According to the BIS in blog post from 2022, ‘Project mBridge is a collaboration between the BIS Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China and the Central Bank of the United Arab Emirates.’

They add: ‘After experimenting with different technology architectures in earlier phases of the project, the project team developed a new blockchain – the mBridge Ledger – custom-built by central banks for central banks to serve as a specialised and flexible platform for implementation of multi-currency cross-border payments in central bank digital currencies (CBDCs).’

More recently, the BIS announced that much progress has made with mBridge and are now ready to begin the next major phase of development, indicating that CBDCs around the world are close to being implemented via nation’s central banks. Additionally, the BIS announced in its press release that Saudi Arabia has become the latest member to join in the mBridge collaboration.

The BIS wrote in their press release:

Project mBridge continues its development and has reached the minimum viable product (MVP) stage, while broadening its international reach. The project aims to explore a multi-central bank digital currency (CBDC) platform shared among participating central banks and commercial banks, built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement.

[…] The Saudi Central Bank is joining mBridge as a full participant.The project aims to tackle some of the key inefficiencies in cross-border payments, including high costs, low speed and operational complexities. It also addresses financial inclusion concerns, particularly in jurisdictions where correspondent banking (which connects countries to the global financial system) has been in retreat, causing additional costs and delays. Multi-CBDC arrangements that connect different jurisdictions in a single common technical infrastructure offer significant potential to improve the current system and allow cross-border payments to be immediate, cheap and universally accessible with final settlement.

A platform based on a new blockchain – the mBridge Ledger – was built to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions. In 2022, a pilot with real-value transactions was conducted. Since then, the mBridge project team has been exploring whether the prototype platform could evolve to become an MVP – a stage now reached.

To achieve this, the four founding participant central banks and monetary authorities have each deployed a validating node, while commercial banks have conducted more real-value transactions in preparation for the MVP release. In tandem, the project steering committee has created a bespoke governance and legal framework, including a rulebook, tailored to match the platform’s unique decentralised nature.

The MVP platform is enabled to undertake real-value transactions (subject to jurisdictional preparedness) and is also compatible with the Ethereum Virtual Machine. This allows it to be a testbed for add-on technology solutions, new use cases and interoperability with other platforms.

As it enters the MVP stage, Project mBridge is now inviting private sector firms to propose new solutions and use cases that help develop the platform and showcase all its potential. Interested firms can apply to participate via the participation form.

As of June 2024, the observing members to Project mBridge include: Asian Infrastructure Investment Bank, Bangko Sentral ng Pilipinas; Bank Indonesia; Bank of France; Bank of Israel; Bank of Italy; Bank of Korea; Bank of Namibia; Central Bank of Bahrain; Central Bank of Chile; Central Bank of Egypt; Central Bank of Jordan; Central Bank of Malaysia; Central Bank of Nepal; Central Bank of Norway; Central Bank of the Republic of Türkiye; European Central Bank; International Monetary Fund; Magyar Nemzeti Bank; National Bank of Cambodia; National Bank of Georgia; National Bank of Kazakhstan; New York Innovation Centre, Federal Reserve Bank of New York; Reserve Bank of Australia; South African Reserve Bank; and World Bank.

Additionally, Mr Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (HKMA), said in a separate statement:

With the collaborative efforts of the central banking community and the private sector, the cross-border payment landscape is undergoing significant development.

The HKMA is very pleased to be an active member of this most advanced multi-CBDC exploration of the BIS Innovation Hub and to have contributed to the progression of mBridge to the MVP stage. We cordially invite other central banks peers to join us on this mBridge journey, whether as users to experience the benefits of the platform firsthand, or as co-developers to enhance cross-border payments together.

Interestingly enough, this announcement by the Saudi Central Bank to join BIS’ mBridge comes at a time when the original contractual agreement by the United States and Saudi Arabia to establish the petrodollar on June 6, 1974, technically expired on June 9th. This has caused a number of social media profiles and independent financial channels to insinuate that the dollar will soon collapse because the deal expired.

With Saudi Arabia becoming a member of the BRICS bloc to start 2024, this now opens the door for the country to begin selling their oil in other currencies and not just exclusively dollars anymore.

Lena Petrova, CPA, who regularly reports on the development and rollout of CBDCs and the BRICS bloc, is of the contrary opinion that this latest move by the Saudis actually has very little to do with the petrodollar.

