The following report is by Gregory Mannarino via The Trends Journal:

The silence here is deafening.

There is a BIG secret being kept from the public, one which has the potential to send the already vastly overleveraged financial system into a tailspin on an unprecedented scale… and that is a commercial real estate time bomb.

Every single major investment bank, including the biggest names in the world, banks like Goldman Sachs, JP Morgan, Morgan Stanley, and Wells Fargo, have hundreds of billions of dollars’ worth of exposure to commercial real estate. CRE is a black hole in the financial system, with untold sums of leveraged bets against it.

CRE prices have been under a great deal of pressure as of late, from the onset of the scamdemic right up until now, with no end in sight. Demand for CRE has been in a steep decline, and with demand expected to continue to fall, CRE prices are expected to drop much faster moving forward.

So how did we get here?

Scamdemic aside, CRE prices were seeing a rapid increase beginning around 2012, which was sparked by a loosening of lending standards for CRE, and wild speculation. These things have inflated a massive CRE hyper-bubble. Commercial real estate investors were given easy access to credit by the major institutions, and that is all it took! And as usual a loss of touch with reality became real.

What we have now is a CRE financial nightmare, which is getting almost no attention from the mainstream media.

Today we are clearly seeing cracks in the banking/financial system. Over a year ago I warned my followers that there was a serious underlying problem with the banks, and it came down to just three things.

- No deposits.

- No loans, and

- No deals.

These three things are the direct result of a cratering economy and surging inflation. And since that time, we have seen the beginning of major problems for the smaller/regional banks, who also have exposure to CRE, but certainly not to the magnitude of the larger institutions. While it is true that regional banks have increased their exposure to CRE at a greater pace than the large banks since 2015, the overall exposure to CRE by the larger investment banks eclipses that of the smaller banks.

What this comes down to is yet another “crisis” lying in wait to unfold directly in our path. It is my belief that this “crisis” will lead to a greater consolidation of the banking system itself and a greater concentration of power. More control over the entire system concentrated in fewer and fewer hands.

Let me give you one guess as to who will bear the brunt of this rapidly approaching CRE hyper-bubble bursting/crisis which was brought on by easy credit, and wild speculation?

YOU WILL.

AUTHOR COMMENTARY

If you have been following my work you know that throughout this year, especially more recently, I have been warning about a commercial real estate collapse. The threat is as real as it gets, as Mannarino has articulated. He’s right. The media hardly wants to talk about it because it is so severe, and it is only when it is too late will they announce the full-blown meltdown; though that meltdown is already happening as we speak, the media has yet to instill panic in people yet.

[15] The simple believeth every word: but the prudent man looketh well to his going. [18] The simple inherit folly: but the prudent are crowned with knowledge. Proverbs 14:15, 18

I’m just one person so it is difficult to cover it all, so I encourage you to do your due diligence. The Trends Journal is a good resource. This was the cover of their July 18th edition. An article they published on July 11th covers a lot of ground and overview, and this is just one of them.

It is also worth mentioning the problems in China right now, and how their commercial real estate market is rapidly collapsing, and what happens there will affect the rest of the world. Lynette Zang of ITM Trading summarizes it well.

All of this and more is going to create the biggest banking bust the likes of which has not been seen before.

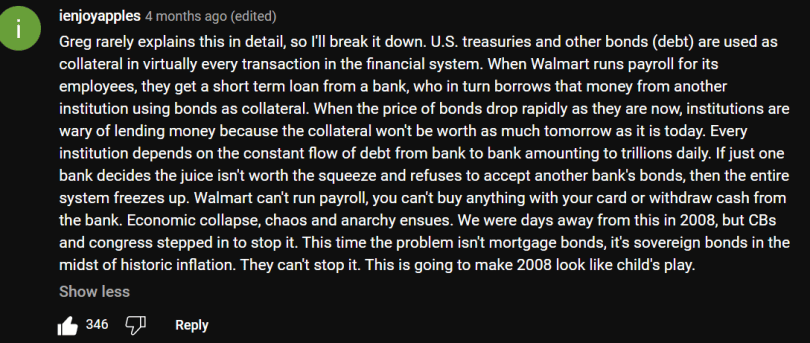

The availability of credit and lending are running dry, and all of these problems Snyder and myself have listed are all going to eventually lead to a massive credit freeze, an entire locking up of the entire financial system.

SEE: What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty

Stay vigilant and brace for impact.

SEE: 9 Signs That The U.S. Consumer Is About To Break

Collapse: Heartland Bank And PacWest Collapse, Barely Receiving News Coverage

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

would it be too late for all the church to collectively purchase a printing press to get KJV 1611 Bibles out to all who want or need one ?

That sounds like a good idea. Print King James Bibles and pass them out with KJB based gospel tracts as a bonus!

Amen! God will be very pleased!

Where can I donate?

Hi Dawn. If you would like to donate, you can either click the words “Click Here To Donate” at the end of this article, click on the piggy bank on the sidebar, or click “donations” in the dropdown menu under ‘About.’ Thank you very much for your consideration.