Signs that the consumer is at wits end continue to present themselves as inflation continues eat away at their savings.

Supermarket chain Target recently released their third quarter sales report, revealing that they completely missed their spending forecasts and are now changing their outlook moving forward, blaming the miss in sales on inflation eroding the consumer’s spending power.

In the latter weeks of the quarter, sales and profit trends softened meaningfully, with guests’ shopping behavior increasingly impacted by inflation, rising interest rates and economic uncertainty. This resulted in a third quarter profit performance well below our expectations.

While we’re ready to deliver exceptional value for our guests this holiday season, supported by the decisive inventory actions we took earlier this year, the rapidly evolving consumer environment means we’re planning the balance of the year more conservatively.

We’re also taking new actions to drive efficiencies now and in the future, optimizing our operations to match the scale of our business and drive continued growth.

CEO Brian Cornell, said

The Street gets into more data specifics, but Target’s miss in sales is another snapshot into how the consumer is spending their money.

Recently official federal inflation numbers were adjusted to 7.7%, down from the 8.1% a month ago – leading many mainstream pundits to proclaim that inflation has peaked, largely due to the Federal Reserve’s actions of raising federal interest rates, which is now at 4.0%.

But the current CFO for Walmart has pushed back against the mainstream forecasts and says he is not confident to say inflation has hit its peak, pointing to food being the biggest problem, corroborating with Target’s statistics.

I can’t call that. Food inflation, in particular, has been pretty persistent. We see it in mid-teens growth [in grocery sales]. In general merchandise, we have seen more progress, but I can’t call a peak on that just yet.

Walmart CFO John David Rainey said on Yahoo Finance Live when asked if inflation had peaked.

Mainstream media economists, including Federal Reserve presidents and Treasurer Janet Yellen, have all been calling for peak inflation for a long time since 2020, especially with Yellen’s and Fed Chair Jerome Powell repeated calls that inflation was only “transitory;” which of course has proven to be totally wrong.

But alternative economists and analysts remain firm that inflation will not be allowed to slowdown, and new mechanisms will be instigated to keep the money printers pumping.

Longtime stock market analyst and guest contributor for The Trends Journal, Gregory Mannarino, strongly emphasizes: “Raising rates is meant to slow demand, and that’s all- PERIOD.”

Furthermore, “If in fact a central bank were serious about wanting to control inflation, all it would have to do is contract the money supply by raising the capital reserve requirements of financial institutions/banks—and doing that alone would have an immediate effect on rapidly rising inflation,” he adds.

This is of course will not happen, at least right now that is.

Mannarino forecasts what the Federal Reserve and other international banks will do to ensure the money printing continues:

First, central banks will continue to balloon the money supply, faster. This will dilute the purchasing power of their respective currencies and inflation will continue to rise.

Secondly, central banks will continue to raise rates, although at a slower pace, and sometime early next year they will pause.

Thirdly, central banks working together will vastly increase their repo programs. This means that financial institutions will pass vast amounts of cash between each other overnight in an effort to trick the system into thinking it’s more liquid than it actually is.

Collectively these three mechanisms as outlined above, if successful, will allow central banks to vastly increase global debt and as a side effect push global stock markets higher.

As a further effect, this mechanism will continue to crush the global economy and create more people who are dependent on the system.

When the Feds raised rates another .75 a little over two weeks ago, the big news was not so much the rate hike, but direct indications that the Fed would peradventure drastically slowdown the velocity of their hikes, including the point spread itself; if not outright pausing going into next year. This essentially translates into elevated costs of borrowing and lending funds, but with inflation rates still remaining unabated.

