This was brought up after Senator Catherine Cortez Masto (D-Nevada) inquired to Powell about the stability of the banking sector, and their exposure to commercial real estate and office buildings that are currently under duress.

Powell admitted that he and the Federal Reserve are very much aware of this issue, and have identified which banks are the most at risk and are currently in contact with them about the problem. Powell did not disclose which institutions are most at risk and how many, but admits that more banks are guaranteed to fail this year but will not necessarily affect the top U.S. banks, but rather medium and small banks, which relatively have the most exposure to commercial real estate.

Powell answered in full:

We have a secular change in people working from home. This is one big part of it that means that in many cities the downtown office district is very underpopulated. There are empty buildings in many major and minor cities, and it also means that all the retail that was there to service the thousands and thousands of people who work in those buildings – they’re under pressure too, and banks will have made loans to many of those buildings, not all of them, but many.

We’ve known for for some years and so what do we do: we have identified the banks that have high commercial real estate concentrations, particularly office and retail and other ones that that have been affected a lot. We identify them and we are in dialogue with them;

‘Do do you have your arms around this problem? do you have enough capital? Do you have enough liquidity? Do you have a plan? You’re going to take losses here, are you are you being truthful with yourself and with your owners?’ So we’ve been working with them and so for some time we’ve been doing that.

You know this is a problem that we’ll be working on for years more I’m sure. There will be bank failures, but this is not the big banks. If you look at the very big banks it’s not a first order issue for any of the of the very large banks. It’s more, you know, smaller and medium-sized banks that have these issues.

We’re working with them, we’re getting through it – I think it’s manageable, is the word I would use, but it’s you know it’s a very active thing for us and the other regulators, and it will be for some time.

Having said that, Senator Cortez Masto followed-up by asking about the potential of contagion, other banks falling because of other investors and customers pulling their money and dumping stocks.

Powell responded: “We’re trying to stay ahead of that. So, we also reached out to banks that had high concentrations of uninsured deposits, and particularly uninsured deposits, and a lot of commercial real estate in the office sector. So, we’re well aware of that issue, just trying to stay ahead of it on a bank-by-bank basis, and overall and so far we’ve been able to d that.”

Lena Petrova, CPA, provided more insight into Powell’s comments and other statements made during the hearing.

Additionally, Powell reaffirmed during the hearing that interest rate cuts will happen this year. A number of economists and financial commentors have turned bearish on this prospect, claiming that the provided data does not indicate a possible single rate cut, though Powell seems pretty affirmative. His exact words were cuts “can and will begin” this year.

Last year around this time, amidst the collapse of Silicon Valley Bank (SVB) and a wave international contagion that spread because of it, Treasurer Janet Yellen was called upon to give answers during a Senate Banking Committee hearing. During that meeting Yellen made an important admission, basically revealing that the Federal Reserve and Treasury will set in motion measures to bailout and rescue the so-called “too-big-to-fail” banks, or any institution the Feds feel is of significant importance to them, but medium and small banks will not receive such treatment.

A bank only gets that treatment if a super-majority of the Fed board, and I, in consultation with the President conclude that failure to protect uninsured depositors would create systemic risk to the banking system.

She said at the time

She went on to explain other banks such as Signature Bank, another bank that collapsed in the tidal wave caused by SVB’s fall, received special treatment and depositor insurance because the Treasury and Federal Reserve felt in their judgment it would prevent wider contagion – relating back to what Senator Cortez Masto queried more recently. SEE: Treasurer Janet Yellen Admits That Favored Banks Will Be Bailed-Out But Smaller Ones Will Be Left To Die

AUTHOR COMMENTARY

The WinePress has been warning about a banking bust for years, and now the warnings signs are no longer deniable, now that this bankster gangster is just casually admitting to a collapse. Remember last year when they told us this was “contained?” Remember when they told everyone inflation was “transitory?” Yeah, and we see how that’s unfolding…

“Manageable?” Define manageable, sir? Of course he won’t do that but I will: you and I, we the American tax cattle we be forced to pay for all these collapses, like always; the bigs will also be affected but they get special treatment, and your little local bank can go eat dirt, or it’ll get absorbed and consolidated by one of these bigger ones.

