The following report is by Michael Snyder for End of the American Dream:

When the U.S. consumer is in healthy financial shape, the outlook for the U.S. economy is generally positive. But just like we witnessed prior to the Great Recession of 2008 and 2009, when the U.S. consumer is not in healthy financial shape, bad things tend to happen.

Unfortunately, the numbers are telling us that current conditions are eerily similar to what we experienced during the run up to the Great Recession. Households don’t have enough money coming in, debt levels are soaring, delinquency rates are rising, and tens of millions of us are just barely scraping by from month to month.

The following are 9 signs that the U.S. consumer is about to break…

#1 After adjusting for inflation and taxes, household income in the United States has fallen 9.1 percent since April 2020…

On the inflation issue, household income adjusted for inflation and taxes is running some 9.1% below where it was in April 2020, putting additional pressure on consumers, according to SMB Nikko Securities.

#2 Credit card debt has surpassed the one trillion dollar mark for the first time ever as struggling American households increasingly turn to credit cards to get by from month to month…

Americans increasingly turned to their credit cards to make ends meet heading into the summer, sending aggregate balances over $1 trillion for the first time ever, the New York Federal Reserve reported Tuesday.

Total credit card indebtedness rose by $45 billion in the April-through-June period, an increase of more than 4%. That took the total amount owed to $1.03 trillion, the highest gross value in Fed data going back to 2003.

#3 The average rate of interest on credit card balances is over 20 percent, and that is financially crippling millions of our fellow citizens…

The average credit card charges a near-record 20.53% interest rate, according to Bankrate.

#4 Credit card delinquency rates are hitting levels that we haven’t seen in more than a decade…

The Fed’s measure of credit card debt 30 or more days late climbed to 7.2% in the second quarter, up from 6.5% in Q1 and the highest rate since the first quarter of 2012 though close to the long-run normal, central bank officials said. Total debt delinquency edged higher to 3.18% from 3%.

#5 The number of Americans that are making emergency withdrawals from their 401(k) plans is absolutely surging…

More Americans are tapping their 401(k) accounts because of financial distress, according to Bank of America data released Tuesday.

The number of people who made a hardship withdrawal during the second quarter surged from the first three months of the year to 15,950, an increase of 36% from the second quarter of 2022, according to Bank of America’s analysis of clients’ employee benefits programs, which are comprised of more than 4 million plan participants.

#6 Over the past year it has become much more expensive to purchase a home…

Elevated mortgage rates and sales prices mean owning a home is about 20% more expensive than it was last year.

The typical U.S. homebuyer’s monthly mortgage payment was $2,605 during the four weeks ending July 30, down $32 from July’s record high but up 19% from a year prior, according to a Friday report from real estate listing company Redfin.

#7 The nationwide average rent-to-income ratio has been over 30 percent for the past two years. This is the first time in U.S. history that this has ever happened.

#8 It is being reported that vehicle repair costs have gone up by almost 20 percent over the past year…

Car repair costs are up almost 20% in the past year, according to the consumer price index — more than six times the national inflation rate and among the largest annual price increases of any household good or service.

So, what’s driving up prices?

It’s a combination of factors, experts said. Some emerged in the pandemic era while others are longer-term trends in the auto market, they said.

#9 A whopping 69 percent of all U.S. consumers that live in urban areas are currently living paycheck to paycheck…

Sixty-nine percent of consumers in urban areas live paycheck to paycheck, which is 25% more than their suburban counterparts, 55% of whom live paycheck to paycheck. Additionally, 63% of rural consumers reported living paycheck to paycheck. These regional concentrations of paycheck-to-paycheck consumers could be attributed to the high percentage of millennials living in urban areas (48%) as well as the large share of baby boomers and seniors — many of whom are retired and living on a fixed income — living in rural areas (32%).

After seeing all those numbers, is there anyone out there that still wishes to argue that the average U.S. consumer is in good shape?

The truth is that economic conditions are rough, and they are deteriorating a little bit more with each passing day.

On Tuesday, Moody’s decided to downgrade ratings for 10 different U.S. banks, and they are warning that more downgrades may be coming…

US bank stocks declined after Moody’s Investors Service lowered its ratings for 10 small and midsize lenders and said it may downgrade major firms including U.S. Bancorp, Bank of New York Mellon Corp., State Street Corp., and Truist Financial Corp.

Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate are among strains prompting the review, Moody’s said late Monday.

SEE: Collapse: Heartland Bank And PacWest Collapse, Barely Receiving News Coverage

And Tyson Foods has just announced that it will be shutting down four more chicken plants…

Chicken prices are down. That’s good news for chicken eaters, but bad news for Tyson Foods.

The meat processor, which supplies about a fifth of the beef, pork and chicken in the United States, said Monday that it is shutting down four chicken plants -— two in Missouri, one in Indiana and one in Arkansas — following declining chicken revenue. The Arkansas-based company previously announced two separate closures in the spring.

But despite everything that has already happened, Fed officials are telling us that “multiple rate hikes” may still be necessary.

SEE: Federal Reserve Raises Rates Another 25 Points, The Highest In 22 Years. Hints At More Rate Hikes

Is this some kind of a sick joke?

The historic economic meltdown that we have long been warned about is unfolding right in front of our eyes, and they want to raise rates even higher?