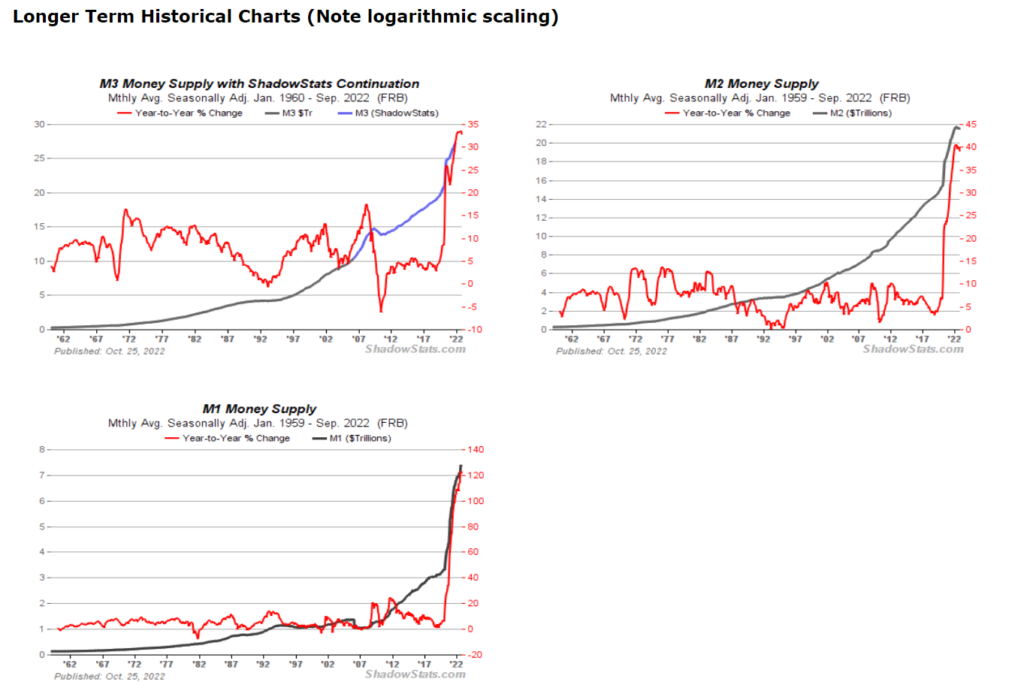

The money supply has gone parabolic as the Feds have continued to print seemingly infinite amounts of cash – on top of what the Federal government continues to spend, increasing the debt; supplementing the problem at hand, but is not the core of it, though mainstream media simply refuses to discuss this fact:

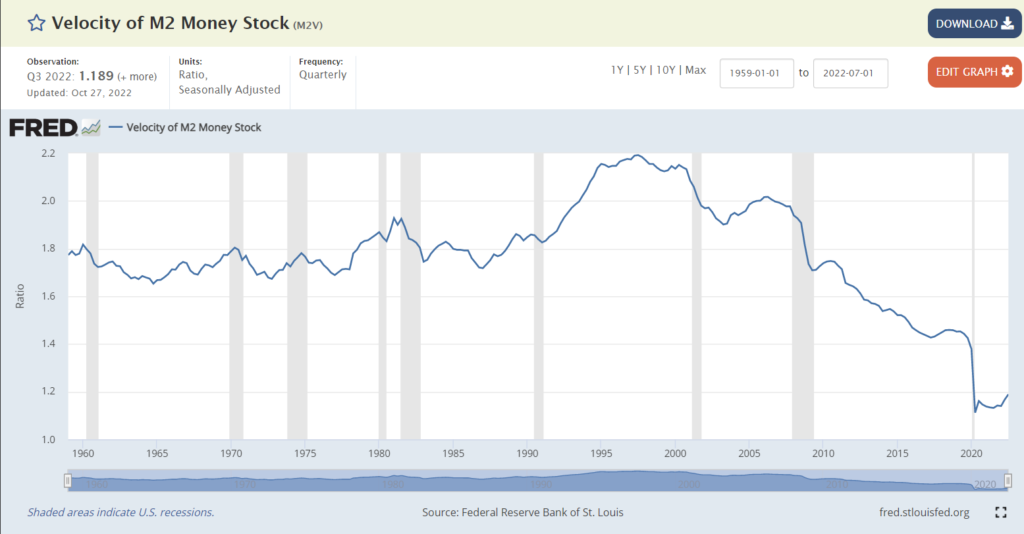

Meanwhile the money velocity – the rate at which cash moves/transacts through an economy – is still very low, though it has slightly ticked-up higher these past few months, which would indicate that the consumer is being forced to use more dollars because of inflation; which is beget of the ever-rising money supply.

