Trump has lauded implementing steep tariffs throughout his campaign. Trump intends to slap China with new tariffs – on top of the ones the Biden-Harris administration is already levying – anywhere from 60% to 100%, including a 10% to 20% across-the-board tariff on imports from other countries, including European allies. “I can’t believe how many people are negative on tariffs that are actually smart,” Trump said earlier this year. “Man, is it good for negotiation. I’ve had guys, I’ve had countries that were potentially extremely hostile coming to me and saying, ‘Sir, please stop with the tariff stuff.’”

Trump has also threatened to slap nations attempting to de-dollarize with 100% tariffs on goods as well. “Many countries are leaving the dollar. They not going to leave the dollar with me. I’ll say, you leave the dollar, you’re not doing business with the United States because we’re going to put 100% tariff on your goods,” Trump said in September.

Trump has even threatened tractor manufacturer John Deere with 200% tariffs if the company decides to move some production to Mexico. The former President has also mulled the idea of a 100% tariff on all goods imported from Mexico.

A lot of economists have warned that increased tariffs would increase the price of goods domestically. Investopedia lists a few of the side effects that often come with tariffs:

- They can make domestic industries less efficient and innovative by reducing competition.

- They can hurt domestic consumers since a lack of competition tends to push up prices.

- They can generate tensions by favoring specific industries or geographic regions over others. For example, tariffs designed to help manufacturers in cities may hurt consumers in rural areas who do not benefit from the policy and are likely to pay more for manufactured goods.

- Finally, an attempt to pressure a rival country by using tariffs can devolve into an unproductive cycle of retaliation, commonly known as a trade war.

In a statement to Business Insider, Karoline Leavitt, a Trump-Vance transition spokeswoman, said: “In his first term, President Trump instituted tariffs against China that created jobs, spurred investment, and resulted in no inflation.” She added that Trump will “work quickly” to lower taxes and create more American jobs.

Nevertheless, some companies have already signaled that they will be passing on these extra costs onto the consumer. Citing Business Insider, the heads of AutoZone, Columbia Sportswear, and Stanley Black & Decker had this to say in regard to Trump’s tariff plans:

Philip Daniele, the CEO of the auto-parts company AutoZone, told analysts on a September earnings call that tariff policies had “ebbed and flowed over the years,” and if Trump implemented more tariffs, “we will pass those tariff costs back to the consumer.”

“We generally raise prices ahead of that,” Daniele said, adding that prices would gradually settle over time. “So, that’s historically what we’ve done,” he said.

Tim Boyle, the CEO of Columbia Sportswear, told analysts on an October earnings call that the company was “very concerned about the imposition of tariffs. ” He said that while he considered Columbia adept at managing tariffs, “trade wars are not good and not easy to win.”

Boyle also told The Washington Post in October that the company was “set to raise prices.”

“It’s going to be very, very difficult to keep products affordable for Americans,” he said.

Donald Allan, the CEO of the manufacturing company Stanley Black & Decker, told analysts in an October earnings call that the company had been evaluating “a variety of different scenarios” to plan for new tariffs under Trump.

“And obviously, coming out of the gate, there would be price increases associated with tariffs that we put into the market,” Allan said, adding that “there’s usually some type of delay given the processes that our customers have around implementing price.”

Allan also said the company would consider moving its production out of China and to other countries, such as Mexico, to reduce the impact of a 60% tariff on Chinese imported goods. Steve Madden was among other companies that announced plans to import fewer goods from China, with its CEO, Edward Rosenfeld, saying on an earnings call that the company had already started that process.

Tech companies will also pass on higher costs to Americans. In October, the Consumer Technology Association (CTA) published a report on how Trump’s proposed tariffs would affect the cost of consumer goods. Apple Insider noted by how much prices could increase on popular tech items, writing:

The CTA expects that the price increases could result in notebooks and tablets being priced at 46% higher than current levels. Game consoles could increase in price by 40%, while smartphones could be 26% more expensive.

Computer accessories could go up 10.9%, with monitors possibly costing another 31.2% more, and desktop computers up 6.2%.

The CTA believes that tariffs on the above products, as well as video games, headphones, connected devices, TVs, and batteries could end up reducing the American consumer’s spending power by $90 billion.

The report adds that the tariffs probably won’t result in that much manufacturing returning to the United States at all. Reshoring tech manufacturing to the U.S. likely isn’t going to happen on a large scale, as Tim Cook has said in the past, but it could drive production to other countries instead of China.

AUTHOR COMMENTARY

Naysayers will immediately say that globalization is hurting us (and it is) and that we need to bring jobs back to the U.S. The problem is that this country simply does not have the infrastructure and manufacturing capacity, and one cannot simply flip a switch and turn this country into a production juggernaut again overnight.