Either they are extremely incompetent, or they are doing this to us on purpose.

In any event, much rougher times for the economy are on the horizon, and that is really bad news for the U.S. consumer.

AUTHOR COMMENTARY

Indeed, this is a sick joke, and the joke is on you and I. The Federal Reserve wants as much suffering as possible, and they are not done yet and things will get a whole lot worse from here unfortunately. This is just the tip of the iceberg.

The rich man’s wealth is his strong city: the destruction of the poor is their poverty.

Proverbs 10:15

But remember everyone, the government, the Federal Reserve, and the propaganda ministry are telling us there is no recession and will not be one – even though they literally changed the definition of it last year. We’ve BEEN in one!

Then you have the consider the auto loan apocalypse that’ll really begin to unfold soon enough, and already is, because rates are killing the consumers because so many people bought new cars with stimulus while rates were at 0 and everything was in forbearance; the housing bubble that is starting to lose some air but is still insanely overvalued, and again with homeowners dealing with elevated mortgage rates; and then commercial real estate and an office building bust, landlords overturning their vacant properties back to the banks, while other properties are getting eaten alive by interest rates, as people don’t want to work and real wages can’t keep up with inflation; which all that I have listed leads to the banks and they’ll be forced to at all of this, while they are all insolvent and are holding onto toxic bonds and debt because they bought so many in 2020 because of 0% rates, that are now worth far less than they are now.

All of this is going to create the biggest banking bust the likes of which has not been seen before.

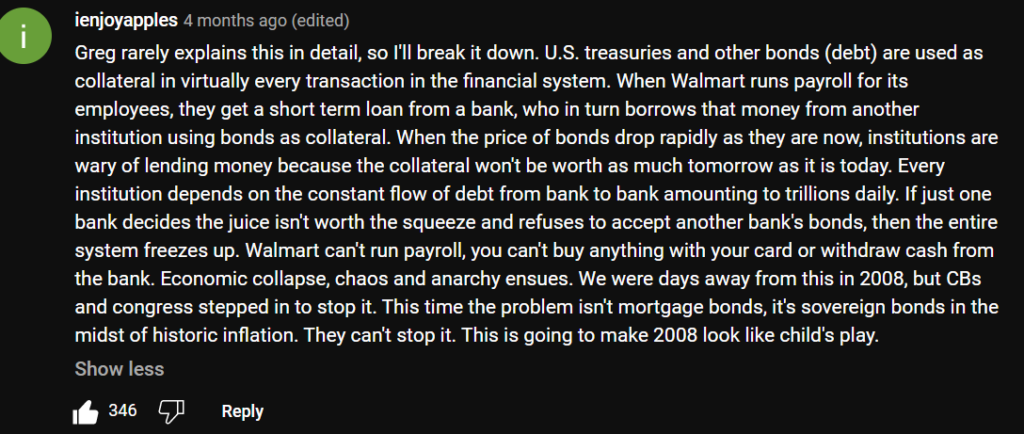

The availability of credit and lending are running dry, and all of these problems Snyder and myself have listed are all going to eventually lead to a massive credit freeze, an entire locking up of the entire financial system.

SEE: What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Spoiled, decadent and selfish Americans who just spend and spend, shopping has become a sport to them.

After their attendance at the cult building dismisses, they stuff their faces at the restaurants and then they hit the shopping centers like a swarm of bees.

Black Friday, when greed is at its worst, where people have killed LITERALLY killed others and have trampled store workers to death without so much as saying “Oh sir/ma’am I’m so sorry,” so they can buy a mind control machine (TV), or an Xbox, or a couch from IKEA at 70 percent off.

Now, it’s all coming to an end!

The Lord knows the conditioning used by the greed & lust pushers, & the justification for being part of the parasite class building kingdoms on the destruction of lives & souls. After the ‘purge’, many will go pompously & self-righteously into the time of Jacob’s trouble as Rome & her Daughters have ever been known to do, wiping their mouths & saying ‘we’ve done nothing wrong’. Do you believe the Lord is pleased at this? Did Jezebel & Ahab fare well for stealing Naboth’s vineyard? I never would have become born again had it been for the majority calling themselves ‘Christian’, for the self-righteousness was so thick you could cut it with a knife: but Jesus & the sweetness of the Gospel according to the word of God. If we truly knew the battle with sin that every soul faces & the content of hearts, even among the redeemed: we’d all be shocked & puking. And were it not for the Lord, no one could be saved. Some of these ‘truth-tellers’ make me sick: they still chose to be part of the system, & the author of this is a potty-mouth Catholic & Masonic guy whose pictures proving such were still on the web up to a short time ago. He made himself rich at others expense playing the market, & living an unnatural lifestyle of greed & gearhead playboy. Because he griped about it along the way as though he were truly resisting or fighting it rather than milking it from the ‘right’ as surely as those who fell out to the ‘left’ milk what they were actively guided into that makes it alright? This ‘controlled demolition’ has been planned for a long time by plotters not realizing they are but fulfilling the Lord’s word & heaping hot coals on their own heads. Those resorting to hating on people and comparing themselves with themselves are acting as conditioned idolatrous humanists & are not wise. The standard is the Lord’s holiness according to the word, and there are many who made themselves poor trying to help others & to push back. I’ll trust myself to the Lord. Men aren’t worthy, self included.