In a post on Truth Social on April 23rd, Trump wrote:

The Dollar has just hit a 34 year high against the Yen, a total disaster for the United States. When I was President, I spent a good deal of time telling Japan and China, in particular, you can’t do that. It sounds good to stupid people, but it is a disaster for our manufacturers and others.

They are actually unable to compete and will be forced to either lose lots of business, or build plants, or whatever, in the “smart” Countries. This is what made Japan and China into behemoths years ago. I put limits on both (and others!), and if they violated those limits, there was hell to pay. Biden has let it go. Watch them now pick apart the U.S. It will be an open field day. Don’t let this happen Crooked Joe. Wake up and smell the roses!

Forbes noted in a report, ‘Trump is exploring options to devalue the dollar if he returns to office in November in order to address the U.S. trade deficit with countries like China and Japan, Politico reported—a move widely criticized by experts who say this could also contribute to inflation and raise prices for American consumers.’

Additionally, Trump’s advisers have also hinted at penalties for nations that move away from the dollar.

Bloomberg noted that these ‘discussions include penalties for allies or adversaries who seek active ways to engage in bilateral trade in currencies other than the dollar — with options including export controls, currency manipulation charges and tariffs, the people said, speaking on the condition of anonymity.’

Trump and his advisers have insinuated that, should he be reelected, he will move to stop BRICS and others from de-dollarizing.

I hate when countries go off the dollar. I would not allow countries to go off the dollar because when we lose that standard, that will be like losing a revolutionary war. That will be a hit to our country.

With Biden, you’re going to lose the dollar as the standard. That’ll be like losing the biggest war we’ve ever lost.

Trump said in a March 11th interview on CNBC

Trump has indicated a number of other times during his presidency that he hates a strong American dollar.

In April, 2017, USA Today reported: ‘In an interview with The Wall Street Journal, the president made headlines and moved currency and bond markets when he said the strength of the U.S. dollar was hurting the competitiveness of U.S. companies that do a lot of business abroad. Trump also admitted he’s a fan of lower interest rates, saying, “I do like a low-interest rate policy, I must be honest with you.”‘

I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me.

It’s very, very hard to compete when you have a strong dollar and other countries are devaluing their currency.

He said during the interview

He also noted in that interview, speaking of then Federal Reserve Chair Janet Yellen, now Treasury Secretary under Biden, said “I like her, I respect her.”

Trump echoed similar sentiments in 2019, saying that he is not joyous that the dollar is strong. He said in a tweet:

As your President, one would think that I would be thrilled with our very strong dollar. I am not! The Fed’s high interest rate level, in comparison to other countries, is keeping the dollar high, making it more difficult for our great manufacturers like Caterpillar, Boeing, John Deere, our car companies, & others, to compete on a level playing field.

With substantial Fed Cuts (there is no inflation) and no quantitative tightening, the dollar will make it possible for our companies to win against any competition.

We have the greatest companies, in the world, there is nobody even close, but unfortunately the same cannot be said about our Federal Reserve. They have called it wrong at every step of the way, and we are still winning. Can you imagine what would happen if they actually called it right?

Negative Interest Rates

President Trump has also advocated for negative interest rates. Essentially, negative interest rate policies would push customers to pay banks to hold their savings and reserves, and gift interest to those who hold onto debt, such as personal loans or mortgages.

As explained by Investopedia:

The idea of negative interest rates may seem counterintuitive, if not downright crazy. In a world where lenders make money by charging their customers interest, why would they be willing to pay someone to borrow money? In this case, the lender is the one taking the risk of defaulting on the loan. As strange as it may seem, there are times when central banks run out of policy options to stimulate their nations’ economies and turn to the desperate measure of negative interest rates.

- Negative interest rates are an unconventional, and seemingly counterintuitive, monetary policy tool.

- Central banks impose negative interest rates when they fear their economies are slipping into a deflationary spiral with no spending, dropping prices, no profits, and no growth.

- Cash deposited at a bank yields a storage charge rather than the opportunity to earn interest income when rates are negative

- The idea of negative interest rates is to incentivize loaning and spending, rather than saving and hoarding.

- Several European and Asian central banks have imposed negative interest rates on commercial banks.