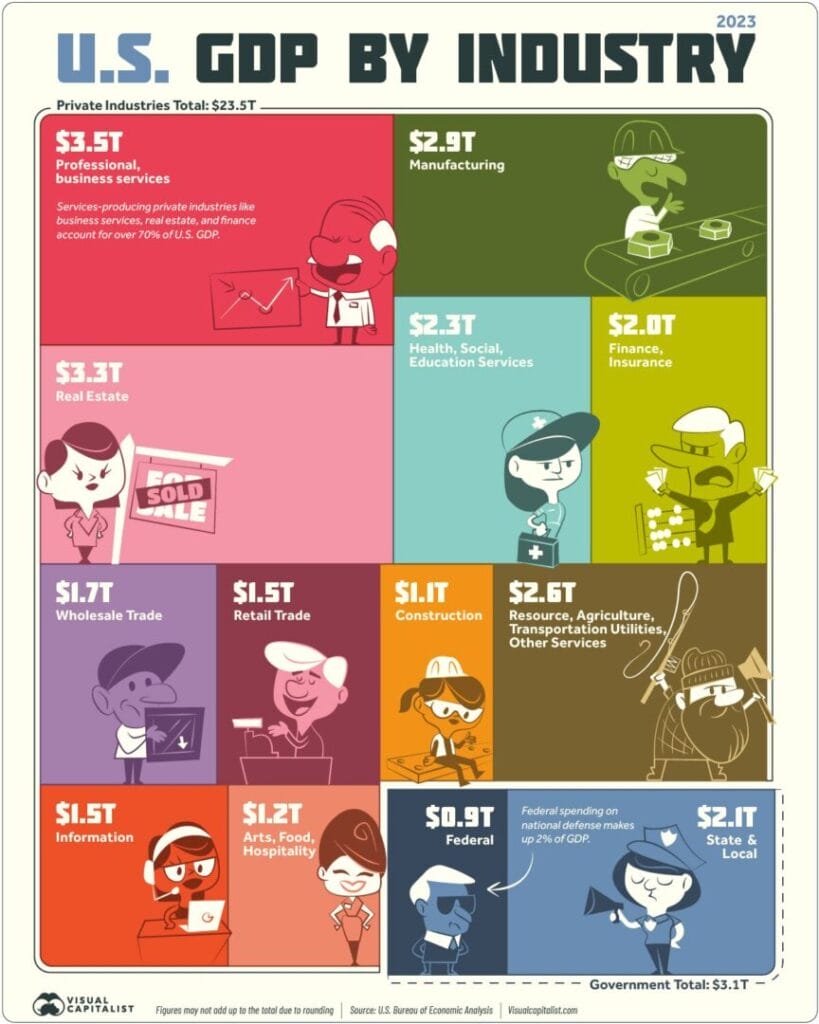

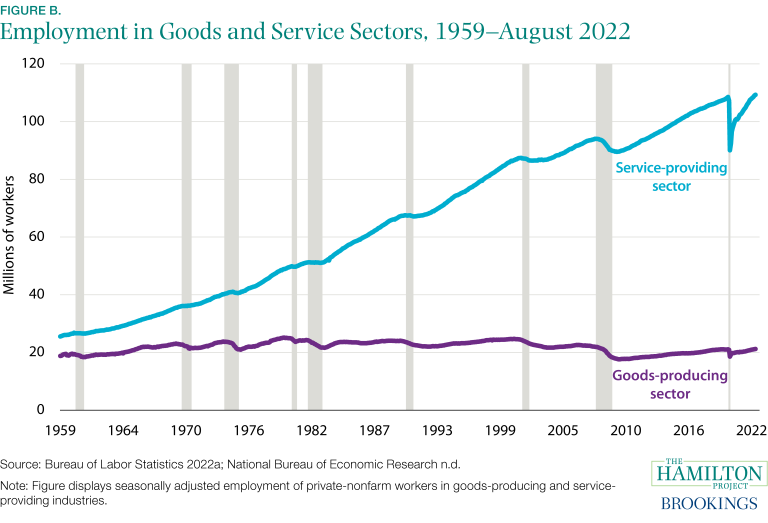

The U.S. is a service and consumer-based economy. The country manufactures very little anymore. Only 11% of the nation’s GDP in 2023 was in manufacturing. This country is an importer nation.

I want better paying jobs in this country; I wish this country’s politicians and crooked corporations would not have sold us out for cheap labor elsewhere; but imposing self-defeating measures by drastically increasing protectionist measures will only make the problem worse. Free trade and competition allows for cheaper prices: this is monetary theory and economics 101.

I have warned for months that Trump’s policies will drastically increase the prices of everything, and now you are reading it straight from the heads of these different companies across different sectors. On top of this, one must also consider that he will be cutting the corporate tax rate from 21% to 15% while interest rates move lower. This will allow corporations to pay even less while we are forced to pay substantially more, thereby pushing stock prices higher.

If you are going to spend your money, then do so with care, and you might consider stocking up on an array of items now before they get crazy more expensive next year and into 2026.

Proverbs 10:15 The rich man’s wealth is his strong city: the destruction of the poor is their poverty.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Idiots only believe that tariff will help the United States Socialist of America (U.S.S.A) industries. The U.S.S.A has no industry, but debt that will never be paid. Nobody wants U.S.S.A’s products. You beloved G want to make you transhuman or robotics without your consent. It is either you consent to be mindless cyborgs and you are already Augmented Human adopt or will be killed by your beloved G.

In international economics, a country cannot operate in autarky and it must find its comparative advantage to trade with other countries. Say that Bill is good at baking and making bread, he should be baker. While Phil has a green thumb and he can grow apples, he should be Apple farmer. At some point one has to find some specialization to become more efficient producing something. For instance, Switzerland is great at making Rolex watches, while the U.S. is good at making muscle cars. Both countries will benefit by trading rather imposing tariffs. Nonetheless, ordinary people will be hurt. The Lizard Richman Sperm Club will not be hurt. They have money to spend.

In the end, it doesn’t matter. You are either to receive government’s Universal Basic Income and the AGI Displaces Human Work the integration of Artificial General Intelligence (AGI) and robotics automation is expected to significantly displace jobs, particularly those that are routine, repetitive, or can be easily automated. According to various estimates, AGI and robotics could displace more jobs than they create by 2025.

It is always look here. Don’t look there.

https://odysee.com/@Psinergy:a/trim.AD92A960-6E44-4614-BBF9-CCA5433D9A88:c

Censorship is real in this website.

Some genuinely great content on this website , thanks for contribution.

Hi, i think that i saw you visited my blog so i came to “go back the prefer”.I’m attempting to to find issues to enhance my website!I suppose its good enough to make use of some of your concepts!!