On a March 14th broadcast of his radio show and podcast, Ramsey discussed the fallout of Silicon Valley Bank and the reactions it was causing. It short, Ramsey wants people to calm down and assures everyone that their bank is safe.

He explains that the FDIC will insure all depositors up to $250,000, so there is nothing to fear. However, what Mr. Ramsey did not explain is that the FDIC only insures 1.5 cents for every dollar in banks, so it most certainly does not cover ever dollar deposited; and if massive runs on the banks occurred, then most Americans would be out of luck as the FDIC would not be able to cover the losses.

Regardless, Ramsey said that SVB’s collapse does not effect smaller regional banks because SVB was full of “playas,” venture capitalists, and plenty of rich people. “Your bank is safe, calm your butt down,” he said. He furthered reiterated that your regional bank does not have “playas,” so there is no need to worry or transfer assets out of these banks.

My local bank is fine. I’ve got deposits in excess of $250,000 in my local bank, in excess of all the limits in my local bank. I’m not worried about it one iota, not a penny.

He said

Immediately following that statement Ramsey switched gears and excitedly told everyone to basically go run and buy a home right now, due to mortgage rates acutely falling a smidge due to a fluctuation in the bond market; and plugged his real estate sponsor for his listeners to go apply for a new mortgage.

But the great news is the bond market freaked out, because they kind of cause this with the interest rates going up, and bond interest rates dropped, bond prices went up-

Translation: your mortgage rates are cheaper today than they were this time last week. If you were going to get a mortgage in the next month or so and get a house, run to your mortgage company before all the dust settles on this.

This is a great time to get a mortgage! Go to Churchill Mortgage today and lock in your mortgage today, because this is an anomaly […]

All that to say: get your mortgage right now. Go to Churchill Mortgage today. If you’re thinking about buying a house, and you’re just kind of on the fence, this is gonna be your month baby, this is going to be the time to jump in […]

And people are going buying gold! ‘BANKS ARE GONNA FAIL!!!’ It’s like they live in the wild wild west or something! You don’t know how the FDIC insurance works? The entire federal government would have to fail for you to not get your money out of your bank, when you have less than $250,000 in your bank.

Quit acting like – dad gum conspiracy theorists. These banks are not on the wire, they’re not about to collapse.

He said

But other economic analysts disagree, such as Jeremiah Babe who commented on Ramsey’s remarks, and was almost in disbelief at what he heard, advising people to not buy a house right now and that it is the worse time to buy right now.

AUTHOR COMMENTARY

I have a few remarks to make here about this. I’ve talked about Dave before, and I’ll touch on that in a moment.

I do not claim to be a financial guru or expert, and if him and I were to “duke it out” over financial know-how and experience, he’d KO me in the first round. However, I’d like to think I also have a bit of common sense and prudence, and honest and clear eyes to see the truth when presented to me. And that is something Dave Ramsey lacks: honesty and integrity.

This is AWFUL advice – I mean just mind-bogglingly stupid on so many levels! Dave Ramsey is a false prophet, who loves to always paint rainbows for everyone and tell everyone how great everything is. And his pride, o’, his arrogance is some of the worst out there! The man is one of the most heady people I’ve seen, and he is a massive condescending jerk who talks to everyone like they are little children.

There is a generation, O how lofty are their eyes! and their eyelids are lifted up.

Proverbs 30:13

Starting with the banks – if you have been following this drama and following my reports on this, then you KNOW the banks are NOT safe, big or small. I had been warning since January 2021 to get your money out of the banks because the banks were collapsing and closing, both in the U.S. and Europe; and this trend has continued since then.

Now that SVB collapsed, we’ve had two more come down with it, Signature and First Republic, and other megabanks like Credit Suisse needing bailouts to stay afloat, and even that is not quite working well.

The system is insolvent. Prior to this there were no deposits, no savings, and no loans; and once word got out that SVB was having problems, it set the chain reaction off and now people are pulling money out from their local banks into the perceived safety of the larger ones. How can anyone say that these banks are safe?

SEE: Smaller Banks Begin To Crash And Face Banks Runs As Flight Of Deposits Flow Into Megabanks

I realize this is not the perfect metric, but go look-up the stock values of your banks right now, and you tell me if you think your bank is “safe.” I looked-up the stock price of my bank Friday night, and it has taken a big dump. And it’s like this for the small and regional banks right now. The bank runs are going on like crazy now. Just this week alone a whopping $550 Billion in deposits have been yanked in just this week alone. Furthermore, banks have borrowed $165 billion from the Federal Reserve this week, too – a number so large that according to Forbes surpasses the $111 billion high recorded in 2008 during the financial meltdown that year; and the Federal Reserve is pumping in quantitative easing to or over $2 Trillion for the regional banks to keep themselves stable.

