In late-October Vancity bank located in British Colombia, Canada, announced that starting in 2023 they will be offering the first of its kind carbon tracking card in Canada, called The Carbon Counter.

“It will be the first financial institution in Canada to offer its individual and business members a way to estimate the CO2 emissions that come from their purchases,” Vancity wrote in a press release.

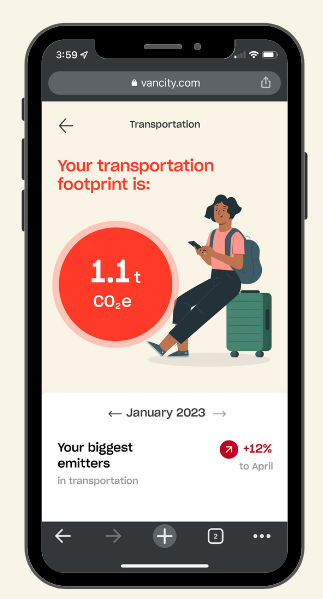

This move, according to the banking chain, says every Vancity Visa Card holder will be allowed to track the estimated carbon emissions of their credit card purchases, and compare their monthly emissions to the national average, and which specific purchases have been labeled to have higher carbon emissions.

The app that accompanies the card will also provide suggestions on how to reduce the holder’s carbon footprint. “In addition to providing a snapshot of your “count,” the Carbon Counter provides insights on how to reduce your carbon “spending” and tips for more sustainable choices,” Vancity added.

We know many Vancity members are looking for ways to reduce the impact they have on the environment, particularly when it comes to the emissions that cause climate change.

As a member-owned financial cooperative, we believe it is our job to do everything we can to help, especially when it comes to the decisions people make with their money. This tool will equip Vancity Visa credit cardholders with valuable information on their purchases and enable them to connect their daily spending decisions to the change they want to see in the world.

Jonathan Fowlie, Vancity’s Chief External Relations Officer who oversees the credit union’s impact and climate efforts, said

Besides working with Visa, Vancity also teamed-up with Ecolytiq – “one of Europe’s leading climate engagement technology companies” – who have already been working with Visa.

Ecolytiq was one of the many guest companies at this year’s COP 27 climate conference in Egypt, who offered their climate-tracking products and services for free to new clients and investors at the end of the summit.

We are breaking new ground here. We developed a White Label solution to offer financial institutions all over the world an agile and effective way to offer their customers tools to forge a better tomorrow. With the launch of Carbon Counter, Vancity is solidifying its role as a leading sustainability innovator both in Canada and in the global banking world.

Ulrich Pietsch, Ecolytiq Co-Founder and Managing Director, said

We are proud to support the launch of Vancity’s CO2 calculator, a first on a Visa card in Canada. This is a great example of how we can empower consumers to understand their environmental impact and honour Visa’s commitment to a sustainable future.

Stacey Madge, Country Manager & President, Visa Canada, said

Just over a year ago Visa announced that they would be implementing their “Visa Eco Benefits” throughout Europe, with plans to later expand thereafter.

The program offers a “carbon footprint calculator” courtesy of Ecoltyiq, providing insights “for cardholders into the estimated carbon footprint of their spend, including a new temperature score, which helps cardholders understand the climate impact of their personal spending behavior and how their consumption choices contribute to the 1.5°C Paris Climate Change Agreement goal;” along with other benefits, and “expanded rewards for cardholders for sustainable behaviors.”

Sustainability is the challenge of our time, but also one of the greatest opportunities for the finance industry. Equipped with the right tools like the Visa Eco Benefits bundle, the finance industry becomes the driving force for change by educating millions of consumers about their impact and by empowering them to take effective climate action to build the sustainable future we all deserve.

Ulrich Pietsch, said

The WinePress reported in October that an Australian megabank has already implemented an emissions calculator and a social credit score style of tracking, penalizing, and incentivizing of users’ purchases.

The U.S. Federal Reserve also announced in October that they six other megabanks in America will conduct a piloted carbon-based social credit score system to be later implemented. The Federal Reserve has also announced plans to launch a pilot program to trial their new central bank digital currency (CBDC).

Furthermore, alternative and conservative pundit Candace Owens announced her support for a new alternative banking app that too has a social credit score style of incentivizing users for doing and participating in certain things the platform deems to be just.

AUTHOR COMMENTARY

What the co-founder of Ecolytiq said parallels what I have been warning how these changes come in: go after the people’s piggy banks and wallets, and watch them all line-up like ducks and waddle to obey to whatever ‘they’ want them to do.

[9] But they that will be rich fall into temptation and a snare, and into many foolish and hurtful lusts, which drown men in destruction and perdition. [10] For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows. 1 Timothy 6:9-10

Moreover, as I have said, these programs are being very quietly and subtly floated out to the broad masses right now as to grease the wheels, and get them used to the idea of one. Eventually it will be mandated, or face being locked-out of society. When the world economies are allowed to finally implode in on themselves, and the fallout is so severe, then the desperate masses will accept whatever these banks want them to; including social credit scores, CBDCs, food IDs, digital licenses, and so on.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I hope the lost people here would have enough sense to reject this even if it’s just on the reasoning of “what I purchase with my money is none of anybody’s business”.