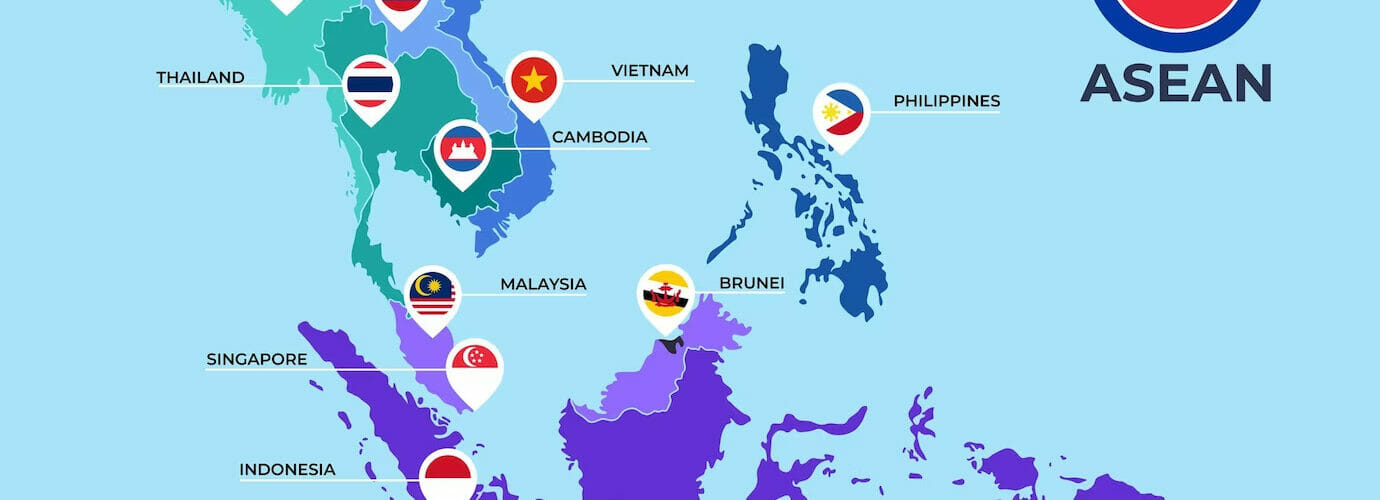

ASEAN comprises 10 different Asian nations, which include: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam; with Australia and New Zealand also working closely with this association via new a free trade agreement pact established in November, 2022. Subtract Australia and New Zealand, and ASEAN affects over 600 million people and is one of the world’s largest economies.

The International Monetary Fund (IMF), says the combined GDP of ASEAN nations is approximately $4 trillion.

This move to further wash their hands of the U.S. dollar is explained by Watcher.Guru:

If the ASEAN alliance completely starts using local currencies for trade, the U.S. dollar will be in jeopardy. In particular, Indonesia is the most aggressive among the lot in pushing the de-dollarization agenda ahead. Indonesian President Joko Widodo is urging the bloc to quickly move away from the U.S. dollar and start using local currencies.

The move will strengthen their native economies giving local currencies a boost in the global foreign exchange markets. Several developing countries fear the rising U.S. debt of $34.4 trillion can affect their native economies and businesses. Therefore, the only solution to American debt is to make ASEAN countries use local currencies and sideline the U.S. dollar.

The U.S. pressing sanctions on other developing countries is also among the reasons why ASEAN wants to ditch the dollar. A stronger local currency will have no adverse effects from U.S. sanctions making their economies safer. In conclusion, the next decade will be different for the U.S. dollar as many nations are looking to uproot it.

The WinePress reported over a year ago when ASEAN formally announced their intentions to “reduce dependence on the US Dollar, Euro, Yen, and British Pound from financial transactions and move to settlements in local currencies.”

SEE: ASEAN Bloc Increases Use Of Instant Transfer Payment Systems In Precursor To CBDCs

AUTHOR COMMENTARY

The U.S. dollar is on borrowed time. With ASEAN dumping the dollar, and especially with BRICS nations leading that charge – with over 40 nations expressing interest in joining the bloc, on top of the other five that joined last year – the U.S. dollar is quickly on its way out. I suspect, in my opinion as it stands, it appears 2025 is shaping up to be ‘the year’ of total economic chaos…

Empires rise and fall, and the United States of America is just the latest addition to the history books.

Job 12:23 He increaseth the nations, and destroyeth them: he enlargeth the nations, and straiteneth them again.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Seems the dominos are starting to fall, for the US Dollar! Even though 2025 may be the year things totally collapse, I have to think the cost of everything will start increasing again, on top of the Huge inflation since 2022. I am

Still going to shy away from

Gold /Silver… and continue to keep purchasing more dry goods n supplies. Maybe even more in the next 4 to 6 weeks before prices skyrocket