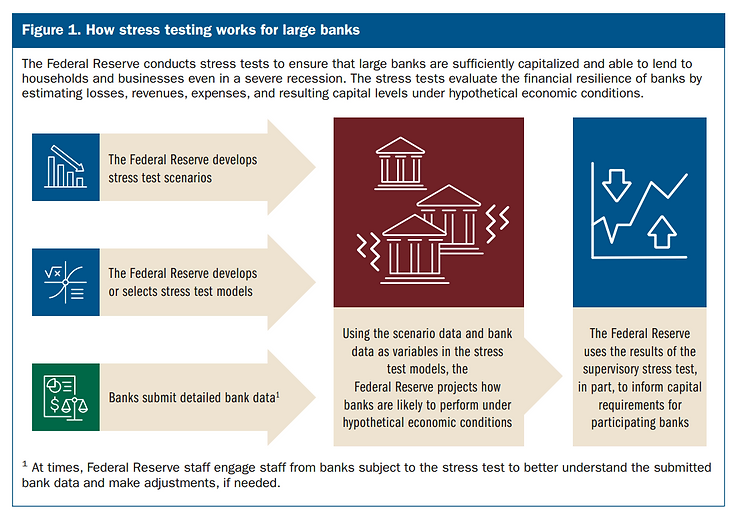

In 2008, the Feds introduced a stress test annually that put the banks’ books through a series of simulated possibilities, marking to see if these hefty institutions could handle serious economic turmoil and events. This year it was revealed that Goldman Sachs actually failed.

The fine data from this year’s results can be viewed on the Fed’s website.

The Institutional Risk Analyst explained what the data represents:

Just by coincidence, Stephen Gandel and Joshua Franklin of the FT wrote an important piece last week reporting on the results for Goldman Sachs. They suggest that the bank is attempting to change the Fed stress test results. “Goldman Sachs faces long odds in getting the Federal Reserve to reconsider its disappointing grade in this year’s bank stress tests, according to regulatory experts,” they relate.

We reminded readers in our last missive (“Who Leads the Asset Gatherers? | SCHW, MS, GS, AMP, RJF & SF“) that GS continues to have the worst credit performance of the group. We regret to say that the Fed test results confirm our view and more. If you page through the individual bank stress test results, you will see that GS is clearly the outlier in the group in terms of assumed credit and counterparty risk losses through to Q1 2026.

“Goldman in some ways fared better on the Fed’s stress test than it did on its own, which the banks also had to disclose last week,” the FT reports. “Its internally run stress test predicted a bigger drop in revenue and larger trading losses in an economic downturn that the one run by the central bank.”

While other, large banks such as Citigroup (C) were able to negotiate the stressed scenario losses imposed by the Fed’s test, Goldman missed the target completely and ended up below the minimum capital level for the bank. Remember, each test is different for each bank, thus the test results suggest how the Fed views a given bank business model. Just remember that the Fed stress tests are not a fair comparison of the soundness of one bank to another.

The FT reports that GS may not be able to increase dividends or share buybacks as a result of its poor test performance. Perhaps the Fed has finally discovered that GS is one of the most risky banks in the US. Sure, Morgan Stanley (MS) has a slightly bigger derivatives book than does Goldman, but rarely reports a significant credit loss.

Goldman under CEO David Solomon, however, is shoveling money into the furnace in terms of credit losses even with an 11% gross loan spread. Notice, by comparison, that MS barely saw a reduction in capital and reported a small loss relative to GS and other universal banks. Citi compares well with the other top-five moneycenter banks.

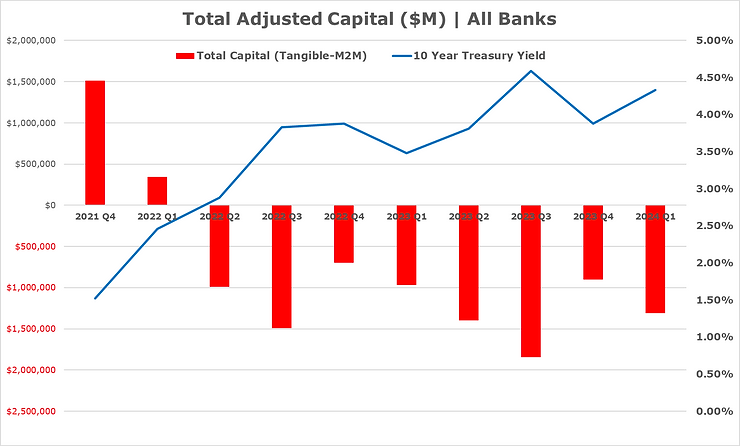

The outlet also pointed out: ‘Notice that the Fed stress test is silent on trillions of dollars in mark-to-market losses facing US banks from COVID-era MBS and US Treasury debt. How can the Fed report to Congress on the state of US banks and not mention that many institutions (and the central bank itself) are insolvent? This sad state is due to radical swings in interest rates engineered by the FOMC since Q1 2020. The chart below comes from our earlier comment with the full mark-to-market analysis for all US banks (“Q2 2024 Earnings Setup: JPM, BAC, WFC, C, USB, PNC, TFC“).’

AUTHOR COMMENTARY

I don’t want to get into all the technical jargon as it’s not really relevant to us, so don’t feel too bad if you don’t quite understand all of this stuff.

All you need to know is that the banks are in trouble, and the government, media, and Federal Reserve are covering up how severe of an issue this is, that will continue to persist this year and especially in 2025.

Therefore, be prudent where you put your money. I continue to recommend that you keep most of it outside the system. Put it under your mattress or whereever, just avoid the banks. Only keep the necessary amount in to maintain a balance, pay bills and buy stuff online.

Proverbs 14:15 The simple believeth every word: but the prudent man looketh well to his going.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.