After a month of banking turmoil around the world, the American megabank JP Morgan announced earlier this week the launch of a pilot program for a new facial recognition payment platform, which they plan to franchise to other banks and businesses to use.

Other credit card companies have introduced similar type of payment systems, such as VISA’s contactless payment and facial recognition system for last year’s FIFA World Cup in Qatar, or Mastercard’s “Smile to Pay” feature.

JP Morgan explains in more detail on this contactless payment system in a press released published on March 23rd:

J.P. Morgan will begin piloting biometrics-based payments with select retailers in the U.S. This is the first pilot solution to launch from J.P. Morgan Payments’ new Commerce Solutions suite of products, dedicated to helping merchants adapt to the rapidly evolving payments landscape.

Its biometrics-based payment pilot includes palm and face identification for payments authentication in-store and works on an enrol-capture-authenticate-pay basis. Global biometric payments are expected to reach $5.8T and 3B users by 2026, according to Goode Intelligence.

J.P. Morgan Payments’ biometrics pilot offering should allow for fast, secure and simple checkout experiences for its merchants’ customers, delivering a modern payments experience to enhance customer loyalty. As the leading global merchant acquirer, J.P. Morgan Payments is uniquely positioned to enable this solution to meet shopper expectations without compromising security and reliability.

Jean-Marc Thienpont, Head of Omnichannel Solutions, J.P. Morgan Payments said,

At its heart, biometrics-based payments empowers our merchant clients to deliver a better customer payment experience. We are a trusted payments provider and financial institution worldwide, and fully equipped to manage the highly secure identification points that power biometrics solutions.

The evolution of consumer technology has created new expectations for shoppers, and merchants need to be ready to adapt to these new expectations.

The first pilots will be run with brick-and-mortar stores in the U.S., and potentially includes the Formula 1 Crypto.com Miami Grand Prix, which is planning to be the first Formula 1 race to pilot biometrics-based payments to provide guests with a faster checkout experience.

We’re delighted to work with J.P. Morgan Payments for this exciting and innovative technology.

Formula 1 prides itself on pioneering solutions and state-of-the-art technology and being able to roll out this new biometrics-based payments scheme would enhance the race-day experience for our guests as they will enjoy a new, faster checkout process. Our mission at the Miami International Autodrome is to offer our guests a best-in-class experience and this offering helps us deliver on that commitment.

Ramon M Peneda, VP & Chief Information Officer of Formula 1 Crypto.com Miami Grand Prix 2023, said

If the pilot stage is successful, a wider rollout would be planned to U.S. merchant clients in 2024.

How Do Biometrics-Based Payments Work?

