buy a home every waking second it feels like.

[17] Now I beseech you, brethren, mark them which cause divisions and offences contrary to the doctrine which ye have learned; and avoid them. [18] For they that are such serve not our Lord Jesus Christ, but their own belly; and by good words and fair speeches deceive the hearts of the simple. Romans 16:17-18

That’s how the conmen do it. They go after the innocent and ignorant, all for clicks, clout, and quick cash. It’s dog-eat-dog: they need suckers to go broke or be distracted as to level the playing field. Again, in order to win money in markets one must lose money.

[14] It is naught, it is naught, saith the buyer: but when he is gone his way, then he boasteth. [15] There is gold, and a multitude of rubies: but the lips of knowledge are a precious jewel. Proverbs 20:14-15

As I said with Ninja – Verse is 14 is the credo of all get-rich-quick, Ponzis, and other greedy scams, and it absolutely fits like a glove here with Ninja. By the way the verse is written the inverse is true. The seller comes along and says, “my [such and such] will change your life. You need it; but if you want to stay broke, then don’t buy it: but if you want to be rich like me, then buy now before it’s too late!” The same applies to this housing market hopium.

As much as this truth is unfortunate and a bit demoralizing, Brian interprets the writing on the wall, sort of speak:

We are moving towards a nation of renters. It’s not going to be overnight, but slow and steady wins the race for big institutions.

And, as he points out, even if there is a housing crash these institutional buyers (Blackrock, Vanguard, State Street) will come in with their blank checks and deep pockets, and buy up the homes and properties for pennies on the dollar.

Oh, and should a housing crash even occur, and even if it’s a really deep one, prices will still be well out of target range and affordability for a mortgage.

Again, supply and demand. Demand must crater significantly; and the only potential way this happens is there would be a mass-culling of the population, though even that still does not discount the institutional buyers that can buy up the Monopoly board unconstrained.

I mean, haven’t you heard: “You’ll own nothing and be happy?”

Having said that – to the saved, be aware and be vigilant, but don’t fret yourself and wait on the Lord. Patience is key here, as with everything; and I hope to, Lord willing, further discuss these topics in future studies with the scriptures as to what’s going to happen with the economies of the world, and what we can do about it…

[7] Rest in the LORD, and wait patiently for him: fret not thyself because of him who prospereth in his way, because of the man who bringeth wicked devices to pass. [8] Cease from anger, and forsake wrath: fret not thyself in any wise to do evil. [19] Fret not thyself because of evil men, neither be thou envious at the wicked; [20] For there shall be no reward to the evil man; the candle of the wicked shall be put out. Psalms 37:7-8; Proverbs 24:19-20

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Correct! You’ll own nothing and be happy living in a 15min city in your home the size of a large closet, perhaps a bit larger. Th powers that be will make sure home ownership is not affordable. They will also do whatever is possible to usurp th current ownership of your house. Enjoy it while you have it. Thankfully, Jesus is preparing a better home for us.

While I am a younger American living in my parent’s home, I do not need to fret because of high value homes. Why?

1 Peter 1:3 Blessed be the God and Father of our Lord Jesus Christ, which according to his abundant mercy hath begotten us again unto a lively hope by the resurrection of Jesus Christ from the dead, 4 To an inheritance incorruptible, and undefiled, and that fadeth not away, reserved in heaven for you,

2 Corinthians 5:1 For we know that if our earthly house of this tabernacle were dissolved, we have a building of God, an house not made with hands, eternal in the heavens.

Hebrews 11:16 But now they desire a better country, that is, an heavenly: wherefore God is not ashamed to be called their God: for he hath prepared for them a city.

John 14:2 In my Father’s house are many mansions: if it were not so, I would have told you. I go to prepare a place for you.

Amen, Isaac.

Inflation is running much higher than reported. Just look at what you pay for everything. We are close to the Fed realizing and jacking up rates killing the housing market

Inflation is running much higher than the 3.1% reported. Watch what happens to interest rates when the Fed realizes. Everyone knows the truth about inflation. Just look at what you pay for everything. When interest rates resume their uptrend the housing market will crash. The know it all attitude of this author is going to be amusing when I go back and reread this article in a year!

The Feds and Powell have said a number of times openly this year that rate cuts are a lock. The Swiss National Bank has already cut rates. Rate hikes are absolutely off the table. The crash callers have been wrong since 2020. The data does not matter: it’s all game for control.

Jacob, I had someone in my area state that Black Rock and Van Guard have been buying up real estate, and then NOT putting Same on the market. If true, I would think they are doing everywhere? Not sure about the source who mentioned this? Black Rock being apart of the WEF Gang and their (15 Minute City / Own Nothing agenda) is it plausible to think this is possible?Your thoughts? Also regarding housing, my thoughts are, eventually these Mortgage Debtors will start losing employment…Thus the housing crash or banking crash?

Time will tell. The last thing out of the Fed is from Bowman expressing some concerns that they are watching https://www.federalreserve.gov/newsevents/speech/bowman20240405a.htm

Here is the interesting part” In the most recent SEP, some FOMC participants indicated that they now see fewer rate cuts over 2024 and over the next two years than in December. Some also included a higher longer-run level of the federal funds rate than in the past.28″ You know where I stand. I think that this is the start of them backing away from the rate cuts.