Federal Reserve Chair Jerome Powell conceded earlier this month that he and the Feds, along with the the Federal Deposit Insurance Corporation (FDIC), are aware of and monitoring a number of banks that are likely to fail sometime in the future, primarily due to their overexposure to commercial real estate (CRE) and losses on their balance sheet because of higher interest rates.

In February Powell sat down for an interview with CBS’ 60 Minutes and explained the prospect of bank failures due to CRE exposure, but emphasized it was only the medium and small banks.

Scott Pelley: The value of commercial office buildings all across the country is dropping as people work from home. Those buildings support the balance sheets of banks all across the country. What is the likelihood of another real estate-led banking crisis?

Powell: I don’t think that’s likely. So, what’s happening is, as you point out, we have work-from-home, and you have weakness in office real estate, and also retail, downtown retail. You have some of that. And there will be losses in that. We looked at the larger banks’ balance sheets, and it appears to be a manageable problem. There’s some smaller and regional banks that have concentrated exposures in these areas that are challenged. And, you know we’re working with them.

This is something we’ve been aware of for, you know, a long time, and we’re working with them to make sure that they have the resources and a plan to work their way through the expected losses. There will be expected losses. It feels like a problem we’ll be working on for years. It’s a sizable problem. I don’t think — it doesn’t appear to have the makings of the kind of crisis things that we’ve seen sometimes in the past, for example, with the global financial crisis.

Powell explained – though part of his statement was not included in the televised interview

Moreover, during a Senate Banking Committee hearing Powell earlier this month, acknowledged this but said it is medium and small regional banks that are affected.

There will be bank failures, but this is not the big banks. If you look at the very big banks it’s not a first order issue for any of the of the very large banks. It’s more, you know, smaller and medium-sized banks that have these issues.

We’re working with them, we’re getting through it – I think it’s manageable, is the word I would use, but it’s you know it’s a very active thing for us and the other regulators, and it will be for some time.

Powell said at the time

But federal data unfortunately betrays Powell’s words, that it’s not only the regional banks most affected by an overexposure to CRE loans.

On March 7th, the same day Powell gave his testimony to the Senate Banking Committee, the FDIC issued their public meeting and contradicted Powell’s words, saying that it is actually the large institutions that also have heavy exposure to CRE.

Chairman Martin Gruenberg made his announcement during the FDIC Quarterly Banking Profile (4th Quarter 2023), in which he stated:

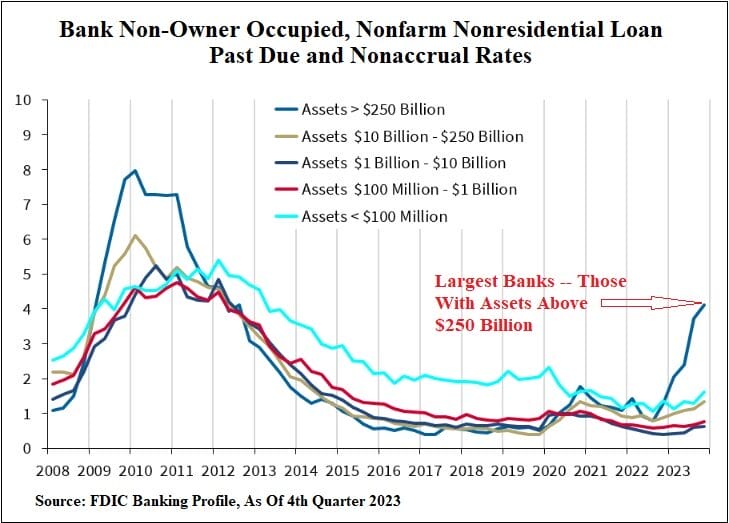

The increase in noncurrent loan balances was greatest among CRE [Commercial Real Estate] loans and credit cards. Weak demand for office space has softened property values and higher interest rates are affecting credit quality and refinancing ability of office and other types of CRE loans. As a result, the noncurrent rate for nonowner occupied CRE loans is now at its highest level since first quarter of 2014, driven by portfolios at the largest banks.

He said

This blatant contradiction was found by Pam and Russ Martens for Wall Street on Parade, who highlighted just how much increased exposure the largest institutions in the U.S. have to CRE assets.

The authors wrote:

In fact, according to the chart above and accompanying data provided in an Excel spreadsheet by the FDIC, past due loans on commercial real estate at the largest banks (those with more than $250 billion in assets) as of December 31 of last year are at 4.11 percent. That’s 1.66 percent higher than at the end of the fourth quarter of 2008 when banks were exploding all over Wall Street during the financial crisis. As the chart above indicates, commercial real estate problems quickly became a lot worse at the largest banks, with the past due rate reaching 7.97 by the end of the first quarter of 2010.

