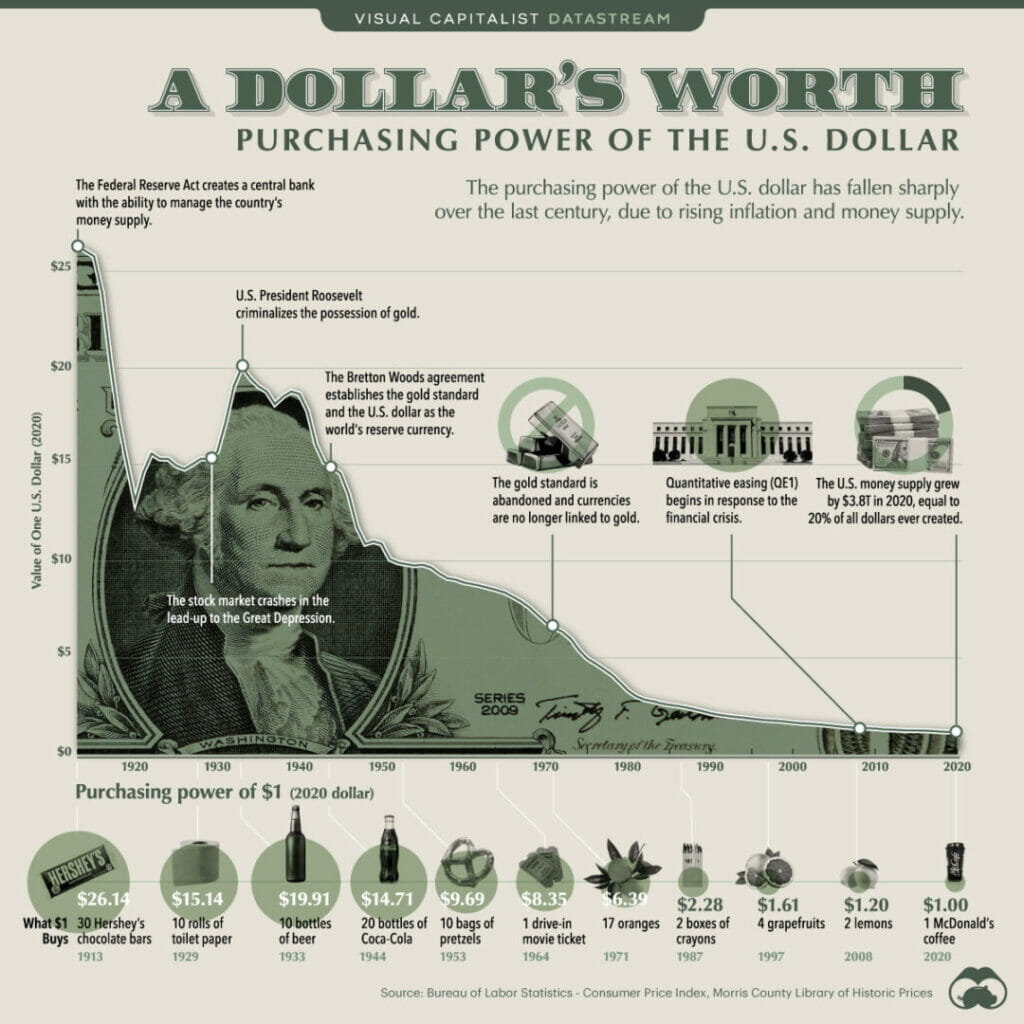

It is no secret that the US Dollar is becoming less and less valuable by the day, losing its purchasing power at a rapid scale; and with the clear divide that has been created between the East and Western world due to the Russia-Ukraine war, many nations are growing sick and tired of the dollar and are now looking to dump it before it depreciates in value some more.

Now the President of Kenya is urging citizens and national investors to begin releasing their holdings of US dollars for the time being.

Last week President William Ruto says that wealthy investors in the country will incur losses if they are holding onto a lot of dollars because his administration launched measures that will ensure that demand for foreign currency will lessen in the weeks to follow, as reported by Africa outlet Digital Citizen.

‘President Ruto noted that one of these measures involved the State finalizing on an arrangement that will allow oil importers to purchase the commodity using shillings instead of dollars,’ the outlet explained. Gas imports account for 30% of the country’s yearly import bill.

Ruto explained that the State is working with the Central Bank of Kenya (CBK) to renew the interchange exchange market in order to further address the dollar crunch.

He said during a speech at the Nairobi Securities Exchange (NSE):

We just concluded a market-driven arrangement in our fuel sector that will see Kenya access all our fuel needs on a deferred six-month credit that will eliminate a demand of USD 500 million dollars every month from this market.