Just today I reported how Treasurer Janet Yellen has admitted that the “too-big-to-fails” and other special interests will be protected, will little banks will be left to die.

So, tell me, does that sound safe to you?

(I’ll get back to the banks in a moment).

But I think what is even more asinine is him telling us to get a new home right now. That has got to be the craziest thing I have heard in recent weeks. On the contrary: it’s the WORST time to buy.

Again, I have warned about the coming housing collapse before as well, and right now the bubble is starting to let out air. When your average consumer is priced out of the market then that is the definition of a market, and those prices are now dropping month over month – which is what happened before the markets exploded in 2008.

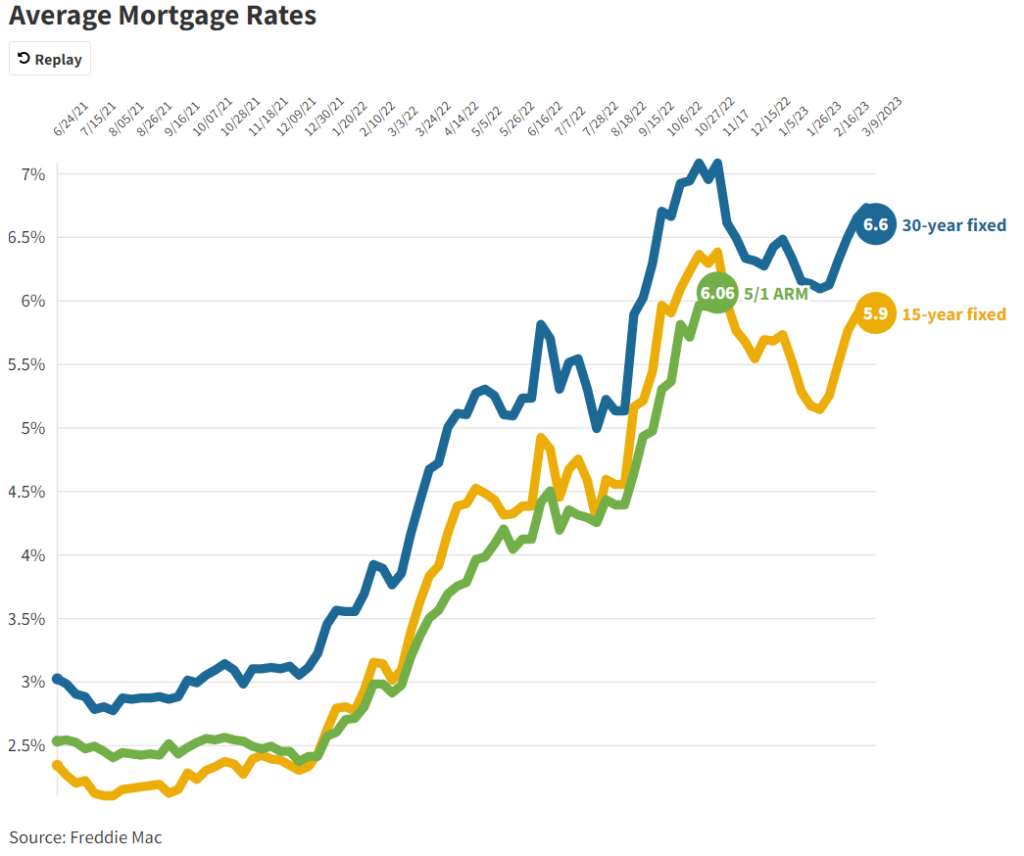

Just last week The Trends Journal reported that mortgage rates were just about 7%. That’s right everyone, Ramsey wants you to buy a house when rates are fluctuating above 6.5% from around the 3% in 2021, when prices are at several hundreds of thousands of dollars, far more costly than they are worth.

Furthermore, the average American right now, basically 2/3rds of the country, is living paycheck-to-paycheck, have no savings, have no emergency funds, living on debt and buy now, pay later credit apps; and needed stimulus and forbearance to kick the can down the road some more.

Needless to say, the housing market is in trouble, again. In mid-February home sales fell 40% from the same period in 2021, according to Redfin. A week later The TJ reported that the stock value of U.S housing fell by $2.3 trillion, the largest since 2008.