That 4.11 percent past due rate at the biggest banks on December 31, 2023 compares with a past due rate of 1.35 percent at banks with $10 billion to $250 billion in assets, according to the latest FDIC bank profile data. Banks with $1 billion to $10 billion in assets have a negligible past due rate of 0.64 percent.

The title of the FDIC chart above is “Bank Non-Owner Occupied, Nonfarm Nonresidential Loan Past Due and Nonaccrual Rates.” The FDIC defines nonfarm nonresidential commercial properties as follows:

“loans secured by real estate as evidenced by mortgages or other liens on nonfarm nonresidential properties, including business and industrial properties, hotels, motels, churches, hospitals, educational and charitable institutions, dormitories, clubs, lodges, association buildings, ‘homes’ for aged persons and orphans, golf courses, recreational facilities, and similar properties.”

The FDIC defines “nonaccrual” status as follows:

“Nonaccrual — For purposes of this schedule, an asset is to be reported as being in nonaccrual status if: (1) it is maintained on a cash basis because of deterioration in the financial condition of the borrower, (2) payment in full of principal or interest is not expected, or (3) principal or interest has been in default for a period of 90 days or more unless the asset is both well secured and in the process of collection.”

The Fed is also doing something else related to growing losses at U.S. banks that is deeply concerning. It has stopped providing the aggregated quarterly data on the loan loss reserves at commercial banks – something it had previously done quarterly since 1984. The Fed data charts now come up with the words “DISCONTINUED.” (See here, here and here.) Our concern is that the largest banks are woefully under-reserved for their potential real estate losses.

According to a Federal Reserve chart, as of December 31, 2023, there were only 13 banks in the U.S. with consolidated assets in excess of $250 billion.

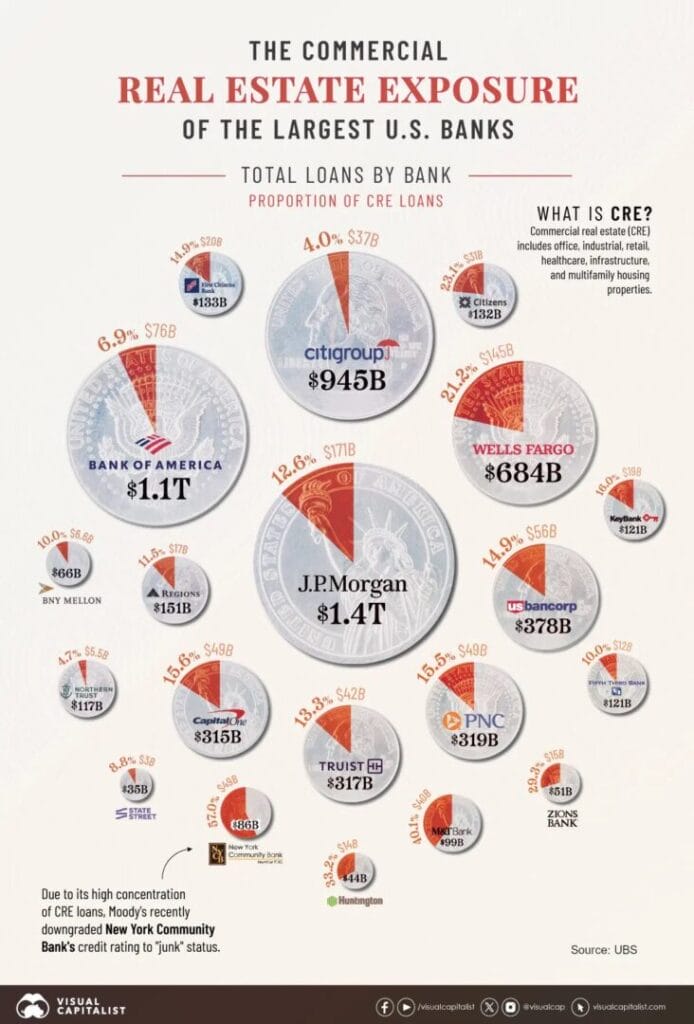

Corroborating with this data, Visual Capitalist published data that showcases the sheer amount of commercial real estate the so-called too-big-to-fails are holding onto, alongside some of the regionals that have the most exposure also.

The six largest U.S. banks saw delinquent commercial property loans nearly triple to $9.3 billion in 2023 amid high vacancy rates and increasing borrowing costs.

Today, the sector is facing greater scrutiny from regulators amid growing risks to bank stability. In fact, for almost half of all U.S. banks, commercial real estate debt is the largest loan category overall. While commercial loans are more heavily concentrated in small U.S. banks, several major financial institutions have amassed significant commercial loan portfolios.

