In order to pay for things like coffee or sandwiches, The New York Times reported several weeks ago that Americans are increasingly turning to buy now, pay later (BNPL) apps to try and alleviate the upfront costs.

One lady who frequently uses these apps told the Times she does not hesitate to use them:

If I wanted to pick up a coffee on the way home from somewhere and I didn’t have any money in my coffee or eat-out budget, I would push it to next month’s budget.

Philip Belamant, founder of BNPL company Zilch, told The NYT that consumers do not hesitate to swipe their credit cards to purchase a meal or coffee, so he sees this is a similar process but with no interest payments.

Why would you take a line of credit out to buy a sandwich [via a credit card?] You are doing it today and paying 20 percent interest on it.

The Times also notes that the popular BNPL app Klarna based in Sweden is also now growingly being used to pay for food expenses, when the app traditionally was used for higher-priced items like concert tickets.

Restaurants are also starting to adopt these pay later systems, such as payments firm Block acquiring the Afterpay app, and many restaurants also use Square, also owned by Block.

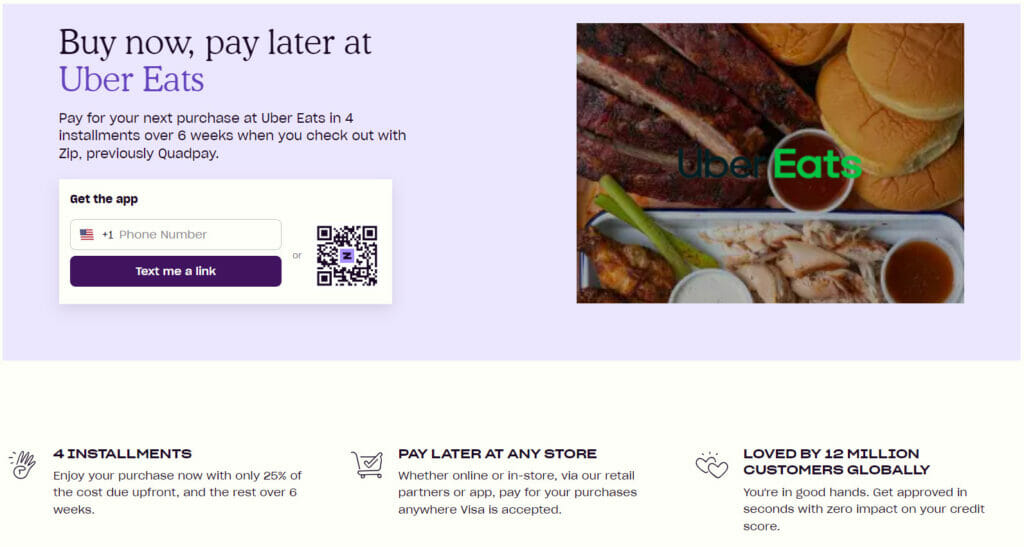

Even last year the BNPL philosophy crept up in apps like Uber Eats, where customers could opt to pay for a pizza or another meal over the course 6 weeks, via Zilch.

Personal finance author Jason Sadowski explained that these programs as basically loans with unique implications, with some apps charging late fees, and can exceed the amount of interest payments for credit cards. Missing a payment also has the potential of a dinging that person’s credit score.

But there are plenty of critics, with one user telling the Times that they soon found themselves in debt after using these apps.

If you are not financially literate, it is easy to abuse it and say, ‘I will just keep using it, it is free money.’

Said the frustrated user

Convenience.org provided additional statistics as to how much these apps are earning thus far:

In 2020, consumers made $15.3 billion in BNPL transactions, and last year, that amount rose to $45.9 billion. Food was 6% of that amount in 2021, and in the past year, BNPL company Zip says it has seen 95% growth in U.S. grocery purchases and 64% in restaurant transactions. Zilch says groceries and dining out are 38% of its transactions.

BNPL companies tout the convenience of their services and how they help consumers through difficult financial times. Shoppers can apply for a BNPL service as they’re checking out and can be approved in minutes. Most companies don’t charge interest, and borrowers don’t have to have their credit checked. There is usually a processing fee involved, but typically, the merchant pays that fee.

BNPL users tend to hold more debt than the general population, and 41% have poor credit history, according to a report by Fitch Ratings. The report also found that BNPL late payments have risen from 1.7% in June 2021 to 4.1% in March 2022, yet credit card delinquencies have remained the same at 1.4%.

In April of this year The WinePress how an Australian BNPL app has tailored their services to provide easier ways for customers to pay for groceries with their app.

But this trend in BNPL is congruent with American’s inability to payoff their already existing credit card debts.

Citing a survey from CreditCards.com, The Trends Journal reported that 6 in 10 Americans cannot pay off their credit card balances at a year minimum, rising from 5 in 10 in 2021.

‘The proportion of cardholders in debt for at least two years has risen from 32 percent in 2021 to 40 percent now, the survey showed,’ The TJ noted. More households are turning to credit cards to pay for utilities and food, the survey found.

Approximately 25% of respondents say they accrued more credit card debt because of the plastic card, and almost 50% used the card to cover sudden emergencies like medical or repair fees.

The TJ also noted, ‘Total consumer debt grew by $23.8 billion in July, reaching a record $4.64 trillion, according to Federal Reserve figures.’

As noted in several other WinePress reports, as the Federal Reserve continues to incrementally raise interest raises well below the published rate of inflation, it will increasingly cost more money for people to borrow and payback loans.

As interest rates rise and adjustable-rate credit cards adjust upward, more Americans will begin to miss payments, resulting in canceled cards, ruined credit, and revenue lost to banks.

As banks have with mortgages, card issuers will become much more selective and demanding in determining who qualifies as a cardholder. Many cardholders will be denied requests for limit increases or even find their credit limits reduced.

The Trends Journal forecasts

AUTHOR COMMENTARY

[7] The rich ruleth over the poor, and the borrower is servant to the lender. [26] Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee?Proverbs 22:7, 26-27

This is a spending addiction on steroids, junkies who need their continual fix, of cheap Chinese tchotchkes.

Paying for a Dominoes pizza over the course of six weeks is startling when you realize, relatively speaking, how low-cost they are. I looked-up the prices at my nearest Dominoes, and, the cheapest pizza they offer is a small 10″ cheese pizza that costs $10.99 before tax. So, rounding up to $12 for a more even number – instead of paying the $12 up front, I instead could make 6 payments of $2. That’s insanity.

But, this is an early trial run for the monthly slave points and CBDCs in this smart city future, where the masses will “own nothing and be happy.”

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Absolute insanity! Apps where you can make monthly payments on a pizza or a bucket of chicken like you would if you bought a couch or a bed. The economy is just about to go kaboomey!

(Sarcasm) but hey, things are getting better! The economy has never looked so wonderful, well all be driving Bentleys and living in 10,000 square foot houses with white picket fences and green lawns.