Today the Federal Reserve announced that they will raise federal interest rates yet another 25 basis points, after pausing the rate hikes at the precious FOMC meeting.

The current rate is now at 5.5%. This is the highest rate in 22 years, since 2001.

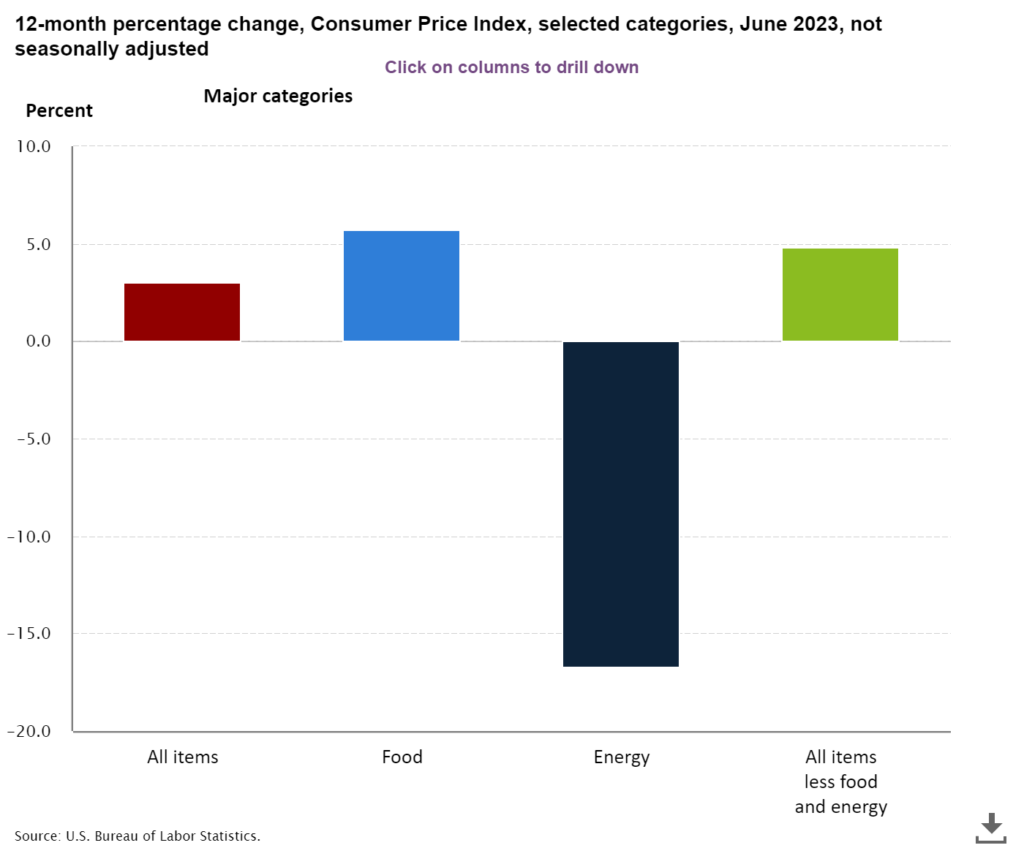

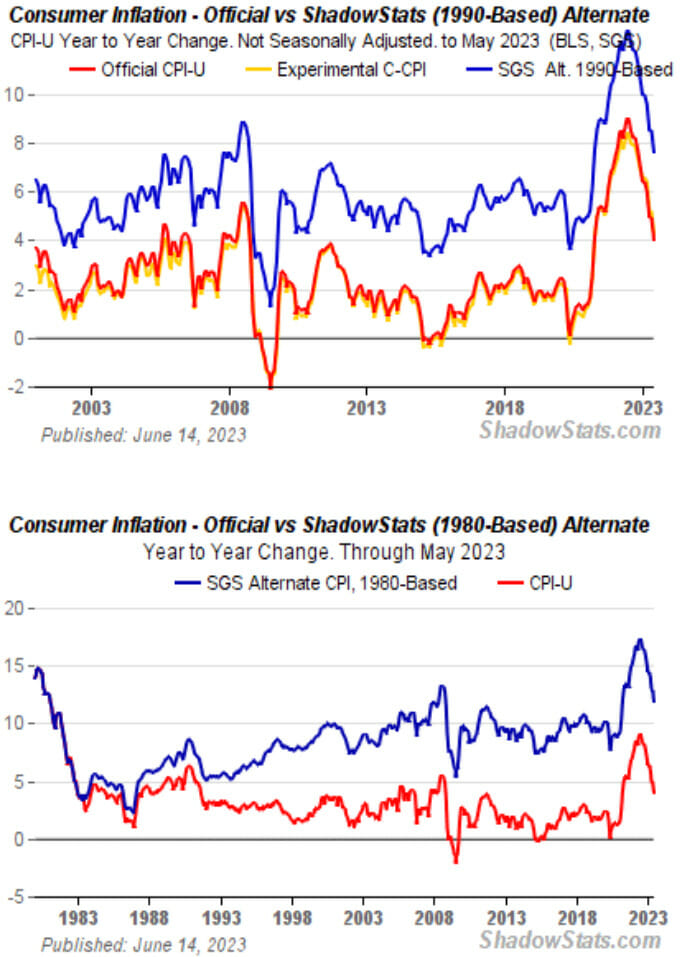

The U.S. Department of Labor announced earlier this month that the pace of inflation is now only at 3%.

