Today the Federal Reserve raised interest rates for the tenth time in a row, adding onto the most aggressive series of rate hikes since the 1980’s. The Feds raised rates another 25 basis points, widely speculated this would be the case, bringing the total rate to 5.25%.

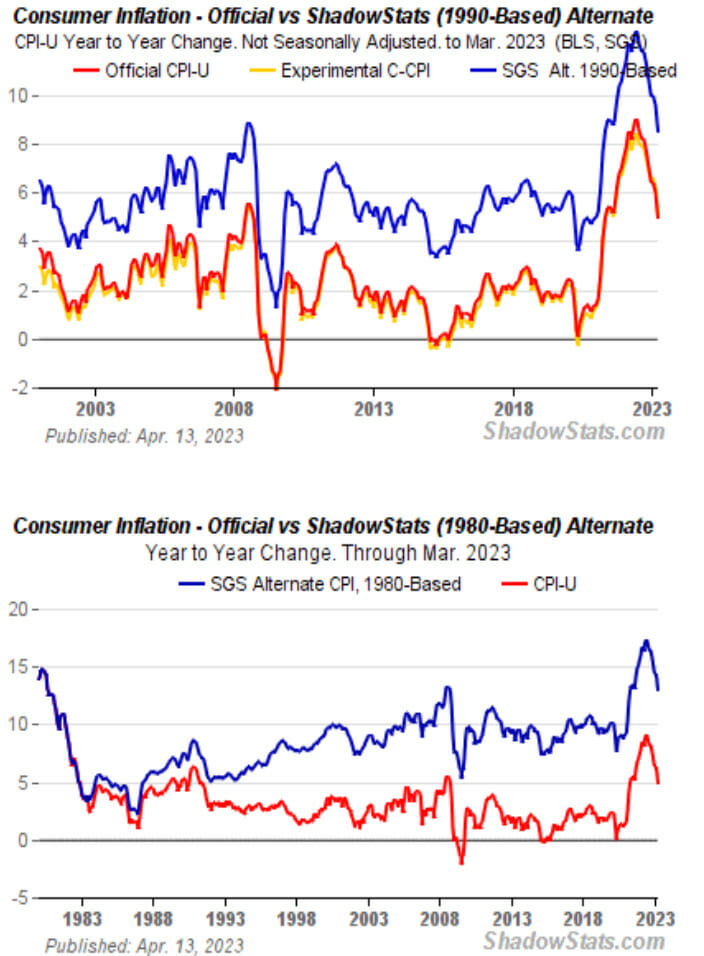

Inflation, according to the government, still has no where near returned to the Fed’s supposed 2% target, which is reportedly at 5% now, according to the U.S. Labor Department. But alternative data that factors in other data points reveals that overall inflation is still much higher than the government is willing to report.

At the last FOMC meeting in March Fed Chair Jerome Powell had said that they had planned to stay at 5% for a while, but did leave the door open for my rate hikes if needed. Clearly they went with another one.

Inflation pressures continue to run high and process of getting inflation back down to 2% has a long way to go.

Powell said

Before even getting into the rate hike news however, Powell immediately addressed the banking turmoil, claiming that the banking sector is “sound and resilient.”

Powell also noted that because of the rise in interest rates the economy and economic growth is starting to tighten, which is their ultimate goal: stymming the overall economy to throttle in inflation.

It will take time however for the full effects of monetary restraint to be realized, especially on inflation. In addition, the economy is likely to face further head winds because of tight credit conditions. They had been tightening in the last year or so. But the strains that emerge in the banking sector in March, result in tighter conditions.

These tighter credit conditions are likely to weigh on economic activity, hiring and inflation. The extent of these effects remains uncertain: In light of these uncertain head winds along with monetary policy restraint we put in place our future policy actions will depend on how events unfold.

More forward Powell more affirmatively stated that the Fed does not foresee more rate hikes moving forward.

Certified accountant Lena Petrova provided more details on what this rate hike means for Americans.

AUTHOR COMMENTARY

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

The data is faker than a plant-based meat burger! These criminals are talking about entering into a recession soon, even though we’ve already been in a recession, but the bankster gangsters and Treasury quite literally changed the definition of it last year to keep sentiment high.

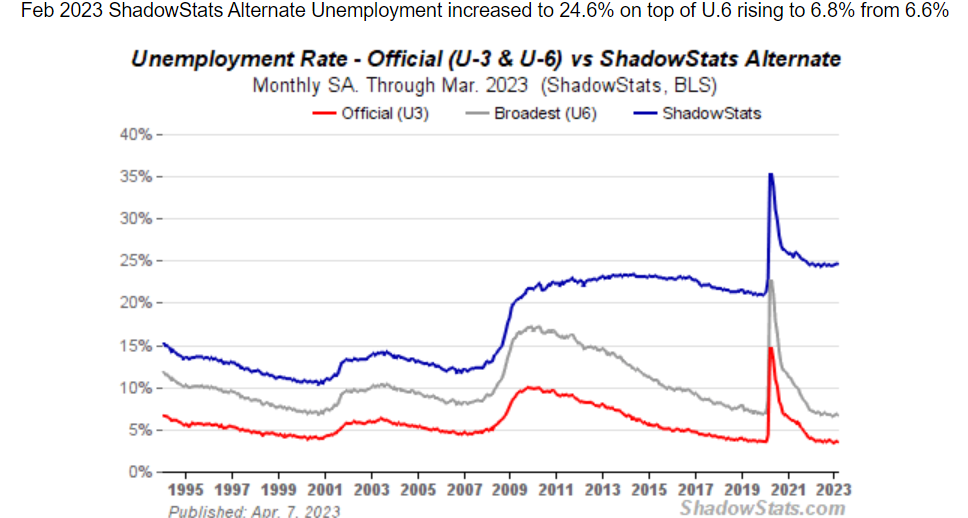

I don’t buy their employment numbers either. People are laying off staff left and right, especially in tech and other major corporations, and hours are being shuttered; and yet I am supposed to believe the labor market is still somewhat strong? Give me a break. Real unemployment according to Shadow Stats is around 25%, which makes a lot more sense with what you and I see.

Furthermore, with the Federal Reserve lending out well over trillions of dollars to small and medium banks to cover their withdrawals and bad assets, and the daily credit swaps they are doing are MASSIVELY inflationary; but this will go unreported.

Federal Reserve To Pump $2 Trillion Of Liquidity Into Economy To Keep The Ship Barely Afloat

I’ll will be doing much deeper dives into the economy in the coming days, and it’s a ticking timebomb, so stay tuned.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I’m thankful that brother Bryan made that live stream this noon about the economy. I’m going to try to start paying more close attention to the state of the economy, especially concerning the banks.