Absent from very little mainstream attention, yesterday the Federal Reserve ended a strategic emergency bailout program that lent money to banks and financial institutions to keep them afloat, in the wake of the Silicon Valley Bank (SVB) collapse one year ago.

Fearful that SVB’s demise would result in large spread contagion and bank runs across the United States, the Federal Reserve created the Bank Term Funding Program (BTFP); providing well over $2 trillion that banks could borrow to cover withdrawals, and losses they incurred because of loans, bonds, derivatives, and other assets that had gone underwater, because of the interest rate hikes that created massive unrealized losses on bank’s balance sheets.

As detailed by The WinePress, Fed Chair Jerome Powell said at the time, “the Federal Reserve is prepared to address any liquidity pressures that may arise,” and that “these actions will reduce stress across the financial system, support financial stability and minimize any impact on businesses, households, taxpayers, and the broader economy.”

Moreover, in an interview with Marketplace, Joseph Wang, chief investment officer at Monetary Macro, said a year ago:

This is basically the biggest bailout to the banking sector [since the financial crisis of 2008–09].

In central banking, one of the basic tenets is you lend to solvent banks with good collateral at above-market rates because the role of a central bank, as we understand, is to be a lender of last resort. But that [new] bank facility, it breaks all those tenets.

I think there is a moral hazard aspect to this.

He said – as a “moral hazard” infers that since the public is to be reassured that they will be made safe, that this will lend towards the incentivization again.

Powell said that this program would only last a year. Now, yesterday, March 11th, that program officially came to an end.

In late-January the Fed’s officially announced that the program would end on March 11th and what that would entail:

During a period of stress last spring, the Bank Term Funding Program helped assure the stability of the banking system and provide support for the economy. After March 11, banks and other depository institutions will continue to have ready access to the discount window to meet liquidity needs.

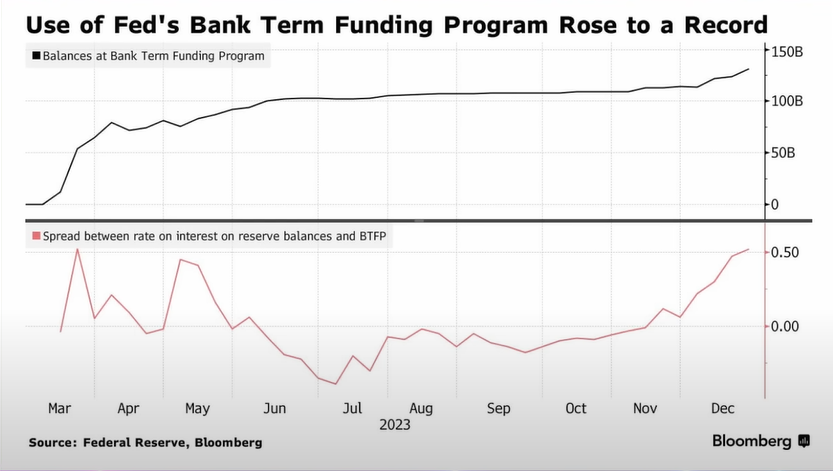

As the program ends, the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made. This rate adjustment ensures that the BTFP continues to support the goals of the program in the current interest rate environment. This change is effective immediately. All other terms of the program are unchanged.