As discussed before on The WinePress, a receding velocity of money is indicating that an economy is in a contraction; and, coupled with a parabolic money supply with no end in sight, is no bueno.

SEE: The Quickest Way To Know The Economy Is Broken Beyond Repair

The United States Does Not Have An Economy

And yet, paradoxically, even though Target vastly underperformed and the Walmart CFO is bearish on peak inflation, Americans are still spending more money in other sectors.

According to a Trends Journal report released this week, cruise lines are seeing way more guests, as are hotels, along with crowds packing theme parks; and summer attendance for concerts and festivals broke records, as ticket sales are forecast to only increase these next several years.

After years of feeling exhausted fighting the Covid War, the consumer wants to get out more, and they are willing to spend it.

People at the beginning of the [COVID infestation] were spending unlimited amounts on home improvements, Pelotons, you name it, and the bloom is off that rose entirely.

What they’re now spending on is experiences.

Mark Hoplamazian, CEO of Hyatt Hotels told the WSJ.

The demand we’re seeing right now is more robust than we ever would have thought possible.

Geoffrey Ballotti, CEO of Wyndham Hotels & Resorts, a chain catering to middle-income travelers, said in a WSJ interview.

Despite a lot of consumers pulling back on spending, the one area I haven’t seen them pull back on as much is travel. They still want to have meaningful experiences.

Airbnb’s CEO Brian Chesky, said to the WSJ

The TJ wrote:

The shift to remote work has created a new trend: people taking “work vacations,” in which they visit locales that interest them while they keep working, often for longer stays.

Remote work, enabled by technological improvements, has become a new norm that has reshaped the issue of “work-life balance.”

Footloose workers, especially contract or gig workers, can travel for pleasure while they keep earning, blurring or virtually erasing the line segregating work and leisure.

And yet household debt continues to climb with no end in sight. The Federal Reserve reported several days ago that household debt has now climbed to $16.51 trillion in Q3.

They reported:

The Report shows an increase in total household debt in the third quarter of 2022, increasing by $351 billion (2.2%) to $16.51 trillion. Balances now stand $2.36 trillion higher than at the end of 2019, before the pandemic recession.

Mortgage balances rose by $282 billion in the third quarter of 2022 and stood at $11.67 trillion at the end of September, representing a $1 trillion increase from the previous year. Credit card balances also increased by $38 billion. The 15% year-over-year increase in credit card balances represents the largest in more than 20 years. Auto loan balances increased by $22 billion in the third quarter, consistent with the upward trajectory seen since 2011. Student loan balances slightly declined and now stand at $1.57 trillion. In total, non-housing balances grew by $66 billion.

Mortgage originations, which include refinances, stood at $633 billion in the third quarter, representing a $126 billion decline from the second quarter and a return to pre-pandemic volumes. The volume of newly originated auto loans was $185 billion, a slight reduction from the previous quarter but still elevated compared to the average volumes seen through the 2018-2019 period. Aggregate limits on credit

AUTHOR COMMENTARY

And he said unto them, Take heed, and beware of covetousness: for a man’s life consisteth not in the abundance of the things which he possesseth.

Luke 12:15

The problem here is that the people simply will not stop spending money they don’t even have. Instead of having to tighten their belts, they instead bellyache and consume even more, and especially to have vain “experiences.” So while the government and Federal Reserve is to be blamed, the masses who continue to borrow beyond their eyeballs are feeding right into the hands of these handlers, only making their problems worse.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.