I am giving you free advice that those of you who are hoarding dollars you shortly might go into losses. You better do what you must do because this market is going to be different in a couple of weeks.

I am happy that the players in that sector including our banks are coming forward and they are participating and their working with the Central Bank so that we can again take charge of our market so that it is not distorted by brokers.

We have done what we must do as the government to ensure that we ease the burden on people who want to realize their returns in dollars.

President Ruto said

Putin Mocks U.S. For Destroying Their Dollar

It is no secret that Russia has been dumping their holdings of US dollars for many years as they look for new currencies and nations to increase trade with.

In 2021 Russia had already dumped all their holdings of the dollar. At the time Kremlin spokesman Dmitry Peskov said in a statement:

The de-dollarization process is… taking place not only in our country, but also in many countries around the world, which have begun to experience concerns about the reliability of the main reserve currency.

He said

Almost exactly one year to date, The WinePress reported in 2022 that Russia still is maintaining their plight of “de-dollarization” of the Russian economy, along with other European ones, as they move to increase trade with China and other BRICS nations and allies.

Finance Minister Anton Siluanov said at the time:

The American and European currencies are toxic for us. What should we do with them?

What do we need them for? That is, we are selling our own wealth – gas, while getting candy wrappers, toxic candy wrappers. Who needs them?

Following Chinese President Xi Jinping’s recent visit to Russia, Putin once again put the US dollar on blast during an interview on a Russian news outlet.

They saw off the branch they’re sitting on – I’ve been reiterating that – by limiting the use of the dollar based on momentary, situational considerations of political nature. They are harming themselves, and we might even add, they shoot themselves in the foot.

We would use the dollar, but they do not let us. How can we make payments? In a currency that is acceptable to our partners. The yuan is one of these currencies, especially since it is used by the International Monetary Fund.

Putin said in an interview with journalist Pavel Zarubin.

Putin added that ‘after the Russian gold and foreign currency reserves were frozen, all the countries in the world have wondered how reliable their US partners are,’ according to Russian outlet Tass. “And they have come to the conclusion that they are not reliable,” he noted.

In comparison, Putin gave praise to the Chinese yuan for trade and transactions.

Do you know that the Middle Eastern oil-producing countries have announced they want to use the yuan for settlements? We will be gradually expanding this and will be expanding [the use] of the reliable currencies.

However, each country is determined to strengthen its national currency, and all the countries will strive to do so. Therefore, no doubt, it is a big mistake on the part of the US authorities that they restrict settlements in dollars around the world for the countries they do not like for some reason.

Putin concluded

SEE: Putin Says Russia Is Ready To Switch To Chinese Yuan For Foreign Trade

The Rise Of Petroyuan

Because of the devaluation and death of the dollar and the rise of Chinese yuan, there is some speculation that the yuan could become the new world reserve currency that is priced at and traded in dollars. And while this is not a done-deal and solidified in stone, the rise of the petroyuan certainly poses a real threat to the petrodollar’s supremacy.

First Post explains more about the rise of the Chinese currency in international trade:

In an attempt to compete with the petrodollar, China came up with the petroyuan. It is intended to be used for oil trading. In fact, in 2017, the People’s Bank of China and the Central Bank of the Russian Federation agreed to carry out oil transactions in the Chinese currency through the platform of the Shanghai Oil and Natural Gas Exchange, the first step towards converting the yuan into a petrocurrency. In late March, the global trade of crude oil recognized a new entrant to the marketplace. A product denominated in the Chinese yuan renminbi (CNY, RMB) known as the “petroyuan” was launched on the Shanghai International Energy Exchange (INE).

Since being introduced many of China’s major oil suppliers began accepting oil payments in yuan. Russia, Iraq, Indonesia and a few other countries also have engaged in non-dollar trades.

China has for some time been buying increasing amounts of oil and liquefied natural gas from Iran, Venezuela, Russia and parts of Africa in its own currency — petroyuan.

In March of 2022, Saudi Arabia was in talks with Beijing to price some of its oil sales to China in yuan. According to a report in the Wall Street Journal, the talks with China over yuan-priced oil contracts have been off and on for six years but accelerated in 2022 as the Saudis grew increasingly unhappy with decades-old US security commitments to defend the kingdom.

In December last year, China’s president Xi Jinping said in Riyadh that Beijing and Gulf nations should make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.

China and states of the Gulf Cooperation Council (GCC) are natural partners for cooperation, Xi said in a speech at the China-GCC summit, according to a Reuters report.

