The Trends Journal explains more details on this latest partnership agreement:

Blackrock, one of the world’s largest asset management firms, is partnering with Coinbase to provide investors with crypto investing capabilities.

Through connectivity with Coinbase Prime, institutional clients of Aladdin, BlackRock’s end-to-end investment management platform, will have direct access to cryptocurrencies, starting with bitcoin.

Coinbase announced the partnership on 4 August, and shares of Coinbase stock jumped 10 percent on the news, according to CNBC.

The CNBC report actually noted that the Coinbase stock price was already rising before the news.

Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets. This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.

Said Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock, according to a Coinbase blog post.

Aladdin’s institutional clientele will get access to crypto trading, custody, prime brokerage, and reporting tools via Coinbase Prime.

The Coinbase exchange represents a superior fit for institutional grade investing, said Brett Tejpaul, Head of Coinbase Institutional and Greg Tusar, Vice President, Institutional Product, since the platform has cutting-edge security, insurance, and compliance processes. Hedge funds, asset allocators, financial institutions, corporate treasuries, and other institutions are some of Coinbase’s clientele.

Positive News For Coinbase And The Crypto Sector

The announcement represents a positive turn for Coinbase, in the wake of a recent insider scandal involving an employee who gave info to a friend and family member regarding crypto tokens that were about to be newly listed on the exchange.

Typically, new listings on major exchanges often result in a price boost for the listed tokens.

The SEC has filed a suit over the matter, while muddying the central issue by using the suit to allege that various cryptos listed on Coinbase should be classed as securities.

The Trends Journal has previously covered details of that story in “SEC REBUKED FOR ‘REGULATION BY ENFORCEMENT’ BY CFTC COMMISSIONER” (2 Aug 2022).

Some industry observers said the latest news, since it involves one of the largest institutional investment companies in the world, could contribute to a turn around in the crypto sector, which saw steep declines in early 2022, earning the “Crypto Winter” label.

The Quartz crypto news outlet (qz.com) noted that Blackrock’s move marks a significant revision in CEO Larry Fink’s earlier assessments of the crypto sector.

During the Crypto banner runs of 2021, Fink claimed Blackrock clients were not showing much interest in digital assets.

But Fink opined earlier this year that Russia’s invasion of Ukraine was accelerating demand for cryptocurrencies like Bitcoin.

Big-Tech Releases “WorldCoin:” An Eye-Scanner That Gives Free Cryptocurrency In Return

AUTHOR COMMENTARY

Whoso is partner with a thief hateth his own soul: he heareth cursing, and bewrayeth it not.

Proverbs 29:24

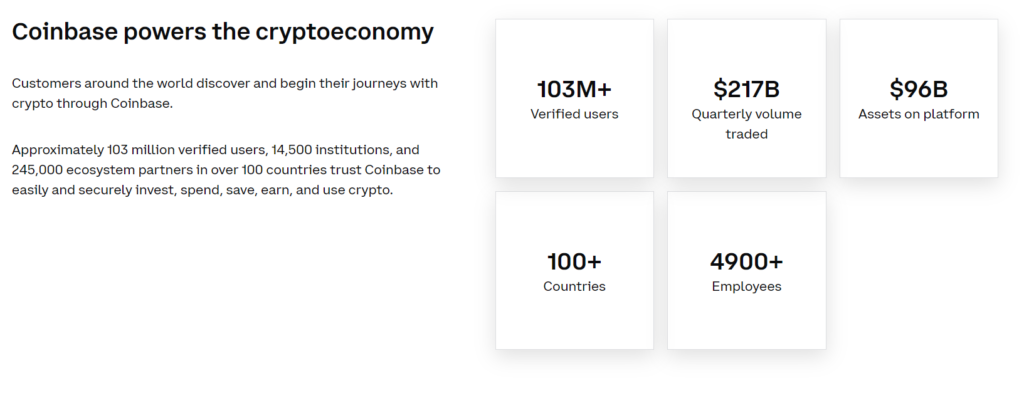

Blackrock, which is easily one of the most evil companies in the world – one of the main bruisers bringing the World Economic Forum’s vision for 2030 to come to pass – will now have access to Coinbase’s current $96 billion worth of crypto assets!

So now that the handlers got hundreds of millions of people involved into, what I believe is, basically a giant Ponzi scheme, buttering people up for the coming mark of the beast and digital currencies; now Blackrock essentially will be able to mitigate and control cryptos to a great extent. So much for “deregulated.”

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

I knew that this Bitcoin craze was fishy and boy am I glad I didn’t invest in that trap!

Black Rock, eh? I never knew about them…thanks for the information. Interesting note, in that youtube video that’s posted above it mentioned that he got his “break” from his fraternity friends… all roads lead to Rome.

So sad. I know Christians caught up in the bitcoin thing thinking it would be a good tool for an alternate, parallel society of local communities, following the ideas of men like that Canadian whistleblower who moved to Japan, James Colbert (I always have to think as I type to remember that guy’s name!…). I’m afraid nothing but barter & tight Christian fellowship type community will be sufficient for what’s coming, though…even familial tried to the max as Christ experienced, not only knowing we are but dust, but also being touched by our infirmities & tempted as we, though without sin….warning us what was coming. How long the Lord will hold it back & what means he will use to shelter or to grant grace for his people to face what they must are the questions. Thinking no one monolithic means but tending to be as individual & unique as his dealings with his people within the bounds of his word….and it is so easy to get caught up in those things, & the false ‘community’ teachings etc. The just shall walk by faith. We need to know him by that word, & thus that word like the back of our hand.