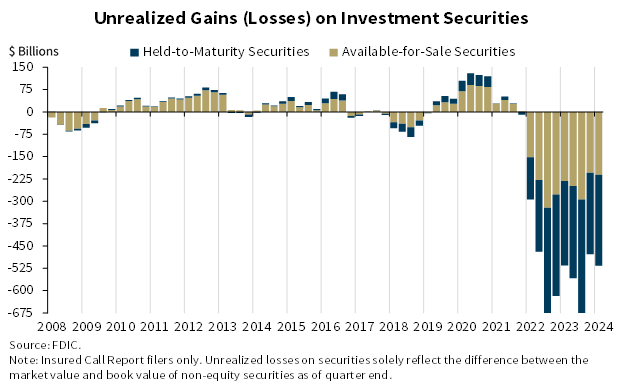

The Daily Hodl explained that ‘unrealized losses represent the difference between the price banks paid for securities and the current market value of those assets. Although banks can hold securities until they mature without marking them to market on their balance sheets, unrealized losses can become an extreme liability when banks need liquidity.’

The FDIC stated:

Unrealized losses on available-for-sale and held-to-maturity securities increased by $39 billion to $517 billion in the first quarter. Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase. This is the ninth straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022.

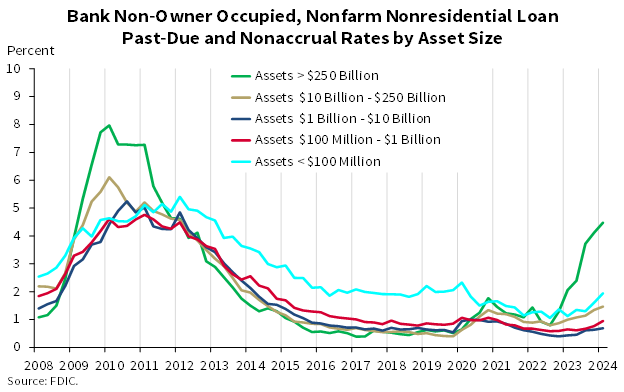

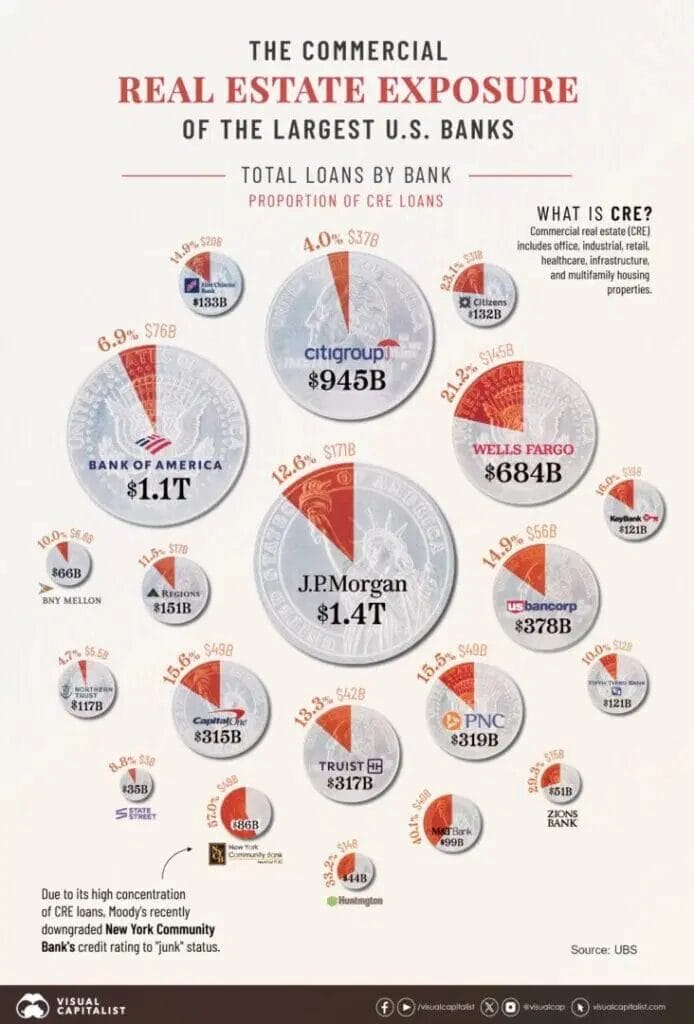

The increase in noncurrent loan balances continued among non-owner occupied CRE loans, driven by office loans at the largest banks, those with assets greater than $250 billion. The next tier of banks, those with total assets between $10 billion and $250 billion in assets, is also showing some stress in non-owner occupied CRE loans.