Visual Capitalist wrote

Top 20 U.S. Banks by Assets: Commercial Property Exposure

| Bank | Total Assets | Total Loans and Leases | Total Commercial Real Estate Loans | Share of Total Loans |

|---|---|---|---|---|

| JPMorgan Chase & Co. | $3.9T | $1.4T | $171B | 12.6% |

| Bank of America Corp | $3.2T | $1.1T | $76B | 6.9% |

| Citigroup Inc. | $2.2T | $945B | $37B | 4.0% |

| Wells Fargo & Company | $1.9T | $684B | $145B | 21.2% |

| U.S. Bancorp | $668B | $378B | $56B | 14.9% |

| PNC Financial Services Group, Inc. | $557B | $319B | $49B | 15.5% |

| Truist Financial Corporation | $543B | $317B | $42B | 13.3% |

| Capital One Financial Corp | $471B | $316B | $49B | 15.6% |

| Bank of New York Mellon Corp | $405B | $66B | $7B | 10.0% |

| State Street Corporation | $284B | $35B | $3B | 8.8% |

| Citizens Financial Group, Inc. | $226B | $132B | $31B | 23.1% |

| First Citizens BancShares, Inc. | $214B | $133B | $20B | 14.9% |

| Fifth Third Bancorp | $213B | $121B | $12B | 10.0% |

| M&T Bank Corporation | $209B | $99B | $40B | 40.1% |

| Keycorp | $188B | $121B | $19B | 16.0% |

| Huntington Bancshares Incorporated | $187B | $44B | $14B | 33.2% |

| Regions Financial Corporation | $154B | $151B | $17B | 11.5% |

| Northern Trust Corporation | $146B | $117B | $6B | 4.7% |

| New York Community Bancorp Inc | $111B | $86B | $49B | 57.0% |

| Zions Bancorporation, N.A. | $87B | $51B | $15B | 29.3% |

So, evidently the data suggests Powell is being disingenuous in his claims to the Senate and to the nation.

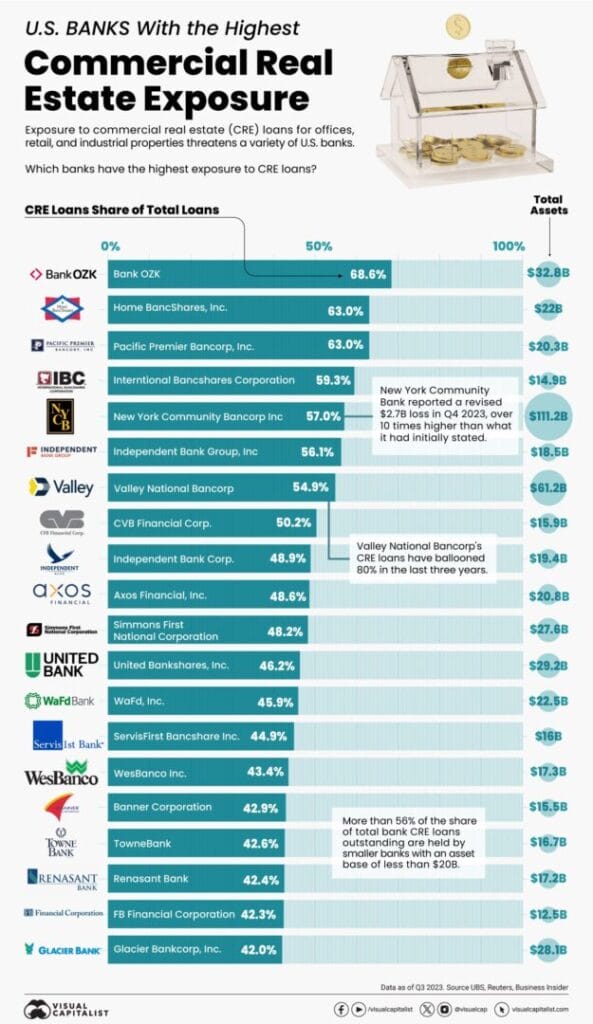

Notwithstanding this does not discount the reality that many medium and small regional banks definitely are in a grave situation. In a separate post Visual Capitalist highlighted more specifically the banks that have the most exposure to commercial real estate; reporting that “there is roughly $5.7 trillion in commercial real estate debt outstanding—with U.S. banks holding approximately half of this total on their balance sheets.”