In short, she says what she really thinks this represents and how far off the implementation of CBDCs are:

[…] It means an end to an illusion rather that the launch of a [CBDC] is lightyears away – it’s certainly not the case, it’s going to happen sooner than we think; and in this particular case a wholesale CBDC has not implication on individuals, but it is safe to assume the retail CBDCs will follow shortly thereafter. […] Nevertheless, let’s be realists: Saudi Arabia will continue settling transactions in United States dollars with its Western and regional partners. It will do both, and it will benefit from it tremendously. Petrova said. Watch her update fore more details

AUTHOR COMMENTARY

The CBDC agenda is not failing nor has there been any real indication that it is, and the BIS’ latest announcement of them entering their next stage of CBDC development is proof of that.

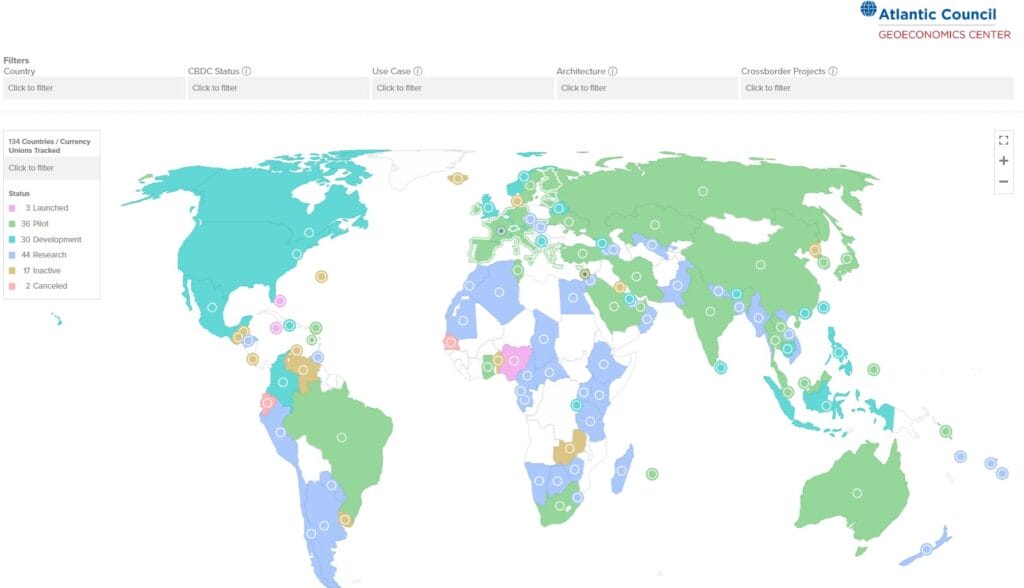

I have PLENTY of other reports on the incoming CBDC agenda and how we are not that far off from international implementation. I can’t give an exact date but it is definitely around the bend. Definitely give the articles a read for a refresher. As of January, over 130 countries are actively working on a CBDC at varying stages of development.

Allow me to use this passage for instruction in righteousness to illustrate a point:

1 Corinthians 15:35 But some man will say, How are the dead raised up? and with what body do they come? [36] Thou fool, that which thou sowest is not quickened, except it die: [37] And that which thou sowest, thou sowest not that body that shall be, but bare grain, it may chance of wheat, or of some other grain:

I realize this passage is talking about the resurrection, but it still helps explain my point. Central banks and governments are not going to speak softly and present it to the public, eagerly crossing their fingers hoping the public will accept; no, they are going to (and they are right now) actively and systematically destroying the current system in a controlled demolition, and then when they intentionally allow this gigantic Ponzi scheme to collapse, and chaos ensues, then they will roll it out with a desperate and groveling population that will submit to another to survive and keep their fake wealth. Count on it. I will discuss this in other future reports. SEE: Must Read: Top Economist And Professor Reveals That Central Banks Want To Microchip People So They Can Administer CBDCs

This is not “defeatism,” this is reality; this is not fearmongering and scare tactics, this is reality: time to start living in it. Again, as I said, I have reports and sermons I have been holding on to for a while now that need to be brought out that I suppose will help you better understand where things are going.

Proverbs 27:7 The full soul loatheth an honeycomb; but to the hungry soul every bitter thing is sweet.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Saudi is Sheba and Dedan. Part of the Whore’s antichrist team with & against Jerusalem & the Lord Jesus Christ. Their ‘help’ and their ‘partnership’ is treacherous: only words, & as for their part in BRICS: it will still be a petrocurrency. Rome is just changing mounts, actually astride both: white pope, black pope. See Ezekiel 38 & Psalm 83 KJB. Something crazy & unexpected by all is going to happen. Eyes on Jesus, watch and pray.

Well I have to practice what I preach. I say to FEAR NOT and it’s hard sometimes because of these unannounced actions they throw at us, but hopefully we will not see this due to be taken out of here in the Pre-Tribulation Rapture, I pray.

Great – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Excellent task.

Enjoyed reading through this, very good stuff, thankyou.

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! By the way, how can we communicate?