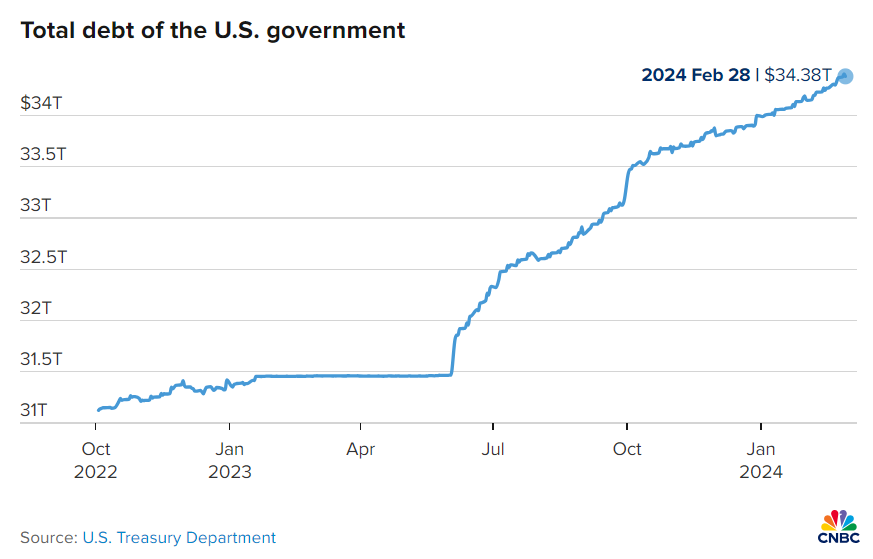

CNBC was the first to report on this on March 1st, but did not see much circulation otherwise, save only a few other economic outlets that referenced it but still did not get that much attention either.

The outlet wrote: ‘The nation’s debt permanently crossed over to $34 trillion on Jan. 4, after briefly crossing the mark on Dec. 29, according to data from the U.S. Department of the Treasury. It reached $33 trillion on Sept. 15, 2023, and $32 trillion on June 15, 2023, hitting this accelerated pace. Before that, the $1 trillion move higher from $31 trillion took about eight months.’

Bank of America investment strategist Michael Hartnett said that the 100-day cycle will remain intact with the move from $34 trillion to $35 trillion.

The Treasury said in a statement around this time:

The national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time. Simply put, the national debt is similar to a person using a credit card for purchases and not paying off the full balance each month. The cost of purchases exceeding the amount paid off represents a deficit, while accumulated deficits over time represents a person’s overall debt.

The Treasury Department said in a statement

And yet the Treasury was displeased when credit ratings firm and analysts at Moody’s dropped the country’s credit rating last November.

Additionally, today President Joe Biden, with the expeditated work of the Congress and Senate, was able to pass a new $1.2 trillion omnibus spending package, which will soon bring the national debt to approximately $35.7 trillion.

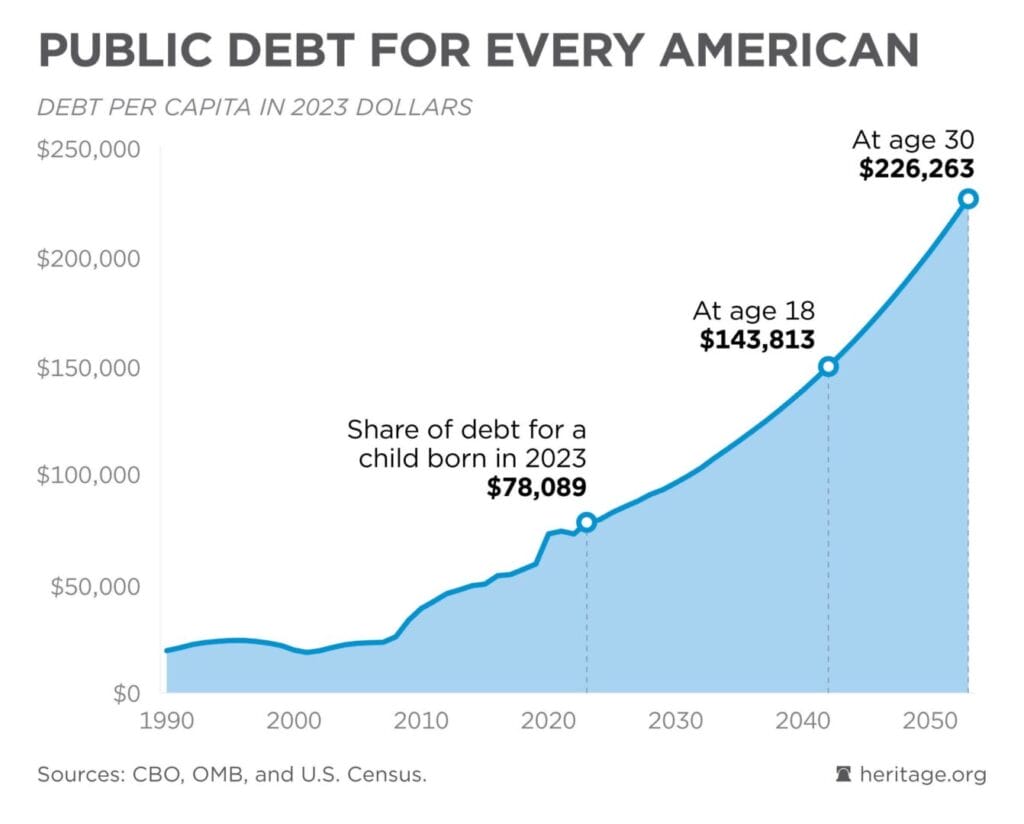

As explained in a detail analysis by Seeking Alpha, ‘The activist think tank The Heritage Foundation uses U.S. government’s own projections to show that there is no off-ramp for this habituation: within 30 years, the average debt imputed on a citizen born in 2023 is expected to rise at least 189%.’

