The following report is by Biometric Update:

Roughly half (51 percent) of people in the UK believe physical wallets will become less relevant as digital ways to pay become increasingly popular, new research from Mastercard suggests.

The data hints at a decrease in cash usage in the UK. According to Mastercard, around 60 percent of payments were made in cash a decade ago, with UK Finance estimating that this figure will fall to 6 percent by 2031.

In contrast to a decade ago, many who still carry wallets are now seeing them more as a site of personal archive rather than a vessel for physical cash and cards.

As technology continues to evolve, wallets shrink, and people increasingly embrace digital methods of payment, our focus remains on delivering choice, convenience, and speed for people around the country.

Comments Kelly Devine, president of UK and Ireland at Mastercard.

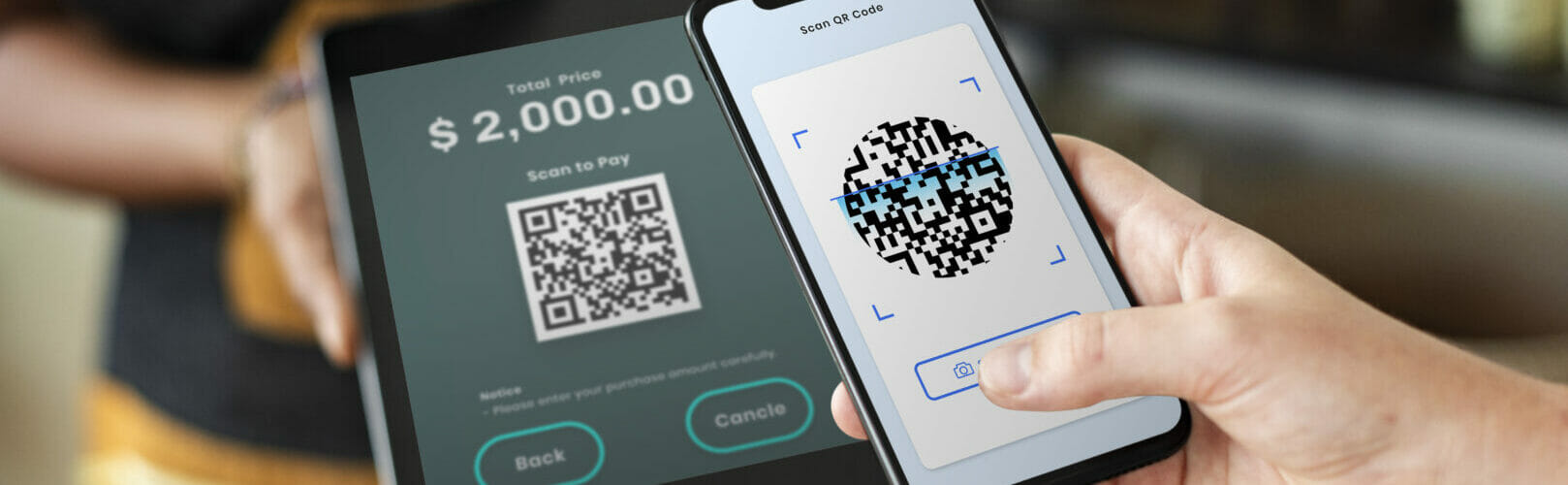

The research also highlights a corresponding increase in the adoption of digital payment methods globally, with 93 percent of consumers saying they will consider using alternative means of payment such as contactless, QR code, biometrics, and cryptocurrency transactions in the next year.

Scotland’s financial sector to lead UK biometrics efforts

Over a third of people living in Britain (36 percent) agreed that biometrics will be widely used for payments by 2025, according to a separate survey.

The figures come from a new report by Accenture, which was recently discussed by the company’s head of commercial banking for the UK and Ireland, Stuart Chalmers.

Writing in The Scotsman, Chalmers notes that 7 percent of the aforementioned 36 percent said they would be willing to use biometrics.

We estimate that this will translate to £95 billion [$113.04 billion] of UK payments moving to biometrics in two years.

He writes.

At the same time, Chalmers warns that cost-of-living pressures and rising strains on household budgets are causing consumers to choose more traditional payment methods to help with budgeting as well as to reduce debt interest.

To tackle these negative factors and tap into new technologies such as the metaverse and phenomena like the ‘influencers,’ banks need to evolve further.

As new payments trends, ways to engage customers and sustainability factors emerge, there is opportunity.

Digital technology is Scotland’s fastest-growing sector, and Scotland is the UK’s largest financial center outside of London, so the potential exists for Scottish-led organizations to drive further economic growth.

Chalmers explains.

The claims come a couple of months after the Scottish government unveiled plans to test its new digital identity platform early this year.

AUTHOR COMMENTARY

Per this survey, over 90% of the UK supposedly is ready to make the jump to biometrics and contactless payments exclusively. It’s the blind leading the blind. Therefore it is easy to see just how easily CBDCs will be instigated, including social credit scores and vaccine passports, and the masses will accept it regardless.

[16] And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. Revelation 13:16-18

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I don’t unremarkably comment but I gotta state thanks for the post on this perfect one : D.

Fantastic site. Plenty of useful info here. I?¦m sending it to several buddies ans also sharing in delicious. And obviously, thank you to your effort!

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!