China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, strengthen cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.

He said.

These comments led to Credit Suisse analyst Zoltan Pozsar writing in a note to his clients, that this marked “the birth of the petroyuan”.

According to Pozsar, “China wants to rewrite the rules of the global energy market”, as part of a larger effort to de-dollarise the so-called BRIC countries of Brazil, Russia, India and China, and many other parts of the world after the weaponisation of dollar foreign exchange reserves following Russia’s invasion of Ukraine.

As recently as February this year, Iraq too agreed to allow trade from China to be settled directly in yuan instead of the US dollar.

But why the move from petrodollar to petroyuan?

For the Chinese, who are today the world’s top oil importer, they see this move as only logical. But beyond that, moving away from the petrodollar is a strategic priority for countries like China and Russia. Both aim to ultimately reduce their dependency on the dollar, limiting their exposure to US currency risk and the politics of American sanctions regimes.

As experts state — such a move would chip away at the US dollar’s role as the world’s reserve currency, spurring “de-dollarization.”

However, the move from petrodollar to petroyuan has its own struggles. In Saudi, officials have been sceptical as switching millions of barrels of oil trades from dollars to yuan every day could rattle the Saudi economy.

Additionally, doing more sales in yuan would more closely connect Saudi Arabia to China’s currency, which hasn’t caught on with international investors because of the tight controls Beijing keeps on it.

Another reason why China’s ambitions to price oil in yuan is tough is the currency itself. CNBC explained in a report that the yuan is not yet fully convertible, it’s fixed daily, prone to intervention and subject to capital controls.

My biggest reservations are the role of the Chinese central government, potential state intervention and favoritism toward Chinese companies.

John Driscoll, director of JTD Energy Services in Singapore and a former oil trader whose career spans nearly 40 years, told CNBC.

But things are moving in China’s favour and the petroyuan is being accepted across the world.

As Gal Luft, co-director of the Institute for the Analysis of Global Security, a Washington based think tank focused on energy security told CNBC,

Game changer it is not — at least not yet.

But is another indicator of the beginning of the glacial, and I emphasize the word glacial, decline of the dollar.

On top of this, Farhad Omar, Founder, MOTECHWA, Founder, Aus Halal Services, Educator and Mentor Australian Islamic College, explained what would happen to the US’ influence and petrodollar if it is ultimately replaced by the petroyuan, in a post published yesterday on LinkedIn.

[…] The rise of the petro-yuan and the potential for major oil producers to shift towards using it could have significant implications for the international financial system and US global influence. The petrodollar system has been a fundamental pillar of the international financial system for decades, with the US dollar dominating international oil transactions. However, the emergence of the petro-yuan poses a significant challenge to the petrodollar system and could lead to a major shift in the global economic landscape.

A decline in demand for US dollars could result in higher borrowing costs for the US government and businesses. This could lead to higher inflation and interest rates. This could have a substantial impact on the US economy and the global financial markets.

Moreover, a reduction in the US’s ability to use economic sanctions as a geopolitical tool could have significant implications for US foreign policy and its position as a global superpower. The US has used economic sanctions to influence other countries’ behaviour, and a reduction in its ability to do so could lead to a decline in its influence on the world stage.

Therefore, policymakers and economists must monitor this development closely and plan for any potential outcomes. The world economy may need to adjust to this new reality, and countries may need to explore alternative ways of conducting international trade and finance.

It is clear that the rise of the petro-yuan poses a significant challenge to the petrodollar system and could lead to a major shift in the global financial landscape. As such, it is critical to comprehend the potential economic consequences of this development and plan accordingly. The world economy is at a critical juncture. It is up to policymakers, economists, and business leaders to navigate this complex and rapidly changing environment.

AUTHOR COMMENTARY

He that trusteth in his riches shall fall: but the righteous shall flourish as a branch.

Proverbs 11:28

Let’s cut to the chase: the dollar is dead. It’s value continues to plummet day-to-day. The only real reasons why it is still propped-up now because its relative strength is still high because the other currencies are getting slammed, and because of the petrodollar.

I do not know if the petroyuan will be the currency to dethrone the once almighty dollar, but what I can say is the dollar is on borrowed time.

He that loveth pleasure shall be a poor man: he that loveth wine and oil shall not be rich.

Proverbs 21:17

America loves its pleasure, but its fun in the sun is far spent. Once the U.S. loses its reserve currency status, America will become a backwater land with no real power and influence anymore, on top of all the other problems the country. Losing its reserve status would only pour tons of gasoline on the inferno we have now.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.