The following report is a press release by the UN Trade and Development Organization (excerpts):

In a new report released on 4 June, the United Nations sounded the alarm over the escalating debt burdens to global prosperity.

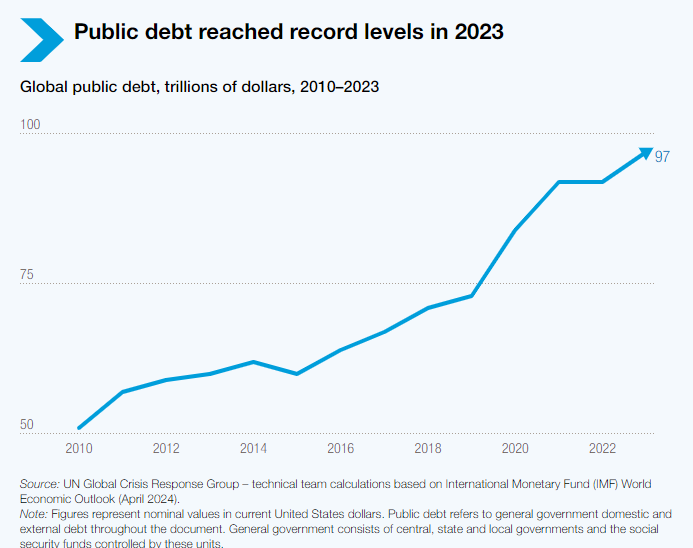

Titled ”A world of debt 2024: A growing burden to global prosperity”, the report highlights the unprecedented surge in public debt – comprising both domestic and external general government borrowing – which reached a historic peak of $97 trillion in 2023, up by a notable $5.6 trillion from the previous year.

Particularly in Africa, faltering economies in the wake of multiple global crises have resulted in a heavier debt burden. The number of African countries with debt-to-GDP rations above 60% has increased from 6 to 27 between 2013 and 2023.

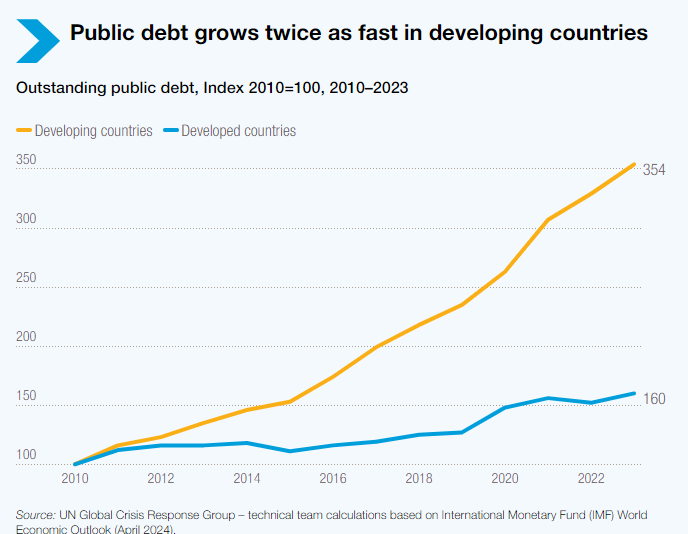

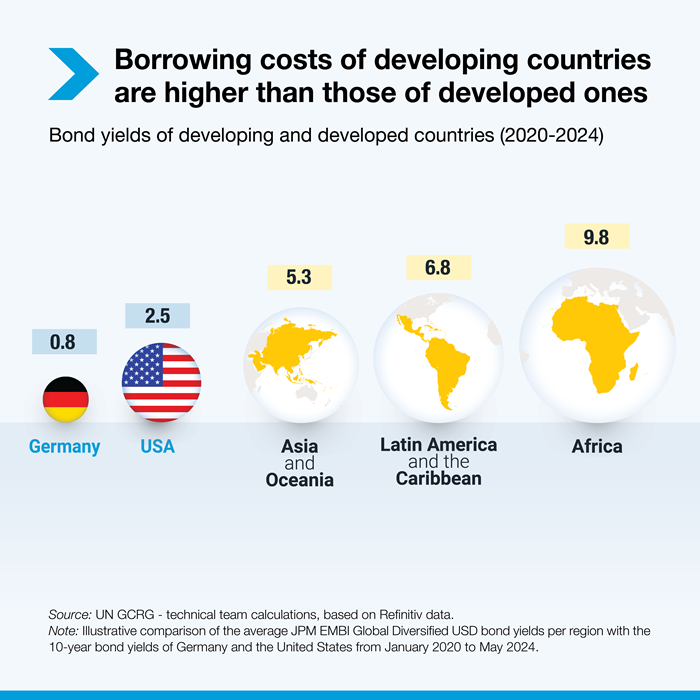

Meanwhile, repaying debt has become more costly, and this is hitting developing countries disproportionately.

In 2023, developing nations paid $847 billion in net interest, a 26% increase from 2021. They borrowed internationally at rates two to four times higher than the U.S. and six to 12 times higher than Germany.