When interest rates are negative, lenders pay borrowers for holding debt. This means that someone gets paid interest for holding a loan, such as a mortgage or personal loan. As such, banks lose out while borrowers benefit. Savers, on the other hand, lose out. That’s because it costs them money to store their cash at the bank. This means that they don’t earn any interest on their deposits. Instead, they pay their bank interest to hold their savings.

When the Eurozone inflation rate dropped into deflationary territory at -0.5% in Mar. 2015, European policymakers promised to do whatever it took to avoid a deflationary spiral. However, even as Europe entered unchartered monetary territory, many analysts warned that negative interest rate policies could have severe unintended consequences.

In September 2019, Reuters reported: ‘U.S. President Donald Trump’s push for low interest rates reached a new pitch on Wednesday, when he demanded the Federal Reserve take the extraordinary step of sending them below zero.’

The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. We have the great currency, power, and balance sheet… The USA should always be paying the … lowest rate. No Inflation!

It is only the naïveté of (Fed Chairman) Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of ‘Boneheads.’

Said in a tweet

On November 12th, 2019, Trump said during a speech to the Economic Club of New York:

Remember we are actively competing with nations that openly cut interest rates so that many are now actually getting paid when they pay off their loan, known as negative interest. Who ever heard of such a thing? Give me some of that. Give me some of that money. I want some of that money. Our Federal Reserve doesn’t let us do it.

He said

More Tax Breaks For The 1%

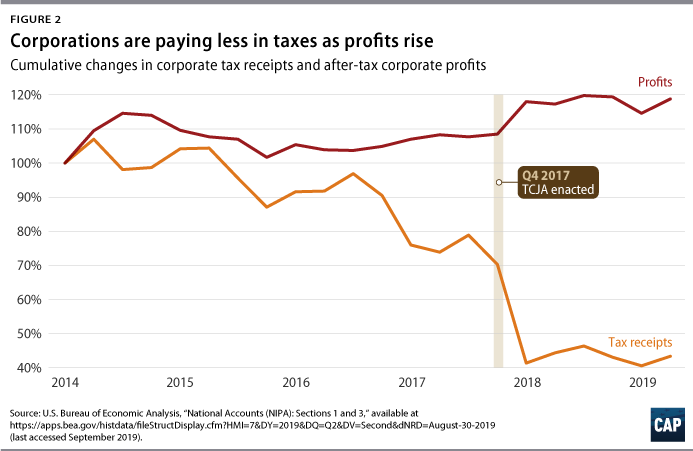

Donald Trump has signaled that he would cut the corporate tax rate further than what he already did when he was President. Trump, a proponent of “trickle-down effect,” cut the corporate tax rate from 35 percent to 21 percent via the Tax Cuts and Jobs Act of 2017 (TCJA). Now Trump and his team have indicated they are looking to cut the corporate tax rate down to 15%, coupled with a 10% across-the-board tariff

When Trump passed the TCJA in 2017 he lauded that it would increase the average household income in the United States by $4,000, and perhaps even upwards of $9,000, according to an official White House document. Americans, however, were not anymore better off, according to statistics cited by the Center for American Progress (CAP).

Instead, the money that was supposed to reach the common American simply stayed within corporations and the nation’s very top earners. CAP wrote: ‘Instead of substantially increasing investment, the windfall businesses received largely went to paying off wealthy investors. One analysis of Fortune 500 companies found that just 20 percent of increased cashflow in 2018 was spent on increasing capital expenditures or research and development.’

‘The remaining 80 percent of cashflow went to investors through buybacks, dividends, or other asset planning adjustments. The vast majority of corporate stocks are held by the wealthy, including foreign investors, and thus they are the ultimate beneficiaries of the windfall corporate tax cuts,’ the group added.

Furthermore, ‘as the TCJA was being rushed through Congress, critics warned that some of the key international tax provisions would actually create new incentives for U.S. companies to invest overseas instead of in the United States,’ CAP pointed out.