Take heed, friend: this commercial real estate bust is the real deal and is no laughing matter. This WILL takedown the banks. Jerome Powell is just trying to whitewash a collapsed barn.

A prudent man foreseeth the evil, and hideth himself: but the simple pass on, and are punished.

Proverbs 22:3

To start the year, The Trends Journal gives their annual top trends for the year, and one of them was this banking bust and collapsing commercial real estate market. It was also one of their top trends in 2023, but 2024 will be the year it is finally recognized (which now it is officially). You can read their whole forecast here, but in short they noted:

Banks will take a beating from corporate bankruptcies.

While banks are setting aside more cash against an expected wave of bad loans to office building owners and other commercial property owners, it won’t be enough for many banks that will go bust.

U.S. institutions are estimated to be holding $400 billion or more in unrealized losses from the low-yield bonds they bought during the COVID War and now are unable to sell because investors can earn more interest by buying newer bonds.

In 2024, the banking sector’s troubles will reach crisis levels in some markets and in some countries. The number and rate of bank failures will increase, leaving fewer small banks and helping large banks get even larger, reducing the benefits that competition and small companies can offer consumers.

Because banks are a collecting point for economic bad news among consumers and businesses, their stocks will be an early bellwether to watch for the first signs of not only an economic downturn… but most importantly a market crash, as the banksters did in creating the Panic of ’08.