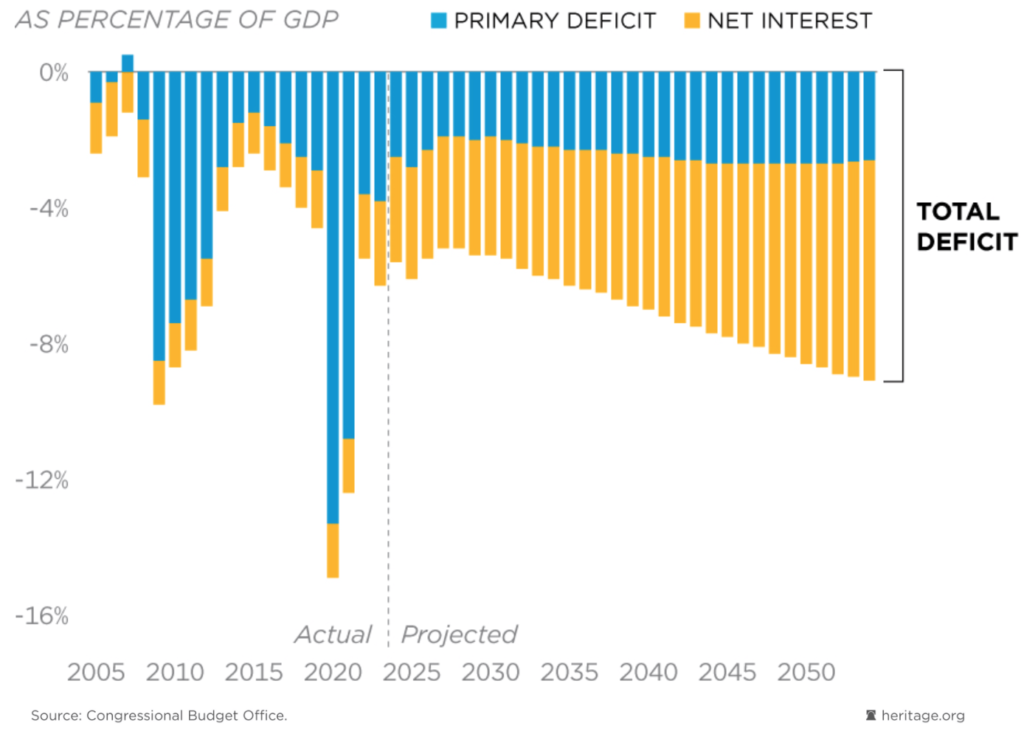

Over the course of this century, the U.S. government has never had a budget surplus (barring for one single year). If current issuance patterns continue, it is estimated that this deficit will continue to widen: before the end of this current decade, interest payments are slated to overtake all other drivers of spending.

Seeking Alpha wrote

AUTHOR COMMENTARY

As defined by Investopedia, Insolvency is “a state of financial distress in which a person or business is unable to pay their debts,” and “is when liabilities are greater than the value of the company, or when a debtor cannot pay the debts they owe.”

The country is insolvent. Truth be told, we’ve been insolvent for a VERY long time now; but it has gotten so bad and so out of control that every 100 days 1 trillion (1,000,000,000,000; one million million; ten to the twelfth power) is being tacked onto the already existing debt. It’s impossible to pay this off.

[26] Be not thou one of them that strike hands, or of them that are sureties for debts. [27] If thou hast nothing to pay, why should he take away thy bed from under thee? [12] In thee have they taken gifts to shed blood; thou hast taken usury and increase, and thou hast greedily gained of thy neighbours by extortion, and hast forgotten me, saith the Lord GOD. [13] Behold, therefore I have smitten mine hand at thy dishonest gain which thou hast made, and at thy blood which hath been in the midst of thee. [14] Can thine heart endure, or can thine hands be strong, in the days that I shall deal with thee? I the LORD have spoken it, and will do it. Proverbs 22:26-27; Ezekiel 22:12-14

If you have not figured it out yet (and God help you if you haven’t), the country is going to collapse. We discussed this going into this year that we knew that debts and deficits would only increase, and all that can be done is print more money and create more debt.

I figure the handlers will try to keep this failed pyramid scheme going at least for the rest of this year, but will finally rug pull it in 2025. That’s my current estimate at the moment that is, based on what I have researched and forecasting. We’ll see how it all pans out; but this only means that you must continue to stay on course with working to pay off your debts, being frugal with your cash, get in the best shape you can; make sure you have plenty of extra food, water, ammo, clothing, medical supplies, ways to stay warm, etc.; because, when this Ponzi is allowed to finally break apart, the collapse will be epic and will result mass deaths and destruction: count on that.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

The very first trillion was unsustainable, impossible to pay.

‘They’ are attempting a controlled collapse. One in which, they are able to protect all the marbles they collected (so to speak), hurt others but not themselves. It won’t work that way. Just like they think they’ll eat, but you won’t, etc. Mighty and great will the devastation be. I pray The Bride of Jesus Christ will be gone – FIRST.

Psalms 37:21 The wicked borroweth, and payeth not again: but the righteous sheweth mercy, and giveth.