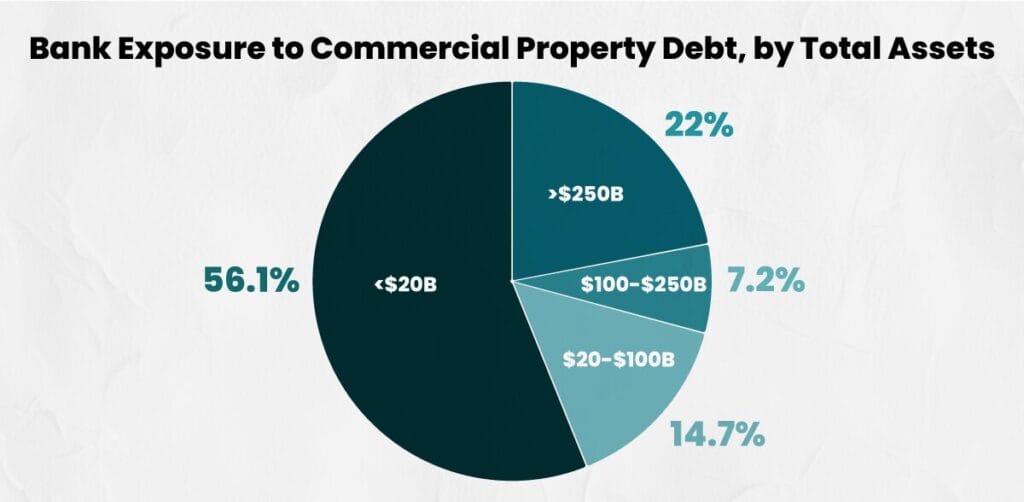

The majority of commercial real estate loans are found in small U.S. banks, which are those with assets of $20 billion and under.

With 56.1% of all commercial property loans, small U.S. banks face the highest risk compared to other bigger banks.

Given the high share of loans, banks may run the risk of failure especially if credit losses accelerate and valuations decline. At the same time, it could be more challenging to refinance debt as valuations deteriorate.

While these troubles have begun to emerge over the last year, there is also the likelihood that losses could continue over the next several years. In fact, after the global financial crisis, credit losses peaked two years after delinquencies hit their highest point.

Visual Capitalist explained

Earlier this month New York Federal Reserve board member Scott Rechler said in a paper he expects roughly 500 banks or so to fail over the next couple of years, because of their CRE exposure.

And to make matters worse the Federal Reserve abruptly ended their emergency bailout program this month, called the Bank Term Funding Program (BTFP), which provided lines of credit for banks who needed extra liquidity to cover withdrawals and net losses on their balance sheets. An increasing number of banks were still taking advantage of the program up until the BTFP was terminated.

AUTHOR COMMENTARY

An hypocrite with his mouth destroyeth his neighbour: but through knowledge shall the just be delivered.

Proverbs 11:9

As I have oft pointed out (as if you needed me to do so), Jerome Powell, or anyone of these bankster gangsters, are trained stone cold liars. They will not flinch or blink when telling a lie.

Truth be told, we knew that the megabanks definitely had plenty commercial real estate exposure, but the evidence and admission given by the FDIC clearly contradicts the notion that this problem is limited to the regional banks. On the contrary, it is effecting the banks of all sizes.

Last year around this time, amidst the collapse of Silicon Valley Bank (SVB) and a wave international contagion that spread because of it, Treasurer Janet Yellen was called upon to give answers during a Senate Banking Committee hearing. During that meeting Yellen made an important admission, basically revealing that the Federal Reserve and Treasury will set in motion measures to bailout and rescue the so-called “too-big-to-fail” banks, or any institution the Feds feel is of significant importance to them, but medium and small banks will not receive such treatment.

A bank only gets that treatment if a super-majority of the Fed board, and I, in consultation with the President conclude that failure to protect uninsured depositors would create systemic risk to the banking system.

She said at the time

She went on to explain other banks such as Signature Bank, another bank that collapsed in the tidal wave caused by SVB’s fall, received special treatment and depositor insurance because the Treasury and Federal Reserve felt in their judgment it would prevent wider contagion – relating back to what Senator Cortez Masto queried more recently. SEE: Treasurer Janet Yellen Admits That Favored Banks Will Be Bailed-Out But Smaller Ones Will Be Left To Die

Yellen was already forecasting in advance what was going to occur. You and I will be forced to bailout these so-called “too-big-to-fails” while your little bank can go eat dirt, and be forced to shutter its doors and be consolidated by one of the megabanks.

In this coming wave of bank failures we will see this year and in 2025, one, if not more, of these megabanks will be scarified similar to how Lehman Brothers was sacrificed on the altar during the Great Recession. From what I have been hearing from a number of analysts, it would seem that Bank of America might be the sacrificial cow that gets slaughtered. But, we’ll have to wait and see.

The point is, Powell, to no one’s surprise, is a brazen liar; and independent and FDIC data plainly shows that CRE is heavily on the books of these megabanks, and the American tax cattle will be forced to pay for their problems just as before.

Again, for the umpteenth time, get your money out of these places. Keep only the amounts you need to maintain a balance, pay bills, and make some purchases, but keep most of it out if in the event your bank collapses and/or is hit with bank runs.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.