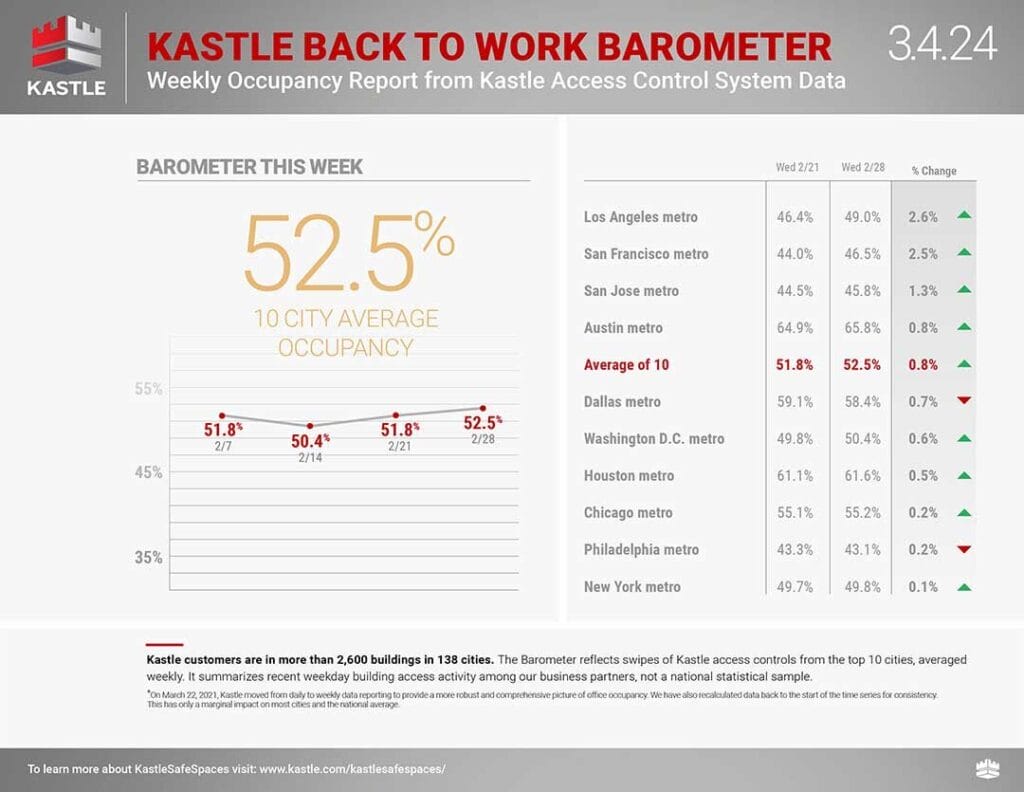

For the week ending March 4th, Kastle Systems reports that current average office occupancy rate for the 10th largest U.S. cities sits at a dismal 52.5%.

As of November of last year, it was reported that 20% of U.S. offices in total in the U.S. are vacant. That’s one of out of every five.

Last month Commercial Edge released a detailed breakdown of some of the numbers concerning commercial real estate. The firm wrote:

The office real estate sector is currently facing steep discounts in asset values due to post-pandemic effects and rising interest rates, with average property values down by at least 25%, according to the latest U.S. office market report.

The downward trend in office valuation is more pronounced in older and less ideally located buildings. Over 20% of office properties sold since the start of 2023 have fetched lower prices than their previous sales. CBD offices have been hit the hardest by the changes wrought by the pandemic, with 35% of properties trading at a lower sale price last year. For example, in Washington, D.C., a 13-story building with ground-floor retail sold for $18.2 million in 2023, down 70% from its 2017 price tag of $61.8 million. At the same time, only 21% of properties sold in the suburbs recorded a decline in value.

Moreover, an astonishing $900 billion is commercial real estate loans are coming due very soon, and banks will have to absorb this crunch soon.

Oh, and by the way, this is just commercial real estate: we have not even gotten into consumer credit card debt, subprime auto loans, home foreclosures, unfunded liabilities and pensions, etc.

Rate cuts are a lock. The Fed is NOT data dependent as they say they are. They will cut rates regardless if banks collapse or not. These bailouts coupled with rate cuts will cause inflation to rocket back up. Therefore, save your money, be frugal, continue to stock-up now.

Needless to say, the banks are going down hard and fast and you need to be prepared for that. Thus, as I have regularly warned, you need to get your money out of the banks and keep the necessary amounts there to keep a running balance, pay bills and make online purchases. Do not keep more than you need to and can’t afford to lose. Also, transferring your money into other assets may prove to be advantageous. Some gold and silver, for example, is by no means fool proof, but it is at least safer than other things; but I still recommend prioritizing food and water, brass, clothing, heat, shelter, etc., especially if you are strapped (Proverbs 11:4).

Ultimately, what we are witnessing is a mass-consolidation, with central banks fulfilling their endgame of being the buyers and lenders of last resort.

The rich ruleth over the poor, and the borrower is servant to the lender.

Proverbs 22:7

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.

Thank you for the update on the banking crisis brother. Godspeed

You’re welcome, brother. More to come soon on this. Things are ramping up quick.

So if they are going to ban the buck soon, where do we put our money if we take it out of the bank? Under our pillow till it’s not accepted anywhere?,

Jacob, do you have the name of any reputable silver or gold companies to invest in? I hope my son will listen to me , but he’s not a believer and thinks Mom doesn’t know what she’s talking about

I am going to be coming out with a sermon, hopefully soon, going over some verses about this coming wealth transfer and collapse of the economy, and I will delve into that.

Gold and silver has its upsides for sure, but I still have reservations on its longevity. With CBDCs coming in, the final transaction is going to be a digital, tokenized record, not physical. The people who are calling for a return to a gold-backed currency are simply just prophesying a divination out of their own hearts (Jeremiah 14:14). No one has been able to give a sufficient answer as to how people will transfer the gold and silver into a CBDC, number one; and number two, why I want to transfer my precious metals for a CBDC? As I said, not sure when, but I do hope to cover this more in depth a future sermon I have in the works.

s9vako02