Amidst the fallout of the Silicon Valley Bank collapse that happened on Friday, U.S. Treasury Secretary Janet Yellen announced that the government (taxpayer’s money, she means) will not bail-out SVB.

In an interview with CBS’ Face The Nation, attempted to reassure Americans and investors that they will not be bailing-out SVV, but wanted assure the public that this will not create a collapsing domino effect.

Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out… and the reforms that have been put in place means we are not going to do that again.

But we are concerned about depositors, and we’re focused on trying to meet their needs.

The American banking system is really safe and well capitalized. It’s resilient.

She said

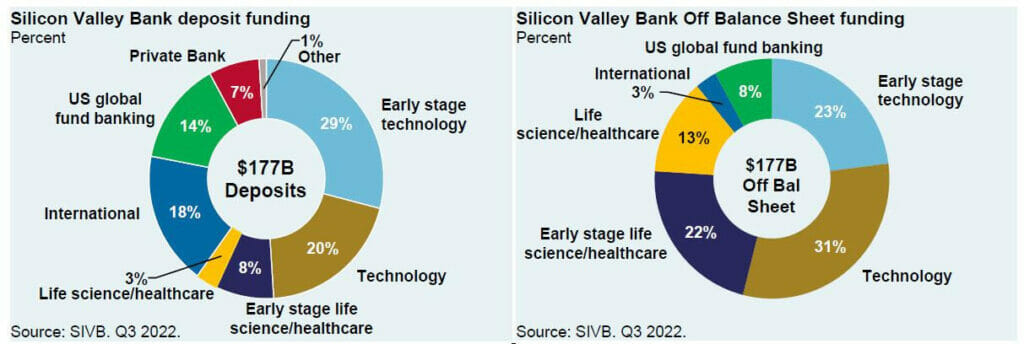

ZeroHedge commented on this and wrote: ‘It wasn’t clear which depositors she meant: as we first pointed out on Friday, out of SIVB’s $173 billion of customer deposits at the end of 2022, $152 billion were uninsured (i.e., over the $250,000 FDIC insurance threshold) and only $4.8 billion were fully insured. As we also noted last week, a further look at SIVB funding (pie charts) shows unusually high reliance on corporate/VC funding; only the small red private bank slice looks like traditional retail deposits to us.’

The Federal Reserve has announced that they will convene in an emergency meeting on Monday to discuss these events and what can be done.

At the same time they and the FDIC are “weighing creating a fund that would allow regulators to backstop more deposits at banks that run into trouble following Silicon Valley Bank’s collapse,” and that “regulators discussed the new special vehicle in conversations with banking executives.”

The hope is that setting up such a vehicle would reassure depositors and help contain any panic, said the people. They asked not to be identified because the talks weren’t public.

The Bloomberg article said

Read more about the proposals on CNBC.

But calling their bluff on the calls for “hope,” ZeroHedge wrote:

Well, needless to say, any time one mentions “hope” as a wise macroprudential policy, alarms go off, because the entire banking system suddenly becomes reduced to a game of chicken as follows: Fed/regulators won’t backstop deposits today and won’t admit a bank crisis is emerging, but if a bank crisis emerges and there is a flight of deposits on Monday morning, they will move.