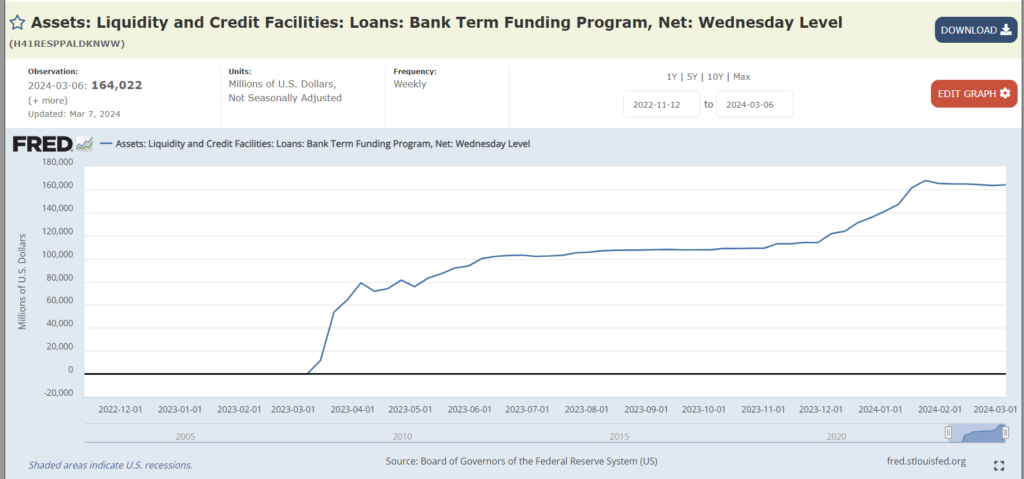

However, according to the Federal Reserve’s own data, banks were still increasingly borrowing liquidity to keep themselves functioning going into this year, where the trend line went up from its highs and still remained at an elevated baseline up till yesterday. Roughly $164 billion was lent as of last Wednesday.

This nudge higher in December coincides with the Federal Reserve’s indication that they would begin to pivot and cut rates.

As Bloomberg noted, ‘It’s a crucial test for the Federal Reserve, which is still shrinking its balance sheet via so-called quantitative tightening after years of stimulus meant to spur a pandemic recovery. If cracks start to appear in the funding market, that process stands to stall — and the stability of the banking system could teeter again.’

Financial analyst group The Kobeissi Letter said in an X post to close out January, explained that regional banks were still posting heavy losses even after taking advantage of this bailout program:

ITM Trading provides more details on this closure of the program. Taylor Kenney for the firm explained that this quiet move will definitely create a ripple effect moving forward, that will add serious strain on banks in the months to come.

On top of this, the program had loopholes that many institutions took out advantage of, allowing banks to basic pocket the money themselves, by taking the borrowed cash and placing it in another account with the Federal Reserve that pays out at a higher interest. Another words, it’s bank arbitrage. Lena Petrova, CPA, explains more about this scheme in a video report. The Fed’s increased interest rates referenced earlier by Powell was to stop that, but this was basically two months before the program’s conclusion.

One commentor, who received a ‘heart’ from Ms. Petrova, said, “I’ve been thinking about this arbitrage opportunity and been a little frustrated that how much borrowing is occurring through this facility isn’t a reliable indicator of how healthy the banks are currently. Guess we’ll find out who is swimming naked come March when it terminates… ”

This news of the end of the BTFP comes at a time when Powell recently admitted that there will be guaranteed bank failures come later this year, especially because of the pressures created by commercial real estate defaults and loans going sour.

There will be bank failures, but this is not the big banks. If you look at the very big banks it’s not a first order issue for any of the of the very large banks. It’s more, you know, smaller and medium-sized banks that have these issues.

We’re working with them, we’re getting through it – I think it’s manageable, is the word I would use, but it’s you know it’s a very active thing for us and the other regulators, and it will be for some time.

Powell said at a Senate Banking Committee hearing

AUTHOR COMMENTARY

This is very important news but so few are talking about it; nay, most Americans didn’t even know this program existed in the first place!

The fake Ponzi economy is collapsing at breakneck speeds, and the riches and the money is failing. The banks are insolvent and will collapse, and most Americans are fix’n to get wiped in short order. This program succeeded in once again kicking the can down the road, never fixing the problems, but increasing the debt loads; and we will find out here in short notice who was pocketing all this money for themselves.

Again, friend, I URGE you to PLEASE get your money out of the banks. Keep the necessary amounts there to maintain the minimum balances required, and to pay bills and make some online purchases, but otherwise you need to limit your exposure to these places. Credit unions are safer, but not fool proof either. You need to stuff this stuff under your mattresses, a personal safe, just somewhere other the banks. Many will not listen, even after I have incessantly have been sounding off on this since January, 2021 – LONG before most people were even talking about this coming catastrophe, and the commercial real estate bust that was transpiring…

He that trusteth in his riches shall fall: but the righteous shall flourish as a branch.

The rich man’s wealth is his strong city, and as an high wall in his own conceit.

He that oppresseth the poor to increase his riches, and he that giveth to the rich, shall surely come to want.

He that hasteth to be rich hath an evil eye, and considereth not that poverty shall come upon him.

Proverbs 11:28, 18:11, 22:16 , 28:22

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.