The following report is by ZeroHedge:

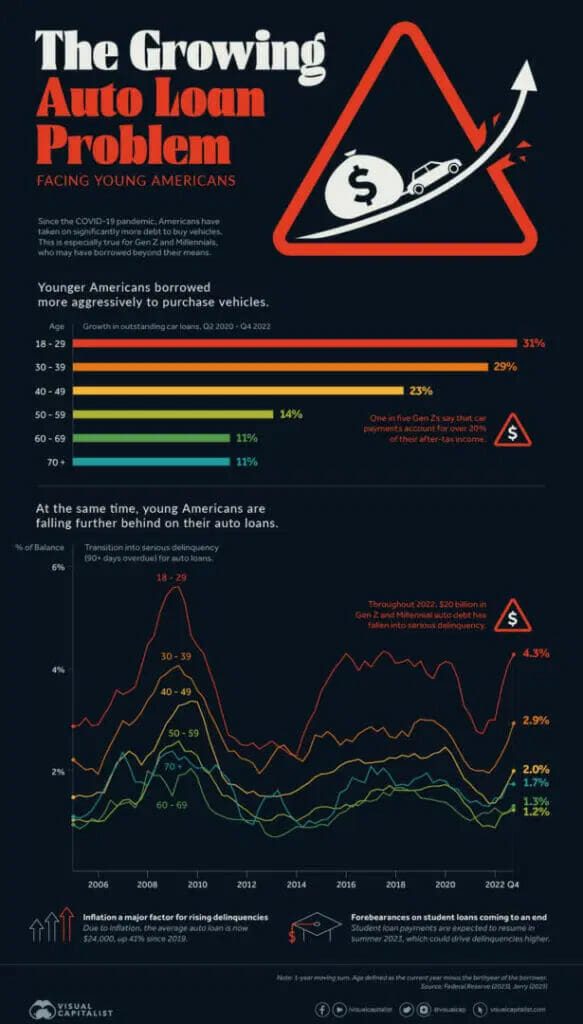

As more consumers default on credit card and auto loan payments, financial strain intensifies as the Federal Reserve’s interest rate hiking campaign stands at two-decade highs, potentially leading to a surge in vehicle repossessions.

A recent Moody’s report showed new credit card delinquencies hit 7.2% in the second quarter, up from 6.5% in the first quarter. As for new auto loan delinquencies, the rate topped 7.3%, compared with 6.9% in the first quarter.

Moody’s expects new credit card and auto loan delinquencies to continue “rising materially” through the rest of the year and top sometime in 2024 at 9% and 10%, compared with 7% pre-Covid.

The increase in delinquencies and defaults is symptomatic of the tough decisions that these households are having to make right now — whether to pay their credit card bills, their rent or buy groceries.

Mark Zandi, chief economist at Moody’s Analytics, told The Washington Post.

A weakening labor market and tapped-out consumers, some of whom have $1,000 monthly auto payments, are finding it difficult to pay not just shelter costs, put food on the table, but service their car payments. We’ve outlined to readers in the last three quarters, “Massive Wave” Of Car Repossessions And Loan Defaults To Trigger Auto Market Disaster, Cripple US Economy and Negative Equity Surges: More Consumers Find Themselves In Underwater Auto Loans — and it’s only a matter of time before the repo wave begins. We noted in July that Repos From Auto Loans That Originated In 2020 And 2021 Are Skyrocketing.

“The Fed might look at this and say this is the whole purpose of raising rates, to make it more difficult” to make purchases, Zandi said, adding, “The bigger question is when the Fed will have succeeded in slowing down the broader economy, and how many consumers have to be impacted in a negative way.”

Delinquency on auto loan payments is a sign that the Fed’s restrictive monetary policy might be working to quash inflation, which leaves the economy in a heightened period of macroeconomic uncertainty as low/mid-tier consumers appear to be financially cracking.

So, as per Moody’s report, auto loan delinquencies are set to rise even higher. In a world where robots are being integrated into every business model, we found one towing company in the UK using a robot to move illegally parked cars.

Although the video doesn’t show a repossession, a repo company can only imagine integrating robots into vehicle retrieval will provide much-needed relief to avoid unwanted confrontations with car owners.

It’s only a matter of time before repo companies adopt these robots.

AUTHOR COMMENTARY

The idea is not too farfetched: Ford has filed a new patent that will allow their new vehicles to autonomously drive themselves back to the lot if the bills are not paid.

I’ve touched on this before but the U.S., none more so than other nations, is headed for a total catastrophe with auto loans. We are clearly already seeing it happen and it’s only going to get worse. Silly Americans used their stimulus money to buy overpriced new vehicles that they could not afford, and the dealers and banks sold them these inflated vehicles with next to no credit, at a time when payments were in forbearance and the easy money kept coming in. Now that interest rates continue to rise, along with gas and oil prices rising, the inflation of everything rocketing higher as the dollar keeps buying less and less; people are having to forego paying their auto loans.

In March, 2021, I had reported how monthly auto loans had reached a new all-time record high. Americans could not stop buying stuff they don’t need and can’t afford, and now that is coming home to roost.

In the words of the World Economic Forum, the group warned in a post: “The auto loan crisis of America.”

America, a nation of debtor slaves, is going to collapse, hard. The economic data is unfathomably bad; and all this is going to put pressure on the banks, which are insolvent across the board, as all of these bad loans start to pour back into the lenders and then to the banks. Coupled with home affordability being at the worst it’s even been, and a real estate and office building bust and collapse – we are going to see a banking bust the likes of which we have never seen before, so be ready for it, because it’s coming faster than you think.

[26] Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee? Proverbs 22:26-27

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

The next car I get will be a used but good running one.

I tell ya what, all these spoiled brat Americans with their sports cars and super duty pickup trucks as well as Mercedes Benz’s because they wanna drive rich & big, they’ll be saying bye bye to their vehicles very soon.