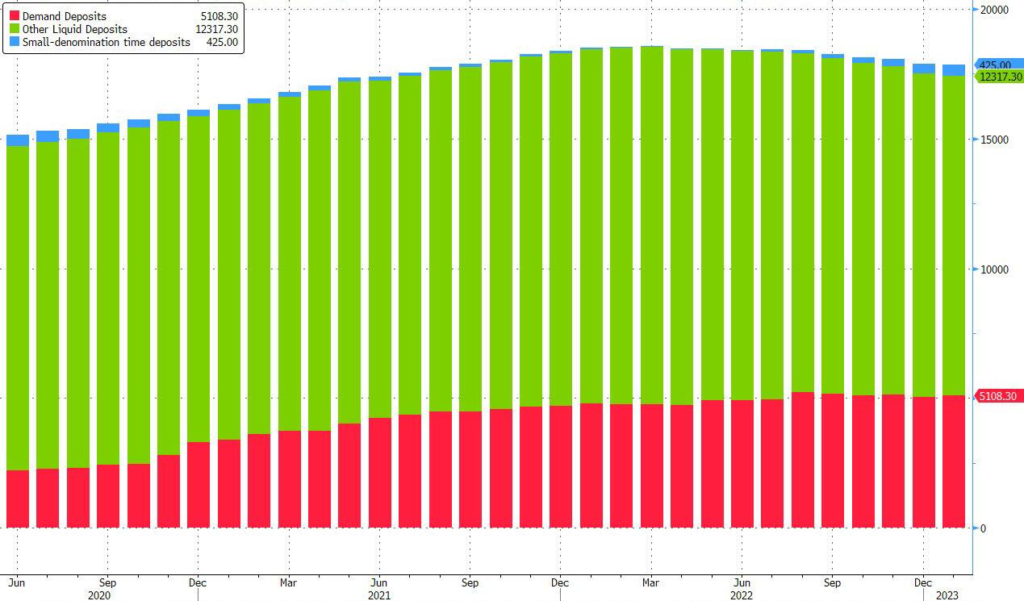

But then it will be far too late as once a bank run has started it is virtually impossible to stop it under controlled circumstances and is why the number one prerogative for regulators is to avoid just this kind of outcome, which is catastrophic for a fractional reserve system that is entirely based on confidence, and where available “demand money” is merely a fraction of the $18 trillion in deposits, far more than the $2.2 trillion in circulating currency.

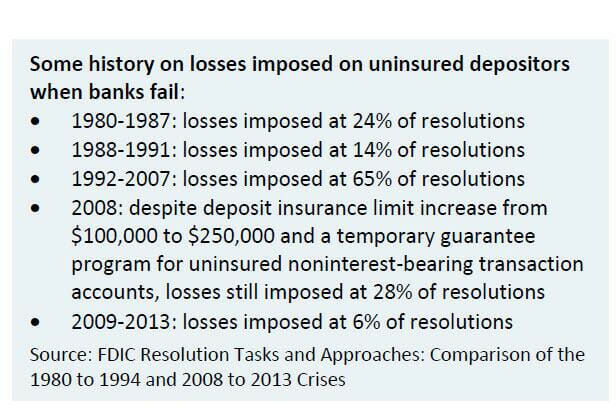

Furthermore, a quick look at historical unsecured depositor impairment numbers show that losses imposed on uninsured depositors range between 6% and 65%: huge numbers in today’s context even assuming that banks are mostly solvent (which they likely won’t be once the commercial real estate crisis hurricane hits).

But it did not take long for government officials to now backtrack these comments – a typical phenomena that seems to happen a lot when Yellen opens her mouth to the public.

Now federal authorities are “seriously considering safeguarding all uninsured deposits at Silicon Valley Bank,” according to the Washington Post, which also includes other banks at risk. This means they could bail-out all depositors and not just those guaranteed by the FDIC’s $250K threshold.

Officials at the Treasury Department, Federal Reserve, and Federal Deposit Insurance Corporation discussed the idea this weekend, the people said, with only hours to go before financial markets opened in Asia. White House officials have also studied the idea, per two separate people familiar with those discussions. The plan would be among the potential policy responses if the government is unable to find a buyer for the failed bank.

Although the FDIC insures bank deposits up to $250,000, a provision in federal banking law may give them the authority to protect the uninsured deposits as well if they conclude that failing to do so would pose a systemic risk to the broader financial system, the people said. In that event, uninsured deposits could be backstopped by an insurance fund, paid into regularly by U.S. banks.

Before that happens, the systemic risk verdict must be endorsed by a two-thirds vote of the Fed’s Board of Governors and the FDIC board along with Treasury Secretary Janet Yellen. No final decision has been made, but the deliberations reflect concern over the collateral damage from SVB’s collapse and authorities’ struggle to respond amid limits on their powers implemented following the 2008 financial bailouts.

The consolidation of SVB’s good assets are underway.

MarketWatch wrote: ‘The U.S. [FDIC] is reportedly holding an auction for the assets of failed Silicon Valley Bank of California this weekend, while discussions are also said to be underway involving the Federal Reserve to possibly create a fund to protect depositors. Meanwhile, the U.K. government said Sunday it was working on a lifeline for companies that had deposits locked up at Silicon Valley Bank’s British arm.’

