For the third time in a row, the Federal Reserve has raised interest rates another .75%, bringing the total to 3.25%: the largest that has been since 2008.

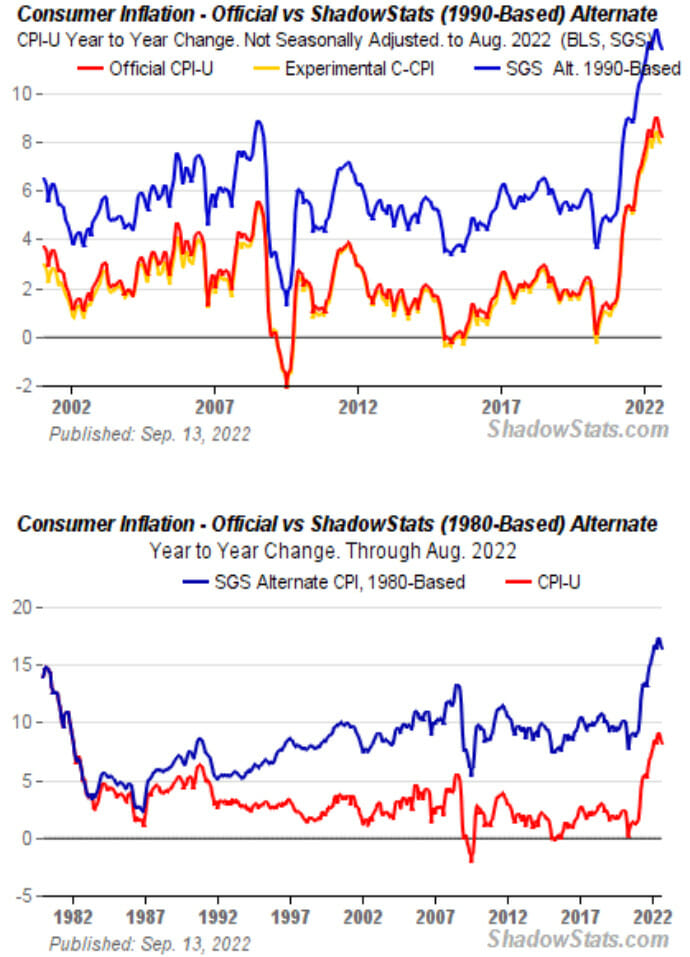

However, the current federal inflation rate is at 8.3%. Moreover, the real inflation numbers, when factoring in other data points the feds do not, the ravine even widens and deepens, according to ShadowStats.

You can read Fed Chairman Jerome Powell’s transcript if you wish, but here are two interesting statements he made (to me anyways):

To conclude, we understand that our actions affect communities, families, and businesses across the country. Everything we do is in service to our public mission. We at the Fed will do everything we can to achieve our goals. Thank you, and I look forward to your questions.

This is a strong, robust economy. People have savings on their balance sheet from the period where they couldn’t spend and were getting government transfers. There are significant savings, although not as much at the lower end of the income strum, but still some savings of — spectrum — but still savings. The states are flush with cash.

There’s good reason to think this will be a reasonably strong economy. The data sort of are showing that growth will be below trend. Trend is 1.8%. We’re forecasting growth below that and most are. But there’s a possibility that growth can be stronger than that. That’s a good thing because that means the economy will be more resistant to a significant downturn. But, of course, we are focused on getting inflation back down to 2%.

I mean, seriously? You must be a fool to believe such rhetoric!

“56% Of Americans Can’t Cover A $1,000 Emergency Expense With Savings” – The WP reported in January.

Notwithstanding, with rates continuing to move higher at such an incremental pace, the ability for the consumer to borrow money dwindles each time, and causes the prices of goods to increase in some sectors.

CNBC admitted to four things that are primed to get even pricier:

By increasing its key interest rate, the central bank discourages spending, which can reduce inflation for the prices for goods and services. However, the downside to each rate hike is increased monthly debt costs for Americans.

Here are four things that will likely get more expensive.

1. Credit cards

Fed rate hikes affect your credit card’s annual percentage rate (APR), which determines how much interest you pay for any outstanding debt not paid off by the end of the month.

When the rate hikes began in early 2022, average APRs were close to 16% and have since climbed to just over 18%. With today’s increase, the average credit card APR could reach closer to 19%, according to financial services site Bankrate.com.

In that case, for a credit card balance of $5,000 with an APR of 19%, you’d pay an additional $1,197 in interest costs compared to an APR of 16%, if you only made the minimum payment each month.

2. Auto financing

Federal funds rate hikes don’t affect fixed-rate car loans already in place. However, they do increase interest costs for new auto loans, or those with variable-rate financing.

At the start of 2022, the average interest rate on a 60-month new car loan was 3.85%. But with today’s increase, the interest rate could nudge up closer to 5.5% to 5.75%, says Bankrate’s chief financial analyst Greg McBride. That works out to about an extra $31 per month in auto financing payments, for a $35,000 new car.

3. Mortgages

If you have a fixed-rate mortgage, rising interest rates will have no impact on your loan. However, if you get a new mortgage or have a variable-rate mortgage, your monthly payments could increase.

Mortgage rates tend to rise with rate hikes, but they are more directly influenced by the bond market. Since early 2022, mortgage rates have climbed from 3% to over 6%, increasing the monthly costs on a 30-year fixed-rate $400,000 mortgage with a 20% down payment by a whopping $569.

The one silver lining is that today’s widely anticipated rate increase might already be baked into current mortgage rates, meaning they might not climb much further based on today’s announcement. Mortgage rate forecasts for the remainder of the year are a mixed bag, with many suggesting that rates will level off.

4. Other variable-rate loans

Expect increased costs for variable-rate loans like personal loans and home equity lines of credit (HELOC).

In early 2022, HELOC interest rates were averaging more than 4%, but that rate has since climbed to 6.51%, per Bankrate.com. With the rate hike, the average rate could increase to something closer to 7.25%, says McBride.

Home equity loans were 5.96% at the beginning of the year, and are now at about 7.01%, but they could nudge up closer to 8% with today’s interest hike, says McBride.

How much you’ll pay vary widely based on your lender, the size of the loan and your credit score.

The bottom line is this: Bob the Builder can’t fix this one: Powell and the feds constantly are talking about using their “tools” to fix the inflation and economic problems, but, the only tools they have are to adjust rates and print money; and you can’t infinitely print your way out of a collapse: it only makes it deeper.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Economic collapse is on the horizon.

‘Robust’ purpose driven rip-off crisis creation….while transferring a little more wealth to crony pockets, the useful idiots, to keep them compliant. The deceiving and being deceived. Chilling. More slow motion train wreck. They couldn’t stop this if they tried. Once they committed & put the wheels in motion it took on a devilish life with Revelation 12 wrath all its own. BUT: they are also piling up the wrath postponed by the longsuffering of God to usward, not willing that any should perish but that all should come to repentance (2 Peter 3 KJB)…and when it breaks & falls…those responsible will be ground to powder. Daniel 2; Psalm 118; Matthew 21; Mark 12; Luke 20; Revelation 19 KJB.