Corroborating with CAP, The Trends Journal noted in a 2020 report:

The Congressional Research Service report finds that the 2017 Tax Cuts and Jobs Act (TCJA) had little measurable effect on the overall U.S. economy in 2018. Indeed, as we have long noted and the CRS confirms, much of it went to $1 trillion in stock buybacks. Further, the CRS concluded that after adjusting for inflation, wages grew more slowly than overall economic output and at a pace relatively consistent with wage growth prior to passage of the TCJA.

According to the Tax Policy Center, the richest fifth of Americans will receive nearly two-thirds of total benefits in 2018 and the richest 1 percent alone will receive 83 percent of the total benefits in 2027.

And again, ‘According to the Tax Policy Center, the 1 percent got almost 83 percent of the benefits from Trump’s 2017 tax bill.’

AUTHOR COMMENTARY

Trump loves quick, cheap, easy money, helicopter money. Now, I ask you, Trump supporters, how does this gel with the Make America Great Again narrative? I thought a strong dollar is what we want to build a strong America? Of course, when he refers to ‘strong’ he only means the relative strength, as the dollar’s current purchasing power has become practically worthless at this point.

Let me explain it in simple terms. A weaker dollar and lower yields/rates empower the Federal Reserve, as their power resides in their ability to inflate and weaken the purchasing power of the dollar. A weaker dollar with low rates is inflationary, and therefore it takes more debt units (dollars) to purchase things, which is stock market positive. Therefore, on top of him wanting even lower corporate taxes, and the loopholes that there are, it enriches the lives of the 1% and 2%’ers, and strengthens the stranglehold the corporatocracy we have in this country; which, as Benito Mussolini called it, fascism – “Fascism should more appropriately be called Corporatism because it is a merger of state and corporate power.” Though, as I have said before, this country has a weird fusion of neo-fascism-communism – yet to be defined on the elemental chart.

Trump will of course not spell it out like that. Instead we get this jumbled-up, confusing word salad that he always loves to do. The fact of the matter is that his policies did not benefit you and I, and they will not if he is [S]elected again – not elected, [S]elected.

Ecclesiastes 5:12 The sleep of a labouring man is sweet, whether he eat little or much: but the abundance of the rich will not suffer him to sleep. [13] There is a sore evil which I have seen under the sun, namely, riches kept for the owners thereof to their hurt. [14] But those riches perish by evil travail: and he begetteth a son, and there is nothing in his hand.

But his supporters will be lulled into a comatose state just as they were before, watching everyone get richer and richer while they sink deeper and deeper. Instead, if he [s]elected and these policies are implemented, the MAGA crowd will just blame Biden for everything.

Take your pick: Donald Duck or Goofy.

Proverbs 22:16 He that oppresseth the poor to increase his riches, and he that giveth to the rich, shall surely come to want.

All Ponzi’s and pyramid schemes eventually fail and they all bottom-out, and that’s what’s taking place right now. Whether it’s Trump, Biden, or Mickey Mouse come this November, the U.S. is on a collision course with imminent and cataclysmic destruction. The country died in 2020: everything after is just a formality.

And, this constant threatening of other countries to stay in the dollar – the same thing the Biden admin is doing right now – is a core reason why so many nations are running to exit the dollar, such as BRICS, ASEAN, and others. Other countries want mutual business partners, not loud barking dogs frothing at the mouth, shouting hypocrisies and virtual signaling daily.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Thank you for the good writeup. It actually used to be a amusement account it. Look advanced to more introduced agreeable from you! By the way, how can we keep in touch?

you’ve an incredible blog here! would you wish to make some invite posts on my weblog?

Yay google is my queen assisted me to find this outstanding web site! .

Hi there, just became alert to your blog through Google, and found that it’s really informative. I’m gonna be careful for brussels. I’ll appreciate when you continue this in future. Lots of people might be benefited out of your writing. Cheers!

Yeah bookmaking this wasn’t a bad determination outstanding post! .

We are a group of volunteers and starting a new scheme in our community. Your web site provided us with helpful info to paintings on. You have done a formidable job and our entire community will probably be thankful to you.

Thanks for the marvelous posting! I definitely enjoyed reading it, you might be a great author.I will make certain to bookmark your blog and may come back from now on. I want to encourage that you continue your great writing, have a nice day!

Good write-up, I?¦m normal visitor of one?¦s site, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.