Weak demand for office space is softening property values, and higher interest rates are affecting the credit quality and refinancing ability of office and other types of CRE loans. As a result, the noncurrent rate for non-owner occupied CRE loans is now at its highest level since fourth quarter 2013.

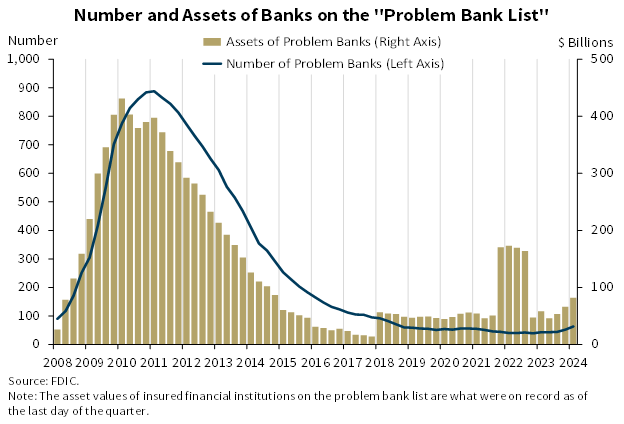

Additionally, the FDIC says the list of institutions on its Problem Bank List increased last quarter and are near insolvency.

The number of banks on the Problem Bank List, those with a CAMELS composite rating of “4” or “5,” increased from 52 in fourth quarter 2023 to 63 in first quarter 2024. The number of problem banks represented 1.4 percent of total banks, which was within the normal range for non-crisis periods of one to two percent of all banks. Total assets held by problem banks increased $15.8 billion to $82.1 billion during the quarter.

The FDIC explained

In March, Federal Reserve Chair Jerome Powell stated that there will be bank failures due to their overexposure to CRE loans.

You know this is a problem that we’ll be working on for years more I’m sure. There will be bank failures, but this is not the big banks. If you look at the very big banks it’s not a first order issue for any of the of the very large banks. It’s more, you know, smaller and medium-sized banks that have these issues.

We’re working with them, we’re getting through it – I think it’s manageable, is the word I would use, but it’s you know it’s a very active thing for us and the other regulators, and it will be for some time.

Powell said during a Senate Financial Committee hearing

However, Powell undersold the issue and claimed that this problem was limited to only small and regional banks. The FDIC on the other hand contradicted Powell and warned that the big banks also have heavy exposure to underwater CRE contracts.

The increase in noncurrent loan balances was greatest among CRE [Commercial Real Estate] loans and credit cards. Weak demand for office space has softened property values and higher interest rates are affecting credit quality and refinancing ability of office and other types of CRE loans. As a result, the noncurrent rate for nonowner occupied CRE loans is now at its highest level since first quarter of 2014, driven by portfolios at the largest banks.

Chairman Martin Gruenberg said at the time

Also in March, a Scott Rechler, an active member of the board for the Federal Reserve of New York, said in a note that 500 or so banks will indeed fail in the not-too distant future. “I think there’s going to be…500 or more fewer banks in the U.S. over the next two years. I’m not saying they’re all going to fail, but they’re going to be forced into consolidation if they don’t fail,” he warned.

Bank Bail-ins: US Regulators Warned To Be Ready To Handle Failed Clearing Houses

AUTHOR COMMENTARY

The FDIC is underselling just how serious of an issue this is; and you can go read some of my other reports on this issue to get further details on just how systematic the issue is, and will affect us all. Should these 62 banks fail, the domino effect it will create will put pressure on the rest of the banks that are also teetering, causing massive bank runs, bail-ins and bail-outs.

This banking bust is serious business, and only in recent months has it now finally started to get some coverage in mainstream media, but even that is still watered down and does not fully get into the weeds of the issue.

We are heading into a banking bust the likes of which has never been seen before, and when the lit match is thrown into warehouse full of fireworks there will be no stopping it, and that will destroy the economy as we know it; plus, when you factor in an inevitable pan-selloff in the debt market when the Fed and other wealth managers start dumping all this bad debt onto the market with no where to go; and subprime auto increasingly going bust, home affordability unattainable at this point, consumer credit going pop, student loans, all the money printing, etc…

If it is somehow staved-off this year, for the most part, then the dominoes will be allowed to fall in 2025 for sure, in my opinion.

Proverbs 22:3 A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished. [7] The rich ruleth over the poor, and the borrower is servant to the lender.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

The banks would sell whatever property they had in an attempt to pay every dollar they owed, but we how this will end up.