The Federal Reserve said in a statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

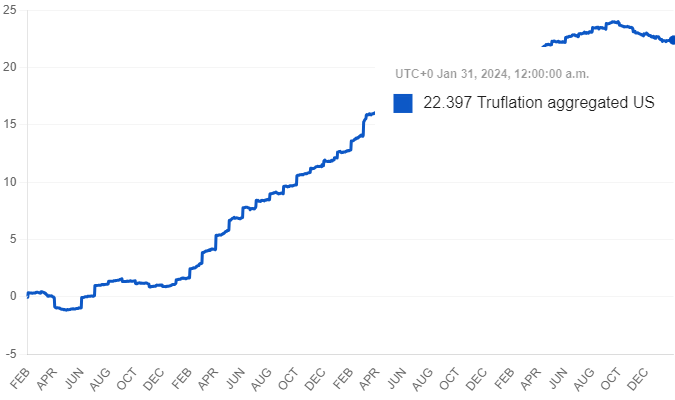

The current federal official data claims inflation is 3.4%, a 0.3% from the previous month, which is still not at the Federal Reserve’s 2% goal they have been touting for some time now. However, alternative date reports that real U.S. inflation aggregated is around 22.3%.

AUTHOR COMMENTARY

Powell’s speech was just more lies and baked numbers per usual, fake metrics they use to belie the masses with and utilize to justify their actions, though we know better and can see with our own eyes that what they say is a farce.

Unless a wild card event occurs by chance, expect rate cuts to start happening later this year. This will of course allow for more money printing and easy money, which is stock market positive; which is why the markets have been trending higher and hitting new record highs already.

Rate cuts will also cause mortgage rates to come down, and will therefore allow for demand in housing to grow even more and values to increase along with them. Sorry, no housing crash, contrary to the daily crash callers. I was at one point buying into the hopium that a housing crash might be coming soon, but I have since changed my opinion on that, as the data simply does not support the fearmongering a lot YouTube “gurus” and conmen are peddling.

Lowering rates will also inevitably cause inflation rise, so do not buy the narrative that inflation is coming down when the TV screen says that it is.

[7] Who goeth a warfare any time at his own charges? who planteth a vineyard, and eateth not of the fruit thereof? or who feedeth a flock, and eateth not of the milk of the flock? [8] Say I these things as a man? or saith not the law the same also? [9] For it is written in the law of Moses, Thou shalt not muzzle the mouth of the ox that treadeth out the corn. Doth God take care for oxen? [10] Or saith he it altogether for our sakes? For our sakes, no doubt, this is written: that he that ploweth should plow in hope; and that he that thresheth in hope should be partaker of his hope. (1 Corinthians 9:7-10).

The WinePress needs your support! If God has laid it on your heart to want to contribute, please prayerfully consider donating to this ministry. If you cannot gift a monetary donation, then please donate your fervent prayers to keep this ministry going! Thank you and may God bless you.