Today the Federal Reserve raised the national interest rates again, this time by .75 percentage points; or as the Associated Press put it, “Fed attacks inflation with its largest rate hike since 1994.”

“Attacks inflation?” How about no – the Fed is doing no such thing of the kind, and if you have been following The WP you know that this rate hike still will do nothing to curb inflation.

We thought strong action was warranted at this meeting, and we delivered that.

Fed Chair President Jerome Powell

Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low.

The Fed said in a statement

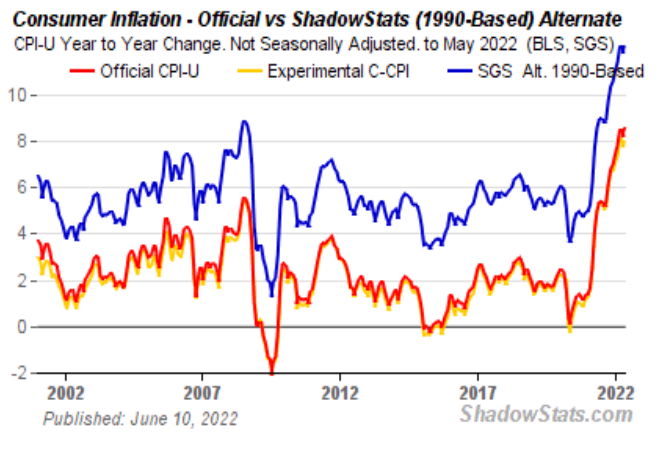

After this rate hike, the U.S. is at a 1.75% interest rate, which is still quite low anyways; but, the official federal inflation metrics are at 8.6%. The only way for inflation to slowdown is to increase the rates at the same rate or higher than inflation. The other problem is the REAL inflation numbers are at least double what the government tells us, if you factor in other important metrics that the federal government used to measure.

As a matter of fact, increased interest rates will only exacerbate inflation, because producers will include these higher costs of loans into their final price. But you are not supposed to figure that out.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

Moreover, I recently discussed how there was some ‘interesting’ action in the debt market recently that could be a telltale sign that things were about to burst. But today the 10-year-yield came back down by a fairly noticeable amount; which indicates that the Feds got in the markets and started buying up and manipulating that market too, to prevent a crash. Go figure.

What An Implosion In The Debt Market Would Look Like – And It Isn’t Pretty

Meanwhile on the back of the news of rising interest rates, mortgage rates also rose again.

Investopedia wrote:

As the Federal Reserve prepares to announce its latest interest rate hike, possibly by as much as 75 basis points, mortgage rates are soaring and expected to continue to move higher.

The average rate offered for a conventional 30-year fixed mortgage jumped to 6.51% on Tuesday and is now over 1 percentage point higher than it was two weeks ago, according to data collected by Investopedia’s sister site, The Balance.

Rising rates are taking a toll on the housing market, with home sales falling for six straight months, according to the National Association of Realtors. However home prices have continued to hit record highs, increasing over 20% in March from a year ago, according to the latest S&P CoreLogic Case-Shiller Index report. This marked the strongest increase in the history of the report.

Real estate brokerage Redfin announced it was laying off about 470 employees after May demand came in 17% below expectations. Real estate firm Compass also said it was laying off about 450 workers. Redfin (RDFN) shares are down almost 80% this year, while shares of Compass (COMP) are down over 55%.

Tomorrow, the Census Bureau will release new home construction data for May. Economists are projecting housing starts to slip to 1.72 million units, slightly below April starts.

The U.S. housing market’s slowdown coincides with a 20% rise in homeowner equity to a record high of $27.8 trillion. While that’s good news for homeowners, rising mortgage rates will make them think twice about tapping their homes for equity to spend on other goods and services.

Said Caleb Silver, Editor in Chief of Investopedia

I have previously reported on the crippling housing market, and how it is on the precipice of collapse. Be ready for that to break apart eventually…

Mortgage Rates Continue To Climb. Housing Market On The Verge Of Collapse

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.