‘The total market value of U.S. homes fell from an all-time high of $47.7 trillion in June to $45.4 trillion at the end of December, slumping 4.9 percent in the largest percentage drop in value since 2008 during the Great Recession, according to a study by online broker Redfin. Record home prices, combined with mortgage interest rates that have more than doubled in the last year, have sidelined many prospective buyers,’ The TJ wrote.

Or then on March 1st CNBC reported, “Mortgage demand from homebuyers drops to a 28-year low.”

And again, BCA Research has a great article titled, “The US Housing Recession Is The Canary In The Coal Mine,” further documenting this slump we are in.

I could keep going, but I think you get the point. And yet Ramsey wants you to buy a house now!

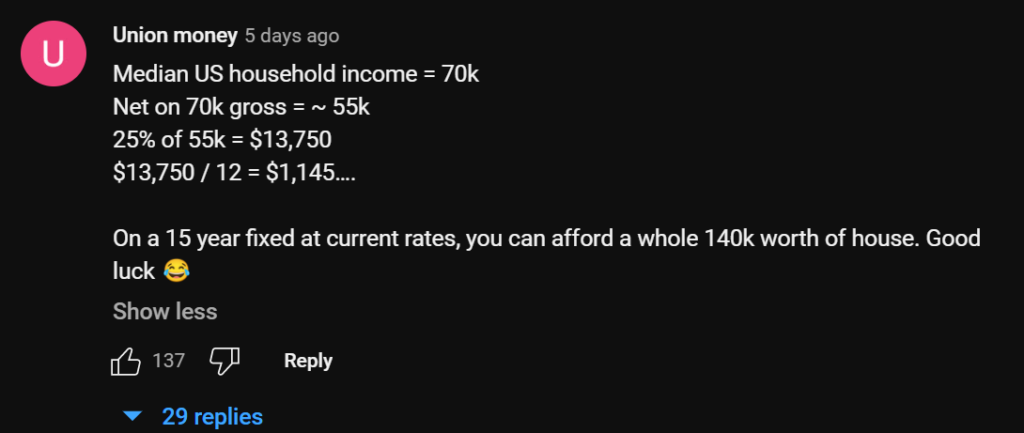

But prior to Ramsey’s rant about SVB and housing, his cohost George and his daughter Rachel were still telling people to buy a home; telling people to make a down payment of $100K, on a 15-year mortgage rate at 25% take home pay. These people live on another planet… Thankfully most people in the comment section roasted them for their stupidity. But again, if you listen to the video, this is literally the same script that everyone was telling people in the prelude to 2008 and 2009.

Isn’t this a Christian program? Why deceive so many into purchasing overpriced homes with: “You can ALWAYS refinance later”. Refinancing isn’t always an option when you have negative equity. The way things are going in certain metros, many will have negative equity in the coming months and years, likely walking away and foreclosing altogether when that $500k home took a 20-30% haircut. Dave is incredibly prideful and can’t seem to admit when he’s wrong, as he was in 2008. It’s sad to see his team echoing his own delusions.

Said a commentor

And speaking of 2008, Ramsey, unsurprisingly, fought the idea that the economy would collapse and go into a deep recession for years, and in 2008 persistently fought the idea of a recession. And even after he was royally embarrassed, did he apologize? Don’t kid yourself.

I’m 47-years-old, and every year in my memory, there’s been some sort of talk like this … but I’ve never seen it happen.

The U.S has the most robust economy in the history of man, and it’s the most sophisticated it’s ever been; there are lots of checks and balances and safety nets.

By definition we are not in a recession. We have not even had one month of recession; we’ve had SLOW GROWTH. The economy was growing at (an annual rate of) 3.5 percent; now, it’s at 1.5 percent, which is a big impact, but it’s still growth. In order to be in a recession we must RECEDE: The official definition of an economic recession is an economy that has negative growth, that shrinks, for six consecutive months or more.

Ramsey said, according to a January 2008 article by CBS

Furthermore, Patrick Bet-David of Valuetainment embarrasses Ramsey on the housing market and why he is wrong about it, and that it will take a hit.

But now, let’s get back to the banks and let’s tie in some other points.

We also have a huge problem with commercial real estate and office occupancy. This is the biggest silent killer out there. Commercial real estate is in a huge mega bubble right now. Commercial real estate all over the country and cities are vacant, and offices are half-filled and many operating at sublevels because of remote working. As interest rates rise, because commercial real estate is linked to these rates, and the tenets don’t want to pay, the landlords are just going to default or sell their property. Well, who do you suppose will be holding onto this real estate? Yup, that’s right, THE BANKS, both large and small. This is a silent killer of epic proportions that will thrust down the banks, far surpassing the residential housing debacle.

