Last night a collective of central banks from around the world have partnered to pump large sums of liquidity to help uphold the global economies and banks.

These banks – the U.S. Federal Reserve, the Bank of Canada, the European Central Bank, the Bank of England, the Swiss National Bank, and the Bank of Japan – announced that they will be engaging in daily US dollar credit swap lines in an attempt to ease the burden of the banking crisis.

The Financial Post wrote that this “coordinated move” is “reminiscent of the global financial crisis of more than a decade ago.” This action will attempt to “boost the flow of US dollars through the global financial system with the aim of keeping credit flowing to households and businesses,” CNN Business wrote.

In a joint press release, the banks wrote in a statement:

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

To improve the swap lines’ effectiveness in providing U.S. dollar funding, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 20, 2023, and will continue at least through the end of April.

The network of swap lines among these central banks is a set of available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses.

In other words, these central banks will be issuing a seemingly endless supply of cash to stabilize the banking industry and credit markets, until this April deadline.

Additionally, ECB President Christine Largarde said in a statement,

The euro area banking sector is resilient, with strong capital and liquidity positions. In any case, our policy toolkit is fully equipped to provide liquidity support to the euro area financial system if needed and to preserve the smooth transmission of monetary policy.

She stated

SEE: Charlatan Dave Ramsey Says The Banks Are Safe And You Need To Buy A House Now

As explained by Investopedia, a swap line is as follows:

The purpose of a swap network is to maintain liquidity in foreign and domestic currencies so that commercial banks can maintain their mandated reserve requirements. By lending currency between themselves and auctioning off the borrowed funds to private banks, central banks can influence the supply of currencies and thereby help lower the interest rate that banks charge when lending to each other. This interest rate is known as the interbank rate.

Swap networks can play a critical role in maintaining financial-market stability when liquidity is otherwise strained, such as in the midst of a credit crunch. The swap network can help increase banks’ access to affordable financing, which in turn can be passed on to businesses throughout the economy in the form of bank loans. For this reason, central banks are sometimes referred to as “the lender of last resort.”

In the United States, the Federal Reserve operates swap networks under the authority granted to it by Section 14 of the Federal Reserve Act. In doing so, the Federal Reserve must also comply with the authorizations, policies, and procedures established by the Federal Open Market Committee (FOMC).

During the 2007–2008 financial crisis, swap network arrangements were used extensively by central banks throughout the world. At that time, central banks worldwide were desperate to improve liquidity conditions in the foreign exchange market and among domestic banks.

In response to the news ZeroHedge wrote:

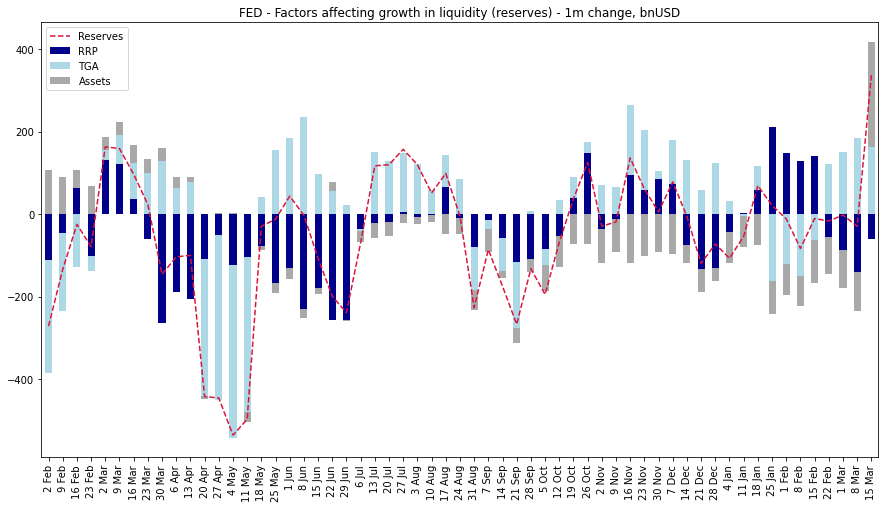

And once the USD swap lines are reopened, the rest of the cavalry follows: rate cuts, QE (the real stuff, not that Discount Window nonsense), etc, etc. In fact, we have already seen a near record surge in reserve injections.

The Fed may as well formalize it now and at least preserve some confidence in the banking sector, even if it means destroying all confidence left in the “inflation fighting” Fed, with all those whose were in charge handing in their resignation for their catastrophic handling of this bank crisis.

[…] now that we are back in liquidity injection mode, well, say goodbye to hopes of seeing affordable eggs every again.

AUTHOR COMMENTARY

The Federal Reserve is going to be blowing a lot of smoke in the weeks and months to come as they, and the government lackies, try to seduce the masses that inflation is going down, or at least is in a “disinflationary” or “sticky” stage. CPI numbers we get now are an absolute joke, and then even had to be revised higher for the month of January, which therefore proved what we knew all along: raising interest rates would NOT tame inflation, nor was it ever designed to. But even those numbers are a joke.

SEE: The Federal Reserve Is Guaranteeing Inflation Will Persist: Ignore The Media’s Rhetoric

But I mention that because the amount of inflation this is going to cause is going to be CRAZY.

Let’s review: the Federal Reserve alone has already forecast to pumping over $2 trillion into the banking sector to keep it afloat, mainly for the smaller banks to nab so they can protect themselves, then the bailouts of these banks already; and now factor in what they have just announced, and all the money printing that have been doing – the inflation is going to remain hot.

Clearly, as the data shows, the system is coming apart, as the rate hikes are just destroying the banks and other markets, as to with the consumer. There will be a temporary simmering down of events soon, I think anyways, and most people will be quickly lulled back to sleep (as always), forgetting that there are humungous problems right now .

This is why Trump is supposedly getting “arrested.” The media and government needs a cover story to distract the public from what is actually at play. Classic divide and conquer; classic, “Look here, look here, don’t look there.”

Again, keep your money out of the banks. They are insolvent and will not be insured if and when they fail, per the words of Janet Yellen.

Furthermore, as these reports in this post have hinted at, these actions are largely designed to keep the credit/debt market stable. This is a major issue that was also a problem during 2008; for if the Federal Reserve did not print all that money (as much as I hate the thought of it), the credit marker would have locked-up, which would have resulted in Mad Max and zombie apocalypse-style scenes across the country. This is what the Feds and other central banks are trying to stave off right now. The debt market is a time-bomb, and I have warned that once this thing is finally allowed to get sky high and collapse – the devastation and loss of life in the country will be monumental. But if you are preparing, being frugal and prudent, and walking circumspectly, then fret not, for things will all work out, but you cannot be lazy.

[…] drowsiness shall clothe a man with rags.He becometh poor that dealeth with a slack hand: but the hand of the diligent maketh rich.

Proverbs 23:21(b), 10:4

SEE: What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.