President of the Federal Reserve Bank of Chicago, Charles Evans, told CNBC in an interview yesterday that reeling in inflation is his top priority even if it comes at the cost of Americans losing even more of their jobs.

Evans claimed in his brief interview that he and the rest of the Feds say they can or are at least confident that, they can bringdown inflation without entering into a recognized recession.

Ultimately, inflation is the most important thing to get under control. That’s job-one. Price stability sets the stage for stronger growth in the future.

If unemployment goes up, that’s unfortunate. If it goes up a lot, that’s really very difficult. But price stability makes the future better.

Evans said on CNBC’s “Squawk on the Street”

CNBC added, ‘On the employment front, the Bureau of Labor Statistics reported Friday that nonfarm payrolls increased 263,000 in September, while the unemployment rate fell to 3.5%, tied for the lowest level since late 1969. However, Fed officials including Chair Jerome Powell have warned that they expect “some pain” from the Fed’s inflation-fighting efforts that could include higher levels of joblessness.’

Evans earlier in the day made a speech at the 64th National Association for Business Economics (NABE) Annual Meeting in Chicago, Illinois, where he reiterated the point that getting inflation under control will come at the sacrifice of jobs:

The Federal Reserve is committed to returning inflation to its 2 percent average goal. To do so, I expect we will need to raise rates further and then to hold that stance for a while. Of course, the exact path forward for policy will depend on the evolution of the economy and risks to the outlook.

Reducing inflation to a level consistent with the Fed’s 2 percent objective will require a period of restrictive financial conditions to restore better balance between supply and demand economy-wide.

This will generate below-trend growth and some softening of labor market conditions. But ensuring low and stable inflation is a prerequisite for achieving the sustained strong labor market outcomes that bring benefits to everyone in our society.

This mechanism does, however, require reducing the heat in labor and product markets as well as maintaining a downward pull from inflation expectations. This is where tighter monetary policy comes into play. I see the nominal funds rate rising to a bit above 4-1/2 percent early next year and then remaining at this level for some time while we assess how our policy adjustments are affecting the economy.

When you factor in inflation expectations and the reductions in our balance sheet, we’ll be at something equivalent to nearly a 2 percent real funds rate at this time. This is a fair amount of restriction when compared with the 1/4 to 1/2 percent long-run real neutral federal funds rate that is implied in the SEP. But I feel it is needed to facilitate market adjustments by bringing aggregate demand into better balance with aggregate supply and to ensure that long-run inflation expectations remain in check.

Today, though, inflation is our primary concern. Reducing it will likely require a sustained period of restrictive monetary policy, below-trend growth, and some softening of labor market conditions. But this is necessary to restore inflation to our 2 percent target.

We hope to achieve this goal as quickly and efficiently as possible, leading to a period of sustained price stability and strong labor market outcomes under which all can prosper.

AUTHOR COMMENTARY

The rich man is wise in his own conceit; but the poor that hath understanding searcheth him out.

Proverbs 28:11

Allow me to dissect his semantical word salad. What he really is saying is this: inflation will continue to remain elevated and rip higher, as more Americans lose their jobs as they fall into the lower rungs of society out of the middle class.

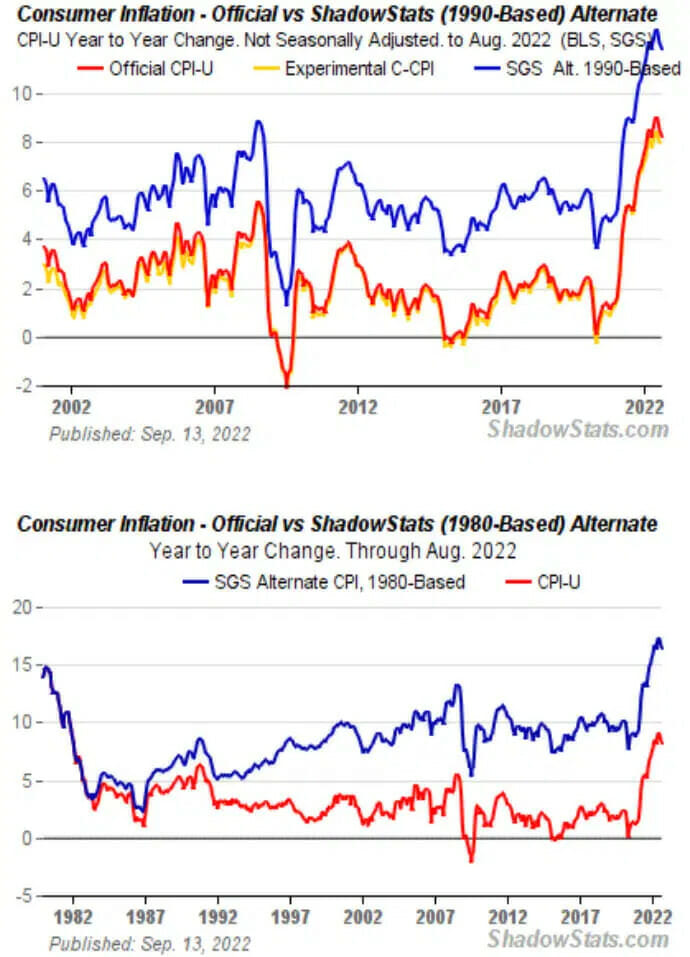

This statement by Evans should make you irate, notwithstanding regulars of The WinePress should not be aghast by this either, as I have been covering this issue for sometime. I repeatedly pointed out that the Feds are guaranteeing inflation will persist. The only way to stop it is to raise federal interest rates above the current rate of inflation, which is at 8.3%. Currently the interest rates are at 3.25%. And even then, the federal statistics are not accurate and are disingenuous at the very least, and is actually more than double what they say it is when factoring other datapoints they do not.

Now this demoniac is saying the Feds are poised to get rates at a little above 4%, and keep them there for a lengthy amount of time. Therefore, as I said, inflation WILL persist, as the money printer keeps on churning, and Americans will continue to lose their jobs and fall deeper into debt, as higher rates will be felt by an already struggling consumer as it costs more to borrow and repay loans and credit.

Every time these people open their mouths, they are LYING to you. They are some of the most dishonest people on the earth. They will sell their own mother and children if they need, and polish it up in a way that sounds prudent and equitable.

NEWS FLASH: The United States and the rest of the world are WELL beyond a recession, but are in the early stages of the greatest global DEPRESSION ever.

Some of you may recall how The WinePress reported earlier this year that the Bank of America directly stated in a corporate memo that “we hope” more Americans lose their jobs as the months roll by.

This is the third time I am coming to you. In the mouth of two or three witnesses shall every word be established.

2 Corinthians 13:1

The banks are laying out the script to the masses. They paint this rose-colored hope for the masses while literally saying they are going to burry them, and those same people will come running back to them for help!

The elites are stringing this façade and artificially dead economy out as long as they can, performing every magic trick in the book, to drain out as many people as they can, then pull the rug out from under them, and then offer their “final solution” the masses will readily accept without any resistance.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

“But ensuring low and stable inflation is a prerequisite for achieving the sustained strong labor market outcomes that bring benefits to everyone in our society.”

They are indeed a bunch of compulsive liars! Only THEM benefit! While the 99% of society suffer and just keep on losing the purchasing power! God judge them harshly!