And then you have things like subprime auto loans, when people purchased overpriced vehicles with no credit down and used their stimmies as the down payment, while payments were in forbearance. Now new vehicles are charging obscene prices and the consumer is tapped-out. Again, who do you suppose will be left holding the bag on these, besides the consumer? Again, THE BANKS.

SEE: What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty

I could keep going but think you get the point.

[16] Thus saith the LORD of hosts, Hearken not unto the words of the prophets that prophesy unto you: they make you vain: they speak a vision of their own heart, and not out of the mouth of the LORD. [17] They say still unto them that despise me, The LORD hath said, Ye shall have peace; and they say unto every one that walketh after the imagination of his own heart, No evil shall come upon you. [26] How long shall this be in the heart of the prophets that prophesy lies? yea, they are prophets of the deceit of their own heart; Jeremiah 23:16-17, 26

Dave Ramsey is a false prophet. Ramsey, you see, is heavily invested in real estate, to the tune of hundreds of millions; so for him, it can’t go down. And like I said earlier, he is so wealthy he is so out of touch with reality, and his staff might as well be forced at gunpoint to smile and spew lies (not that I defend them).

There is no new thing under the sun, and the false prophets in Israel’s collapse were telling everyone that everything is getting better, peace and health are here and coming some more, when nothing could be farther from the truth.

[12] And their houses shall be turned unto others, with their fields and wives together: for I will stretch out my hand upon the inhabitants of the land, saith the LORD. [13] For from the least of them even unto the greatest of them every one is given to covetousness; and from the prophet even unto the priest every one dealeth falsely. [14] They have healed also the hurt of the daughter of my people slightly, saying, Peace, peace; when there is no peace. [15] Were they ashamed when they had committed abomination? nay, they were not at all ashamed, neither could they blush: therefore they shall fall among them that fall: at the time that I visit them they shall be cast down, saith the LORD. Jeremiah 6:12-15

In June of last year King James Video Ministries proved Ramsey to be a deceiver as well, when he told people the prices of homes would not be coming down (which they have been each month for roughly a year now), and that housing prices have only fallen dramatically one time in America in the modern era, which was 2008 but only for a few months; which is patently false.

Ramsey is like the Jim Cramer of financial advice and investing. Cramer will tell you how the market works, different terminologies and stuff, but then he’ll drain your wallet for his endlessly terrible and knowingly wrong stock calls. That’s Ramsey for you. Ramsey will help you get out of debt, just so he can put you right back into debt with his awful investment advice!

Furthermore, this stiffnecked mule prides himself on being some Evangelical Christian, and yet he mocks the mark of the beast and that will never happen, calling those who do believe The Bible as being “crazy,” and that we are NOT going cashless… I did a video on it years ago but it got deleted. But you can see the original below:

SEE: Red Alert: Federal Reserve Set To Launch “FedNow” Digital Payment System To Usher In CBDC

In short, dump Dave. I may not be a “financial guru,” but I’m also not a compulsive liar either that never wants to tell the whole truth.

He that speaketh truth sheweth forth righteousness: but a false witness deceit.

Proverbs 12:17

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Maybe because he’s part of the club, one of the builders, & one who Yellen & co. will bailout while he leads many lambs to the slaughter. He angered me with his so-called ‘curricula’ & refused to refund his antichrist garbage misrepresented as ‘Christian’, and when he publicly called believing in the word of God & blessed hope ‘stupid’ on his truly ‘stupid’, & evil antichrist radio program: he’s been plainly identified as an antichrist & a liar so far as I’m concerned. Warned anyone who would listen, which is few…but that just confirms the word of God even more.

–

Talk about turning the grace of our Lord into lasciviousness, this guy turns him into a slot machine, in a wicked casino called the world, & where all the machines are rigged, the house always winning sufficiently to deceive the dupes & carry on the ponzi. Wickedness.

When I hear someone deny our “blessed hope”, I immediately assume that person is Catholic or a closet Catholic.

The Federal Reserve was created under very secretive goings on, and if the Titanic disaster was part of its coming into being, it has had blood on its hands from the start and can’t possibly bear any good fruit. I wish I had known that sooner than I did, but better late than never.

It took me a bit to realize why I did not like him. He is a very condescending man indeed.

He is all about his money.

your headlines reminds me over and over again how pervasive and deadly the Spirit of Religion is. I’m so glad your rear-end is large enough to sit in the judgment chair. I hope I’m never like you.

Your collection of lemmings must offer you community and comfort.

Shalom (if there is any).