But again, alternative data says that it is more than double, when other datapoints are factored in.

During Fed Chair Jerome Powell’s speech today, he hinted that at least one more rate hike may come in September, which has been the word on the street since the last meeting, but Powell said they still could remain the same.

It’s really a question of how do you balance the two risks, the risk of doing too much or doing too little.

He said

However, Powell ruled out any rate cuts this year. He added that “the process of getting inflation back down to 2% has a long way to go.”

I would say it is certainly possible that we would raise funds again at the September meeting if the data warranted. And I would also say it’s possible that we would choose to hold steady at that meeting. We’re going to be making careful assessments as I said meeting by meeting.

It will take time however for the full effects of our ongoing monetary restraint to be realized, especially on inflation.

Powell noted

Howbeit the Fed Head was asked about bank credit tightening ahead of next week’s quarterly senior loan officers survey, to which he answered that banks are tightening lending, but is not necessarily a result of bank failures seen this year.

[Bank credit is] broadly consistent with what you would expect. You’ve got lending conditions tight and getting tighter — weak demand. And, you know, it gives a picture of a pretty tight credit conditions in the economy.I think it’s really hard to tease out how much of that is from this source or that source, but I think what matters is the overall picture of tightening lending conditions and that’s what the SLOOS will say.

He said

Dan from iAllegedly details all the other stuff that Powell did not want to discuss, how the rising rates are only going to make things more expensive, but other things like the massive elephant in the room concerning the banking sector begging to show even more tremors of colossal problems coming soon.

AUTHOR COMMENTARY

A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

Proverbs 22:3

The data is all fake and no one wants to talk about what these interest rate hikes are going to do. Most Americans are done. They’ve been burning both ends of the candle and are down to a nub or completely burned out.

I plan to eventually to get into much more detail at some point in the future, but we are heading into some seriously dire economic problems. The consumer is in massive unrepayable debt and is only getting more expensive because of rates; you have an auto loan apocalypse that continues to show more signs of massive implosion; housing market madness with people going delinquent, unable to pay their mortgages, getting rejected for loans, evictions increasing, and younger Americans locked out because of high prices; and then the grand-daddy of commercial real estate, as more landlords default or overturn their properties to the banks, and the banks are forced to eat assets they can’t afford; while the banks themselves are insolvent, having no capitol investment reserves, are operating at massive losses because their bonds, treasuries, securities, and deritiivies are all costing more because of the rate hikes – all of which is leading to a massive banking crisis the likes of which has not been seen before.

I suspect by September and October we are going to see some massive turmoil, so be ready and have the ground, and take some necessary precautions, which you should have already been doing.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Everyone and everything gorged on a lot of debt when rates were low. Now, the economic chickens are coming home to roost. The KJV tells us a global economic collapse/famine will one day take place, and we’re seeing the buildup to this now.

A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

Proverbs 22:3.

That is becoming more and more relevant as the days roll by. I’ve been keeping as much to myself and as low-key as possible and have tried to disengage from people I view as real liabilities to have around when things get really ugly out there. It’s not that hard for me as it is for younger people, but do what you can. I do not think this is a big priority, but maybe find something and stock up on something you can barter with, not necessarily silver or gold.

Totally agree.

Praise the Lord we just paid off our house last week! We are now debt free. Only ongoing expenses like electricity, water, internet, food, etc. God has been so good to us, we have seen this coming for a while now and have really made some serious sacrifices to get where we are today.

I pray for those who are in dire situations. For those whose situations are not looking good because you’re eating out multiple times a week, going to the movies, and overspending in general on unnecessary things, get your house in order before it’s too late.

About two years ago my wife and I surrendered a huge life changing decision to GOD. The result was selling everything ( nice home as well) off that were pleasantries which got us out of total debt. We paid cash for acreage and placed a small cabin, garage, shed on same. We live 100% off grid other than a well ran off solar. In Cash saved, we have some but not much. We are leaning more in Faith than the almighty dollar. My question relates to Gold/Silver: Have never purchased before, but thinking it may be wise to have some. Not to get rich, just to protect/ maintain the value of some or most of what we have saved ( thinking the dollar will collapse soon ). My thought is.. I prefer to not comply with the digital monetary system coming, but may have to until Jesus Christ catches us up. So maybe our Gold can then be exchanged into the digital system ( but did not lose value). We are looking at Gold ounces and some Silver. Would anyone be gracious to provide thoughts and insight on what I am thinking? I am

Just not well versed in GOLD / SILVER.