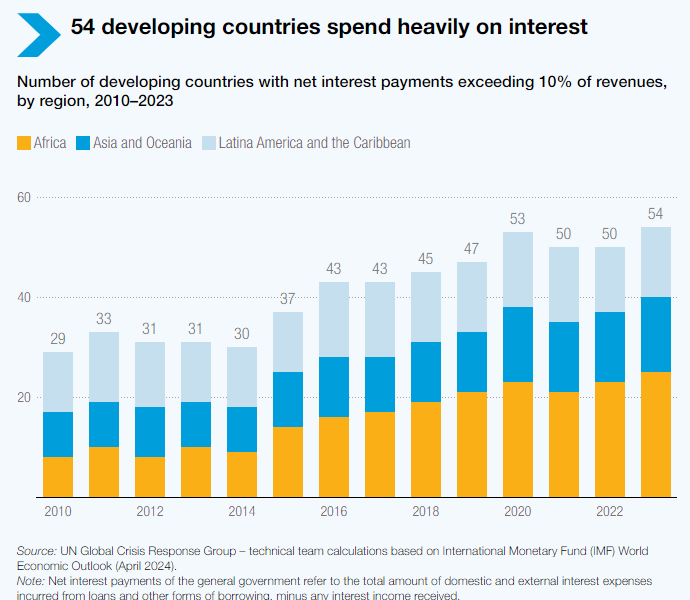

The rapid rise in interest costs is limiting budgets in developing countries. Presently, half of them designate a minimum of 8% of government revenues to debt servicing, a number that has doubled in the last ten years.

Moreover, in 2023, a historic 54 developing nations, with almost half in Africa, dedicated a minimum of 10% of government funds to debt interest payments.

With the crisis intensifying, actions to limit global warming to 1.5°C become urgent. Despite this urgency, developing countries are currently allocating a larger proportion of their GDP to interest payments (2.4%), than to climate initiatives (2.1%). Debt is limiting their capacity to tackle climate change.

The report revealed that 3.3 billion individuals reside in nations where interest payments exceed spending on either education or health.

In Africa, the average person’s spending on interest ($70) surpasses that of education ($60) and health ($39) per capita. A staggering 769 million Africans live in countries where interest payments outweigh investments in either education or health, accounting for nearly two-thirds of the entire population.

AUTHOR COMMENTARY

The Trends Journal provided their forecast (most of it) based on this information:

TREND FORECAST: China borrows to build infrastructure so its annual GDP figure looks good.

In the U.S., Joe Biden and Democrats in Congress passed massive new spending bills to fund tech manufacturing, green energy, and infrastructure repair without raising revenue enough to pay for them.

During Donald Trump’s presidency, he and Congressional Republicans passed an unfunded tax cut that shot the annual deficit past $1 trillion for the first time, and that was before COVID arrived.

Now Trump has promised “a Trump middle class, upper class, lower class, business class big tax cut” if he returns to the White House, he told an 11 May rally. Thus, the lower the taxes the less money the government has to pay its bills.

And while Trump brags about his tax-cuts, the one he did in 2017, according to the Tax Policy Center, the “one percent” got 64 percent of the tax cuts.

Also, Trump sold the line that the tax cuts to the big corporations would result in their spending money on capital improvements. It did not, instead, they used the money for stock buy-backs and set a buy back record in 2018.

As we have said previously, voters give politicians little motivation to run on a platform of raising taxes and cutting spending on the military industrial complex and social programs.

Global debt has become a crisis acknowledged by the Institute of International Finance, the International Monetary Fund, the World Bank, and other global watchdogs.

The current trend of spending deeper into debt will continue until another national or global financial crisis threatens to plunge the world into an economic death spiral.

Even at the current level of debt danger, developed economies will see more banks fail, more households claim bankruptcy, consumers able to buy less, and economies slowing further, with more falling into recession and staying there longer.

Populist movements fueled by grievance and victimhood, such as America’s MAGA movement, will, as we have long forecast, keep gaining strength.

Emerging nations will fare worse.

Many of those economies survive by exporting timber, minerals, and other resources. A puckered global economy requires less of those inputs, as we saw during the COVID War.

Several emerging nations already are struggling to repay massive debt and are pleading with the International Monetary Fund for loans. A few countries, such as Sri Lanka and Zambia, already have defaulted.

As defaults throw developing economies into turmoil, people increasingly will take to the streets to protest government incompetence, corruption, crime, and violence. Social and political chaos will boil, all part of our long-range Top Trend of New World Disorder.

These events will, in turn, drive more people from their home countries to seek refuge in safe-haven nations—and in those nations where they seek refuge, there will be growing anti-immigration, anti-establishment, populist movements to stop the refugees from entering their nations.

I believe this forecast is very well-put and will play out to varying extents. And this is a big reason why a lot of Gen-Z’ers are totally checked-out and expect everything to get drastically worse quick. SEE: Poll Finds Young Americans Believe US Is ‘A Dying Empire Led By Bad People’

Ultimately, this eventual debt implosion will result in a lot of death, disparity and deep penury.

Proverbs 22:26 Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee?

Proverbs 28:8 He that by usury and unjust gain increaseth his substance, he shall gather it for him that will pity the poor.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Debt is building up more and more each day.

We MUST pray that God protects us – pray and fast especially that God will protect and provide for us. Whenever I pray for God’s judgement upon America, I ask God as a plea “don’t forget about me, and my brothers and sisters in You Lord, don’t forget about them either, Lord!”

Can somebody tell me the verse, I think it’s in Jeremiah, where we ask God not to forget about us?

The massive debt climb also equals the economy crashing down. Just overnight it seems, Rue 21 all over America every single last one of them, just shut their doors in the blink of an eye! The retail apocalypse as well is a byproduct of the economic downfall.

The debt ladder just keeps climbing up! Which also explains the US economy collapsing. Just a little over 2 weeks ago, Rue 21 which was around since 1970 just all of a sudden at random closed all of their stores!

We need to pray for God’s protection and mercy – I suggest prayer and fasting!

I pray for God’s judgement upon America and I also pray that God doesn’t forget about me and my truly saved brothers and sisters as well even.