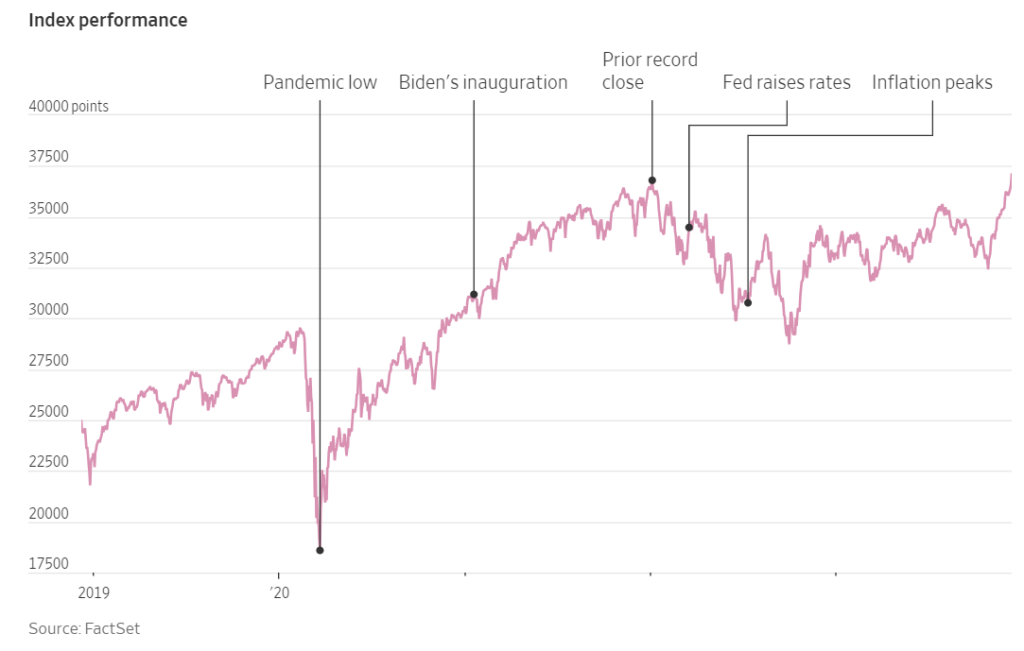

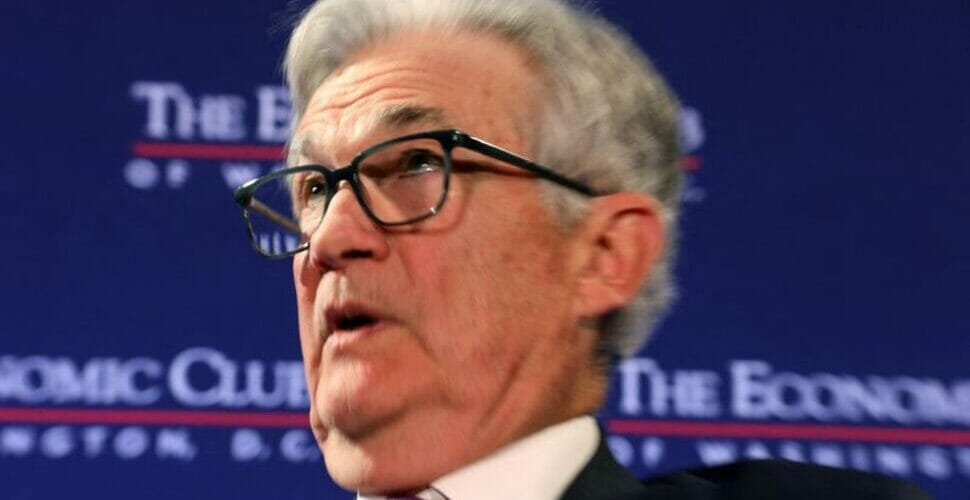

However, Fed Chair Jerome Powell indicated that rate cuts are coming in 2024, even though the Federal Reserve has yet to reach their 2% inflation target. These rate cuts for 2024 were more than expected, but is now a matter of how many and how soon.

As we look ahead to next year, I want to assure the American people that we’re fully committed to returning inflation to our 2% goal. We storing price stability is essential to achieve a sustained period of strong labor market conditions that benefit all.

Powell said during his speech

But, the reported rates of inflation by the government and the Federal Reserve are grossly different compared to third-party sources that are factoring in other datapoints, and the dollar’s purchasing power and parity. Truflation reports that real inflation is closer to 23%, versus the 3.1% the government says it is.

“While the weather is still cold outside, the Fed has suggested a potential thawing of frozen high interest rates over the next few months,” said Rick Rieder, chief investment officer of global fixed income at asset management giant BlackRock, in response to the Fed’s decision.

Again, during Powell’s speech, he made it clear that rate cuts will be coming.

While participants do not view it as likely to be appropriate to raise interest rates further, neither do they want to take the possibility off the table. If the economy evolves as projected, the median participant projects that the appropriate level of the Federal Funds Rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026, still above the median longer-term rate. These projections are not a committee decision or plan. If the economy does not evolve as projected, the path of policy will adjust as appropriate to foster maximum employment and price stability goals.

In determining the extent of any additional policy firming that may be appropriate to return inflation to 2% over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

[…] I mean, the reason you wouldn’t wait to get to 2% to cut rates is that policy would be — it would be too late. I mean, you’d want to be reducing restriction on the economy well before 2%, or before you get to 2%, so you don’t overshoot. If we think of restrictive policy as weighing on economic activity. He explained

He later noted that the Fed’s chose to insert the word “any,” indicating that they are open to rate hikes. “We added “any” as an acknowledgment that we are likely at or near the peak rate for this cycle,” he said.

For more commentary on what this means and where the economy is going, watch ClearValue Tax and Gregory Mannarino’s videos on this.

AUTHOR COMMENTARY

Definitely expect rate cuts in 2024. Even though the inflation metrics given by the government and federal reserve are bogus, expect inflation to rocket back higher as rates go down.

2024 is going to be a crazy, wild ride. The economy simply cannot take the pain any longer; and I just do not see how they will keep kicking the can down the road. If I were you, I would assume and prepare for a monumental collapse to finally occur, which will result chaos and calamity that we really have not yet experienced before.

Take appropriate measures but don’t get scared and lose faith.

The fear of man bringeth a snare: but whoso putteth his trust in the LORD shall be safe.

Proverbs 29:25

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I told you I wouldn’t be posting much on your website, just reading it. So thank you for not deleting what I post. Here’s a good website that is my latest one that I check in on:

https://healthimpactnews.com/2023/new-netflix-movie-warns-of-coming-cyber-attack-former-freemason-wall-street-manager-explains-how-the-banks-will-soon-take-your-money/

Hi, i read your blog occasionally and i own a similar one and

i was just wondering if you get a lot of spam remarks?

If so how do you protect against it, any plugin or anything you can recommend?

I get so much lately it’s driving me insane so any support

is very much appreciated.