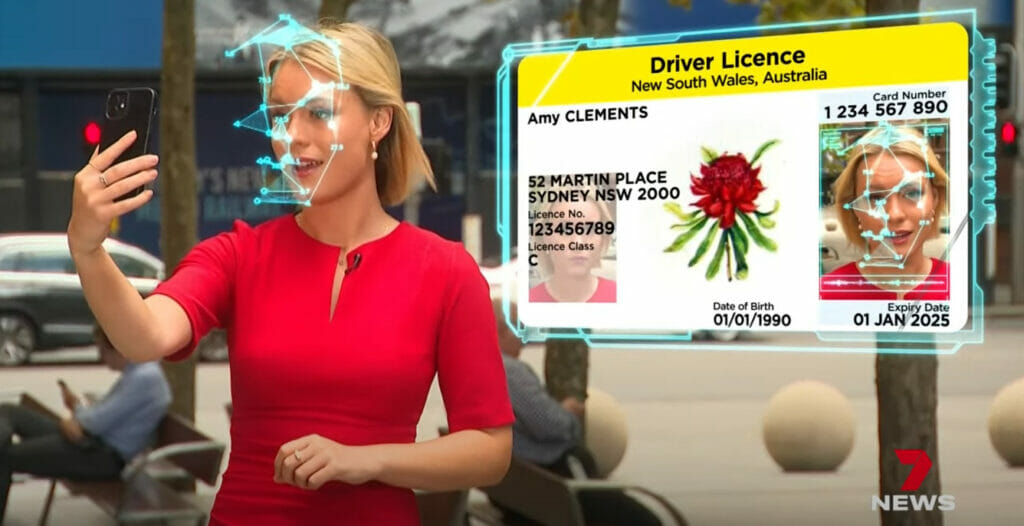

After a short customer enrolment process in store, the workflow is; cashier scans items or customer uses self-service terminal, user scans palm or face, user completes checkout, user gets receipt. The solutions [have] benefits for merchants and their consumers. For merchants, the key benefits include customer sales and loyalty growth and the removal of friction from merchants’ day-to-day processes. For the customer, the payments are phone-free, private, secure, fast and simple.

New J.P. Morgan Payments Commerce Solutions strategy

J.P. Morgan Payments has also launched Commerce Solutions, its next-generation suite of payments infrastructure and applications that helps merchants accept consumer and b2b payments across any touchpoint. The Commerce Solutions launch includes new cloud-based infrastructure for J.P. Morgan Payments’ online and in-store payments APIs, allowing for new tools for developers and technical buyers to discover and deploy J.P. Morgan Payments solutions.

Merchants can struggle to keep up and manage a complex technology ecosystem that includes online payments, in app payments, social payments, in store payments, digital wallets and marketplace payments. J.P. Morgan Payments’ Commerce Solutions will best serve its merchant clients, acting as one-front-door for the needs of its commerce and ecommerce clients in this evolving payments environment. Whether it be a biometrics solutions or better coordination of online and instore payments, the Commerce Solutions offering can help merchant clients end-to-end and prepare for the future.

The evolution of consumer technology has created new expectations for shopping and payments. There are more ways to pay than ever before across an increasing number of channels. And consumers continue to adopt tools like digital wallets and biometric payments to simplify their payment experience.

J.P. Morgan is uniquely positioned to revolutionize payments online and instore and our investments in technology have unlocked new ways for merchants to offer frictionless payments across any touchpoint. Our Commerce Solutions launch positions us perfectly to help our clients prepare and thrive as the payments landscape continues to transform.

Takis Georgakopoulos, Global Head of Payments, J.P. Morgan, said

AUTHOR COMMENTARY

Once again, while the masses are distracted with March Madness and Trump’s indictment ballyhoo, one of the largest banks in the United States and the world are rolling out a new palm and facial recognition payment system. Meanwhile just over a week ago the Federal Reserve announced that the instant payment system FedNow is set to launch this July.

SEE: Red Alert: Federal Reserve Set To Launch “FedNow” Digital Payment System To Usher In CBDC

It is quite obvious where this is headed. As more smaller banks are forced to bleed-out their cash and assets to the larger institutions, via customers withdrawing their cash in large amounts right now and redepositing it into the larger institutions, only the larger ones will be left and bailed-out. Ultimately, the masses will eventually be goaded into accepting CBDCs, digital IDs, social credit scores, and biometric payments, and more.

As you read, the rich scumbuckets at this megabank are pompously saying that the public will accept the biometric payments – “The evolution of consumer technology has created new expectations for shoppers, and merchants need to be ready to adapt to these new expectations.”

Again, this is yet another clear step close to the “final solution:”

[16] And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. Revelation 13:16-18

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Palm and face… there is no connection at all! Of course not!

And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right HAND, or in their FOREHEADS:

exactly lol

written almost 2000 years ago.

The King James Bible is the greatest book ever written in the history of the universe.

Completed in 1611 and yet it prophecies of a futuristic computerized technology that even when computers were becoming more popular from the 1980s to the 2000s, even when the iPhone was first invented, nobody knew about it nor could conceive it!

STAY OFF THIS WEBSITE HOME NETWORK!!! YOU’RE A SCAM!