But beyond just that, MarketWatch added: ‘One fear is that the alarm bells now ringing in the wake of Silicon Valley Bank’s collapse could cause wealthy clients to pull their money from regional and midsize banks, in favor of bigger institutions such as JPMorgan.’

And already this is happening: First Republic Bank, another midsized bank, was greatly affected by this. The Wall Street Journal reported on Friday: ‘First Republic shares fell 52% in early trading before storming back to near the previous day’s closing level, only to then finish the day down 15%. Investors expressed concerns about unrealized losses on assets at the bank as well as its heavy reliance on deposits that could turn out to be flighty.’

In response to the panic FRB published a brief statement:

Sources beyond a well-diversified deposit base include over $60 billion of available, unused borrowing capacity at the Federal Home Loan Bank and the Federal Reserve Bank. It has consistently maintained a strong capital position with capital levels significantly higher than the regulatory requirements for being considered well-capitalized.

As noted in the initial WinePress report about the SVB collapse on Friday, and allusions to it now as well, this contagion would mostly spread to smaller and middle-scale banks and cause a string of bank runs and collapses of those banks.

But House Speaker Kevin McCarthy is calling for the much larger institutions to gobble-up the smaller ones.

I have talked with the administration, from Jay Powell and Janet Yellen. They do have the tools to handle the current situation. They do know the seriousness of this, and they’re working to try to come forward with some announcement before the markets open.

This bank is a unique bank. They do have assets, they have an amazing clientele. It’s very possible for someone to purchase this bank. I think that would be the best outcome to move forward and cool the markets…

Silicon Valley Bank has a lot of assets. It’s just where the capital is currently at. But it is attractive for someone to want to purchase it; it’s just the timeline on where to move forward, and the [Biden] administration has tools to deal with this…

McCarthy told Fox News

And already the proof of this collapse and consolidation looks to be ready to incur. MarketWatch listed 20 different banks that are also sitting on potential securities losses similar to SVB’s losses, and another 10 banks that reported unrealized securities losses in Q4 for last year that similarly led to SVB’s collapse. But if MarketWatch is willing to reveal the names of banks that are in trouble right now, there are bound to more of them coming as well.

All Of This Was Staged And Systematic

Right now the media and pundits on both sides of the aisle are playing the blame-game as to why this happened.

But those who have diligently been paying attention to the financial collapse and meltdown around the world, knew that this was only a formality and sign of the world’s economies being flushed down the toilet.

Greggory Mannarino, a stock market expert and writer or The Trends Journal published a short article warning about this consolidation, why it happened, the lack of accountability, and where it is going (emphasis his).

The overnight collapse of SVB, (Silicon Valley Bank), has certainly got everyone’s attention, but is this really any surprise at all?

Absolutely not.

The collapse of SVB is just a symptom of the current worldwide economic freefall being deliberately fostered by central banks.

If you are at all familiar with any of my work or have paid attention to the many articles I have written for the Trends Journal, then you are already keenly aware that right now today the entire financial system is breaking down… and this is NOT any accident. (We are in the early stages of a deliberate systemic failure).

Today the world economy is in an accelerating freefall, teetering on a knifes edge, being deliberately pushed off the financial cliff by central banks who are collectively attempting to crush the existing system only to issue in a new one.

Roughly 8 months ago, I began to warn those who follow my work on YouTube, (check out my older videos), that the banks are in trouble. It just became too obvious, and the current situation with the banks comes down to just THREE things: no deposits, no loans, and no deals.

In truth, it’s NOT the banks who are in trouble, but as always-We the People. Just some of the fallout from the SVB collapse is this; depositors with more than the government $250K FDIC insurance will never be made whole, and nor will the shareholders, who were just up until a few days ago being told that everything with the bank was sound. Not to mention the throngs of people who just became unemployed. The greatest threat? The collapse of smaller/regional banks will allow the MEGA banks to consolidate power.

And where were the banking regulators in all this?

How did they not see this coming?

Or is it possible that the regulators did see this coming, and they just turned a blind eye. Remember this, in the current environment NOTHING is what it seems to be.

Why would banking regulators just “allow” an overnight collapse of SVB, the 16th largest bank by assets in the US? And are we likely so see more regional/smaller banks fail?

Are we to believe that banking regulators are just incompetent? Moreover, as a reality check, understand… there is absolutely no way that the Federal Reserve nor the US Treasury could not have seen this coming. Remember, NO DEPOSITS, NO LOANS, NO DEALS! If this “no deposits, no loans, and no deals” situation is just plainly obvious to you and I, are we to believe that banking regulators, the US Treasury, and the Federal Reserve just entirely missed this? How about NO.

Let’s ask another question… why didn’t a single larger bank step in and bailout SVB? Well, the mainstream media financial channel commentators appear to be completely baffled as to why no big bank offered to step in and “save” SVB. Well… here is why.

The collapse of SBV, and there will be others, creates a “fire sale” opportunity for the major banks. Not a single major bank stepped in to save SVB because now this collapse presents them with a MAJOR opportunity to now be able to acquire assets from this collapse for next to nothing, pennies on the dollar. Moreover, the big banks by design will now become even larger as more regional bank collapses occur, allowing for more fire sales.

I fully expect that the overnight collapse of SVB will be followed by more, smaller/regional bank failures, AND THAT MEANS MORE FIRE SALES of assets and opportunities for the major banks.

In my opinion, we are about to see a consolidation of the entire banking system accelerate, with more power, and more assets concentrated in the Wall Street Super Banks. ANY “contagion” regarding regional/smaller bank failures will of course allow for the Too Big To Fail institutions to get MUCH bigger.

Do you really believe that any of this is by accident? And no one saw this coming?

EXPECT MORE REGIONAL/SMALLER BANKS TO FAIL.

AUTHOR COMMENTARY

A prudent man foreseeth the evil, and hideth himself; but the simple pass on, and are punished.

Proverbs 27:12

I have routinely warned readers for a longtime to get your money out of the banks, and only keep the amount needed to pay bills and perform online transactions.

Some of you may recall that I was sounding off on the banking collapse in January of 2021, reporting that hundreds of branches and accounts in the U.S. and around the world were shutting down. Here is what wrote at the time:

If you have your money in a bank, PULL IT OUT. There are no incentives to keep it there. These banks take your money and waste it on useless investments and loans. Banks are designed to make money, and in order to make their money, they gamble with yours.

Obviously keep the necessary amount in the bank for online purchasing and for paying bills, but do not keep a ton of it in there. All it takes is another major trigger event to cause a bank run.

Let this report be a warning sign as to keep your money out of the banks. Prior to the lockdowns in 2020, I was already skeptical of keeping my savings in the bank, but when the country went into panic mode over media hysteria, I pulled all my savings out.

I have been hearing many reports from individuals that their local banks are closing their doors left and right, or they are doing some kind of “restructuring” for a length of time. The banks in my area I use are increasing their minimum account balances; and if the account is lower than the minimum by the end of the month, a small charge is made to the account. These places are hemorrhaging cash.

And you also have to take into consideration the effects this has on landlords. The commercial real estate market was already seeing pressure prior to 2020, but once the lockdowns began, that sector has been getting lacerated. So as more banks shutdown, this means more vacant building that will rot and decay as many businesses and companies will not buy them up – unless it is private equity firms, and other mega corporations.

And on top of all that, even more job losses as more and more banks follow the digital trend – which is all by design.

And again I reported on this in July of that year that, ‘Citigroup, JPMorgan, and Wells Fargo collectively have closed more than 250 branches [up to that point], cutting their networks by as much as 5%.’

SEE: Truist Bank Gets Hacked, Preventing Customers From Withdrawing Funds -12/2/22

The point is the banks were not safe and were in danger and I was warning about this for some time. And as Mannarino points out, when you have a savings rate in the toilet, most of the country living paycheck-to-paycheck, Americans living on credit cards and buy now, pay later apps to survive (all of which I have covered before, too) it was only a formality that the banks would start to falter.

Now a much larger one has collapsed; and, as noted before, Jim Cramer of CNBC was pumping SVB’s stock an entire month ago. He KNEW where this was going, but that was a single to all his goonies to start placing puts on that stock to make-out ridiculous returns.

I know, and you know if you have followed The WinePress (and used your own two eyes), that the financial world is crumbling at blistering speeds, and 2023 is going to be a really chaotic year for this. The illusion can no longer be hid as to how insolvent this economy is. It’s all fake and hundreds of millions of Americans are unprepared, walking straight into the grave.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.